On October 1, the federal government shut down. As a result, private employers and employees, as well as federal contractors and government employees, will likely face delays in services and programs until a resolution is reached.

Below is a recap of how the shutdown impacts several key federal agencies and what to expect.

Federal Motor Carrier Safety Administration (FMCSA)

It’s generally business as usual for the FMCSA. Roadside inspections are considered an essential safety function. Both federal and state enforcement partners perform these inspections, and most weigh stations are run by state Department of Transportation (DOT) agencies, which aren’t directly affected by a federal shutdown.

Drivers should assume inspections will continue as normal. Violations will still result in citations, out-of-service orders, and compliance reviews.

While the day-to-day enforcement likely won’t change, some aspects of the FMCSA and DOT operations may slow down, such as:

- Rulemaking and new initiatives: Any changes to federal regulations will pause.

- Audits and investigations: Compliance reviews and safety audits may take longer, although the enforcement of violations will continue.

- Administrative support: Processing non-urgent matters, permits, or correspondence may be slower.

New registrations and filings, such as new USDOT numbers, new authority, and Unified Carrier Registration filings, will likely experience delays until the shutdown is resolved.

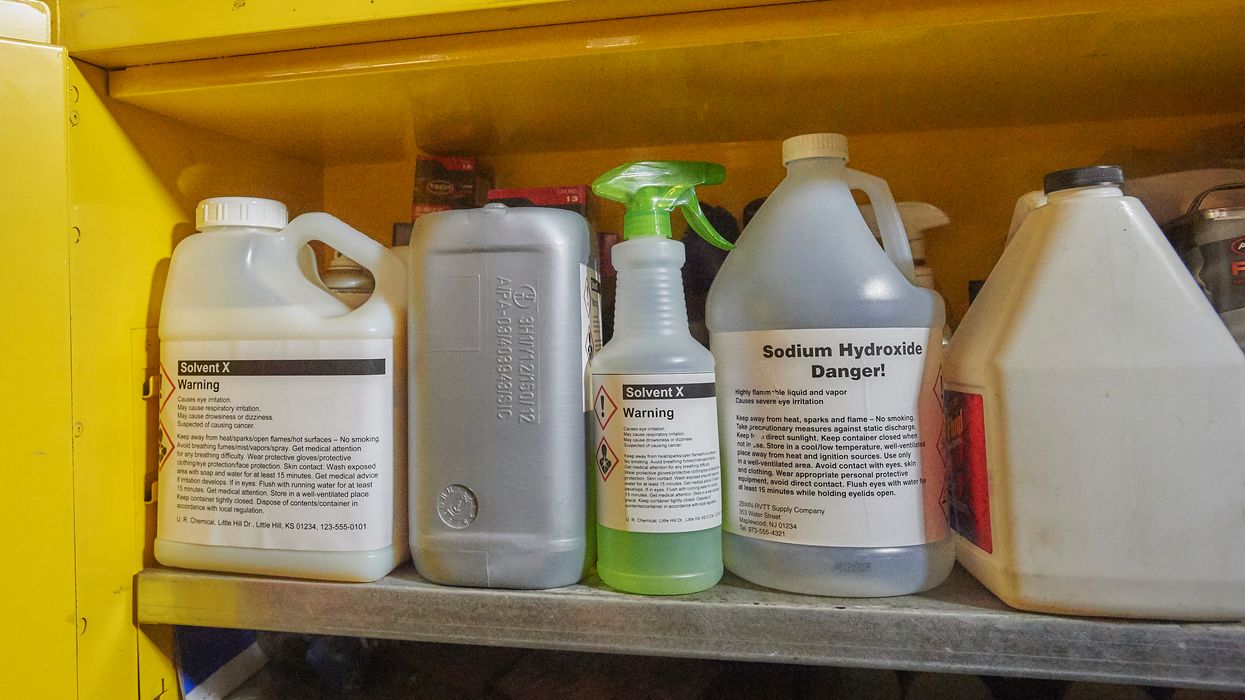

Pipeline and Hazardous Materials Safety Administration (PHMSA)

The picture is more complex at PHMSA. The DOT plan says about one-third of the agency's 580 employees are expected to be furloughed. Inspections of hazardous materials shippers, carriers, and other entities will continue, as will enforcement of the hazardous materials safety regulations. However, a variety of administrative functions are expected to be impacted, including non-emergency approvals and permits, rulemaking activities, research, grants, outreach, and the hazmat registration and fee-collection program.

Occupational Safety and Health Administration (OSHA)

OSHA will continue only its essential functions, including:

- Inspections for imminent danger situations, workplace fatalities, and catastrophes;

- Review and referral of whistleblower complaints tied to imminent threats;

- Follow-up inspections of serious violations without abatement; and

- Enforcement actions needed to meet statutory deadlines on high-risk cases.

All other agency activities such as rulemaking, programmed inspections, compliance assistance, website updates, and outreach programs are suspended. Only employees designated as essential may continue working, and the Occupational Safety and Health Review Commission halts all operations for the duration of the shutdown.

Environmental Protection Agency (EPA)

EPA has implemented its contingency plan, resulting in a significant reduction in operations. Approximately 90 percent of EPA staff have been furloughed, leaving around 1,700 personnel to continue essential functions, including emergency response operations, law enforcement, criminal investigations, maintenance of critical laboratory assets, and Superfund site work only if halting it poses an imminent threat to human life.

Most routine EPA functions have been suspended (like issuing permits and regulations). The agency has also paused work on climate-related regulations and restructuring efforts unless deemed essential or funded through exempted sources (e.g., Infrastructure Investment and Jobs Act or specific fee-based programs).

Equal Employment Opportunity Commission (EEOC)

The EEOC, which investigates discrimination claims, is closed during the shutdown. The agency won’t be responding to inquiries during this time, but a limited number of services will still be available. If employees want to file a discrimination charge, they should be aware that time limits for filing a charge won’t be extended due to the shutdown.

Additional information on filing new charges, the status of pending charges, or other existing business with the EEOC, etc., will likely be delayed. During the shutdown, information on the EEOC website won’t be updated. In addition, transactions submitted via the website won’t be processed, and EEOC staff won’t be able to respond to requests or questions submitted to the EEOC, including those submitted by email or through its website, until the shutdown is over.

Members of the public who call the EEOC during the government shutdown will be able to access the pre-recorded information available on the EEOC's Interactive Voice Response System, but EEOC staff will not be available to assist them. Email inquiries sent to the agency will be monitored for urgent matters but generally not addressed during the shutdown.

National Labor Relations Board (NLRB)

NLRB offices are closed during the shutdown, and hearings are postponed. Because documents may not be filed on the NLRB website during the shutdown, due dates for filing documents will be extended.

As the 6-month statute of limitations for filing unfair labor practice charges remains in effect, the agency recommends mailing or faxing a copy of the charge to the regional office during the shutdown.

Department of Labor (DOL)

The DOL is also shut down, except for activities such as those needed to protect life and property. All regulatory work has ceased, including the final rules on independent contractors and joint employers.

The Wage and Hour Division (WHD), which enforces laws such as the Fair Labor Standards Act and the Family and Medical Leave Act, dropped from 1,270 employees to 7. Employees won’t be able to file claims under such laws.

The agency will monitor and respond to child labor investigations and will pursue and address legal cases or investigations in jeopardy of being lost due to a statute of limitations or as otherwise ordered by the court. It will also continue to process certain benefits payments and support federal and state unemployment programs.

The Employee Benefits Security Administration (EBSA) generally stopped its research activities, audits, compliance assistance, and IT support.

The Veterans’ Employment and Training Service (VETS) stopped conducting investigations of the Uniformed Services Employment and Reemployment Rights Act.

U.S. Citizenship and Immigration Services (USCIS)

Employers must continue to use the Form I-9 during the shutdown to verify that an employee is eligible to work in the United States. The form must be completed within 3 business days after the employee’s first day of employment.

The form may be downloaded from the USCIS website. The agency expects to retain the majority of its employees during the shutdown.

Employers who use the online E-Verify system to confirm an employee’s eligibility to work in the United States may experience a system shutdown, however. In the event of an E-Verify shutdown, employers won’t be able to create E-Verify cases, run reports, or resolve tentative non-confirmations.

E-Verify employers should continue to complete a Form I-9 for each new employee. After the shutdown ends and the E-Verify system is operational, employers should create E-Verify cases for employees who were hired when the website was not available.

In the event of an E-Verify system shutdown, it’s likely that the USCIS will extend deadlines for creating E-Verify cases and resolving tentative non-confirmations. The agency is expected to provide further guidance.

Federal contractors and government employees

Federal contractors and government employees from shut-down agencies are either furloughed — prohibited from work and unpaid — or required to work without pay if their roles are deemed essential to public safety.

Payments to companies with a federal contract may be delayed, and they may receive a stop-work order. Contracts will not be issued or extended during the shutdown.

The Office of Federal Contract Compliance Programs website is not being updated during the shutdown.