['Air Programs']

['Air Quality', 'Acid Rain']

05/13/2025

...

Authority: 42 U.S.C. 7601 and 7651 et seq.

Subpart A - Background and Summary

§73.1 Purpose and scope.

The purpose of this part is to establish the requirements and procedures for the following:

(a) The allocation of sulfur dioxide emissions allowances;

(b) The tracking, holding, and transfer of allowances;

(c) The deduction of allowances for purposes of compliance and for purposes of offsetting excess emissions pursuant to parts 72 and 77 of this chapter;

(d) The sale of allowances through EPA-sponsored auctions and a direct sale, including the independent power producers written guarantee program; and

(e) The application for, and distribution of, allowances from the Conservation andRenewable Energy Reserve.

(f) The application for, and distribution of, allowances for desulfurization of fuel by small diesel refineries.

[58 FR 3687, Jan. 11, 1993, as amended at 58 FR 15650, Mar. 23, 1993]

§73.2 Applicability.

The following parties shall be subject to the provisions of this part:

(a) Owners, operators, and designated representatives of affected sources and affected units pursuant to §72.6 of this chapter;

(b) Any new independent power producer as defined in section 416 of the Act and §72.2 of this chapter, except as provided in section 405(g)(6) of the Act;

(c) Any owner of an affected unit who may apply to receive allowances under the Energy Conservation and Renewable Energy Reserve Program established in accordance with section 404(f) of the Act;

(d) Any small diesel refinery as defined in §72.2 of this chapter, and

(e) Any other person, as defined in §72.2 of this chapter, who chooses to purchase, hold, or transfer allowances as provided in section 403(b) of the Act.

§73.3 General.

Part 72 of this chapter, including §§72.2 (definitions), 72.3 (measurements, abbreviations, and acronyms), 72.4 (Federal authority), 72.5 (State authority), 72.6 (applicability), 72.7 (new units exemption), 72.8 (retired unit exemption), 72.9 (standard requirements), 72.10 (availability of information), and 72.11 (computation of time) of part 72, subpart A of this chapter, shall apply to this part. The procedures for appeals of decisions of the Administrator under this part are contained in part 78 of this chapter. Sections 73.3 (Definitions) and 73.4 (Deadlines), which were previously published with subpart E of this part - “Auctions, Direct Sales, and Independent Power Producers Written Guarantee”, are codified at §§72.2 and 72.12 of this chapter, respectively.

Source: 58 FR 3687, Jan. 11, 1993, unless otherwise noted.

Subpart B - Allowance Allocations

§73.10 Initial allocations for phase I and phase II.

(a) Phase I allowances. The Administrator will allocate allowances to the compliance account for each source that includes a unit listed in table 1 of this section in the amount listed in column A to be held for the years 1995 through 1999.

| State name | Plant name | Boiler | Column A final phase 1 allocation | Column B auction and sales reserve |

|---|---|---|---|---|

| Alabama | Colbert | 1 | 13213 | 357 |

| 2 | 14907 | 403 | ||

| 3 | 14995 | 405 | ||

| 4 | 15005 | 405 | ||

| 5 | 36202 | 978 | ||

| E.C. Gaston | 1 | 17624 | 476 | |

| 2 | 18052 | 488 | ||

| 3 | 17828 | 482 | ||

| 4 | 18773 | 507 | ||

| 5 | 58265 | 1575 | ||

| Florida | Big Bend | BB01 | 27662 | 748 |

| BB02 | 26387 | 713 | ||

| BB03 | 26036 | 704 | ||

| Crist | 6 | 18695 | 505 | |

| 7 | 30846 | 834 | ||

| Georgia | Bowen | 1BLR | 54838 | 1482 |

| 2BLR | 53329 | 1441 | ||

| 3BLR | 69862 | 1888 | ||

| 4BLR | 69852 | 1888 | ||

| Hammond | 1 | 8549 | 231 | |

| 2 | 8977 | 243 | ||

| 3 | 8676 | 234 | ||

| 4 | 36650 | 990 | ||

| Jack McDonough | MB1 | 19386 | 524 | |

| MB2 | 20058 | 542 | ||

| Wansley | 1 | 68908 | 1862 | |

| 2 | 63708 | 1722 | ||

| Yates | Y1BR | 7020 | 190 | |

| Y2BR | 6855 | 185 | ||

| Y3BR | 6767 | 183 | ||

| Y4BR | 8676 | 234 | ||

| Y5BR | 9162 | 248 | ||

| Y6BR | 24108 | 652 | ||

| Y7BR | 20915 | 565 | ||

| Illinois | Baldwin | 1 | 46052 | 1245 |

| 2 | 48695 | 1316 | ||

| 3 | 46644 | 1261 | ||

| Coffeen | 01 | 12925 | 349 | |

| 02 | 39102 | 1057 | ||

| Grand Tower | 09 | 6479 | 175 | |

| Hennepin | 2 | 20182 | 545 | |

| Joppa Steam | 1 | 12259 | 331 | |

| 2 | 10487 | 283 | ||

| 3 | 11947 | 323 | ||

| 4 | 11061 | 299 | ||

| 5 | 11119 | 301 | ||

| 6 | 10341 | 279 | ||

| Kincaid | 1 | 34564 | 934 | |

| 2 | 37063 | 1002 | ||

| Meredosia | 05 | 15227 | 411 | |

| Vermilion | 2 | 9735 | 263 | |

| Indiana | Bailly | 7 | 12256 | 331 |

| 8 | 17134 | 463 | ||

| Breed | 1 | 20280 | 548 | |

| Cayuga | 1 | 36581 | 989 | |

| 2 | 37415 | 1011 | ||

| Clifty Creek | 1 | 19620 | 530 | |

| 2 | 19289 | 521 | ||

| 3 | 19873 | 537 | ||

| 4 | 19552 | 528 | ||

| 5 | 18851 | 509 | ||

| 6 | 19844 | 536 | ||

| Elmer W. Stout | 50 | 4253 | 115 | |

| 60 | 5229 | 141 | ||

| 70 | 25883 | 699 | ||

| F.B. Culley | 2 | 4703 | 127 | |

| 3 | 18603 | 503 | ||

| Frank E. Ratts | 1SG1 | 9131 | 247 | |

| 2SG1 | 9296 | 251 | ||

| Gibson | 1 | 44288 | 1197 | |

| 2 | 44956 | 1215 | ||

| 3 | 45033 | 1217 | ||

| 4 | 44200 | 1195 | ||

| H.T. Pritchard | 6 | 6325 | 171 | |

| Michigan City | 12 | 25553 | 691 | |

| Petersburg | 1 | 18011 | 487 | |

| 2 | 35496 | 959 | ||

| R. Gallagher | 1 | 7115 | 192 | |

| 2 | 7980 | 216 | ||

| 3 | 7159 | 193 | ||

| 4 | 8386 | 227 | ||

| Tanners Creek | U4 | 27209 | 735 | |

| Wabash River | 1 | 4385 | 118 | |

| 2 | 3135 | 85 | ||

| 3 | 4111 | 111 | ||

| 5 | 4023 | 109 | ||

| 6 | 13462 | 364 | ||

| Warrick | 4 | 29577 | 799 | |

| Iowa | Burlington | 1 | 10428 | 282 |

| Des Moines | 11 | 2259 | 61 | |

| George Neal | 1 | 2571 | 69 | |

| Milton L. Kapp | 2 | 13437 | 363 | |

| Prairie Creek | 4 | 7965 | 215 | |

| Riverside | 9 | 3885 | 105 | |

| Kansas | Quindaro | 2 | 4109 | 111 |

| Kentucky | Coleman | C1 | 10954 | 296 |

| C2 | 12502 | 338 | ||

| C3 | 12015 | 325 | ||

| Cooper | 1 | 7254 | 196 | |

| 2 | 14917 | 403 | ||

| E.W. Brown | 1 | 6923 | 187 | |

| 2 | 10623 | 287 | ||

| 3 | 25413 | 687 | ||

| Elmer Smith | 1 | 6348 | 172 | |

| 2 | 14031 | 379 | ||

| Ghent | 1 | 27662 | 748 | |

| Green River | 5 | 7614 | 206 | |

| H.L. Spurlock | 1 | 22181 | 599 | |

| HMP&L Station 2 | H1 | 12989 | 351 | |

| H2 | 11986 | 324 | ||

| Paradise | 3 | 57613 | 1557 | |

| Shawnee | 10 | 9902 | 268 | |

| Maryland | C.P. Crane | 1 | 10058 | 272 |

| 2 | 8987 | 243 | ||

| Chalk Point | 1 | 21333 | 577 | |

| 2 | 23690 | 640 | ||

| Morgantown | 1 | 34332 | 928 | |

| 2 | 37467 | 1013 | ||

| Michigan | J.H. Campbell | 1 | 18773 | 507 |

| 2 | 22453 | 607 | ||

| Minnesota | High Bridge | 6 | 4158 | 112 |

| Mississippi | Jack Watson | 4 | 17439 | 471 |

| 5 | 35734 | 966 | ||

| Missouri | Asbury | 1 | 15764 | 426 |

| James River | 5 | 4722 | 128 | |

| LaBadie | 1 | 39055 | 1055 | |

| 2 | 36718 | 992 | ||

| 3 | 39249 | 1061 | ||

| 4 | 34994 | 946 | ||

| Montrose | 1 | 7196 | 194 | |

| 2 | 7984 | 216 | ||

| 3 | 9824 | 266 | ||

| New Madrid | 1 | 27497 | 743 | |

| 2 | 31625 | 855 | ||

| Sibley | 3 | 15170 | 410 | |

| Sioux | 1 | 21976 | 594 | |

| 2 | 23067 | 623 | ||

| Thomas Hill | MB1 | 9980 | 270 | |

| MB2 | 18880 | 510 | ||

| New Hampshire | Merrimack | 1 | 9922 | 268 |

| 2 | 21421 | 579 | ||

| New Jersey | B.L. England | 1 | 8822 | 238 |

| 2 | 11412 | 308 | ||

| New York | Dunkirk | 3 | 12268 | 332 |

| 4 | 13690 | 370 | ||

| Greenidge | 6 | 7342 | 198 | |

| Milliken | 1 | 10876 | 294 | |

| 2 | 12083 | 327 | ||

| Northport | 1 | 19289 | 521 | |

| 2 | 23476 | 634 | ||

| 3 | 25783 | 697 | ||

| Port Jefferson | 3 | 10194 | 276 | |

| 4 | 12006 | 324 | ||

| Ohio | Ashtabula | 7 | 18351 | 496 |

| Avon Lake | 11 | 12771 | 345 | |

| 12 | 33413 | 903 | ||

| Cardinal | 1 | 37568 | 1015 | |

| 2 | 42008 | 1135 | ||

| Conesville | 1 | 4615 | 125 | |

| 2 | 5360 | 145 | ||

| 3 | 6029 | 163 | ||

| 4 | 53463 | 1445 | ||

| Eastlake | 1 | 8551 | 231 | |

| 2 | 9471 | 256 | ||

| 3 | 10984 | 297 | ||

| 4 | 15906 | 430 | ||

| 5 | 37349 | 1009 | ||

| Edgewater | 13 | 5536 | 150 | |

| Gen. J.M. Gavin | 1 | 86690 | 2343 | |

| 2 | 88312 | 2387 | ||

| Kyger Creek | 1 | 18773 | 507 | |

| 2 | 18072 | 488 | ||

| 3 | 17439 | 471 | ||

| 4 | 18218 | 492 | ||

| 5 | 18247 | 493 | ||

| Miami Fort | 5-1 | 417 | 11 | |

| 5-2 | 417 | 11 | ||

| 6 | 12475 | 337 | ||

| 7 | 42216 | 1141 | ||

| Muskingum River | 1 | 16312 | 441 | |

| 2 | 15533 | 420 | ||

| 3 | 15293 | 413 | ||

| 4 | 12914 | 349 | ||

| 5 | 44364 | 1199 | ||

| Niles | 1 | 7608 | 206 | |

| 2 | 9975 | 270 | ||

| Picway | 9 | 5404 | 146 | |

| R.E. Burger | 5 | 3371 | 91 | |

| 6 | 3371 | 91 | ||

| 7 | 11818 | 319 | ||

| 8 | 13626 | 368 | ||

| W.H. Sammis | 5 | 26496 | 716 | |

| 6 | 43773 | 1183 | ||

| 7 | 47380 | 1280 | ||

| Walter C. Beckjord | 5 | 9811 | 265 | |

| 6 | 25235 | 682 | ||

| Pennsylvania | Armstrong | 1 | 14031 | 379 |

| 2 | 15024 | 406 | ||

| Brunner Island | 1 | 27030 | 730 | |

| 2 | 30282 | 818 | ||

| 3 | 52404 | 1416 | ||

| Cheswick | 1 | 38139 | 1031 | |

| Conemaugh | 1 | 58217 | 1573 | |

| 2 | 64701 | 1749 | ||

| Hatfield's Ferry | 1 | 36835 | 995 | |

| 2 | 36338 | 982 | ||

| 3 | 39210 | 1060 | ||

| Martins Creek | 1 | 12327 | 333 | |

| 2 | 12483 | 337 | ||

| Portland | 1 | 5784 | 156 | |

| 2 | 9961 | 269 | ||

| Shawville | 1 | 10048 | 272 | |

| 2 | 10048 | 272 | ||

| 3 | 13846 | 374 | ||

| 4 | 13700 | 370 | ||

| Sunbury | 3 | 8530 | 230 | |

| 4 | 11149 | 301 | ||

| Tennessee | Allen | 1 | 14917 | 403 |

| 2 | 16329 | 441 | ||

| 3 | 15258 | 412 | ||

| Cumberland | 1 | 84419 | 2281 | |

| 2 | 92344 | 2496 | ||

| Gallatin | 1 | 17400 | 470 | |

| 2 | 16855 | 455 | ||

| 3 | 19493 | 527 | ||

| 4 | 20701 | 559 | ||

| Johnsonville | 1 | 7585 | 205 | |

| 10 | 7351 | 199 | ||

| 2 | 7828 | 212 | ||

| 3 | 8189 | 221 | ||

| 4 | 7780 | 210 | ||

| 5 | 8023 | 217 | ||

| 6 | 7682 | 208 | ||

| 7 | 8744 | 236 | ||

| 8 | 8471 | 229 | ||

| 9 | 6894 | 186 | ||

| West Virginia | Albright | 3 | 11684 | 316 |

| Fort Martin | 1 | 40496 | 1094 | |

| 2 | 40116 | 1084 | ||

| Harrison | 1 | 47341 | 1279 | |

| 2 | 44936 | 1214 | ||

| 3 | 40408 | 1092 | ||

| Kammer | 1 | 18247 | 493 | |

| 2 | 18948 | 512 | ||

| 3 | 16932 | 458 | ||

| Mitchell | 1 | 42823 | 1157 | |

| 2 | 44312 | 1198 | ||

| M.T. Storm | 1 | 42570 | 1150 | |

| 2 | 34644 | 936 | ||

| 3 | 41314 | 1116 | ||

| Wisconsin | Edgewater | 4 | 24099 | 651 |

| Genoa | 1 | 22103 | 597 | |

| Nelson Dewey | 1 | 5852 | 158 | |

| 2 | 6504 | 176 | ||

| North Oak Creek | 1 | 5083 | 137 | |

| 2 | 5005 | 135 | ||

| 3 | 5229 | 141 | ||

| 4 | 6154 | 166 | ||

| Pulliam | 8 | 7312 | 198 | |

| South Oak Creek | 5 | 9416 | 254 | |

| 6 | 11723 | 317 | ||

| 7 | 15754 | 426 | ||

| 8 | 15375 | 415 |

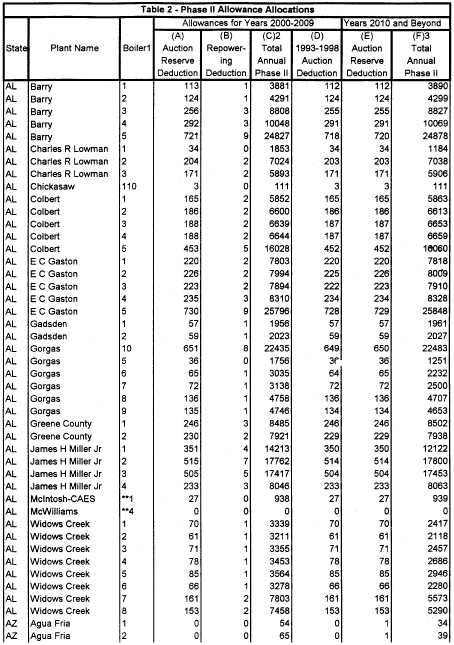

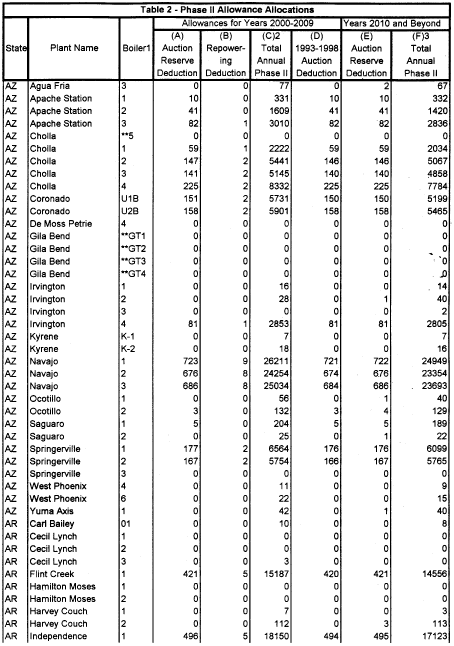

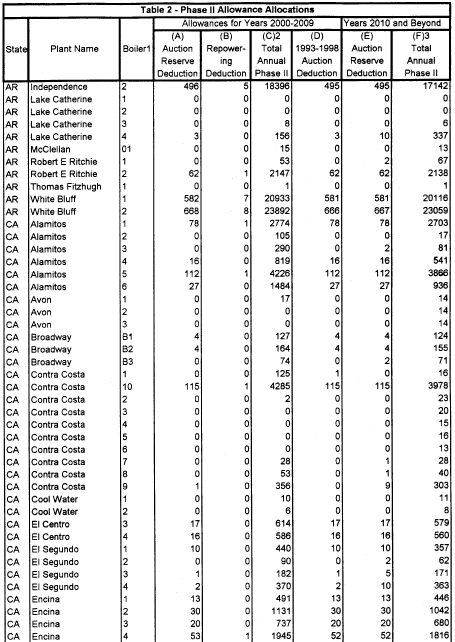

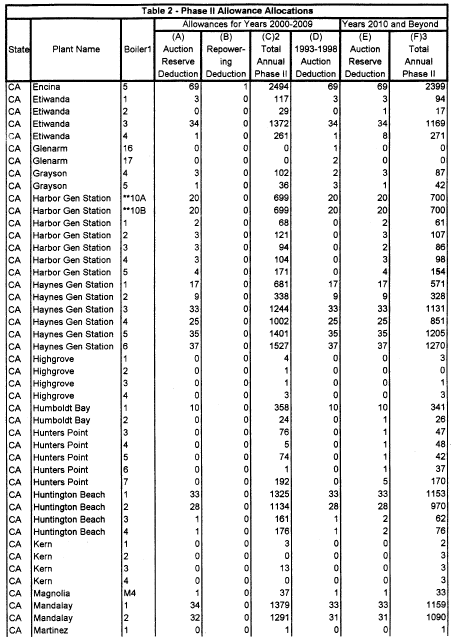

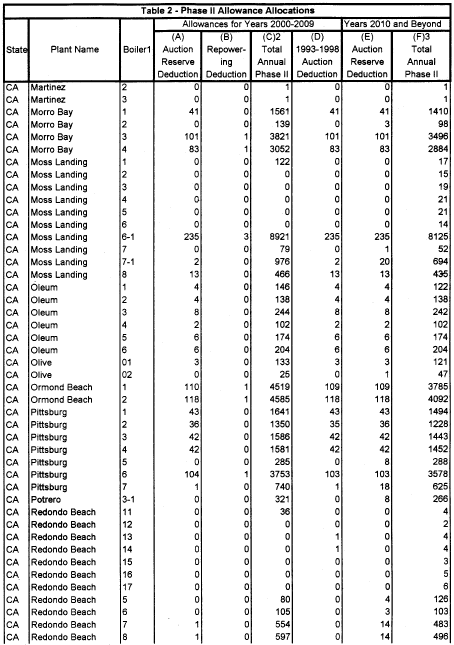

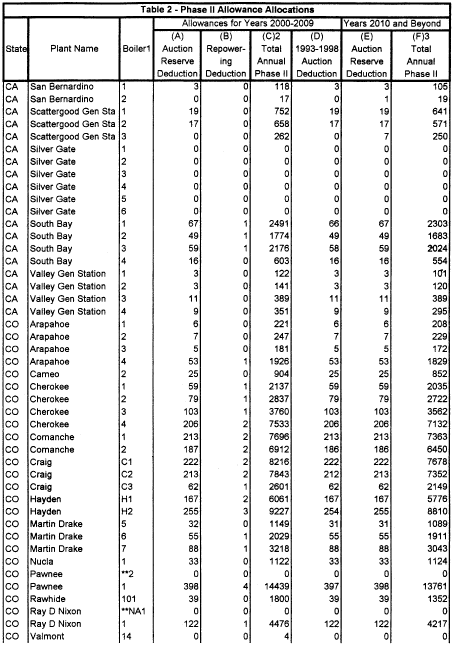

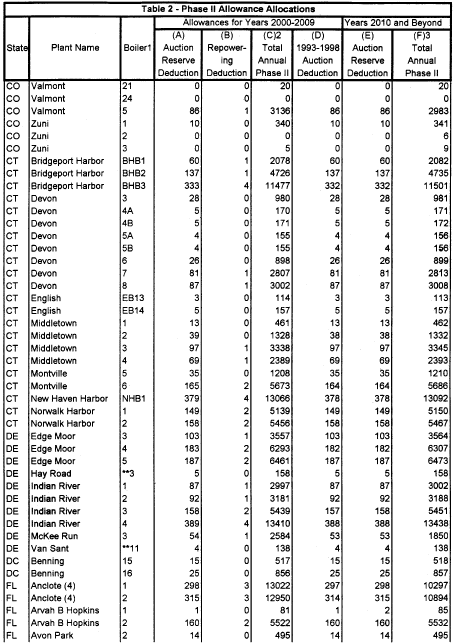

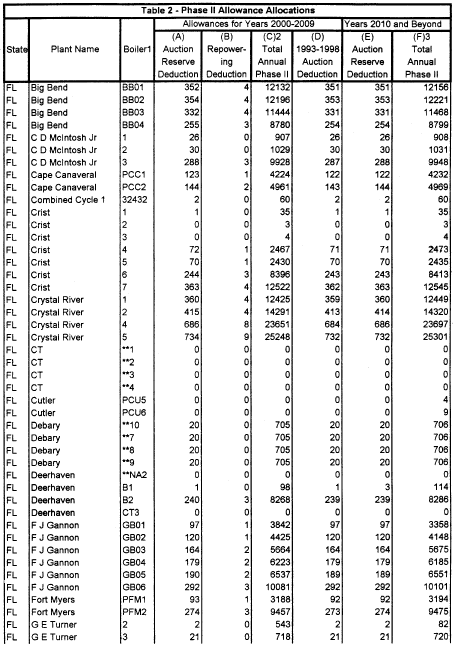

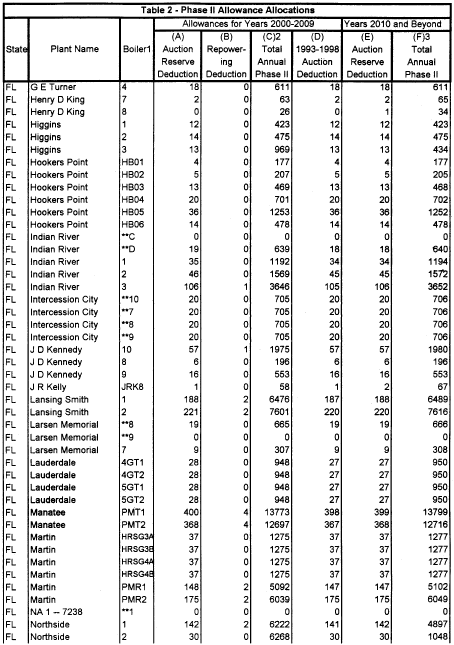

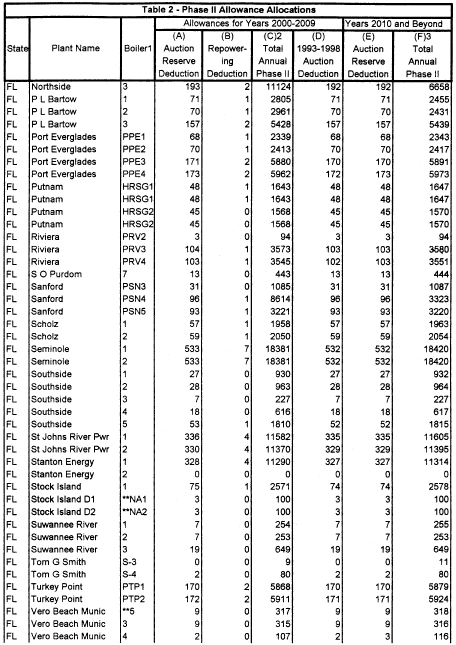

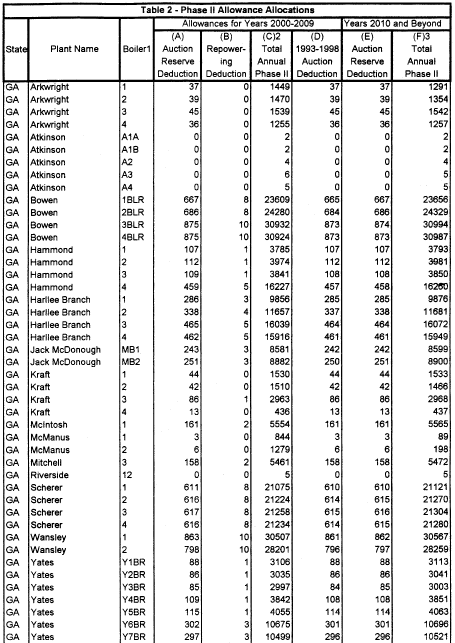

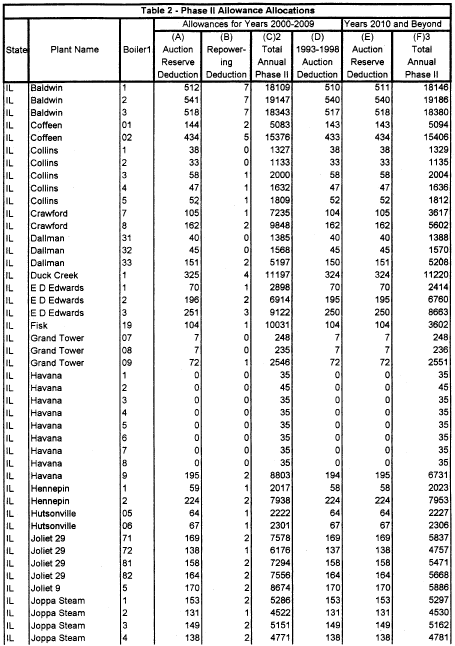

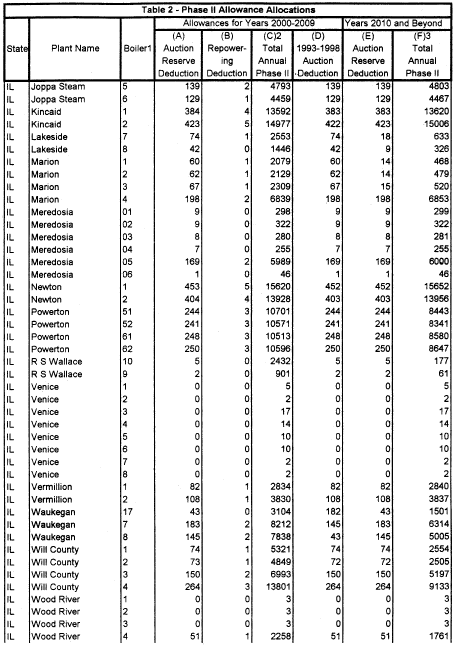

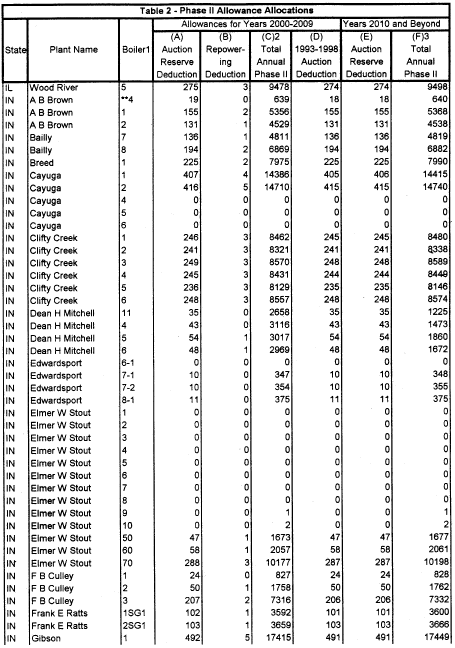

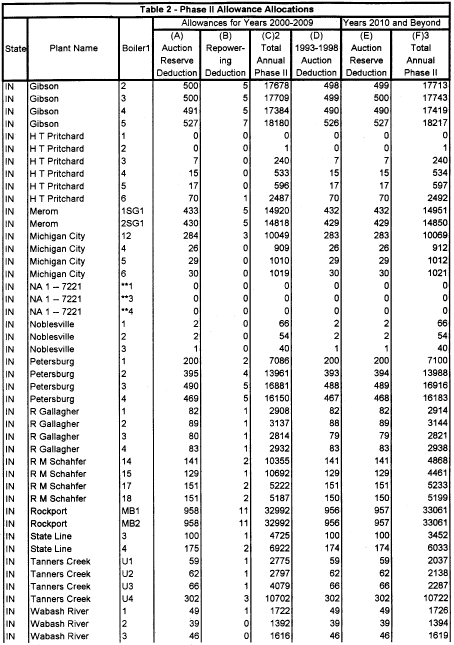

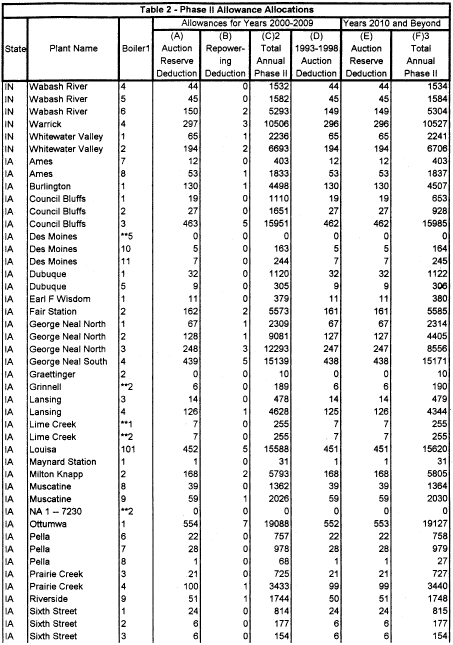

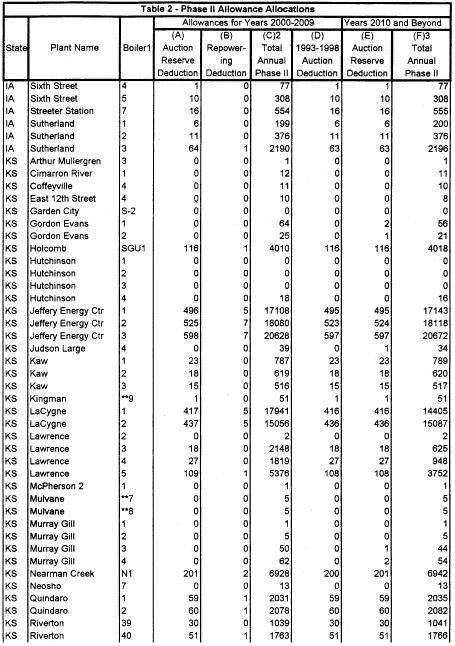

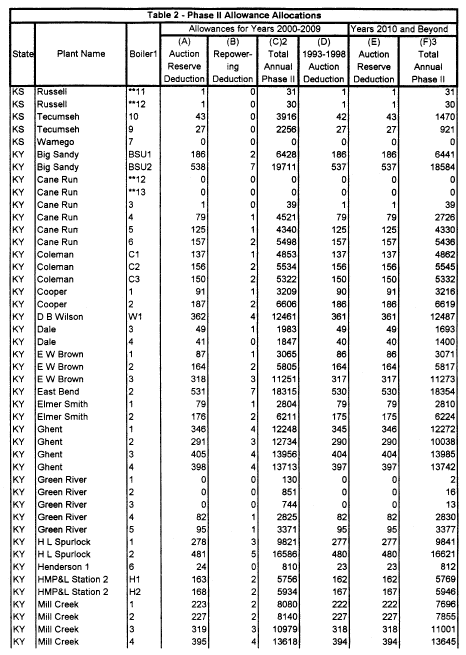

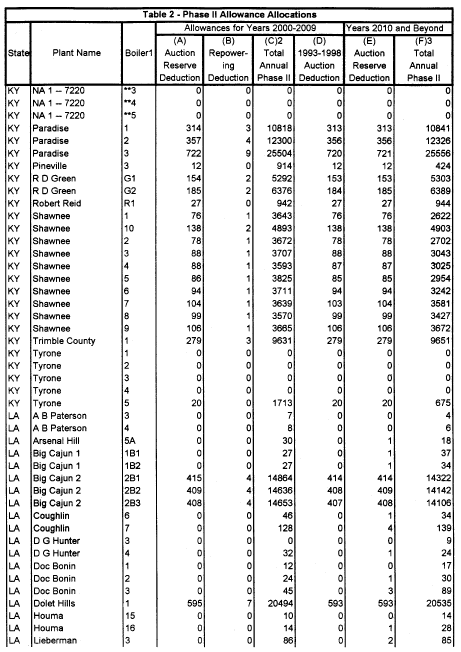

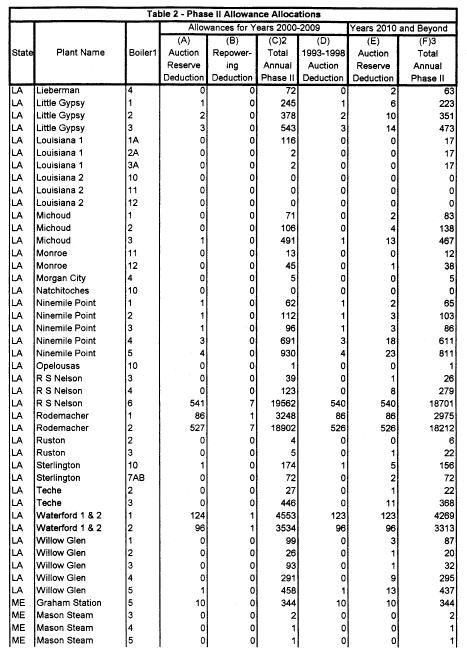

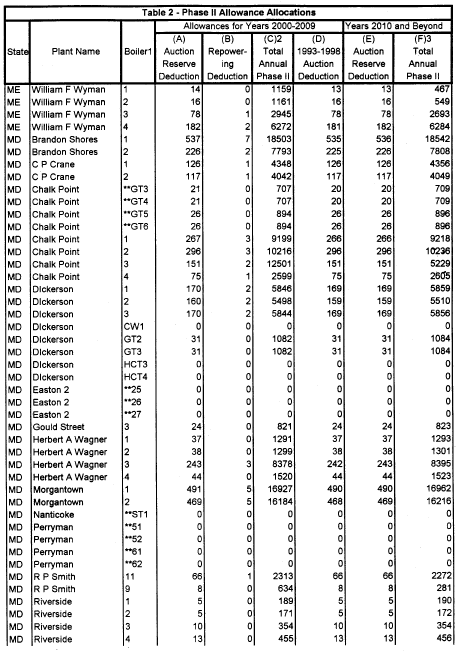

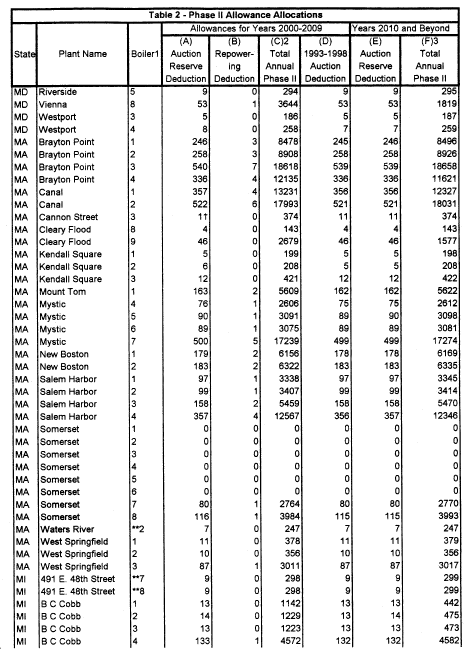

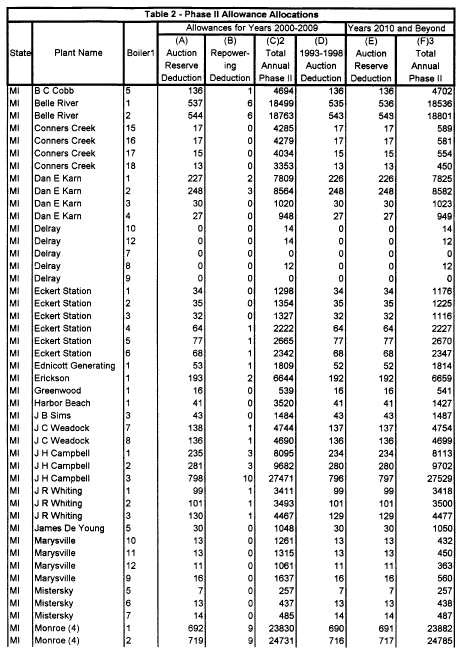

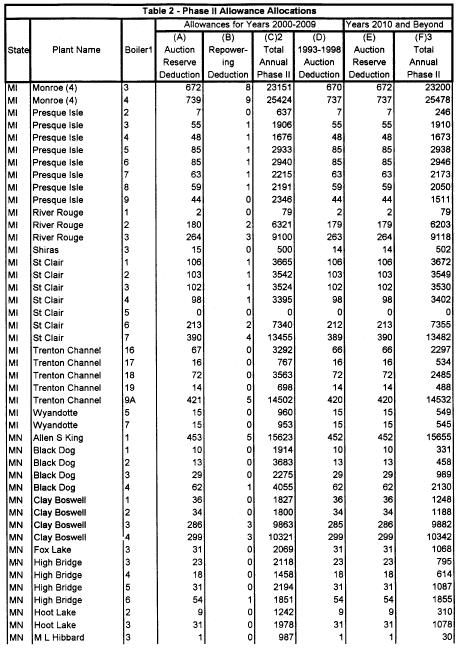

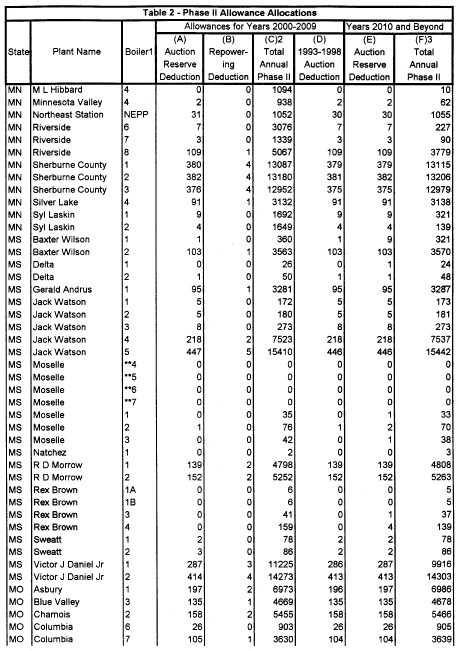

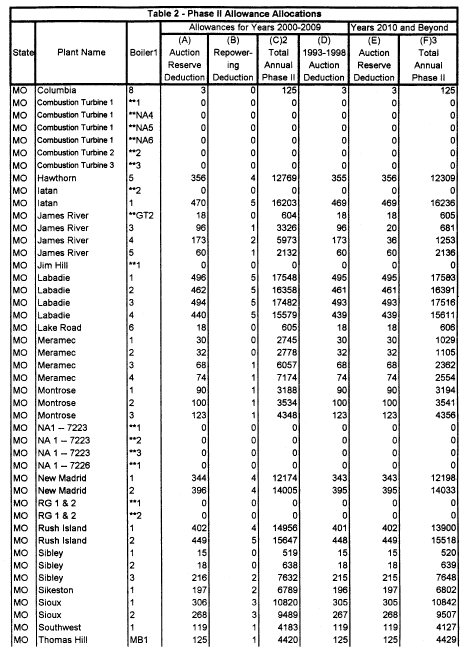

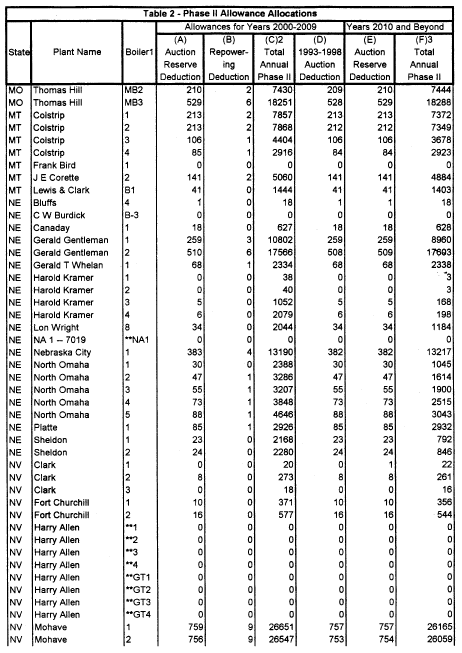

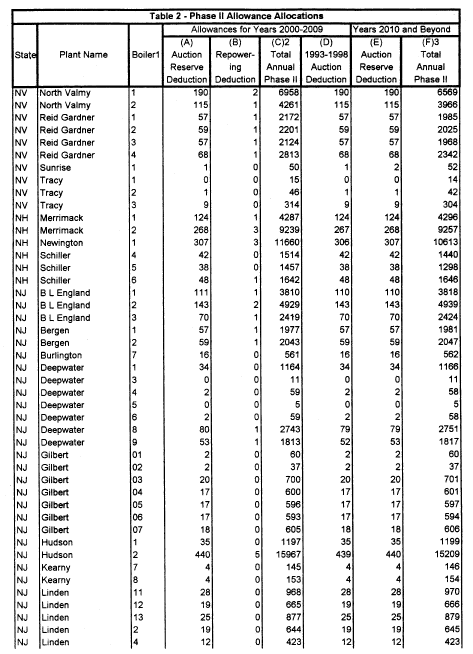

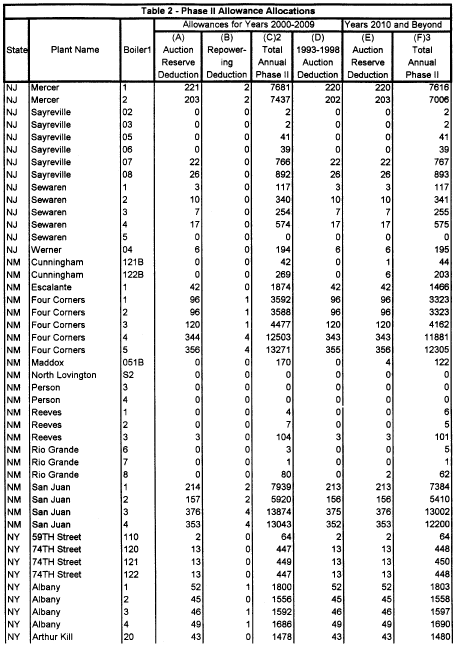

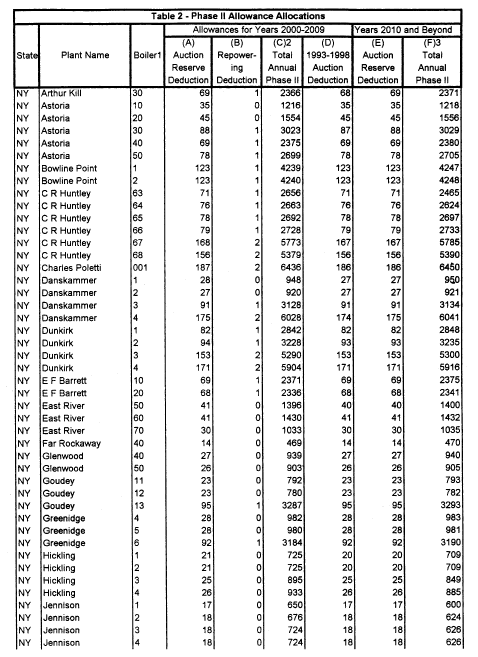

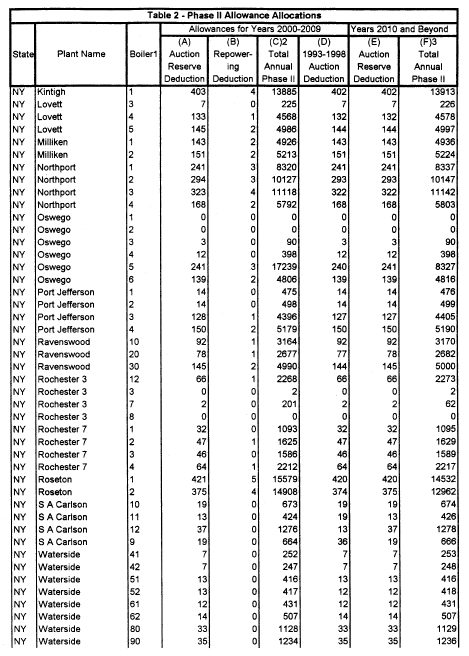

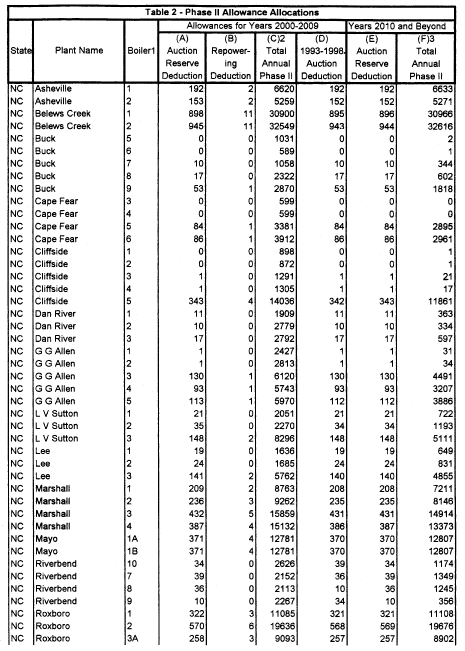

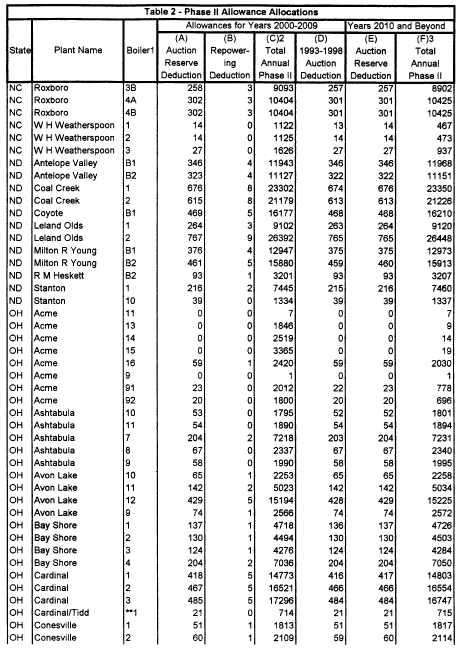

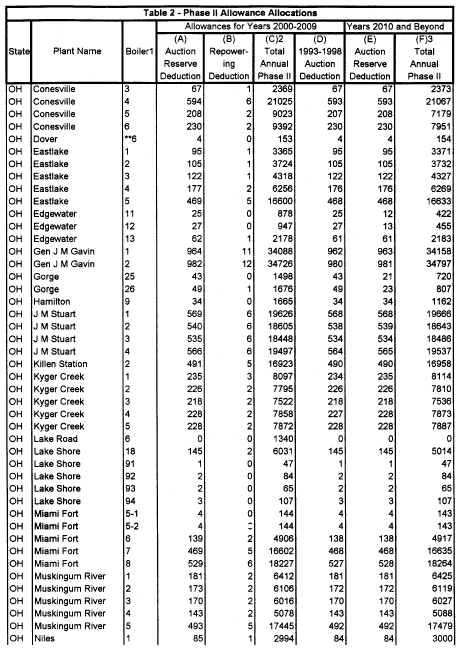

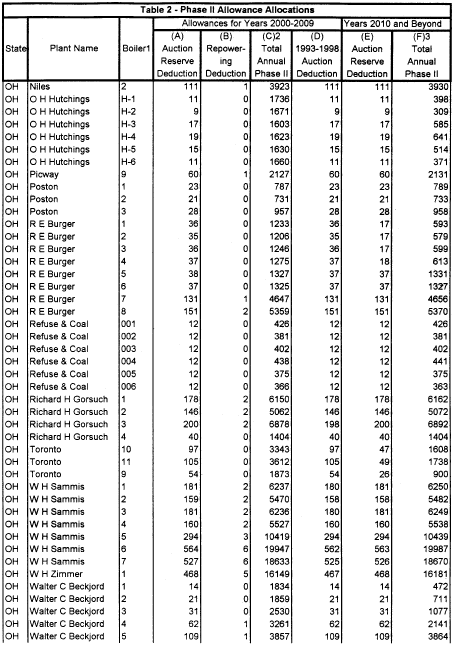

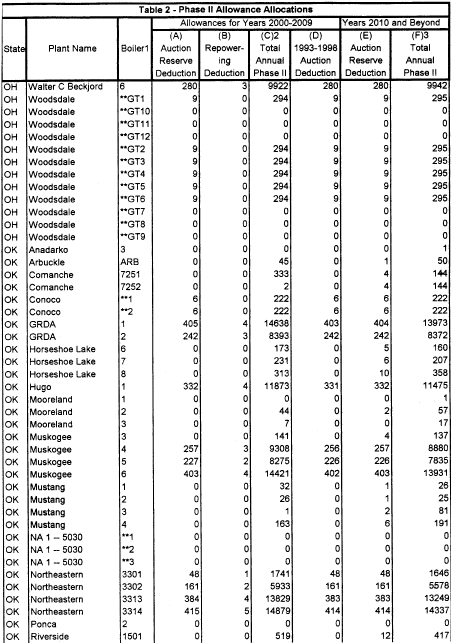

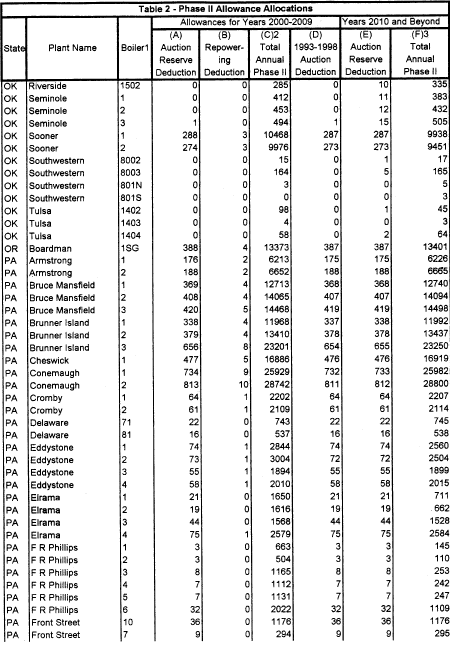

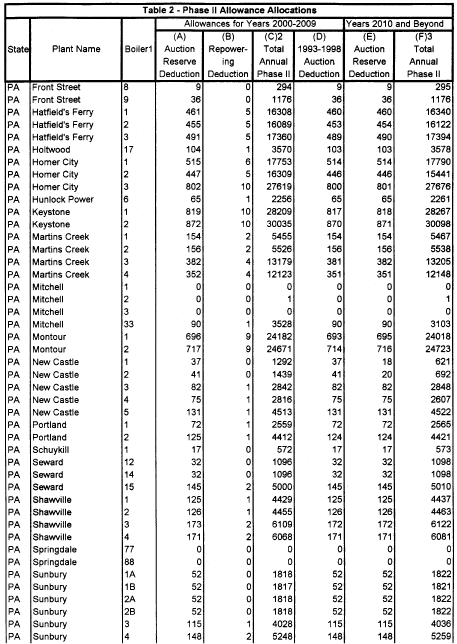

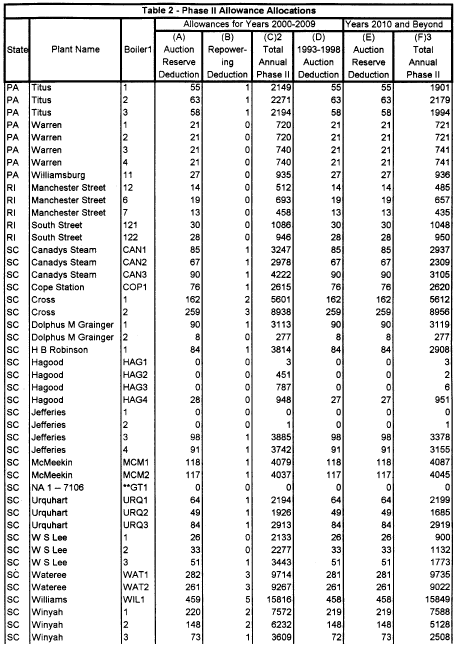

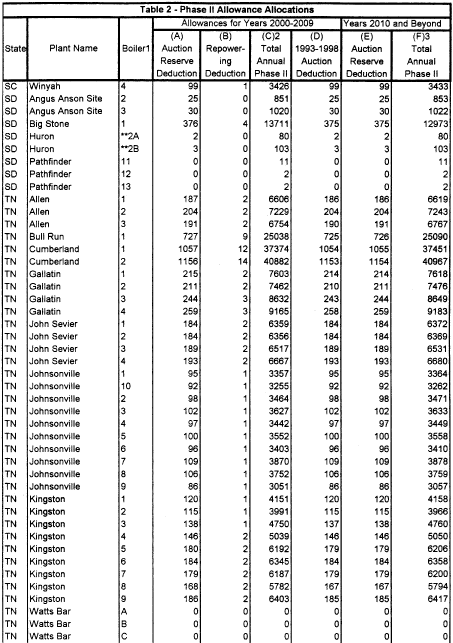

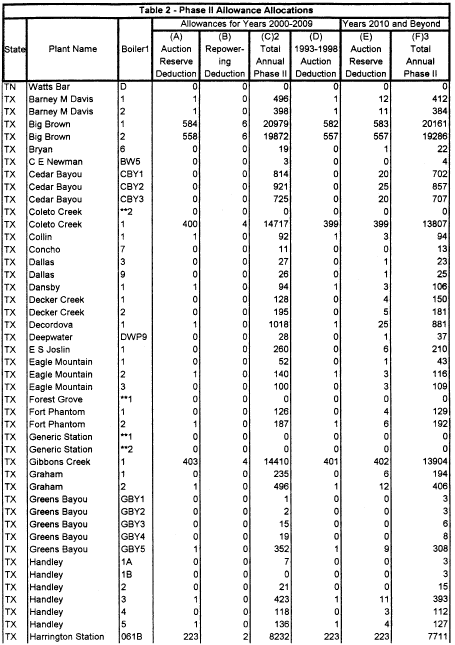

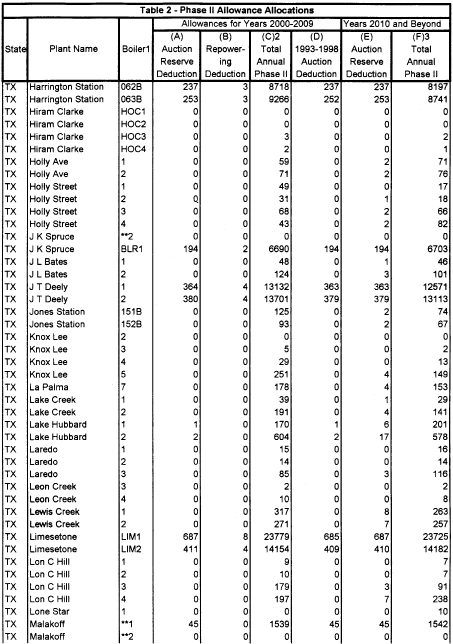

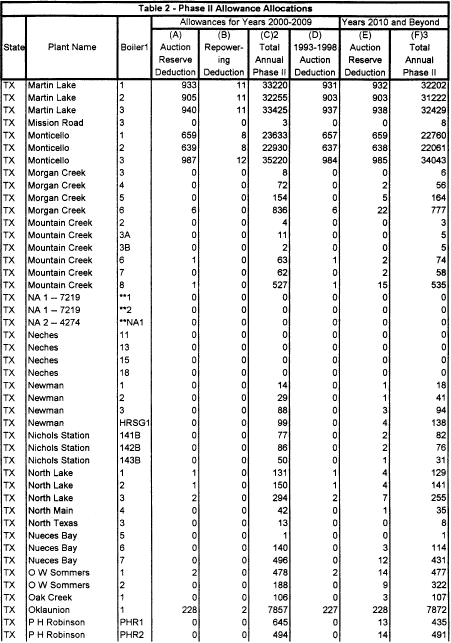

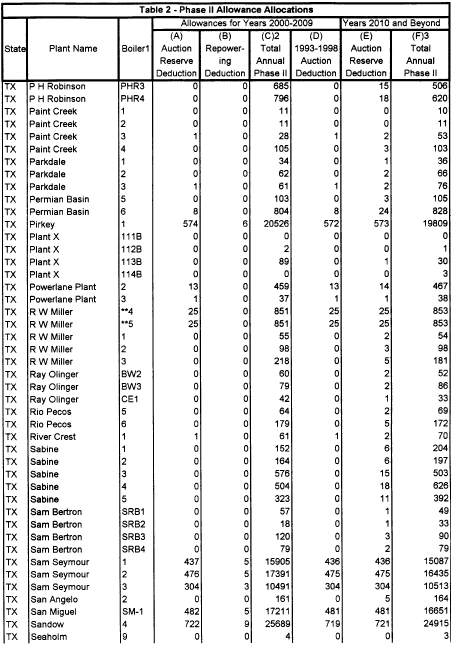

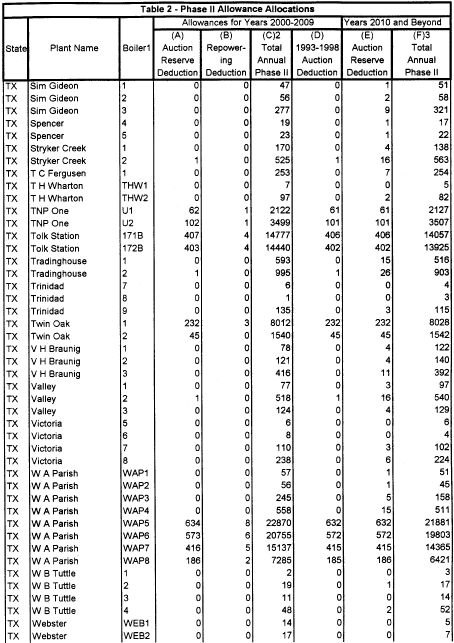

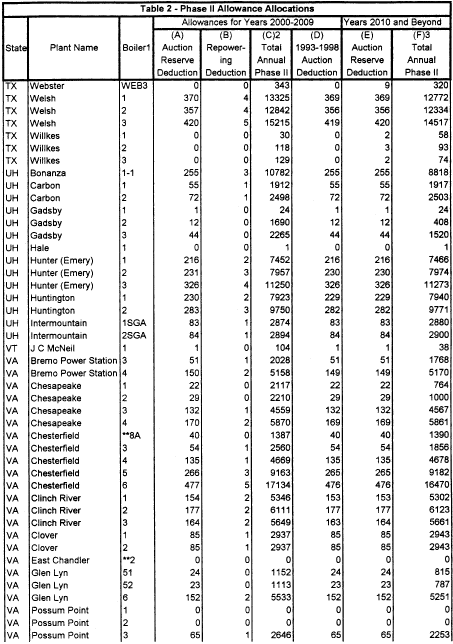

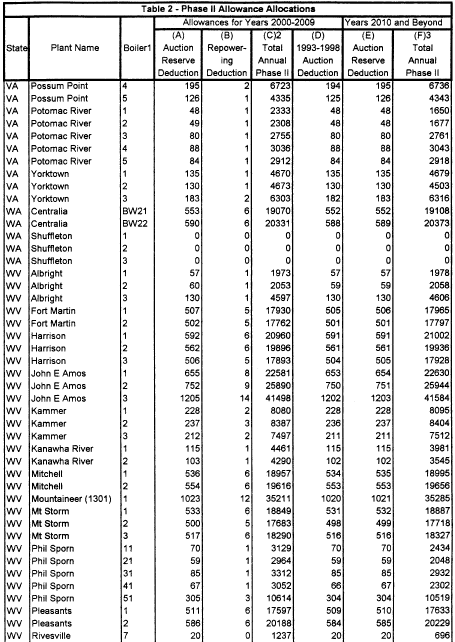

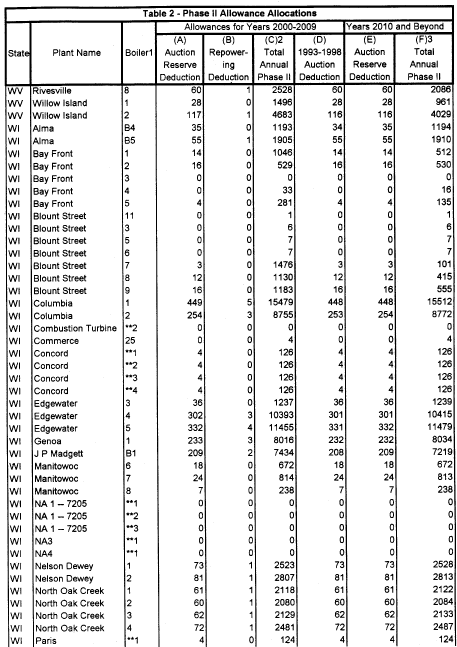

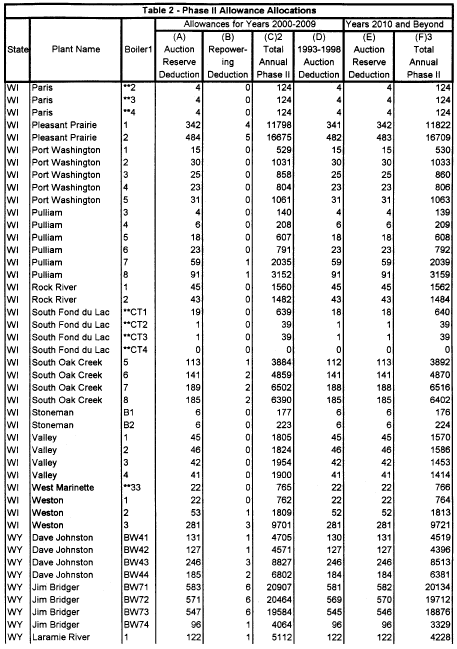

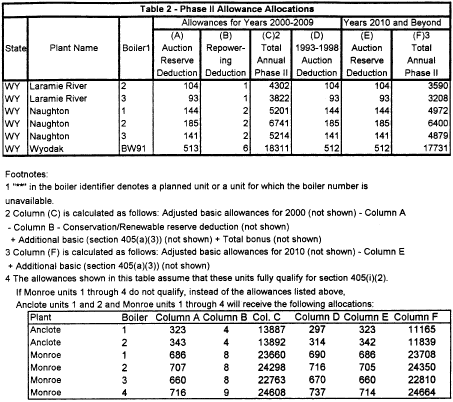

(b) Phase II allowances. (1) The Administrator will allocate allowances to the compliance account for each source that includes a unit listed in table 2 of this section in the amount specified in table 2 column C to be held for the years 2000 through 2009.

(2) The Administrator will allocate allowances to the compliance account for each source that includes a unit listed in table 2 of this section in the amount specified in table 2 column F to be held for the years 2010 and each year thereafter.

(3) The owner of each unit listed in the following table shall surrender, for each allowance listed in Column A or B of such table, an allowance of the same or earlier compliance use date and shall return to the Administrator any proceeds received from allowances withheld from the unit, as listed in Column C of such table. The allowances shall be surrendered and the proceeds shall be returned by December 28, 1998.

| State | Plant name | Unit | Allowances for 2000 through 2009

column (A) | Allowances for 2010 and thereafter

column (B) | Proceeds |

|---|---|---|---|---|---|

| CA | El Centro | 2 | 285 | 272 | $2749.48 |

| CO | Valmont | 11 | 4 | 0 | 0 |

| FL | Lauderdale | PFL4 | 776 | 781 | 7904.74 |

| FL | Lauderdale | PFL5 | 796 | 802 | 7904.74 |

| LA | R S Nelson | 1 | 30 | 34 | 0 |

| LA | R S Nelson | 2 | 33 | 32 | 0 |

| MD | R P Smith | 9 | 0 | 56 | 687.37 |

| NM | Maddox | **3 | 85 | 85 | 687.37 |

| SD | Mobile | **2 | 17 | 17 | 0 |

| VA | Chesterfield | **8B | 409 | 411 | 4124.21 |

| WI | Blount Street | 7 | 0 | 13 | 343.68 |

| WI | Blount Street | 8 | 0 | 294 | 3093.16 |

| WI | Blount Street | 9 | 0 | 355 | 3436.84 |

[58 FR 3687, Jan. 11, 1993, as amended at 58 FR 15650, Mar. 23, 1993; 58 FR 33770, June 21, 1993; 58 FR 40747, July 30, 1993; 62 FR 55486, Oct. 24, 1997; 63 FR 51714, Sept. 28, 1998; 70 FR 25335, May 12, 2005]

§73.11 [Reserved]

§73.12 Rounding Procedures.

(a) Calculation rounding. All allowances under this part and part 72 of this chapter shall be allocated as whole allowances. All calculations for such allowances shall be rounded down for decimals less than 0.500 and up for decimals of 0.500 or greater.

(b) [Reserved]

[58 FR 3687, Jan. 11, 1993, as amended at 63 FR 51765, Sept. 28, 1998]

§73.13 Procedures for submittals.

(a) Address for submittal. All submittals under this subpart shall be made by the designated representative to the Director, Acid Rain Division, (6204J), 1200 Pennsylvania Ave., NW., Washington, DC 20460 and shall meet the requirements specified in 40 CFR 72.21.

(b) Appeals procedures. The designated representative may appeal the decision as to eligibility or allocation of allowances under §§73.18, 73.19, and 73.20, using the appeals procedures of part 78 of this chapter.

[58 FR 15708, Mar. 23, 1993, as amended at 63 FR 51765, Sept. 28, 1998]

§§73.14-73.17 [Reserved]

§73.18 Submittal procedures for units commencing commercial operation during the period from January 1, 1993, through December 31, 1995.

(a) Eligibility. To be eligible for allowances under this section, a unit shall commence commercial operation between January 1, 1993, and December 31, 1995, and have commenced construction before December 31, 1990.

(b) Application for allowances. No later than December 31, 1995, the designated representative for a unit expected to be eligible under this provision must submit a photocopy of a signed contract for the construction of the unit.

(c) Commencement of commercial operation. The Administrator will use EIA information submitted by the utility for the boiler on-line date as commencement of commercial operation.

[58 FR 15710, Mar. 23, 1993]

§73.19 Certain units with declining SO 2 rates.

(a) Eligibility. A unit is eligible for allowance allocations under this section if it meets the following requirements:

(1) It is an existing unit that is a utility unit;

(2) It serves a generator with nameplate capacity equal to or greater than 75 MWe;

(3) Its 1985 actual SO2 emissions rate was equal to or greater than 1.2 lb/mmBtu;

(4) Its 1990 actual SO2 emissions rate is at least 50 percent less than the lesser of its 1980 actual or allowable SO2 emissions rate;

(5) Its actual SO2 emission rate is less than 1.2 lb/mmBtu in any one calendar year from 1996 through 1999, as reported under part 75 of this chapter;

(6) It commenced commercial operation after January 1, 1970;

(7) It is part of a utility system whose combined commercial and industrial kilowatt-hour sales increased more than 20 percent between calendar years 1980 and 1990; and

(8) It is part of a utility system whose company-wide fossil-fuel SO2 emissions rate declined 40 percent or more from 1980 to 1988.

(b) [Reserved]

[58 FR 15710, Mar. 23, 1993, as amended at 63 FR 51765, Sept. 28, 1998]

§73.20 Phase II early reduction credits.

(a) Unit eligibility. Units listed in table 2 or 3 of §73.10 are eligible for allowances under this section if:

(1) The unit is not a unit subject to emissions limitation requirements of Phase I and is not a substitution unit (under 40 CFR 72.41) or a compensating unit (under 40 CFR 72.43);

(2) The unit is authorized by the Governor of the State in which the unit is located;

(3) The unit is part of a utility system (which, for the purposes of this section only, includes all generators operated by a single utility, including generators that are not fossil fuel-fired) that has decreased its total coal-fired generation, as a percentage of total system generation, by more than twenty percent between January 1, 1980, and December 31, 1985; and

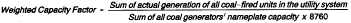

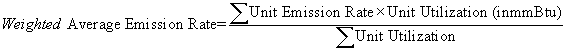

(4) The unit is part of a utility system that during calendar years 1985 through 1987 had a weighted capacity factor for all coal-fired units in the system of less than fifty percent. The weighted capacity factor is equal to:

(b) Emissions reductions eligibility. Sulfur dioxide emissions reductions eligible for allowance credits at units eligible under paragraph (a) of this section must meet the following requirements:

(1) Be made no earlier than calendar year 1995 and no later than calendar year 1999; and

(2) Be due to physical changes to the plant or are a result of a change in the method of operating the plant including but not limited to changing the type or quality of fuel being burned.

(c) Initial certification of eligibility. The designated representative of a unit that seeks allowances under this section shall apply for certification of unit eligibility prior to or accompanying a request for allowances under paragraph (d) of this section. A completed application for this certification shall be submitted according to §73.13 and shall include the following:

(1) A letter from the Governor of the State in which the unit is located authorizing the unit to make reductions in sulfur dioxide emissions; and

(2) A report listing all units in the utility system, each fossil fuel-fired unit's fuel consumption and fuel heat content for calendar year 1980, and each generator's total electrical generation for calendar years 1980 and 1985 (including all generators, whether fossil fuel-fired, nuclear, hydroelectric or other).

(d) Request for allowances. (1) The designated representative of the requesting unit shall submit the request for allowances according to the procedures of §73.13 and shall include the following information:

(i) The calendar year for which credits for reductions are requested and the actual SO2 emissions and fuel consumption in that year;

(ii) A letter signed by the designated representative stating and documenting the specific physical changes to the plant or changes in the method of operating the plant (including but not limited to changing the type or quality of fuel being burned) which resulted in the reduction of emissions; and

(iii) A letter signed by the designated representative certifying that all photocopies are exact copies.

(2) The designated representative shall submit each request for allowances no later than March 1 of the calendar year following the year in which the reductions were made.

(e) Allowance allocation. The Administrator will allocate allowances to the eligible unit upon satisfactory submittal of information under paragraphs (c) and (d) of this section in the amount calculated by the following equations. Such allowances will be allocated to the unit's 2000 future year subaccount.

(1) “Prior year” means a single calendar year selected by the eligible unit from 1995 to 1999 inclusive.

(2) One “credit” equals one ton of eligible SO2 emissions reductions.

(3) “ERC units” are units eligible for early reduction credits, and “non-ERC units” are fossil fuel-fired units that are part of the same operating system but are not eligible for early reduction credits.

(4) For any unit that did not operate during 1990, the unit's 1990 SO2 emission rate will be equal to the weighted average emission rate of all of the other units at the same source that did operate during 1990.

(5) Early reduction credits will be calculated at the unit level, subject to the restrictions in paragraph (e)(6) of this section.

(6) The number of credits for eligible Phase II units will be calculated as follows:

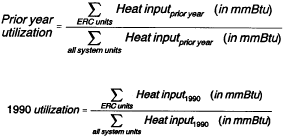

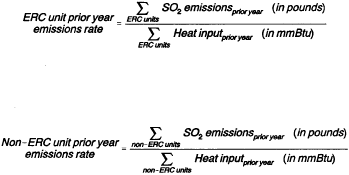

(i) Comparison of the prior year utilization of ERC units to the 1990 utilization, as a percentage of system utilization. If, as calculated below, system-wide prior year utilization of ERC units exceeds systems-wide 1990 utilization of ERC units on a percentage basis, then paragraphs (e)(6)(ii) and (iii) of this section apply. If not, the ERC units are eligible to receive early reduction credits as calculated in paragraph (e)(6)(v)(A) of this section.

(ii) Comparison of the prior year average emission rate of all ERC units to the prior year average emission rate of all non-ERC units. If, as calculated below, the system-wide average SO2 emission rate of ERC units exceeds that of non-ERC units, then a unit's prior year utilization will be restricted in accordance with paragraph (e)(6)(iv) of this section. If not, then paragraph (iii) of this section applies.

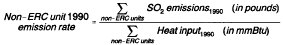

(iii) Comparison of the emission rate of the non-ERC units in the prior year to the emission rate of the non-ERC units in 1990. If, as calculated in paragraph (ii) of this section, the prior year system average non-ERC SO2 emission rate increases above the 1990 system average non-ERC SO2 emission rate, as calculated below, then a unit's prior year utilization will be restricted in accordance with paragraph (e)(6)(iv) of this section. If not, the ERC units are eligible to receive early reduction credits as calculated in paragraph (e)(6)(v)(A) of this section.

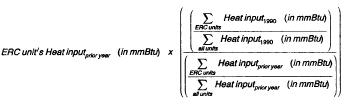

(iv) Calculation of the utilization limit for restricted units. The limit on utilization for each unit eligible for early reduction credits subject to paragraphs (e)(6) (ii) and (iii) of this section will be calculated as follows:

This result, expressed in million Btus, is the restricted utilization of the ERC unit to be used in the calculation of early reduction credits in paragraph (e)(6)(v)(B) of this section.

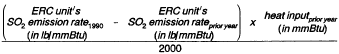

(v)(A) Calculation of the unit's early reduction credits where the unit's prior year utilization is not restricted.

(B) Calculation of the unit's early reduction credits where the unit's prior year utilization is restricted.

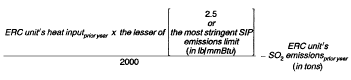

(vi) The Administrator will allocate to the ERC unit allowances equal to the lesser of the calculated number of credits in paragraphs (e)(6)(v) (A) or (B) of this section and the following limitation:

(f) Allowance loan program —(1) Eligibility. Units eligible for Phase II early reduction credits under paragraph (a) of this section are eligible for allowances under this paragraph (f) if the weighted average emission rate (based on heat input) for the prior year for all of the affected units in the unit's dispatch system was less than the system-wide weighted average emission rate for 1990. The weighted average emission rate shall be calculated as follows:

For the purposes of this calculation, the unit's dispatch system will be the dispatch system as it existed as of November 15, 1990.

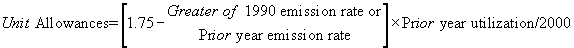

(2) Allowance Calculation. Allowances under this paragraph (f) shall be calculated as follows:

(3) Allowance Loan. (i) The number of allowances calculated under paragraph (f)(2) of this section shall be allocated to the unit's year 2000 subaccount.

(ii) The number of allowances calculated under paragraph (f)(2) of this section shall be deducted, contemporaneously with the allocation under paragraph (f)(3)(i) of this section, from the unit's year 2015 subaccount.

(iii) Notwithstanding paragraph (f)(3)(ii) of this section, if the number of allowances to be deducted exceeds the amount of allowances allocated to the unit for the year 2015, allowances in the year 2015 subaccount equal to the amount of allowances allocated to the unit for the year 2015 shall be deducted. In addition to the deduction from the year 2015 subaccount, a sufficient amount of allowances in the year 2016 subaccount (up to the amount of allowances allocated to the unit for the year 2016) shall be deducted contemporaneously, such that the sum of the allowances deducted from the subaccounts equals the number of allowances required to be deducted under paragraph (f)(3)(ii) of this section.

(iv) Notwithstanding paragraph (f)(3)(ii) of this section, the procedure in paragraph (f)(3)(iii) shall be applied as follows to each year after 2015 (year-by-year in numerical order) for which the number of allowances to be deducted from that year's subaccount exceeds the number allocated to the unit for that year: allowances equal to the number allocated for that year shall be deducted from that year's subaccount and the remainder (up to the amount allocated) necessary to equal the number of allowances required to be deducted under paragraph (f)(3)(ii) of this section shall be deducted from the next year's subaccount.

(v) The owners and operators of the unit shall ensure that sufficient allowances are available to make the full deductions required under paragraphs (f)(3)(ii), (iii), and (iv) of this section. The designated representative may specify the serial number of each allowance to be deducted.

(4) ERC Units. Any unit to which allowances are allocated under paragraph (f)(3)(i) of this section shall be considered an ERC unit for purposes of applying the restrictions in paragraph (e)(6) of this section.

[58 FR 15711, Mar. 23, 1993, as amended at 62 FR 34150, June 24, 1997]

§73.21 Phase II repowering allowances.

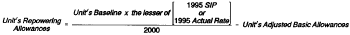

(a) Repowering allowances. In addition to allowances allocated under §73.10(b), the Administrator will allocate, to each existing unit (under §72.44(b)(1) of this chapter) with an approved repowering extension plan, allowances for use during the repowering extension period approved under §72.44(f)(2)(ii) of this chapter (including a prorated allocation for any fraction of a year) equal to:

where:

1995 SIP = Most stringent federally enforceable State implementation plan SO2 emissions limitation for 1995.

1995 Actual Rate = 1995 actual SO2 emissions rate

Unit's Adjusted Basic Allowances are as listed in the following table

| Unit | Year 2000 adjusted basic allowances |

|---|---|

| RE Burger 1 | 1273 |

| RE Burger 2 | 1245 |

| RE Burger 3 | 1286 |

| RE Burger 4 | 1316 |

| RE Burger 5 | 1336 |

| RE Burger 6 | 1332 |

| New Castle 1 | 1334 |

| New Castle 2 | 1485 |

| New Castle 3 | 2935 |

| New Castle 4 | 2686 |

| New Castle 5 | 5481 |

(b) Upon commencement of commercial operation of a new unit (under §72.44(b)(2) of this chapter) with an approved repowering extension plan, allowances for use during the repowering extension period approved will end and allocations under §73.10(b) for the existing unit will be transferred to the subaccounts for the new unit.

(c)(1) If the designated representative for a repowering unit terminates the repowering extension plan in accordance with §72.44(g)(1) of this chapter, the repowering allowances allocated to that unit by paragraph (a) of this section will be terminated and any necessary allowances from that unit's account forfeited, calculated in the following manner:

where:

Forfeiture Period = difference (as a portion of a year) between the end of the approved repowering extension and the end of the repowering extension under §72.44(g)(1)(ii)

1995 SIP = Most stringent federally enforceable State implementation plan SO2 emissions limitation for 1995.

1995 Actual Rate = 1995 actual SO2 emissions rate

Unit's Adjusted Basic Allowances are as listed in the table in paragraph (a) of this section.

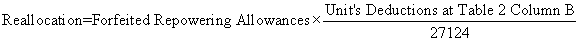

(c)(2) The Administrator will reallocate any allowances forfeited in paragraph (c)(1) of this section with a compliance use date of 2000 or any allowances remaining in the repowering reserve to all Table 2 units' years 2000 through 2009 subaccounts in the following manner:

[53 FR 15713, Mar. 23, 1993, as amended at 63 FR 51765, Sept. 28, 1998]

§§73.22-73.24 [Reserved]

§73.25 Phase I extension reserve.

The Administrator will initially allocate 3.5 million allowances to the Phase I Extension Reserve account of the Allowance Tracking System. Allowances from this Reserve will be allocated to units under §72.42 of this chapter. Allowances remaining in the Phase I Extension Reserve account following allocation of all extension allowances under §72.42 of this chapter will remain in the Reserve.

[58 FR 3687, Jan. 11, 1993]

§73.26 Conservation and renewable energy reserve.

The Administrator will allocate 300,000 allowances to the Conservation and Renewable Energy Reserve subaccount of the Acid Rain Data System. Allowances from this Reserve will be allocated to units under subpart F of this part. Termination of this Reserve and reallocation of allowances will be made under §73.80(c).

[53 FR 15714, Mar. 23, 1993]

§73.27 Special allowance reserve.

(a) Establishment of Reserve. (1) The Administrator will allocate 150,000 allowances annually for calendar years 1995 through 1999 to the Auction Subaccount of the Special Allowance Reserve.

(2) The Administrator will allocate 250,000 allowances annually for calendar year 2000 and each year thereafter to the Auction Subaccount of the Special Allowance Reserve.

(b) Distribution of proceeds. (1) Monetary proceeds from the auctions and sales of allowances from the Special Allowance Reserve (under subpart E of this part) for use in calendar years 1995 through 1999 will be distributed to the designated representative of the unit according to the following equation:

unit proceeds = (Column B of table 1 of section 73.10/150,000) × total proceeds

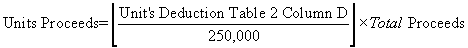

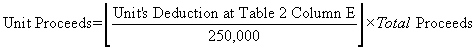

(2) Until June 1, 1998, monetary proceeds from the auctions of allowances from the Special Allowance Reserve (under subpart E of this part) for use in calendar years 2000 through 2009 will be distributed to the designated representative of each unit listed in Table 2 according to the following equation:

(3) On or after June 1, 1998, monetary proceeds from the auctions of allowances from the Special Allowance Reserve (under subpart E of this part) for use in calendar years 2000 through 2009 will be distributed to the designated representative of each unit listed in Table 2 according to the following equation:

(4) Monetary proceeds from the auctions of allowances from the Special Allowance Reserve (under subpart E of this part) from years of purchase from 1993 through 1998, remaining in the U.S. Treasury as a result of the surrender of allowances and return of proceeds under §73.10(b)(3), will be distributed to the designated representative of each unit listed in Table 2 according to the following equation:

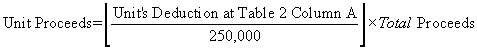

(5) Monetary proceeds from the auctions of allowances from the Special Allowance Reserve (under subpart E of this part) for use in calendar years 2010 and thereafter will be distributed to the designated representative of each unit listed in Table 2 according to the following equation:

(c) Reallocation of allowances. (1) Allowances remaining in the Special Allowance Reserve following the annual auctions and sales (under subpart E of this part) for use in calendar years 1995 through 1999 will be reallocated to the unit's Allowance Tracking System Account according to the following equation:

unit allowances = (Column B of table 1 of section 73.10/150,000) × Allowances remaining

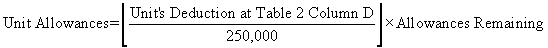

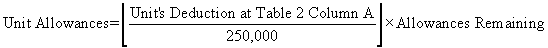

(2) Until June 1, 1998, allowances, for use in calendar years 2000 through 2009, remaining in the Special Allowance Reserve at the end of each year, following that year's auction (under subpart E of this part), will be reallocated to the unit's Allowance Tracking System account according to the following equation:

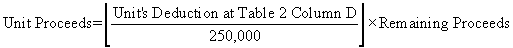

(3) On or after June 1, 1998, allowances, for use in calendar years 2000 through 2009, remaining in the Special Allowance Reserve at the end of each year, following that year's auction (under subpart E of this part), will be reallocated to the compliance account of the source that includes the unit according to the following equation:

(4) [Reserved]

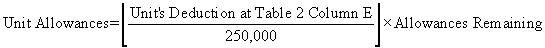

(5) Allowances, for use in calendar years 2010 and thereafter, remaining in the Special Allowance Reserve at the end of each year, following that year's auction (under subpart E of this part), will be reallocated to the compliance account of the source that includes the unit according to the following equation:

(d) Calculation rounding. All proceeds under this section shall be distributed as whole dollars. All calculations for such allowances shall be rounded down for decimals less than .5 and up for decimals of .5 or greater.

(e) Achieving exact totals. (1) If the sum of the proceeds to be distributed under paragraph (b) of this section exceeds the total proceeds or the allowances to be reallocated under paragraph (c) of this section exceeds the allowances remaining, then the Administrator will withdraw one dollar or allowance from each unit, beginning with the unit receiving the largest number of dollars or allowances, in descending order, until the distribution balances with the proceeds and the reallocated allowances balance with the remaining allowances.

(2) If the sum of the proceeds to be distributed under paragraph (b) of this section is less than the total proceeds or the allowances to be reallocated under paragraph (c) of this section is less than the allowances remaining, then EPA will distribute one dollar or allowance for each unit, beginning with the unit receiving the largest number of dollars or allowances, in descending order, until the distribution balances with the proceeds and the reallocated allowances balance with the remaining allowances.

[58 FR 3687, Jan. 11, 1993, as amended at 58 FR 15714, Mar. 23, 1993; 63 FR 51765, Sept. 28, 1998; 70 FR 25335, May 12, 2005]

Source: 58 FR 3687, Jan. 11, 1993, unless otherwise noted.

Subpart C - Allowance Tracking System

§73.30 Allowance tracking system accounts.

(a) Nature and function of unit accounts. The Administrator will establish compliance accounts for all affected sources pursuant to §73.31(a) and (b). All allocations of allowances pursuant to subparts B, E, and F of this part and part 72 of this chapter, transfers of allowances made pursuant to subparts C and D, and deductions of allowances made for purposes of offsetting emissions pursuant to §73.35(b) and (d) and parts 72, 75, and 77 of this chapter will be recorded in the source's compliance account.

(b) Nature and function of general accounts. Transfers of allowances held for any person other than an affected source, made pursuant to subparts C, D, E, F, and G of this part will be recorded in that person's general account established pursuant to §73.31(c).

[58 FR 3687, Jan. 11, 1993; 58 FR 40747, July 30, 1993, as amended at 70 FR 25335, May 12, 2005]

§73.31 Establishment of accounts.

(a) Existing affected units. The Administrator will establish a compliance account and allocate allowances for each source that includes a unit that is, or will become, an existing affected unit pursuant to sections 404(a) or 405 of the Act and §72.6 of this chapter.

(b) New units. Upon receipt of a complete certificate of representation for the designated representative for a new unit pursuant to part 72, subpart B of this chapter, the Administrator will establish a compliance account for the source that includes the unit, unless the source already has a compliance account.

(c) General accounts. (1) Any person may apply to open an Allowance Tracking System account for the purpose of holding and transferring allowances. Such application shall be submitted to the Administrator in a format to be specified by the Administrator by means of the Allowance Account Information Form, or by providing the following information in a similar format:

(i) Name and title of the authorized account representative and alternate authorized account representative (if any) pursuant to §73.33;

(ii) Mailing address, telephone number and facsimile transmission number (if any) of the authorized account representative and alternate authorized account representative (if any);

(iii) Organization or company name (if applicable) and type of organization (if applicable);

(iv) A list of all persons subject to a binding agreement for the authorized account representative to represent their ownership interest with respect to the allowances held in the general account and which shall be amended and resubmitted within 30 days following any transaction giving rise to any change of the list of persons subject to the binding agreement;

(v) A certification statement by the authorized account representative and alternate authorized account representative (if any) that reads “I certify that I was selected under the terms of an agreement that is binding on all persons who have an ownership interest with respect to allowances held in the general account. I certify that I have all necessary authority to carry out my duties and responsibilities on behalf of the persons with an ownership interest and that they shall be fully bound by my representations, actions, inactions, or submissions under 40 CFR part 73. I am authorized to make this submission on behalf of the persons with an ownership interest for whom this submission is made. I certify under penalty of law that I have personally examined and am familiar with the information submitted in this document and all its attachments. Based on my inquiry of those individuals with primary responsibility for obtaining the information, I certify that the information is to the best of my knowledge and belief true, accurate, and complete. I am aware that there are significant penalties for submitting false material information, or omitting material information, including the possibility of fine or imprisonment for violations.”;

(vi) The signature of the authorized account representative and the alternate authorized account representative (if any); and

(vii) The date of the signature of the authorized account representative and the alternate authorized account representative (if any).

(2) Upon receipt of such complete application, the Administrator will establish an Allowance Tracking System account for the person or persons identified in the application.

(3) No allowance transfers will be recorded for a general account until the Administrator has established the new account.

(d) Account identification. The Administrator will assign a unique identifying number to each account established pursuant to this section.

[58 FR 3687, Jan. 11, 1993; 58 FR 40747, July 30, 1993, as amended at 71 FR 25378, Apr. 28, 2006; 70 FR 25335, May 12, 2005]

§73.32 [Reserved]

§73.33 Authorized account representative.

(a) Following the establishment of an Allowance Tracking System account, all matters pertaining to the account, including, but not limited to, the deduction and transfer of allowances in the account, shall be undertaken only by the authorized account representative.

(b)-(c) [Reserved]

(d) General account alternate authorized account representative. Any application for opening a general account may designate one alternate authorized account representative to act on behalf of the certifying authorized account representative, in the event the authorized account representative is absent or otherwise not available to perform actions and duties under this part. The alternate shall be a natural person and shall be authorized, provided that the conditions and procedures specified in §73.31(c)(1) are met.

(1) The alternate authorized account representative may be changed at any time by the authorized account representative upon receipt by the Administrator of a new complete application as required in §73.31(c);

(2) The alternate authorized account representative shall be subject to the provisions of this part applicable to authorized account representatives;

(3) Whenever the term “authorized account representative” is used in this part it shall be construed to include the alternate authorized account representative, unless such a construction would be illogical from the context; and

(4) Any representation, action, inaction, or submission by the alternate authorized account representative when acting in that capacity shall be deemed to be a representation, action, inaction, or submission of the authorized account representative, with all the rights, duties, and responsibilities pertaining thereto.

(e) Changes to the general account authorized account representative. An authorized account representative for a general account may be succeeded by any person who submits an application pursuant to §73.31(c). The representations, actions, inactions, or submissions of an authorized account representative for a general account shall be binding on any successor.

(f) Objections to the authorized account representative. Except for a certification pursuant to paragraph (e) of this section, no objection or other communication submitted to the Administrator concerning any representation, action, inaction, or submission to the Administrator by the authorized account representative shall affect any representation, action, inaction, or submission of the authorized account representative pursuant to subpart D of this part. Neither the United States, the Administrator, nor any permitting authority will adjudicate any dispute between and among persons concerning any submission to the Administrator by the authorized account representative; any actions of the authorized account representative; or any other matter arising directly or indirectly from the certification, actions or representations of the authorized account representative.

(g) Delegation by authorized account representative and alternate authorized account representative. (1) An authorized account representative may delegate, to one or more natural persons, his or her authority to make an electronic submission (in a format prescribed by the Administrator) to the Administrator provided for or required under this part.

(2) An alternate authorized account representative may delegate, to one or more natural persons, his or her authority to make an electronic submission (in a format prescribed by the Administrator) to the Administrator provided for or required under this part.

(3) In order to delegate authority to make an electronic submission to the Administrator in accordance with paragraph (g)(1) or (2) of this section, the authorized account representative or alternate authorized account representative, as appropriate, must submit to the Administrator a notice of delegation, in a format prescribed by the Administrator, that includes the following elements:

(i) The name, address, e-mail address, telephone number, and facsimile transmission number (if any) of such authorized account representative or alternate authorized account representative;

(ii) The name, address, e-mail address, telephone number, and, facsimile transmission number (if any) of each such natural person (referred to as an “agent”);

(iii) For each such natural person, a list of the type or types of electronic submissions under paragraph (g)(1) or (2) of this section for which authority is delegated to him or her;

(iv) The following certification statements by such authorized account representative or alternate authorized account representative:

(A) “I agree that any electronic submission to the Administrator that is by an agent identified in this notice of delegation and of a type listed for such agent in this notice of delegation and that is made when I am a authorized account representative or alternate authorized representative, as appropriate, and before this notice of delegation is superseded by another notice of delegation under 40 CFR 73.33(g)(4) shall be deemed to be an electronic submission by me.”

(B) “Until this notice of delegation is superseded by another notice of delegation under 40 CFR 73.33(g)(4), I agree to maintain an e-mail account and to notify the Administrator immediately of any change in my e-mail address unless all delegation of authority by me under 40 CFR 73.33(g) is eliminated.”

(4) A notice of delegation submitted under paragraph (g)(3) of this section shall be effective, with regard to the authorized account representative or alternate authorized account representative identified in such notice, upon receipt of such notice by the Administrator and until receipt by the Administrator of a superseding notice of delegation submitted by such authorized account representative or alternate authorized account representative, as appropriate. The superseding notice of delegation may replace any previously identified agent, add a new agent, or eliminate entirely any delegation of authority.

(5) Any electronic submission covered by the certification in paragraph (g)(3)(iv)(A) of this section and made in accordance with a notice of delegation effective under paragraph (g)(4) of this section shall be deemed to be an electronic submission by the designated representative or alternate designated representative submitting such notice of delegation.

[58 FR 3691, Jan. 11, 1993, as amended at 71 FR 25378, Apr. 28, 2006]

§73.34 Recordation in accounts.

(a) After a compliance account is established under §73.31(a) or (b), the Administrator will record in the compliance account any allowance allocated to any affected unit at the source for 30 years starting with the later of 1995 or the year in which the compliance account is established and any allowance allocated for 30 years starting with the later of 1995 or the year in which the compliance account is established and transferred to the source with the transfer submitted in accordance with §73.50. In 1996 and each year thereafter, after Administrator has completed the deductions pursuant to §73.35(b), the Administrator will record in the compliance account any allowance allocated to any affected unit at the source for the new 30th year (i.e., the year that is 30 years after the calendar year for which such deductions are made) and any allowance allocated for the new 30th year and transferred to the source with the transfer submitted in accordance with §73.50.

(b) After a general account is established under §73.31(c), the Administrator will record in the general account any allowance allocated for 30 years starting with the later of 1995 or the year in which the general account is established and transferred to the general account with the transfer submitted in accordance with §73.50. In 1996 and each year thereafter, after the Administrator has completed the deductions pursuant to §73.35(b), the Administrator will record in the general account any allowance allocated for the new 30th year (i.e., the year that is 30 years after the calendar year for which such deductions are made) and transferred to the general account with the transfer submitted in accordance with §73.50.

(c) Allowances in each compliance account and general account subaccounts will reflect:

(1) All allowances allocated or deducted for the unit for the year pursuant to subpart B of this part;

(2) All allowances allocated or deducted pursuant to §§72.41, 72.42, 72.43, and 72.44 and part 74 of this chapter;

(3) All allowances allocated pursuant to subparts F and G of this part;

(4) All allowances recorded as a result of purchases or returns from the annual auctions;

(5) All allowances recorded or deducted as a result of allowance transfers recorded pursuant to subpart D of this part; and

(6) All allowances deducted or returned pursuant to §§73.35(d), 72.91 and 72.92, part 74, and part 77 of this chapter.

(d) Serial numbers for allocated allowances. Upon the allocation of allowances to an account, including allowances contained in reserves as provided in subpart B of this part, the Administrator will assign each allowance a unique identification number that will include digits identifying the allowance's compliance use date.

[58 FR 3691, Jan. 11, 1993, as amended at 60 FR 17114, Apr. 4, 1995; 63 FR 68404, Dec. 11, 1998; 70 FR 25335, May 12, 2005]

§73.35 Compliance.

(a) Allowance transfer deadline. No allowance shall be deducted for purposes of compliance with an affected source's sulfur dioxide Acid Rain emissions limitation requirements pursuant to title IV of the Act and paragraph (b) of this section unless:

(1) The compliance use date of the allowance is no later than the year in which the source's SO2 emissions occurred; and

(2) The allowance is:

(i) Recorded in the source's compliance account; or

(ii) Transferred to the source's compliance account, with the transfer submitted correctly pursuant to subpart D of this part for recordation in the source's compliance account by not later than the allowance transfer deadline in the calendar year following the year for which compliance is being established; and

(3) The allowance was not previously deducted by the Administrator in accordance with a State SO2 mass emissions reduction program under §51.124(o) of this chapter or otherwise permanently retired in accordance with §51.124(p) of this chapter.

(b) Deductions for compliance. (1) Except as provided in paragraph (d) of this section, following the recordation of transfers submitted correctly for recordation in the compliance account pursuant to paragraph (a) of this section and subpart D of this part, the Administrator will deduct allowances available for deduction under paragraph (a) of this section from each affected source's compliance account in accordance with the allowance deduction formula in §72.95 of this chapter, or, for opt-in sources, the allowance deduction formula in §74.49 of this chapter, and any correction made under §72.96 of this chapter.

(2) The Administrator will make deductions until either the number of allowances deducted is equal to the amount calculated in accordance with §72.95 of this chapter, or, for opt-in sources, in accordance with §74.49 of this chapter, as modified under §72.96 of this chapter or until no more allowances available for deduction under paragraph (a) of this section remain in the compliance account.

(c)(1) Identification of allowances by serial number. The authorized account representative for a source's compliance account may request that specific allowances, identified by serial number, in the compliance account be deducted for a calendar year in accordance with paragraph (b) or (d) of this section. Such request shall be submitted to the Administrator by the allowance transfer deadline for the year and include, in a format prescribed by the Administrator, the identification of the source and the appropriate serial numbers.

(2) First-in, first-out. In the absence of an identification or in the case of a partial identification of allowances by serial number, as provided for in paragraph (b)(1) or (d) of this section, the Administrator will deduct allowances on a first-in, first-out (FIFO) accounting basis beginning with those allowances with the earliest compliance use date originally allocated for the units at the source and recorded in the source's compliance account. Following the deduction of all originally allocated allowances from the compliance account, the Administrator will deduct those allowances that were transferred and recorded in the source's compliance account pursuant to subpart D of this part, beginning with those with the earliest date of recordation.

(d) Deductions for excess emissions. Pursuant to §77.4 of this chapter, and following the process of recordation set forth in §73.34(a) of this part, the Administrator will deduct allowances for each source with excess emissions for the preceding calendar year in an amount equal to the source's excess emissions tonnage.

[58 FR 3691, Jan. 11, 1993, as amended at 60 FR 17114, Apr. 4, 1995; 64 FR 25842, May 13, 1999; 70 FR 25335, May 12, 2005]

§73.36 Banking.

(a) Compliance accounts. Any allowance in a compliance account not deducted pursuant to §73.35 will remain in the compliance account.

(b) General accounts. In the case of a general account, any allowances in the general account not transferred pursuant to subpart D to another Allowance Tracking System account will remain in the general account.

[58 FR 3691, Jan. 11, 1993, as amended at 70 FR 25336, May 12, 2005]

§73.37 Account error.

The Administrator may, at his or her sole discretion and on his or her own motion, correct any error in any Allowance Tracking System account. Within 10 business days of making such correction, the Administrator will notify the authorized account representative for the account.

[70 FR 25336, May 12, 2005]

§73.38 Closing of accounts.

(a) General account. The authorized account representative of a general account may instruct the Administrator to close the general account by submitting an allowance transfer, pursuant to §73.50 and §73.52, requesting the transfer of all allowances held in the account to one or more other accounts in the Allowance Tracking System, and by submitting in writing, with the signature of the authorized account representative, a request to close the general account.

(b) Inactive accounts. If a general account shows no activity for a 12-month period or longer and does not contain any allowances, the Administrator may notify the account's authorized account representative that the account will be closed following 20 business days from the date the notice is sent. The account will be closed following the 20-day period, unless the Administrator receives and records a request for the transfer of allowances into the account pursuant to §73.52 before the end of the 20-day period, or the authorized account representative submits, in writing, demonstration of good cause as to why the inactive account should not be closed.

[58 FR 3691, Jan. 11, 1993, as amended at 70 FR 25336, May 12, 2005]

Source: 58 FR 3691, Jan. 11, 1993, unless otherwise noted.

Subpart D - Allowance Transfers

§73.50 Scope and submission of transfers.

(a) Scope of transfers. Except as provided in §73.51 and §73.52, the Administrator will record transfers of an allowance to and from Allowance Tracking System accounts.

(b) Submission of transfers. (1) Authorized account representatives seeking recordation of an allowance transfer shall request such transfer by submitting to the Administrator, in a format to be specified by the Administrator, an Allowance Transfer Form. To be considered correctly submitted the request for transfer shall include:

(i) The numbers identifying both the transferror and transferee accounts;

(ii) A specification by serial number of each allowance to be transferred;

(iii) Signatures of the authorized account representatives of both the transferror and transferee accounts;

(iv) The dates of the signatures of the authorized account representatives;

(v) The numbers identifying the authorized account representatives for both the transferror and transferee account; and

(vi) Where the transferee account has not been established, information as required pursuant to §73.31(b) or (c).

(2)(i) The authorized account representative for the transferee account can meet the requirements in paragraphs (b)(1)(iii) and (iv) of this section by submitting, in a format prescribed by the Administrator, a statement signed by the authorized account representative and identifying each account into which any transfer of allowances, submitted on or after the date on which the Administrator receives such statement, is authorized. Such authorization shall be binding on any authorized account representative for such account and shall apply to all transfers into the account that are submitted on or after such date of receipt, unless and until the Administrator receives a statement in a format prescribed by the Administrator and signed by the authorized account representative retracting the authorization for the account.

(ii) The statement under paragraph (b)(2)(i) of this section shall include the following: “By this signature, I authorize any transfer of allowances into each account listed herein, except that I do not waive any remedies under State or federal law to obtain correction of any erroneous transfers into such accounts. This authorization shall be binding on any authorized account representative for such account unless and until a statement signed by the authorized account representative retracting this authorization for the account is received by the Administrator.”

[58 FR 3694, Jan. 11, 1993, as amended at 63 FR 68404, Dec. 11, 1998; 70 FR 25336, May 12, 2005]

§73.51 [Reserved]

§73.52 EPA recordation.

(a) General recordation. Except as provided in this paragraph (a), the Administrator will record an allowance transfer by no later than five business days (or longer as necessary to perform a transfer in perpetuity of allowances allocated to a unit) following receipt of an allowance transfer request pursuant to §73.50, by moving each allowance from the transferror account to the transferee account as specified by the request pursuant to §73.50, provided that:

(1) The transfer is correctly submitted under §73.50;

(2) The transferor account includes each allowance identified by serial number in the transfer; and

(3) If the allowances identified by serial number specified pursuant to §73.50(b)(1)(ii) are subject to the limitation on transfer imposed pursuant to §72.44(h)(1)(i) of this chapter, §74.42 of this chapter, or §74.47(c) of this chapter, the transfer is in accordance with such limitation.

(b) To the extent an allowance transfer submitted for recordation after the allowance transfer deadline includes allowances allocated for any year before the year in which the allowance transfer deadline occurs, the transfer of such allowance will not be recorded until after completion of the deductions pursuant to §73.35(b) for year before the year in which the allowance transfer deadline occurs.

(c) Where an allowance transfer submitted for recordation fails to meet the requirements of paragraph (a) of this section, the Administrator will not record such transfer.

[58 FR 3694, Jan. 11, 1993, as amended at 60 FR 17114, Apr. 4, 1995; 70 FR 25336, May 12, 2005]

§73.53 Notification.

(a) Notification of recordation. The Administrator will notify each party to an allowance transfer within five business days following the recordation of the transfer. Notice will be given in writing or in a format to be specified by the Administrator, to the authorized account representatives of both the transferror and transferee accounts.

(b) Notification of non-recordation. By no later than five business days following receipt of an allowance transfer request by the Administrator, the Administrator will notify, in writing or in a format to be specified by the Administrator, the authorized account representatives of the accounts subject to the allowance transfer request submitted for recordation of:

(1) A decision not to record the transfer, and

(2) The reasons for such non-recordation.

(c) Nothing in this section shall preclude the submission of an allowance transfer request for recordation following notification of non-recordation.

Source: 58 FR 3694, Jan. 11, 1993, unless otherwise noted.

Subpart E - Auctions, Direct Sales, and Independent Power Producers Written Guarantee

§73.70 Auctions.

(a) Allowances to be auctioned. Every year the Administrator will auction allowances from the Auction Subaccount, established pursuant to subpart B of this part, according to the following schedule:

| Year of purchase | Spot auction | Advance auction | Advance auction* |

|---|---|---|---|

| a Not usable until 1995. b Not usable until 7 years after purchase. c Not usable until 6 years after purchase. *These are unsold advance allowances from the direct sale program for 1993, 1994, 1995, and 1996 respectively. | |||

| 1993 | 50,000 a | 100,000 b | |

| 1994 | 50,000 a | 100,000 b | 25,000 c |

| 1995 | 50,000 a | 100,000 b | 25,000 c |

| 1996 | 150,000 | 100,000 b | 25,000 c |

| 1997 | 150,000 | 125,000 b | 25,000 c |

| 1998 | 150,000 | 125,000 b | |

| 1999 | 150,000 | 125,000 b | |

| 2000 and after | 125,000 | 125,000 b | |

In addition to the allowances listed above, the Administrator will auction allowances pursuant to paragraph (c) of this section and §73.72(q) in the amounts and at the times provided for therein.

(b) Timing of the auctions. The spot auction and the advance auction will be held on the same day, selected each year by the Administrator, but no later than March 31 of each year. The Administrator will conduct one spot auction and one advance auction in each calendar year.

(c) Submittal for other allowances for auction. Authorized account representatives may offer allowances for sale at auction, provided that allowances are dated for the year in which they are offered or for any previous year or for seven years following the year in which they are offered. Such authorized account representatives may specify a minimum price for the allowances offered at the auctions. The authorized account representative must notify the Administrator fifteen business days prior to the auctions, using the SO2 Allowance Offer Form published by the Administrator, or by means of electronic communication if the Administrator, following public notice, so requires or permits at some future time. The notification shall include:

(1) The compliance use date of the allowances offered;

(2) The number of allowances to be sold and any other information identifying the allowances offered that may be required by subpart C of this part;

(3) Any minimum price; and

(4) Whether the authorized account representative is willing to sell fewer allowances than the number stated in paragraph (c)(2) of this section, if the full amount cannot be sold. After notification, the Administrator will deduct allowances from the appropriate Allowance Tracking System account from which allowances are being offered and place them in a separate subaccount for such allowances.

(d) Conduct of the auctions. (1) The Administrator will rank all bids in descending order of bid price starting with the highest. Allowances will be sold from the Auction Subaccount in this order at the amounts specified in the bids until there are no allowances in the subaccount. If all allowances are sold from the Auction Subaccount, including unsold allowances transferred from the preceding year's direct sale, and if bids still remain, the Administrator will sell allowances offered by the authorized account representatives, beginning with those offered at the lowest minimum price. Allowances offered at the lowest minimum price will be matched with the highest bid remaining after the Auction Subaccount is exhausted. Sales of offered allowances, including, but not limited to, allowances offered by more than one offeror at the same minimum bid price, will continue in ascending order of minimum price, starting with the lowest, and descending order of remaining bids, starting with the highest, until:

(i) All allowances are sold,

(ii) No bids remain, or

(iii) Prices of remaining bids do not meet minimum prices required in remaining offers.

(2) In the event that there is more than one bid submitting the same price and the total number of allowances requested in all such bids exceeds the number of allowances remaining, the Administrator will award the remaining allowances by lottery to such bidders.

(3) In the event that there are more offers of sale at the minimum price than there are bids meeting that price, allowances from all such offers will be sold to cover the bids, according to each such offeror's pro rata share of all allowances so offered.

(4) In the event that fewer allowances remain than are requested in a bid, the Administrator will sell such remaining allowances to the bidder provided that, pursuant to §73.71(b)(4), the bid states the bidder's willingness to purchase fewer allowances than requested in the bid.

(5) In the event that fewer than all allowances included in an offer for sale would be sold to remaining bids based on price, the Administrator will sell such allowances to the bidder(s), provided that, pursuant to §73.70(c)(4), the offer states the offeror's willingness to sell fewer allowances than were offered for sale.

(e) Announcement of results. Following each auction, the Administrator will publish the names of winning bidders and their bids, the amounts of losing bids, and the lowest price at which allowances are sold.

(f) Transfer of allowances. Allowances will be transferred from the Auction Subaccount and from the Allowance Tracking System account for allowances offered by authorized account representatives to the Allowance Tracking System accounts of successful bidders as soon as payment is collected by the Administrator.

(g) Return of unsuccessful bids. The Administrator will return payment to unsuccessful bidders and to bidders unwilling to purchase fewer allowances than requested following the conclusion of each auction.

(h) Transfer of proceeds. The Administrator will return all proceeds from the auction as follows:

(1) Allowances auctioned from the Auction Subaccount. Not later than 90 days following each auction, the Administrator will pay a pro rata share of the proceeds of each auction to the authorized account representative of each unit from whose annual allowance allocation allowances were withheld for the purposes of establishing the Auction Subaccount. Each unit's pro rata share will be calculated pursuant to regulations to be promulgated under subpart B.

(2) Allowances contributed from others. Not later than 90 days following each auction, the Administrator will transfer the full amount of the proceeds of each sale of allowances offered by authorized account representatives to such representatives. Proceeds from the sale of allowances that were offered with the same specified minimum price will be distributed according to each such offeror's pro rata share of the sale of such allowances.

(3) The Administrator will pay no interest on any payment made pursuant to paragraphs (h) (1) and (2) of this section.

(i) Return of unsold allowances. The Administrator will return all unsold allowances from the auction as follows:

(1) Allowances in the Auction Subaccount. At the conclusion of each auction, the Administrator will transfer to the Allowance Tracking System account of each source that includes a unit specified in paragraph (h)(1) of this section its pro rata share of any allowances remaining in the Auction Subaccount. Each unit's pro rata share will be calculated pursuant to regulations to be promulgated under subpart B.

(2) Allowances contributed from others. At the conclusion of each auction, the Administrator will return unsold allowances to the appropriate offerors' Allowance Tracking System accounts. Any unsold allowances that were offered with the same specified minimum price will be distributed according to each such offeror's pro rata share of all such allowances offered.

[56 FR 65601, Dec. 17, 1991, as amended at 61 FR 28763, June 6, 1996; 63 FR 5735, Feb. 4, 1998; 63 FR 51766, Sept. 28, 1998; 70 FR 25336, May 12, 2005]

§73.71 Bidding.

(a) Who may participate in the auctions. Any person may participate in the auctions by submitting a bid or bids pursuant to this section.

(b) Bidding. Sealed bids shall be sent to the Administrator using the Bid Form for SO2 Allowance Auctions, or some method of electronic transfer if the Administrator, following public notice, so requires or permits at some future time. The bid form shall state:

(1) The number of allowances sought and the price;

(2) Whether spot or advance allowances are sought;

(3) Allowance Tracking System account number;

(4) Whether the bidder is willing to purchase fewer allowances than the number of allowances stated in (b)(1) of this section if the full amount is not available. Where the bidder holds no Allowance Tracking System account, a New Account/New Authorized Account Representative Form must accompany the bid. New account information shall include at a minimum: Name, address, telephone number, facsimile number, organization or company name (if applicable), type of organization, and the authorized account representative for purposes of the account.

(c) Payment. Each bid must include a certified check or letter of credit for the total bid price, or may specify a method of electronic transfer or other method of payment, if the Administrator, following public notice, so requires or permits at some future time. The certified check should be made payable to the U.S. EPA. To meet the requirements of this paragraph bidders must submit a completed SO2 Allowance Auction Letter of Credit Form. If such Form is used, the Administrator must receive full payment for allowances awarded at the auctions, either by wire transfer or certified check, no later than 2 business days after the results of the auction are announced in the Allowance Tracking System.

(d) Bid amount and number of bids. Bidders may request any number of allowances up to the amount of allowances available for auction. Any person may submit more than one bid in each auction, provided that each bid meets the requirements of this section.

(e) Submission of bids. The Administrator will publish in the Federal Register and in the Commerce Business Daily the address of where to submit bids and payment not later than 60 calendar days before each auction.

(f) Deadline for bids. All bids must be revised by the Administrator no later than 3 business days prior to the date of the auctions.

§73.72 Direct sales.

Allowances that were formerly part of the direct sale program, which has been terminated under §73.73(b), will be included in the annual allowance auctions in accordance with §73.70(a).

[61 FR 28763, June 6, 1996]

§73.73 Delegation of auctions and sales and termination of auctions and sales.

(a) Delegation. The Administrator may, in the Administrator's discretion, by delegation or contract provide for the conduct of sales or auctions under the Administrator's supervision by other departments or agencies of the United States Government or by nongovernmental agencies, groups, or organizations.

(b) Termination of sales. If the Administrator determines that, during any period of 2 consecutive calendar years, fewer than 20 percent of the allowances available in the subaccount for direct sales have been purchased, the Administrator shall terminate the Direct Sale Subaccount and transfer such allowances to the Auction Subaccount.

(c) Termination of auctions. The Administrator may, in the Administrator's discretion, terminate the withholding of allowances and the auctions if the Administrator determines, that, during any period of 3 consecutive years after 2002, fewer than 20 percent of the allowances available in the Auction Subaccount have been purchased.

Source: 56 FR 65601, Dec. 17, 1991, unless otherwise noted.

Subpart F - Energy Conservation and Renewable Energy Reserve

§73.80 Operation of allowance reserve program for conservation and renewable energy.

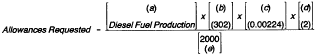

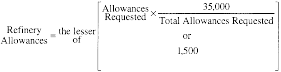

(a) General. The Administrator will allocate allowances from the Conservation and Renewable Energy Reserve (the “Reserve”) established under subpart B based on verified kilowatt hours saved through the use of one or more qualified energy conservation measures or based on kilowatt hours generated by qualified renewable energy generation. Allowances will be allocated to applicants that meet the requirements of this subpart according to the formulas specified in §73.82(d), and in the order in which applications are received, except where provided for in §73.84 and §73.85, until a total of 300,000 allowances have been allocated.

(b) Period of applicability. Allowances will be allocated under this subpart for qualified energy conservation measures or renewable energy generation sources that are operational on or after January 1, 1992, and before the date on which any unit owned or operated by the applicant becomes a Phase I unit or a Phase II unit.

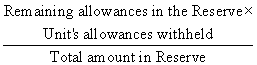

(c) Termination of the Reserve. The Administrator will reallocate any allowances remaining in the Reserve after January 2, 2010 to the affected units from whom allowances were withheld by the Administrator, in accordance with section 404(g), for purposes of establishing the Reserve. Each unit's allocation under this paragraph will be calculated as follows:

(Allowances will be rounded to the nearest allowance)

[58 FR 3695, Jan. 11, 1993; 58 FR 40747, July 30, 1993]

§73.81 Qualified conservation measures and renewable energy generation.

(a) Qualified energy conservation measures. A qualified energy conservation measure is a demand-side measure not operational until the period of applicability, implemented in the residence or facility of a customer to whom the utility sells electricity, that:

(1) Is specified in appendix A(1) of this subpart; or

(2) In the case of a device or material that is not included in appendix A(1) of this subpart,

(i) Is a cost-effective demand-side measure consistent with an applicable least-cost plan or least-cost planning process that increases the efficiency of the customer's use of electricity (as measured in accordance with §73.82(c)) without increasing the use by the customer of any fuel other than qualified renewable energy, industrial waste heat, or, pursuant to paragraph (b)(5) of this section, industrial waste gases;

(ii) Is implemented pursuant to a conservation program approved by the utility regulatory authority, which certifies that it meets the requirements of paragraph (a)(2)(i) of this section and is not excluded by paragraph (b) of this section; and

(iii) Is reported by the applicant in its application to the Reserve.

(b) Non-qualified energy conservation measures. The following energy conservation measures shall not qualify for Allowance Reserve allocations:

(1) Demand-side measures that were operational before January 1, 1992;

(2) Supply-side measures;

(3) Conservation programs that are exclusively informational or educational in nature;

(4) Load management measures that lead to economic reduction of electric energy demand during a utility's peak generating periods, unless kilowatt hour savings can be verified by the utility pursuant to §73.82(c); or

(5) Utilization of industrial waste gases, unless the applicant has certified that there is no net increase in sulfur dioxide emissions from such utilization.

(c) Qualified renewable energy generation. Qualified renewable energy generation is electrical energy generation, not operational until the period of applicability, that:

(1) Is specified in appendix A(3) of this subpart; or

(2) In the case of renewable energy generation that is not included in appendix A(3) of this subpart is#:

(i) Consistent with a least cost plan or a least cost planning process and derived from biomass (i.e., combustible energy-producing materials from biological sources which include wood, plant residues, biological wastes, landfill gas, energy crops, and eligible components of municipal solid waste), solar, geothermal, or wind resources;

(ii) Implemented pursuant to approval by the utility regulatory authority, which certifies that it meets the requirements of paragraphs (c)(2)(i) and (c)(2)(ii) of this section and is not excluded by paragraph (d) of this section; and

(iii) Is reported by the applicant in its application to the Reserve.

(d) Non-qualified renewable energy generation. The following renewable energy generation shall not qualify for Allowance Reserve allocations:

(1) Renewable energy generation that was operational before January 1, 1992;

(2) Measures that reduce electricity demand for a utility's customers without providing electric generation directly for sale to customers; and

(3) Measures that appear on the list of qualified energy conservation measures in appendix A(1) of this subpart.

[58 FR 3695, Jan. 11, 1993; 58 FR 40747, July 30, 1993]

§73.82 Application for allowances from reserve program.

(a) Application Requirements. Each application for Conservation and Renewable Energy Reserve allowances, shall:

(1) Certify that the applicant is a utility;

(2) Demonstrate that the applicant, any subsidiary of the applicant, or any subsidiary of the applicant's holding company, is an owner or operator, in whole or in part, of at least one Phase I or Phase II unit by including in the application the name and Allowance Tracking System account number of a Phase I or Phase II unit which it owns or operates and for which it is listed as an owner or operator on the certificate of representation submitted by the designated representative for the unit pursuant to §72.20 of this chapter;