Canadian carriers are subject to the U.S. HVUT

If you’re operating into the United States, you have a huge list of to-do items to comply. Border crossing and motor carrier safety requirements are likely at the very top of this list. But you’ll have to remember to address one more item during this time of the year: the U.S. heavy vehicle use tax (HVUT).

The HVUT applies to those operating vehicles with a gross weight of 24,948 kilograms (55,000 pounds) or more and operating on a U.S. highway. A new U.S. heavy vehicle use tax (HVUT) tax year starts on July 1. Here’s what you need to know about the tax to keep your operation in good standing.

Applicability depends on your operation

The HVUT year runs from July 1, through June 30 each year. When you have vehicles in operation in the United States in the month of July, you must file and pay by the end of the month following the month in which the vehicle was first used in the tax year – August 31.

You might be wondering what happens if you don’t operate a taxable vehicle into the United States until later in the tax year. In this situation, the tax must be filed and paid by the end of the month following the month of the vehicle’s first use. In this case, the tax is prorated for the remaining months of the tax year.

If you’re not sure this tax applies to you, this site can help: at www.irs.gov/truckers.

How the tax is enforced

For the U.S.-based carrier, enforcement of the HVUT is tracked by the state vehicle licensing office when the carrier registers its vehicles. Of course, the IRS doesn’t expect provincial or territorial vehicle licensing offices to enforce a U.S. tax, so the agency takes a different enforcement approach for Canada-based carriers.

IRS regulations require foreign-based carriers to provide either of the following upon entry into the United States:

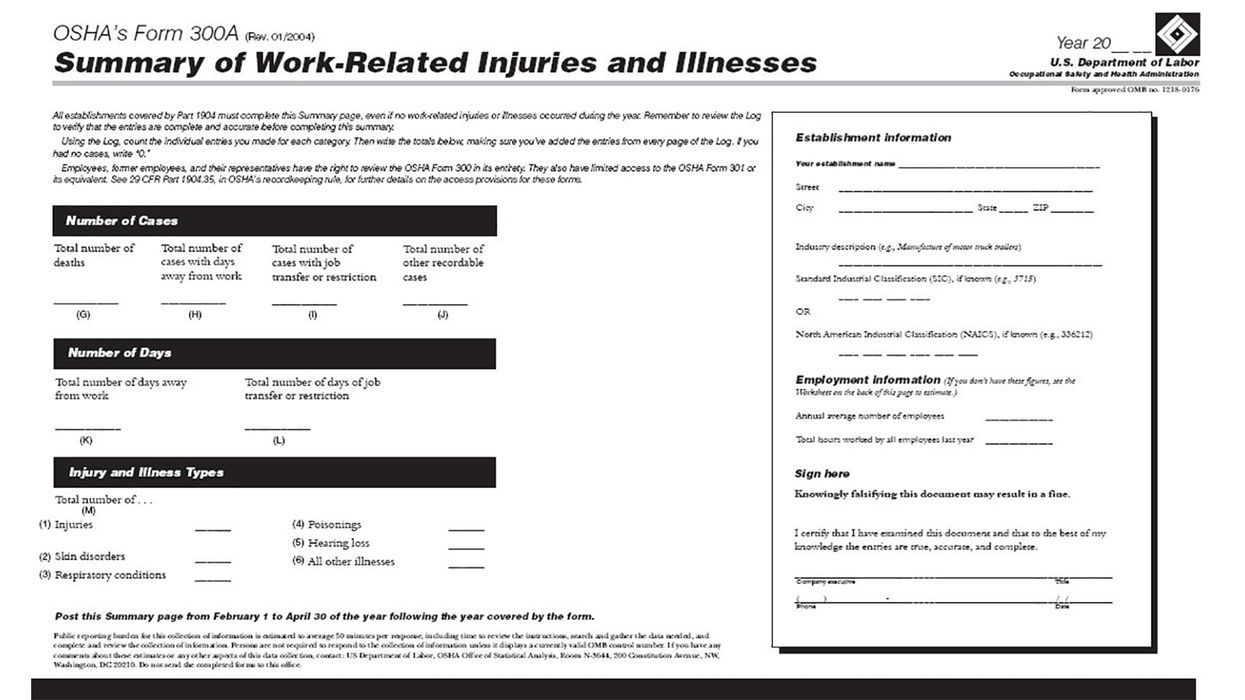

- Proof of tax payment/filing, or

- A written declaration in place of the proof of filing.

Canada-based carriers are allowed to observe the filing timeframe that all other carriers subject to the tax are allowed to observe. This means that if you become subject to the HVUT in July, for example, you have until August 31 to file/pay the HVUT. If you operate into the United States before the HVUT is filed/paid, your driver can carry a written declaration up until August 31, which includes the following items:

- Name, address, and taxpayer identification number of the person liable for the tax imposed on the vehicle;

- Vehicle’s VIN;

- Date on which such vehicle was first used on the public highways in the United States during the taxable period (or a statement that the current entry is the first use);

- Acknowledgment by the person liable for the tax imposed on such vehicle that the willful use of the declaration to evade or defeat the tax will subject such person to a fine and/or imprisonment; and

- Signature of the person liable for the tax imposed on such vehicle.

If the vehicle operates into the United States after August 31, then at that point your driver must carry proof of HVUT tax payment/filing on the vehicle and present it to a U.S. Customs official upon request.

Final tips and information

The following information can help you with the tax:

- File electronically. It can take several weeks to obtain your proof of tax payment if you’re filing on paper. E-filing is much faster and is more accurate. It’s also required for 25 or more vehicles, but everyone is still encouraged to e-file.

- Look into tax breaks or exemptions. In some instances, you can file a suspension of tax if you have very limited operations into the United States. You’ll still file, but tax isn’t due. If you’re operating logging vehicles, you may qualify for a reduced tax rate.

- Carry proof in the vehicle. IRS requires proof of filing or a written declaration. Drivers must have one of these to present to border enforcement.

- Adding trucks between filings. If you add trucks to your fleet between annual filings, you may need to file Form 2290 (Heavy Highway Vehicle Use Tax Return) again after that date.

Key to remember: Be sure to understand the deadlines to keep your operation in good standing and to avoid paying interest and penalties.