When determining injury rates, beware of partial years

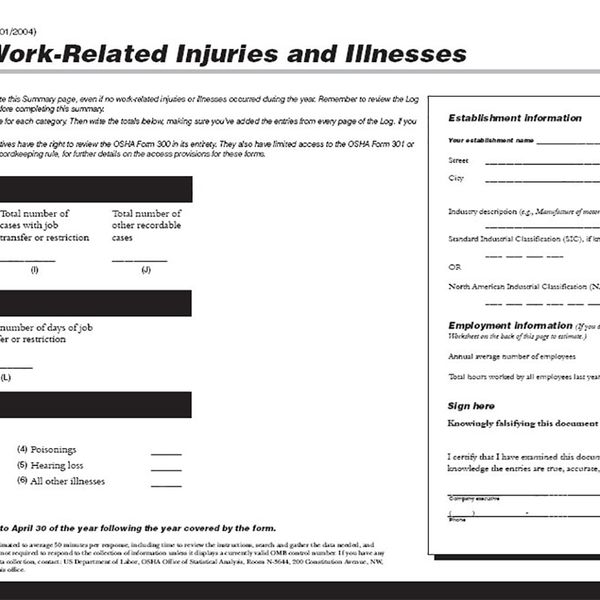

After preparing the OSHA 300A Annual Summary, employers often calculate their incident rates. If calculating a rate for only part of the year, however, the result may not reflect the annual rate.

Employers are not required to determine their incident rates, but OSHA uses these rates to select locations for inspection, if a company’s rate is unusually high.

The most common metrics include the total recordable rate and the Days Away, Restriction and Transfer (DART) rate. The total rate includes all injuries and illnesses, while the DART rate counts only cases that involved days away, restricted work, or transfer to another position.

Both are ratios of incidents per 100 employees, per year, which allows businesses of different sizes to compare rates. For instance, a result of 3.2 means that about three of every 100 employees had a recordable incident.

Using the formula

To determine your total incident rate, use this formula:

Total number of injuries and illnesses X 200,000 ÷ Number of hours worked by all employees = Total recordable rate

Add up the total number of cases or look at the “number of cases” heading on the 300A. Multiply that by 200,000. This represents the hours worked by 100 full-time employees. OSHA assumes 40 hours per week for 50 weeks, with a couple weeks for vacation or holidays. Since every employer uses this conversion factor, the resulting ratio allows for comparison.

Finally, divide by the number of hours worked by employees at the establishment.

To calculate the DART rate, use the same formula but only include the cases in the columns for days away, restriction, or transfer.

For example, if you have 200 employees who worked 400,000 hours, and you had 6 recordable cases, the annual rate would be 3 cases per 100 employees:

6 x 200,000 / 400,000 = 3

Part-time employees do not affect the result because even though the result is expressed as a ratio of injuries per 100 employees, the formula technically creates a ratio of injuries per 200,000 hours worked.

Partial year rates

Employers may want to calculate a rate for a partial year. This can be done, but the result may differ from the annual rate. Even so, a lot of people like to calculate rates to “see how they’re doing” part-way through the year.

In short, use the same formula, including the 200,000 conversion factor. As noted, the ratio of “injuries per 100 employees” is actually injuries per 200,000 hours worked. Therefore, reducing the 200,000 number for a shorter time period would not yield a correct number. Although a partial year may have fewer injuries, it will also have fewer hours worked.

Now, suppose your rate for the first half of the year was 3.6 per 100 employees. At the end of the year, you may get a different number. Factors affecting the rate include the number of employees, the hours worked, and the number of injuries. Any of those could change in the second half of the year, resulting in a different number.

Key to remember: Employers can calculate injury rates for a partial year, but it may differ from the annual rate due to variations in injuries, hours worked, or other factors.