Postings and forms/reporting

- Federal contractors must submit payroll records to the appropriate federal agency if that agency is a party to the contract, or to the applicant, sponsor, or owner for transmission to the appropriate agency.

- The Report of Construction Contractor’s Wage Rates (WD-10) is an optional form to ensure consistency in submission of wage data.

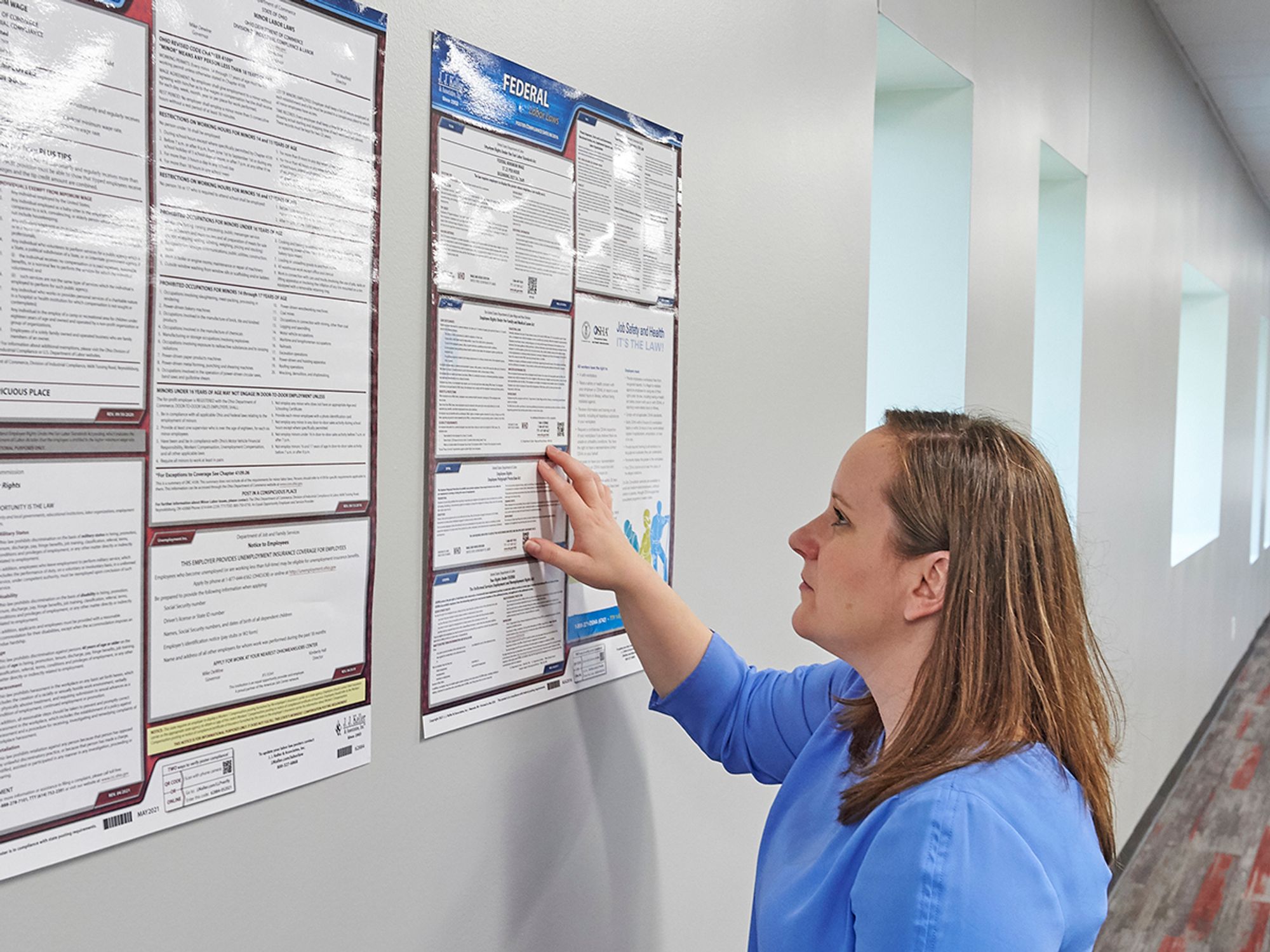

Every employer performing work covered by the labor standards of the Davis-Bacon and Related Acts shall post a notice (including any applicable wage determination) at the site of the work in a prominent and accessible place where it may be easily seen by employees.

The contractor must submit weekly for each week in which any contract work is performed, a copy of all payrolls to the appropriate federal agency if the agency is a party to the contract. If the agency is not such a party, the contractor must submit the payrolls to the applicant, sponsor, or owner, as the case may be, for transmission to the appropriate agency. The payrolls submitted must set out accurately and completely all of the information required to be maintained under 5.5(a)(3)(i) of 29 CFR Part 5. This information may be submitted in any form desired. Optional Form WH-347 is available for this purpose. The prime contractor is responsible for the submission of copies of payrolls by all subcontractors.

Each payroll submitted must be accompanied by a “Statement of Compliance,” signed by the contractor or subcontractor (or the agent who pays or supervises the payment of the persons employed under the contract) and must certify the following:

- That the payroll contains the information required and that such information is correct and complete;

- That each laborer or mechanic (including each helper, apprentice, and trainee) employed on the contract during the payroll period has been paid the full weekly wages earned, without rebate, either directly or indirectly, and that no deductions have been made either directly or indirectly from the full wages earned, other than permissible deductions as set forth in Regulations, 29 CFR Part 3;

- That each laborer or mechanic has been paid not less than the applicable wage rates and fringe benefits or cash equivalents for the classification of work performed, as specified in the applicable wage determination incorporated into the contract.

The Report of Construction Contractor’s Wage Rates (WD-10) is an optional form to ensure consistency in submission of wage data. Respondents may use an alternate form if the information requested is included.