New tax year starts July 1 for HVUT

Filing the appropriate taxes on your vehicles is key to keeping your fleet in compliance. One of those taxes is the United States federal heavy vehicle use tax (HVUT). The new HVUT tax year is about to begin on July 1, and taxes for 2022–2023 are due by August 31.

Who must register?

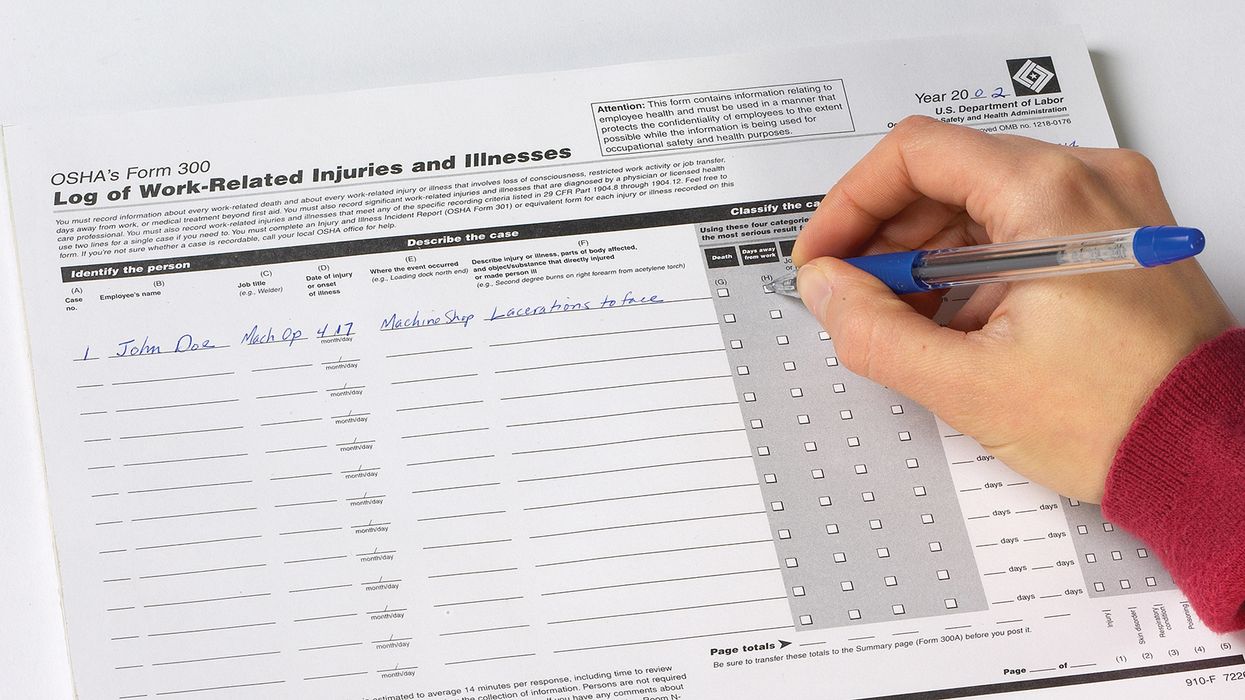

Motor carriers registering and operating vehicles that have a taxable gross weight of 55,000 pounds or more must file the HVUT. To register, Form 2290 must be submitted to the Internal Revenue Service (IRS).

Follow these five steps to make quick work of filing your returns.

1. Gather your numbers

To complete your Form 2290, have the following information available: • Your employer identification number (EIN). Any carrier, including an owner-operator, must have an EIN to file Form 2290. You can’t use your Social Security number.

- The vehicle identification number (VIN) of each vehicle.

- The taxable gross weight of each vehicle to determine its category.

2. Report all vehicles subject to the tax

Vehicles with a taxable gross weight of 55,000 pounds or more (including trucks, tractors, and buses) being used on a public roadway are subject to the HVUT tax. The tax applies to both interstate and intrastate operations.

Note: Canada- and Mexico-based carriers might be surprised to learn they are also responsible for paying HVUT for taxable vehicles operated in the United States.

3. Suspend the tax on qualified low-mileage vehicles

If you believe that you’ll operate your taxable vehicle 5,000 miles or less during the tax year (7,500 miles for agricultural vehicles), you can claim a suspension of tax. You’re still required to file Form 2290, but no tax payment is required for qualified vehicles.

4. Know when to file

Carriers are required to file by August 31 each year when the new tax year begins. However, an additional filing is needed if a vehicle is added to your fleet during the year.

Form 2290 must be submitted by the end of the month following the month the vehicle was first operated on a public highway. For example, if the vehicle was first operated on a public highway during October, Form 2290 must be filed by November 30. Since the vehicle will only be in service for a portion of the tax year, the fee is prorated for the current tax year, and you would pay the full tax on the vehicle the following tax year.

5. File electronically

Carriers filing a return for 25 or more vehicles are required to use the IRS e-file program. However, any carrier can — and is encouraged by the IRS — to file electronically. The benefit to e-filing is that the stamped Schedule 1 can be available within minutes of the IRS accepting your return.

And why is that paid receipt so important? The stamped Schedule 1 becomes your proof of tax payment for the vehicles listed. This proof of payment is required before you can register vehicles with a state’s motor vehicle office.

Key to remember: Carriers operating vehicles weighing 55,000 pounds or more must file heavy vehicle use tax annually with the IRS. File by Aug. 31 each year, and whenever you add a new vehicle.