['Air Programs']

['Greenhouse Gases']

06/26/2024

...

Authority: Sec. 301, Pub. L. 94-163, 89 Stat. 901 (15 U.S.C. 2001, 2003, 2005, 2006).

§600.502 Definitions.

The following definitions apply to this subpart in addition to those in §600.002:

(a) The Declared value of imported components shall be:

(1) The value at which components are declared by the importer to the U.S. Customs Service at the date of entry into the customs territory of the United States; or

(2) With respect to imports into Canada, the declared value of such components as if they were declared as imports into the United States at the date of entry into Canada; or

(3) With respect to imports into Mexico, the declared value of such components as if they were declared as imports into the United States at the date of entry into Mexico.

(b) Cost of production of a car line shall mean the aggregate of the products of:

(1) The average U.S. dealer wholesale price for such car line as computed from each official dealer price list effective during the course of a model year, and

(2) The number of automobiles within the car line produced during the part of the model year that the price list was in effect.

(c) Equivalent petroleum-based fuel economy value means a number representing the average number of miles traveled by an electric vehicle per gallon of gasoline.

[76 FR 39567, July 6, 2011]

§600.507-12 Running change data requirements.

(a) Except as specified in paragraph (d) of this section, the manufacturer shall submit additional running change fuel economy and carbon-related exhaust emissions data as specified in paragraph (b) of this section for any running change approved or implemented under §86.1842 of this chapter, which:

(1) Creates a new base level or,

(2) Affects an existing base level by:

(i) Adding an axle ratio which is at least 10 percent larger (or, optionally, 10 percent smaller) than the largest axle ratio tested.

(ii) Increasing (or, optionally, decreasing) the road-load horsepower for a subconfiguration by 10 percent or more for the individual running change or, when considered cumulatively, since original certification (for each cumulative 10 percent increase using the originally certified road-load horsepower as a base).

(iii) Adding a new subconfiguration by increasing (or, optionally, decreasing) the equivalent test weight for any previously tested subconfiguration in the base level.

(iv) Revising the calibration of an electric vehicle, fuel cell vehicle, hybrid electric vehicle, plug-in hybrid electric vehicle or other advanced technology vehicle in such a way that the city or highway fuel economy of the vehicle (or the energy consumption of the vehicle, as may be applicable) is expected to become less fuel efficient (or optionally, more fuel efficient) by 4.0 percent or more as compared to the original fuel economy label values for fuel economy and/or energy consumption, as applicable.

(b)(1) The additional running change fuel economy and carbon-related exhaust emissions data requirement in paragraph (a) of this section will be determined based on the sales of the vehicle configurations in the created or affected base level(s) as updated at the time of running change approval.

(2) Within each newly created base level as specified in paragraph (a)(1) of this section, the manufacturer shall submit data from the highest projected total model year sales subconfiguration within the highest projected total model year sales configuration in the base level.

(3) Within each base level affected by a running change as specified in paragraph (a)(2) of this section, fuel economy and carbon-related exhaust emissions data shall be submitted for the vehicle configuration created or affected by the running change which has the highest total model year projected sales. The test vehicle shall be of the subconfiguration created by the running change which has the highest projected total model year sales within the applicable vehicle configuration.

(c) The manufacturer shall submit the fuel economy data required by this section to the Administrator in accordance with §600.314.

(d) For those model types created under §600.208-12(a)(2), the manufacturer shall submit fuel economy and carbon-related exhaust emissions data for each subconfiguration added by a running change.

[75 FR 25713, May 7, 2010, as amended at 76 FR 39567, July 6, 2011]

§600.509-12 Voluntary submission of additional data.

(a) The manufacturer may optionally submit data in addition to the data required by the Administrator.

(b) Additional fuel economy and carbon-related exhaust emissions data may be submitted by the manufacturer for any vehicle configuration which is to be tested as required in §600.507 or for which fuel economy and carbon-related exhaust emissions data were previously submitted under paragraph (c) of this section.

(c) Within a base level, additional fuel economy and carbon-related exhaust emissions data may be submitted by the manufacturer for any vehicle configuration which is not required to be tested by §600.507.

[75 FR 25713, May 7, 2010]

§600.510-12 Calculation of average fuel economy and average carbon-related exhaust emissions.

(a)(1) Average fuel economy will be calculated to the nearest 0.1 mpg for the categories of automobiles identified in this section, and the results of such calculations will be reported to the Secretary of Transportation for use in determining compliance with the applicable fuel economy standards.

(i) An average fuel economy calculation will be made for the category of passenger automobiles as determined by the Secretary of Transportation. For example, categories may include, but are not limited to domestically manufactured and/or non-domestically manufactured passenger automobiles as determined by the Secretary of Transportation.

(ii) [Reserved]

(iii) An average fuel economy calculation will be made for the category of trucks as determined by the Secretary of Transportation. For example, categories may include, but are not limited to domestically manufactured trucks, non-domestically manufactured trucks, light-duty trucks, medium-duty passenger vehicles, and/or heavy-duty trucks as determined by the Secretary of Transportation.

(iv) [Reserved]

(2) Average carbon-related exhaust emissions will be calculated to the nearest one gram per mile for the categories of automobiles identified in this section, and the results of such calculations will be reported to the Administrator for use in determining compliance with the applicable CO2 emission standards.

(i) An average carbon-related exhaust emissions calculation will be made for passenger automobiles.

(ii) An average carbon-related exhaust emissions calculation will be made for light trucks.

(b) For the purpose of calculating average fuel economy under paragraph (c) of this section and for the purpose of calculating average carbon-related exhaust emissions under paragraph (j) of this section:

(1) All fuel economy and carbon-related exhaust emissions data submitted in accordance with §600.006(e) or §600.512(c) shall be used.

(2) The combined city/highway fuel economy and carbon-related exhaust emission values will be calculated for each model type in accordance with §600.208 except that:

(i) Separate fuel economy values will be calculated for model types and base levels associated with car lines for each category of passenger automobiles and light trucks as determined by the Secretary of Transportation pursuant to paragraph (a)(1) of this section.

(ii) Total model year production data, as required by this subpart, will be used instead of sales projections;

(iii) [Reserved]

(iv) The fuel economy value will be rounded to the nearest 0.1 mpg;

(v) The carbon-related exhaust emission value will be rounded to the nearest gram per mile; and

(vi) At the manufacturer's option, those vehicle configurations that are self-compensating to altitude changes may be separated by sales into high-altitude sales categories and low-altitude sales categories. These separate sales categories may then be treated (only for the purpose of this section) as separate configurations in accordance with the procedure of §600.208-12(a)(4)(ii).

(3) The fuel economy and carbon-related exhaust emission values for each vehicle configuration are the combined fuel economy and carbon-related exhaust emissions calculated according to §600.206-12(a)(3) except that:

(i) Separate fuel economy values will be calculated for vehicle configurations associated with car lines for each category of passenger automobiles and light trucks as determined by the Secretary of Transportation pursuant to paragraph (a)(1) of this section.

(ii) Total model year production data, as required by this subpart will be used instead of sales projections; and

(iii) [Reserved]

(4) Emergency vehicles may be excluded from the fleet average carbon-related exhaust emission calculations described in paragraph (j) of this section. The manufacturer should notify the Administrator that they are making such an election in the model year reports required under §600.512 of this chapter. Such vehicles should be excluded from both the calculation of the fleet average standard for a manufacturer under 40 CFR 86.1818-12(c)(4) and from the calculation of the fleet average carbon-related exhaust emissions in paragraph (j) of this section.

(c)(1) Average fuel economy shall be calculated as follows:

(i) Except as allowed in paragraph (d) of this section, the average fuel economy for the model years before 2017 will be calculated individually for each category identified in paragraph (a)(1) of this according to the provisions of paragraph (c)(2) of this section.

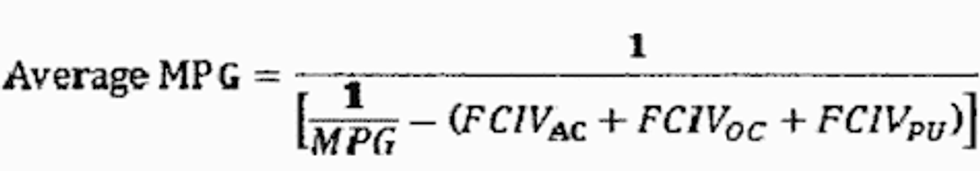

(ii) Except as permitted in paragraph (d) of this section, the average fuel economy for the 2017 and later model years will be calculated individually for each category identified in paragraph (a)(1) of this section using the following equation:

Where:

Average MPG = the fleet average fuel economy for a category of vehicles;

MPG = the average fuel economy for a category of vehicles determined according to paragraph (h) of this section;

FCIVAC = Air conditioning fuel economy credits for a category of vehicles, in gallons per mile, determined according to paragraph (c)(3)(i) of this section;

FCIVOC = Off-cycle technology fuel economy credits for a category of vehicles, in gallons per mile, determined according to paragraph (c)(3)(ii) of this section; and

FCIVPU = Pickup truck fuel economy credits for the light truck category, in gallons per mile, determined according to paragraph (c)(3)(iii) of this section.

(2) Divide the total production volume of that category of automobiles by a sum of terms, each of which corresponds to a model type within that category of automobiles and is a fraction determined by dividing the number of automobiles of that model type produced by the manufacturer in the model year by:

(i) For gasoline-fueled and diesel-fueled model types, the fuel economy calculated for that model type in accordance with paragraph (b)(2) of this section; or

(ii) For alcohol-fueled model types, the fuel economy value calculated for that model type in accordance with paragraph (b)(2) of this section divided by 0.15 and rounded to the nearest 0.1 mpg; or

(iii) For natural gas-fueled model types, the fuel economy value calculated for that model type in accordance with paragraph (b)(2) of this section divided by 0.15 and rounded to the nearest 0.1 mpg; or

(iv) For alcohol dual fuel model types, for model years 1993 through 2019, the harmonic average of the following two terms; the result rounded to the nearest 0.1 mpg:

(A) The combined model type fuel economy value for operation on gasoline or diesel fuel as determined in §600.208-12(b)(5)(i); and

(B) The combined model type fuel economy value for operation on alcohol fuel as determined in §600.208-12(b)(5)(ii) divided by 0.15 provided the requirements of paragraph (g) of this section are met; or

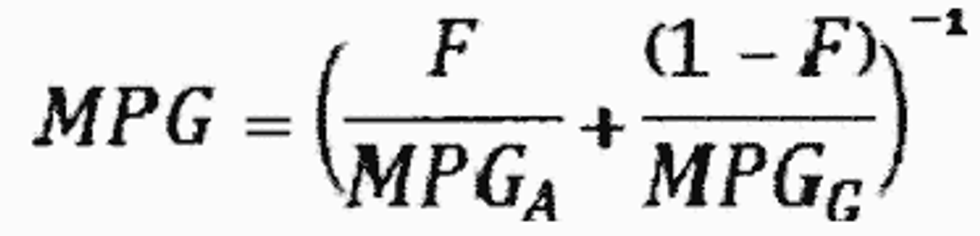

(v) For alcohol dual fuel model types, for model years after 2019, the combined model type fuel economy determined according to the following equation and rounded to the nearest 0.1 mpg:

Where:

F = 0.00 unless otherwise approved by the Administrator according to the provisions of paragraph (k) of this section;

MPGA = The combined model type fuel economy for operation on alcohol fuel as determined in §600.208-12(b)(5)(ii) divided by 0.15 provided the requirements of paragraph (g) of this section are met; and

MPGG = The combined model type fuel economy for operation on gasoline or diesel fuel as determined in §600.208-12(b)(5)(i).

(vi) For natural gas dual fuel model types, for model years 1993 through 2016, and optionally for 2021 and later model years, the harmonic average of the following two terms; the result rounded to the nearest 0.1 mpg:

(A) The combined model type fuel economy value for operation on gasoline or diesel as determined in §600.208-12(b)(5)(i); and

(B) The combined model type fuel economy value for operation on natural gas as determined in §600.208-12(b)(5)(ii) divided by 0.15 provided the requirements of paragraph (g) of this section are met; or

(vii) This paragraph (c)(2)(vii) applies to model year 2017 through 2020 natural gas dual fuel model types. Model year 2021 and later natural gas dual fuel model types may use the provisions of paragraph (c)(2)(vi) of this section or this paragraph (c)(2)(vii).

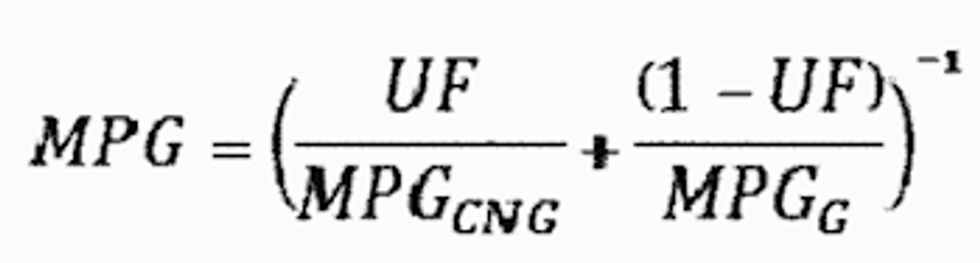

(A) For natural gas dual fuel model types, for model years after 2016, the combined model type fuel economy determined according to the following formula and rounded to the nearest 0.1 mpg:

Where:

MPGCNG = The combined model type fuel economy for operation on natural gas as determined in §600.208-12(b)(5)(ii) divided by 0.15 provided the requirements of paragraph (g) of this section are met; and

MPGG = The combined model type fuel economy for operation on gasoline or diesel fuel as determined in §600.208-12(b)(5)(i).

UF = A Utility Factor (UF) value selected from the following table based on the driving range of the vehicle while operating on natural gas, except for natural gas dual fuel vehicles that do not meet the criteria in paragraph (c)(2)(vii)(B) the Utility Factor shall be 0.5. Determine the vehicle's driving range in miles by multiplying the combined fuel economy as determined in §600.208-12(b)(5)(ii) by the vehicle's usable fuel storage capacity (as defined at §600.002 and expressed in gasoline gallon equivalents), and rounding to the nearest 10 miles.

| Driving range

(miles) | UF |

|---|---|

| 10 | 0.228 |

| 20 | 0.397 |

| 30 | 0.523 |

| 40 | 0.617 |

| 50 | 0.689 |

| 60 | 0.743 |

| 70 | 0.785 |

| 80 | 0.818 |

| 90 | 0.844 |

| 100 | 0.865 |

| 110 | 0.882 |

| 120 | 0.896 |

| 130 | 0.907 |

| 140 | 0.917 |

| 150 | 0.925 |

| 160 | 0.932 |

| 170 | 0.939 |

| 180 | 0.944 |

| 190 | 0.949 |

| 200 | 0.954 |

| 210 | 0.958 |

| 220 | 0.962 |

| 230 | 0.965 |

| 240 | 0.968 |

| 250 | 0.971 |

| 260 | 0.973 |

| 270 | 0.976 |

| 280 | 0.978 |

| 290 | 0.980 |

| 300 | 0.981 |

(B) Model year 2017 through 2020 natural gas dual fuel model types must meet the following criteria to qualify for use of a Utility Factor greater than 0.5:

(1) The driving range using natural gas must be at least two times the driving range using gasoline.

(2) The natural gas dual fuel vehicle must be designed such that gasoline is used only when the natural gas tank is effectively empty, except for limited use of gasoline that may be required to initiate combustion.

(3) Fuel consumption improvement. Calculate the separate air conditioning, off-cycle, and pickup truck fuel consumption improvement as follows:

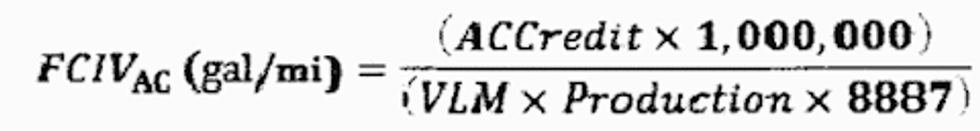

(i) Air conditioning fuel consumption improvement values are calculated separately for each category identified in paragraph (a)(1) of this section using the following equation:

Where:

FCIVAC = the fleet production-weighted total value of air conditioning efficiency credits (fuel consumption improvement value) for all air conditioning systems in the applicable fleet, expressed in gallons per mile;

ACCredit = the total of all air conditioning efficiency credits for the applicable vehicle category, in megagrams, from 40 CFR 86.1868-12(c), and rounded to the nearest whole number;

VLM = vehicle lifetime miles, which for passenger automobiles shall be 195,264 and for light trucks shall be 225,865; and

Production = the total production volume for the applicable category of vehicles.

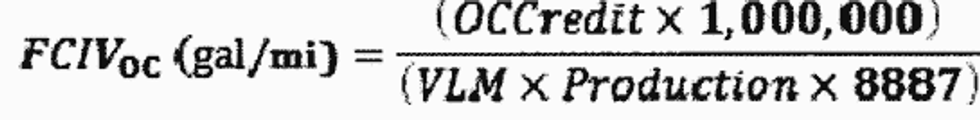

(ii) Off-cycle technology fuel consumption improvement values are calculated separately for each category identified in paragraph (a)(1) of this section using the following equation:

Where:

FCIVOC = the fleet production-weighted total value of off-cycle technology credits (fuel consumption improvement value) for all off-cycle technologies in the applicable fleet, expressed in gallons per mile;

OCCredit = the total of all off-cycle technology credits for the applicable vehicle category, in megagrams, from 40 CFR 86.1869-12(e), and rounded to the nearest whole number;

VLM = vehicle lifetime miles, which for passenger automobiles shall be 195,264 and for light trucks shall be 225,865; and

Production = the total production volume for the applicable category of vehicles.

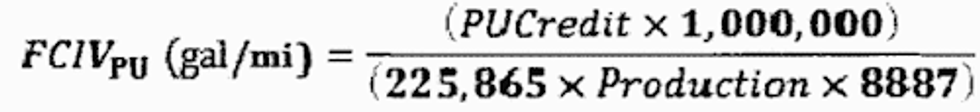

(iii) Full size pickup truck fuel consumption improvement values are calculated for the light truck category identified in paragraph (a)(1) of this section using the following equation:

Where:

FCIVPU = the fleet production-weighted total value of full size pickup truck credits (fuel consumption improvement value) for the light truck fleet, expressed in gallons per mile;

PUCredit = the total of all full size pickup truck credits, in megagrams, from 40 CFR 86.1870-12(c), and rounded to the nearest whole number; and

Production = the total production volume for the light truck category.

(d) The Administrator may approve alternative calculation methods if they are part of an approved credit plan under the provisions of 15 U.S.C. 2003.

(e) For passenger automobile categories identified in paragraph (a)(1) of this section, the average fuel economy calculated in accordance with paragraph (c) of this section shall be adjusted using the following equation:

AFEadj = AFE[((0.55 × a × c) + (0.45 × c) + (0.5556 × a) + 0.4487)/((0.55 × a) + 0.45)] + IW

Where:

AFEadj = Adjusted average combined fuel economy, rounded to the nearest 0.1 mpg;

AFE = Average combined fuel economy as calculated in paragraph (c)(2) of this section, rounded to the nearest 0.0001 mpg;

a = Sales-weight average (rounded to the nearest 0.0001 mpg) of all model type highway fuel economy values (rounded to the nearest 0.1 mpg) divided by the sales-weighted average (rounded to the nearest 0.0001 mpg) of all model type city fuel economy values (rounded to the nearest 0.1 mpg). The quotient shall be rounded to 4 decimal places. These average fuel economies shall be determined using the methodology of paragraph (c) of this section.

c = 0.0014;

IW = (9.2917 × 10−3 × SF3IWC × FE3IWC) − (3.5123 × 10−3 × SF4ETW × FE4IWC).

Note:

Any calculated value of IW less than zero shall be set equal to zero.

SF3IWC = The 3000 lb. inertia weight class sales divided by total sales. The quotient shall be rounded to 4 decimal places.

SF4ETW = The 4000 lb. equivalent test weight category sales divided by total sales. The quotient shall be rounded to 4 decimal places.

FE4IWC = The sales-weighted average combined fuel economy of all 3000 lb. inertia weight class base levels in the compliance category. Round the result to the nearest 0.0001 mpg.

FE4IWC = The sales-weighted average combined fuel economy of all 4000 lb. inertia weight class base levels in the compliance category. Round the result to the nearest 0.0001 mpg.

(f) The Administrator shall calculate and apply additional average fuel economy adjustments if, after notice and opportunity for comment, the Administrator determines that, as a result of test procedure changes not previously considered, such correction is necessary to yield fuel economy test results that are comparable to those obtained under the 1975 test procedures. In making such determinations, the Administrator must find that:

(1) A directional change in measured fuel economy of an average vehicle can be predicted from a revision to the test procedures;

(2) The magnitude of the change in measured fuel economy for any vehicle or fleet of vehicles caused by a revision to the test procedures is quantifiable from theoretical calculations or best available test data;

(3) The impact of a change on average fuel economy is not due to eliminating the ability of manufacturers to take advantage of flexibility within the existing test procedures to gain measured improvements in fuel economy which are not the result of actual improvements in the fuel economy of production vehicles;

(4) The impact of a change on average fuel economy is not solely due to a greater ability of manufacturers to reflect in average fuel economy those design changes expected to have comparable effects on in-use fuel economy;

(5) The test procedure change is required by EPA or is a change initiated by EPA in its laboratory and is not a change implemented solely by a manufacturer in its own laboratory.

(g)(1) Dual fuel automobiles must provide equal or greater energy efficiency while operating on the alternative fuel as while operating on gasoline or diesel fuel to obtain the CAFE credit determined in paragraphs (c)(2)(iv) and (v) of this section or to obtain the carbon-related exhaust emissions credit determined in paragraphs (j)(2)(ii) and (iii) of this section. The following equation must hold true:

Ealt/Epet≥ 1

Where:

Ealt = [FEalt/(NHValt × Dalt)] × 10 6 = energy efficiency while operating on alternative fuel rounded to the nearest 0.01 miles/million BTU.

Epet = [FEpet/(NHVpet × Dpet)] × 10 6 = energy efficiency while operating on gasoline or diesel (petroleum) fuel rounded to the nearest 0.01 miles/million BTU.

FEalt is the fuel economy [miles/gallon for liquid fuels or miles/100 standard cubic feet for gaseous fuels] while operated on the alternative fuel as determined in §600.113-12(a) and (b).

FEpet is the fuel economy [miles/gallon] while operated on petroleum fuel (gasoline or diesel) as determined in §600.113-12(a) and (b).

NHValt is the net (lower) heating value [BTU/lb] of the alternative fuel.

NHVpet is the net (lower) heating value [BTU/lb] of the petroleum fuel.

Dalt is the density [lb/gallon for liquid fuels or lb/100 standard cubic feet for gaseous fuels] of the alternative fuel.

Dpet is the density [lb/gallon] of the petroleum fuel.

(i) The equation must hold true for both the FTP city and HFET highway fuel economy values for each test of each test vehicle.

(ii)(A) The net heating value for alcohol fuels shall be premeasured using a test method which has been approved in advance by the Administrator.

(B) The density for alcohol fuels shall be premeasured using ASTM D 1298 (incorporated by reference at §600.011).

(iii) The net heating value and density of gasoline are to be determined by the manufacturer in accordance with §600.113.

(2) [Reserved]

(3) Dual fuel passenger automobiles manufactured during model years 1993 through 2019 must meet the minimum driving range requirements established by the Secretary of Transportation (49 CFR part 538) to obtain the CAFE credit determined in paragraphs (c)(2)(iv) and (v) of this section.

(h) The increase in average fuel economy determined in paragraph (c) of this section attributable to dual fueled automobiles is subject to a maximum value through model year 2019 that applies separately to each category of automobile specified in paragraph (a)(1) of this section. The increase in average fuel economy attributable to vehicles fueled by electricity or, for model years 2016 and later, by compressed natural gas, is not subject to a maximum value. The increase in average fuel economy attributable to alcohol dual fuel model types calculated under paragraph (c)(2)(v) of this section is also not subject to a maximum value. The following maximum values apply under this paragraph (h):

| Model year | Maximum

increase (mpg) |

|---|---|

| 1993-2014 | 1.2 |

| 2015 | 1.0 |

| 2016 | 0.8 |

| 2017 | 0.6 |

| 2018 | 0.4 |

| 2019 | 0.2 |

(1) The Administrator shall calculate the increase in average fuel economy to determine if the maximum increase provided in this paragraph (h) has been reached. The Administrator shall calculate the increase in average fuel economy for each category of automobiles specified in paragraph (a)(1) of this section by subtracting the average fuel economy values calculated in accordance with this section, assuming all alcohol dual fueled automobiles subject to the provisions of paragraph (c)(2)(iv) of this section are operated exclusively on gasoline (or diesel fuel), from the average fuel economy values determined in paragraph (c) of this section. The difference is limited to the maximum increase specified in this paragraph (h).

(2) [Reserved]

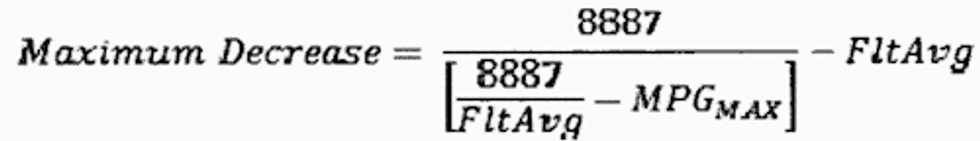

(i) For model years 2012 through 2015, and for each category of automobile identified in paragraph (a)(1) of this section, the maximum decrease in average carbon-related exhaust emissions determined in paragraph (j) of this section attributable to alcohol dual fuel automobiles and natural gas dual fuel automobiles shall be calculated using the following formula, and rounded to the nearest tenth of a gram per mile:

Where:

FltAvg = The fleet average CREE value in grams per mile, rounded to the nearest whole number, for passenger automobiles or light trucks determined for the applicable model year according to paragraph (j) of this section, except by assuming all alcohol dual fuel and natural gas dual fuel automobiles are operated exclusively on gasoline (or diesel) fuel. For the purposes of these calculations, the values for natural gas dual fuel automobiles using the optional Utility Factor approach in paragraph (j)(2)(vii) of this section shall not be the gasoline CREE values, but the CREE values determined in paragraph (j)(2)(vii) of this section.

MPGMAX = The maximum increase in miles per gallon determined for the appropriate model year in paragraph (h) of this section.

(1) The Administrator shall calculate the decrease in average carbon-related exhaust emissions to determine if the maximum decrease provided in this paragraph (i) has been reached. The Administrator shall calculate the average carbon-related exhaust emissions for each category of automobiles specified in paragraph (a) of this section by subtracting the average carbon-related exhaust emission values determined in paragraph (j) of this section from the average carbon-related exhaust emission values calculated in accordance with this section by assuming all alcohol dual fuel and natural gas dual fuel automobiles are operated exclusively on gasoline (or diesel) fuel. For the purposes of these calculations, the values for natural gas dual fuel automobiles using the optional Utility Factor approach in paragraph (j)(2)(vii) of this section shall not be the gasoline CREE values, but the CREE values determined in paragraph (j)(2)(vii) of this section. The difference is limited to the maximum decrease specified in paragraph (i) of this section.

(2) [Reserved]

(j) The average carbon-related exhaust emissions will be calculated individually for each category identified in paragraph (a)(1) of this section as follows:

(1) Divide the total production volume of that category of automobiles into:

(2) A sum of terms, each of which corresponds to a model type within that category of automobiles and is a product determined by multiplying the number of automobiles of that model type produced by the manufacturer in the model year by:

(i) For gasoline-fueled and diesel-fueled model types, the carbon-related exhaust emissions value calculated for that model type in accordance with paragraph (b)(2) of this section; or

(ii)(A) For alcohol-fueled model types, for model years 2012 through 2015, the carbon-related exhaust emissions value calculated for that model type in accordance with paragraph (b)(2) of this section multiplied by 0.15 and rounded to the nearest gram per mile, except that manufacturers complying with the fleet averaging option for N2O and CH4 as allowed under §86.1818 of this chapter must perform this calculation such that N2O and CH4 values are not multiplied by 0.15; or

(B) For alcohol-fueled model types, for model years 2016 and later, the carbon-related exhaust emissions value calculated for that model type in accordance with paragraph (b)(2) of this section; or

(iii)(A) For natural gas-fueled model types, for model years 2012 through 2015, the carbon-related exhaust emissions value calculated for that model type in accordance with paragraph (b)(2) of this section multiplied by 0.15 and rounded to the nearest gram per mile, except that manufacturers complying with the fleet averaging option for N2O and CH4 as allowed under §86.1818 of this chapter must perform this calculation such that N2O and CH4 values are not multiplied by 0.15; or

(B) For natural gas-fueled model types, for model years 2016 and later, the carbon-related exhaust emissions value calculated for that model type in accordance with paragraph (b)(2) of this section; or

(iv) For alcohol dual fuel model types, for model years 2012 through 2015, the arithmetic average of the following two terms, the result rounded to the nearest gram per mile:

(A) The combined model type carbon-related exhaust emissions value for operation on gasoline or diesel fuel as determined in §600.208-12(b)(5)(i); and

(B) The combined model type carbon-related exhaust emissions value for operation on alcohol fuel as determined in §600.208-12(b)(5)(ii) multiplied by 0.15 provided the requirements of paragraph (g) of this section are met, except that manufacturers complying with the fleet averaging option for N2O and CH4 as allowed under §86.1818 of this chapter must perform this calculation such that N2O and CH4 values are not multiplied by 0.15; or

For natural gas dual fuel model types, for model years 2012 through 2015, the arithmetic average of the following two terms; the result rounded to the nearest gram per mile:

(A) The combined model type carbon-related exhaust emissions value for operation on gasoline or diesel as determined in §600.208-12(b)(5)(i); and

(B) The combined model type carbon-related exhaust emissions value for operation on natural gas as determined in §600.208-12(b)(5)(ii) multiplied by 0.15 provided the requirements of paragraph (g) of this section are met, except that manufacturers complying with the fleet averaging option for N2O and CH4 as allowed under §86.1818 of this chapter must perform this calculation such that N2O and CH4 values are not multiplied by 0.15.

(vi) For alcohol dual fuel model types, for model years 2016 and later, the combined model type carbon-related exhaust emissions value determined according to the following formula and rounded to the nearest gram per mile:

CREE = (F × CREEalt) + ((1 − F) × CREEgas)

Where:

F = 0.00 unless otherwise approved by the Administrator according to the provisions of paragraph (k) of this section;

CREEalt = The combined model type carbon-related exhaust emissions value for operation on alcohol fuel as determined in §600.208-12(b)(5)(ii); and

CREEgas = The combined model type carbon-related exhaust emissions value for operation on gasoline or diesel fuel as determined in §600.208-12(b)(5)(i).

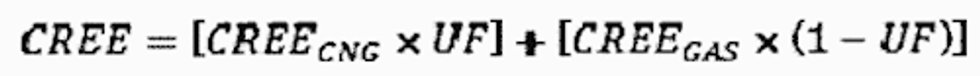

(vii)(A) This paragraph (j)(2)(vii) applies to model year 2016 and later natural gas dual fuel model types. Model year 2021 and later natural gas dual fuel model types may use a utility factor of 0.5 or the utility factor prescribed in this paragraph (j)(2)(vii).

Where:

CREECNG = The combined model type carbon-related exhaust emissions value for operation on natural gas as determined in §600.208-12(b)(5)(ii); and

CREEGAS = The combined model type carbon-related exhaust emissions value for operation on gasoline or diesel fuel as determined in §600.208-12(b)(5)(i).

UF = A Utility Factor (UF) value selected from the following table based on the driving range of the vehicle while operating on natural gas, except for natural gas dual fuel vehicles that do not meet the criteria in paragraph (j)(2)(vii)(B) the Utility Factor shall be 0.5. Determine the vehicle's driving range in miles by multiplying the combined fuel economy as determined in §600.208-12(b)(5)(ii) by the vehicle's usable fuel storage capacity (as defined at §600.002 and expressed in gasoline gallon equivalents), and rounding to the nearest 10 miles.

| Driving range

(miles) | UF |

|---|---|

| 10 | 0.228 |

| 20 | 0.397 |

| 30 | 0.523 |

| 40 | 0.617 |

| 50 | 0.689 |

| 60 | 0.743 |

| 70 | 0.785 |

| 80 | 0.818 |

| 90 | 0.844 |

| 100 | 0.865 |

| 110 | 0.882 |

| 120 | 0.896 |

| 130 | 0.907 |

| 140 | 0.917 |

| 150 | 0.925 |

| 160 | 0.932 |

| 170 | 0.939 |

| 180 | 0.944 |

| 190 | 0.949 |

| 200 | 0.954 |

| 210 | 0.958 |

| 220 | 0.962 |

| 230 | 0.965 |

| 240 | 0.968 |

| 250 | 0.971 |

| 260 | 0.973 |

| 270 | 0.976 |

| 280 | 0.978 |

| 290 | 0.980 |

| 300 | 0.981 |

(B) Model year 2016 through 2020 natural gas dual fuel model types must meet the following criteria to qualify for use of a Utility Factor greater than 0.5:

(1) The driving range using natural gas must be at least two times the driving range using gasoline.

(2) The natural gas dual fuel vehicle must be designed such that gasoline is used only when the natural gas tank is effectively empty, except for limited use of gasoline that may be required to initiate combustion.

(k) Alternative in-use weighting factors for dual fuel model types. Using one of the methods in either paragraph (k)(1) or (2) of this section, manufacturers may request the use of alternative values for the weighting factor F in the equations in paragraphs (j)(2)(vi) and (vii) of this section. Unless otherwise approved by the Administrator, the manufacturer must use the value of F that is in effect in paragraphs (j)(2)(vi) and (vii) of this section.

(1) Upon written request from a manufacturer, the Administrator will determine and publish by written guidance an appropriate value of F for each requested alternative fuel based on the Administrator's assessment of real-world use of the alternative fuel. Such published values would be available for any manufacturer to use. The Administrator will periodically update these values upon written request from a manufacturer.

(2) The manufacturer may optionally submit to the Administrator its own demonstration regarding the real-world use of the alternative fuel in their vehicles and its own estimate of the appropriate value of F in the equations in paragraphs (j)(2)(vi) and (vii) of this section. Depending on the nature of the analytical approach, the manufacturer could provide estimates of F that are model type specific or that are generally applicable to the manufacturer's dual fuel fleet. The manufacturer's analysis could include use of data gathered from on-board sensors and computers, from dual fuel vehicles in fleets that are centrally fueled, or from other sources. The analysis must be based on sound statistical methodology and must account for analytical uncertainty. Any approval by the Administrator will pertain to the use of values of F for the model types specified by the manufacturer.

[75 FR 25714, May 7, 2010, as amended at 76 FR 39567, July 6, 2011; 77 FR 63184, Oct. 15, 2012; 81 FR 74003, Dec. 27, 2016; 85 FR 25273, Apr. 30, 2020; 85 FR 53679, Aug. 31, 2020; 86 FR 74526, Dec. 30, 2021; 88 FR 4484, Jan. 24, 2023]

§600.511-08 Determination of domestic production.

(a) Except with advance approval of the Administrator, an automobile shall be considered domestically produced in any model year if it is included within a domestically produced car line (car line includes station wagons for purposes of this paragraph), unless the assembly of such automobile is completed in Canada or Mexico and such automobile is not imported into the United States prior to the expiration of 30 days following the end of the model year. For purposes of this paragraph a car line will be considered domestically produced if the following ratio is less than 0.25:

(1) The sum of the declared value, as defined in §600.502, of all of the imported components installed or included on automobiles produced within such a car line within a given model year plus the cost of transportation and insuring such components to the United States port of entry, the Mexican port of entry (when paragraph (b)(3) of this section applies), or the Canadian port of entry but exclusive of any customs duty, divided by

(2) The cost of production, as defined in §600.502, of automobiles within such car line.

(b) For the purposes of calculations under this subpart with respect to automobiles manufactured during any model year,

(1) An average exchange rate for the country of origin of each imported component shall be used that is calculated by taking the mean of the exchange rates in effect at the end of each quarter set by the Federal Reserve Bank of New York for twelve calendar quarters prior to and including the calendar quarter ending one year prior to the date that the manufacturer submits the calculation of the preliminary average for such model year. Such rate, once calculated, shall be in effect for the duration of the model year. Upon petition of a manufacturer, the Administrator may permit the use of a different exchange rate where appropriate and necessary.

(2) For automobiles for which paragraph (b)(3) of this section does not apply pursuant to the schedule in paragraph (b)(4), components shall be considered imported unless they are either:

(i) Wholly the growth, product, or manufacture of the United States and/or Canada, or

(ii) Substantially transformed in the United States or Canada into a new and different article of commerce.

(3) For automobiles for which this paragraph applies pursuant to the schedule in paragraph (b)(4) of this section, components shall be considered imported unless they are either:

(i) Wholly the growth, product, or manufacture of the United States and/or Canada and/or Mexico, or

(ii) Substantially transformed in the United States and/or Canada and/or Mexico into a new and different article of commerce.

(4) Paragraphs (b)(4) (i) through (v) of this section set forth the schedule according to which paragraph (b)(3) of this section applies for all automobiles manufactured by a manufacturer and sold in the United States, wherever assembled.

(i) With respect to a manufacturer that initiated the assembly of automobiles in Mexico before model year 1992, the manufacturer may elect, at any time between January 1, 1997, and January 1, 2004, to have paragraph (b)(3) of this section apply to all automobiles it manufactures, beginning with the model year commencing after the date of such election.

(ii) With respect to a manufacturer initiating the assembly of automobiles in Mexico after model year 1991, paragraph (b)(3) of this section shall apply to all automobiles it manufactures, beginning with the model year commencing after January 1, 1994, or the model year commencing after the date that the manufacturer initiates the assembly of automobiles in Mexico, whichever is later.

(iii) With respect to a manufacturer not described by paragraph (b)(4) (i) or (ii) of this section assembling automobiles in the United States or Canada but not in Mexico, the manufacturer may elect, at any time between January 1, 1997, and January 1, 2004, to have paragraph (b)(3) of this section apply to all automobiles it manufactures, beginning with the model year commencing after the date of such election, except that if such manufacturer initiates the assembly of automobiles in Mexico before making such election, this paragraph shall not apply, and the manufacturer shall be subject to paragraph (b)(4)(ii) of this section.

(iv) With respect to a manufacturer not assembling automobiles in the United States, Canada, or Mexico, paragraph (b)(3) of this section shall apply to all automobiles it manufactures, beginning with the model year commencing after January 1, 1994.

(v) With respect to a manufacturer authorized to make an election under paragraph (b)(4) (i) or (iii) of this section which has not made that election within the specified period, paragraph (b)(3) of this section shall apply to all automobiles it manufactures, beginning with the model year commencing after January 1, 2004.

(5) All elections under paragraph (b)(4) of this section shall be made in accordance with the procedures established by the Secretary of Transportation pursuant to 49 U.S.C. 32904(b)(3)(C).

(c) If it is determined by the Administrator at some date later than the date of entry that the declared value of such imported components did not represent fair market value at the date of entry, through U.S. Bureau of Customs appraisals, the Administrator may review the determination made pursuant to paragraph (a) of this section as to whether the pertinent car lines which utilize such components were correctly included within the manufaturer's domestically-produced or foreign-produced fleets. If such a determination was in error due to misrepresentation of the valuation of imported components at the date of entry, the Administrator may recalculate the manufacturer's average for the affected model year, according to §600.510, to reflect the correct valuation of such imported components in each affected car line.

(d)-(e) [Reserved]

[42 FR 45662, Sept. 12, 1977, as amended at 43 FR 39376, Sept. 5, 1978; 59 FR 679, Jan. 6, 1994; 59 FR 33914, July 1, 1994; 74 FR 61554, Nov. 25, 2009. Redesignated at 76 FR 39569, July 6, 2011]

§600.512-12 Model year report.

(a) For each model year, the manufacturer shall submit to the Administrator a report, known as the model year report, containing all information necessary for the calculation of the manufacturer's average fuel economy and all information necessary for the calculation of the manufacturer's average carbon-related exhaust emissions.

(1) The results of the manufacturer calculations and summary information of model type fuel economy values which are contained in the average fuel economy calculation shall also be submitted to the Secretary of the Department of Transportation, National Highway and Traffic Safety Administration.

(2) The results of the manufacturer calculations and summary information of model type carbon-related exhaust emission values which are contained in the average calculation shall be submitted to the Administrator.

(3) Separate reports shall be submitted for passenger automobiles and light trucks (as identified in §600.510-12).

(b) The model year report shall be in writing, signed by the authorized representative of the manufacturer and shall be submitted no later than May 1 following the end of the model year. A manufacturer may request an extension for submitting the model year report if that is needed to provide all additional required data as determined in §600.507-12. The request must clearly indicate the circumstances necessitating the extension.

(c) The model year report must include the following information:

(1)(i) All fuel economy data used in the FTP/HFET-based model type calculations under §600.208, and subsequently required by the Administrator in accordance with §600.507;

(ii) All carbon-related exhaust emission data used in the FTP/HFET-based model type calculations under §600.208, and subsequently required by the Administrator in accordance with §600.507;

(2) (i) All fuel economy data for certification vehicles and for vehicles tested for running changes approved under §86.1842 of this chapter;

(ii) All carbon-related exhaust emission data for certification vehicles and for vehicles tested for running changes approved under §86.1842 of this chapter;

(3) Any additional fuel economy and carbon-related exhaust emission data submitted by the manufacturer under §600.509;

(4)(i) A fuel economy value for each model type of the manufacturer's product line calculated according to §600.510-12(b)(2);

(ii) A carbon-related exhaust emission value for each model type of the manufacturer's product line calculated according to §600.510-12(b)(2);

(5)(i) The manufacturer's average fuel economy value calculated according to §600.510-12(c);

(ii) The manufacturer's average carbon-related exhaust emission value calculated according to §600.510-12(j);

(6) A listing of both domestically and nondomestically produced car lines as determined in §600.511 and the cost information upon which the determination was made; and

(7) The authenticity and accuracy of production data must be attested to by the corporation, and shall bear the signature of an officer (a corporate executive of at least the rank of vice-president) designated by the corporation. Such attestation shall constitute a representation by the manufacturer that the manufacturer has established reasonable, prudent procedures to ascertain and provide production data that are accurate and authentic in all material respects and that these procedures have been followed by employees of the manufacturer involved in the reporting process. The signature of the designated officer shall constitute a representation by the required attestation.

(8) [Reserved]

(9) The “required fuel economy level” pursuant to 49 CFR parts 531 or 533, as applicable. Model year reports shall include information in sufficient detail to verify the accuracy of the calculated required fuel economy level, including but is not limited to, production information for each unique footprint within each model type contained in the model year report and the formula used to calculate the required fuel economy level. Model year reports shall include a statement that the method of measuring vehicle track width, measuring vehicle wheelbase and calculating vehicle footprint is accurate and complies with applicable Department of Transportation requirements.

(10) The “required fuel economy level” pursuant to 49 CFR parts 531 or 533 as applicable, and the applicable fleet average CO2 emission standards. Model year reports shall include information in sufficient detail to verify the accuracy of the calculated required fuel economy level and fleet average CO2 emission standards, including but is not limited to, production information for each unique footprint within each model type contained in the model year report and the formula used to calculate the required fuel economy level and fleet average CO2 emission standards. Model year reports shall include a statement that the method of measuring vehicle track width, measuring vehicle wheelbase and calculating vehicle footprint is accurate and complies with applicable Department of Transportation and EPA requirements.

(11) A detailed (but easy to understand) list of vehicle models and the applicable in-use CREE emission standard. The list of models shall include the applicable carline/subconfiguration parameters (including carline, equivalent test weight, road-load horsepower, axle ratio, engine code, transmission class, transmission configuration and basic engine); the test parameters (ETW and a, b, c, dynamometer coefficients) and the associated CREE emission standard. The manufacturer shall provide the method of identifying EPA engine code for applicable in-use vehicles.

[75 FR 25717, May 7, 2010, as amended at 76 FR 39569, July 6, 2011; 88 FR 4484, Jan. 24, 2023]

§600.513-08 Gas Guzzler Tax.

(a) This section applies only to passenger automobiles sold after December 27, 1991, regardless of the model year of those vehicles. For alcohol dual fuel and natural gas dual fuel automobiles, the fuel economy while such automobiles are operated on gasoline will be used for Gas Guzzler Tax assessments.

(1) The provisions of this section do not apply to passenger automobiles exempted for Gas Guzzler Tax assessments by applicable Federal law and regulations. However, the manufacturer of an exempted passenger automobile may, in its discretion, label such vehicles in accordance with the provisions of this section.

(2) For 1991 and later model year passenger automobiles, the combined FTP/HFET-based model type fuel economy value determined in §600.208 used for Gas Guzzler Tax assessments shall be calculated in accordance with the following equation, rounded to the nearest 0.1 mpg:

FEadj = FE[((0.55 × ag × c) + (0.45 × c) + (0.5556 × ag) + 0.4487)/((0.55 × ag) + 0.45)] + IWg

Where:

FEadj = Fuel economy value to be used for determination of gas guzzler tax assessment rounded to the nearest 0.1 mpg.

FE = Combined model type fuel economy calculated in accordance with §600.208, rounded to the nearest 0.0001 mpg.

ag = Model type highway fuel economy, calculated in accordance with §600.208, rounded to the nearest 0.0001 mpg divided by the model type city fuel economy calculated in accordance with §600.208, rounded to the nearest 0.0001 mpg. The quotient shall be rounded to 4 decimal places.

c = gas guzzler adjustment factor = 1.300 × 10−3 for the 1986 and later model years.

IWg = (9.2917 × 10−3 × SF3IWCGFE3IWCG) − (3.5123 × 10−3 × SF4ETWG × FE4IWCG).

Note:

Any calculated value of IW less than zero shall be set equal to zero.

SF3IWCG = The 3000 lb. inertia weight class sales in the model type divided by the total model type sales; the quotient shall be rounded to 4 decimal places.

SF4ETWG = The 4000 lb. equivalent test weight sales in the model type divided by the total model type sales, the quotient shall be rounded to 4 decimal places.

FE3IWCG = The 3000 lb. inertial weight class base level combined fuel economy used to calculate the model type fuel economy rounded to the nearest 0.0001 mpg.

FE4IWCG = The 4000 lb. inertial weight class base level combined fuel economy used to calculate the model type fuel economy rounded to the nearest 0.001 mpg.

(b)(1) For passenger automobiles sold after December 31, 1990, with a combined FTP/HFET-based model type fuel economy value of less than 22.5 mpg (as determined in §600.208), calculated in accordance with paragraph (a)(2) of this section and rounded to the nearest 0.1 mpg, each vehicle fuel economy label shall include a Gas Guzzler Tax statement pursuant to 49 U.S.C. 32908(b)(1)(E). The tax amount stated shall be as specified in paragraph (b)(2) of this section.

(2) For passenger automobiles with a combined general label model type fuel economy value of:

| At least * * * | but less than * * * | the Gas Guzzler Tax statement shall show a tax of * * * |

|---|---|---|

| (i) 22.5 | $0 | |

| (ii) 21.5 | 22.5 | $1,000 |

| (iii) 20.5 | 21.5 | $1,300 |

| (iv) 19.5 | 20.5 | $1,700 |

| (v) 18.5 | 19.5 | $2,100 |

| (vi) 17.5 | 18.5 | $2,600 |

| (vii) 16.5 | 17.5 | $3,000 |

| (viii) 15.5 | 16.5 | $3,700 |

| (ix) 14.5 | 15.5 | $4,500 |

| (x) 13.5 | 14.5 | $5,400 |

| (xi) 12.5 | 13.5 | $6,400 |

| (xii) - | 12.5 | $7,700 |

[76 FR 39569, July 6, 2011]

§600.514-12 Reports to the Environmental Protection Agency.

This section establishes requirements for automobile manufacturers to submit reports to the Environmental Protection Agency regarding their efforts to reduce automotive greenhouse gas emissions.

(a) General Requirements. (1) For each model year, each manufacturer shall submit a pre-model year report.

(2) The pre-model year report required by this section for each model year must be submitted before the model year begins and before the certification of any test group, no later than December 31 of the calendar year two years before the model year. For example the pre-model year report for the 2012 model year must be submitted no later than December 31, 2010.

(3) Each report required by this section must:

(i) Identify the report as a pre-model year report;

(ii) Identify the manufacturer submitting the report;

(iii) State the full name, title, and address of the official responsible for preparing the report;

(iv) Be submitted to: Director, Compliance and Innovative Strategies Division, U.S. Environmental Protection Agency, 2000 Traverwood, Ann Arbor, Michigan 48105;

(v) Identify the current model year;

(vi) Be written in the English language; and

(vii) Be based upon all information and data available to the manufacturer approximately 30 days before the report is submitted to the Administrator.

(b) Content of pre-model year reports. (1) Each pre-model year report must include the following information for each compliance category for the applicable future model year and to the extent possible, two model years into the future:

(i) The manufacturer's estimate of its footprint-based fleet average CO2 standards (including temporary lead time allowance alternative standards, if applicable);

(ii) Projected total and model-level production volumes for each applicable standard category;

(iii) Projected fleet average CO2 compliance level for each applicable standard category; and the model-level CO2 emission values which form the basis of the projection;

(iv) Projected fleet average CO2 credit/debit status for each applicable standard category;

(v) A description of the various credit, transfer and trading options that will be used to comply with each applicable standard category, including the amount of credit the manufacturer intends to generate for air conditioning leakage, air conditioning efficiency, off-cycle technology, advanced technology vehicles, hybrid or low-emission full size pickup trucks, and various early credit programs;

(vi) A description of the method which will be used to calculate the carbon-related exhaust emissions for any electric vehicles, fuel cell vehicles and plug-in hybrid vehicles;

(vii) A summary by model year (beginning with the 2009 model year) of the number of electric vehicles, fuel cell vehicles, plug-in hybrid electric vehicles, dedicated compressed natural gas vehicles, and dual fuel natural gas vehicles using (or projected to use) the advanced technology vehicle credit and incentives program, including the projected use of production multipliers;

(viii) The methodology which will be used to comply with N2O and CH4 emission standards; and

(ix) Notification of the manufacturer's intent to exclude emergency vehicles from the calculation of fleet average standards and the end-of-year fleet average, including a description of the excluded emergency vehicles and the quantity of such vehicles excluded.

(x) Other information requested by the Administrator.

(2) Manufacturers must submit, in the pre-model year report for each model year in which a credit deficit is generated (or projected to be generated), a compliance plan demonstrating how the manufacturer will comply with the fleet average CO2 standard by the end of the third year after the deficit occurred.

[75 FR 25718, May 7, 2010, as amended at 77 FR 63187, Oct. 15, 2012]

['Air Programs']

['Greenhouse Gases']

UPGRADE TO CONTINUE READING

Load More

J. J. Keller is the trusted source for DOT / Transportation, OSHA / Workplace Safety, Human Resources, Construction Safety and Hazmat / Hazardous Materials regulation compliance products and services. J. J. Keller helps you increase safety awareness, reduce risk, follow best practices, improve safety training, and stay current with changing regulations.

Copyright 2026 J. J. Keller & Associate, Inc. For re-use options please contact copyright@jjkeller.com or call 800-558-5011.