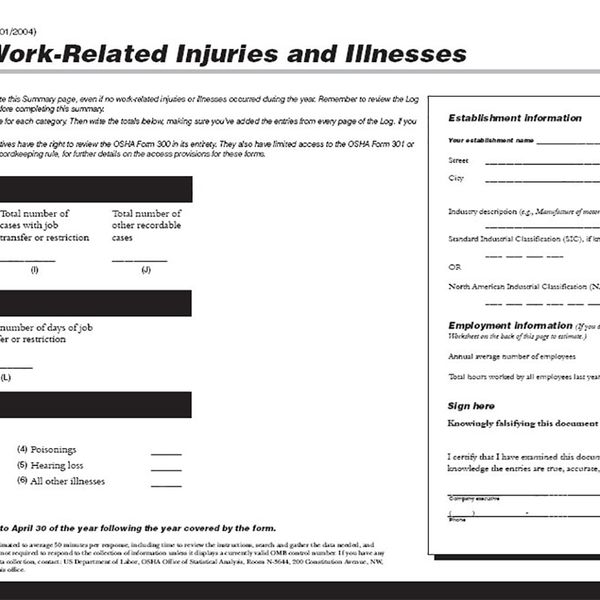

February is here: Make sure your 300A Summary is posted

February is here and that means it’s time once again to post a summary of the total number of job-related injuries and illnesses that occurred during the prior year. The summary (i.e., OSHA Form 300A) must be posted beginning February 1 and must remain posted through April 30. OSHA requires that the summary be displayed in a common area wherever notices to employees are usually posted, such as a bulletin board.

Summary requirements

The annual summary tells employees how many injuries and illnesses occurred over the past year. The summary does not, however, contain the names of employees who have suffered a workplace injury or illness; it only contains summary information.

Specifically, the summary shows:

- Total number of each type of case (e.g., cases with days away, cases with job transfer, fatalities);

- Total number of days away from work, as well as total number of days of job transfer or restriction; and

- Total number of various types of injuries/illnesses (e.g., skin disorders, respiratory conditions, poisonings, and hearing loss).

Each establishment that maintains its own 300 Log must have its own summary. In other words, a company with multiple locations cannot combine several 300 Logs in one summary (unless it is a short-term work location). The reason is that the summary provides workers information about the number and type of injuries where they work, not the numbers for the whole company.

Executive approval

A company executive must certify that he or she has examined the annual summary and that it is a correct and complete representation of the more detailed OSHA Form 300 Log.

How do I find the total hours worked by all employees?

The annual summary requires you to calculate the total hours worked by all employees. This total is also needed to determine your incident rate. Add the hours worked by salaried, hourly, part-time, and seasonal workers, as well as hours worked by other workers your company supervises on a day to day basis (like temporary workers). Basically, if an injury to a worker would have been recorded on your 300 Log, count that worker’s hours on your annual summary.

OSHA says not to include vacation, sick leave, holidays, or other non-work time, even if employees were paid for it, because these are not hours “worked.” An injury that happens on vacation isn’t recordable, so hours of paid vacation don’t get counted as hours worked.

If you only keep records of the total hours paid to each employee, or have salaried employees, estimate the number of hours that were actually worked. For example:

- Find the number of full-time employees for the year.

- Multiply by the number of hours worked by a full-time employee (typically around 2,000 hours a year).

- Add any overtime hours, as well as hours from part-time, temporary, or seasonal workers.

You now have the total number of hours worked by all employees during the year.

Don’t forget about electronic reporting

If you are covered by OSHA’s e-reporting rule, don’t forget to submit the required information from your annual summary to OSHA by March 2, 2021. This must be done using OSHA’s Injury Tracking Portal.

Only the following establishments have to submit this data:

- Establishments with 250 employees (already keeping Part 1904 records), or

- Establishments with 20-249 employees that are ALSO LISTED in Appendix A to Subpart E as high-hazard industries by their NAICS (industry) code.