['Discrimination', 'Government contracts', 'Recordkeeping']

['EEO-1 Reporting', 'Recordkeeping', 'Government Contracts']

05/17/2022

...

DEPARTMENT OF LABOR

Office of Federal Contract Compliance Programs

41 CFR Part 60-1

RIN 1250-AA03

Government Contractors, Requirement To Report Summary Data on Employee Compensation

AGENCY: Office of Federal Contract Compliance Programs, Labor.

ACTION: Notice of proposed rulemaking.

SUMMARY: The Office of Federal Contract Compliance Programs (OFCCP) proposes to amend one of its implementing regulations for Executive Order 11246, Equal Employment Opportunity, which sets forth the reporting obligations of Federal contractors and subcontractors. This notice of proposed rulemaking (NPRM) would amend the regulation by adding a requirement that certain Federal contractors and subcontractors supplement their Employer Information Report (EEO-1 Report) with summary information on compensation paid to employees, as contained in the Form W-2 Wage and Tax Statement (W-2) forms, by sex, race, ethnicity, and specified job categories, as well as other relevant data points such as hours worked, and the number of employees. This summary compensation data collection from Federal contractors and subcontractors by OFCCP is a critical tool for eradicating compensation discrimination. It would enable OFCCP to direct its enforcement resources toward entities for which reported data suggest potential pay violations, and not toward entities for which there is no evidence of potential pay violations. It would also enhance two enforcement objectives: Greater voluntary compliance; and greater deterrence of noncompliant behaviors by contractors and subcontractors. OFCCP seeks to achieve these dual and complementary objectives while minimizing, to the extent feasible, the compliance burden borne by Federal contractors and subcontractors.

DATES: To be assured of consideration, comments must be received on or before November 6, 2014.

ADDRESSES: You may submit comments, identified by RIN number 1250-AA03, by any of the following methods:

- Federal eRulemaking Portal: http://www.regulations.gov. Follow the instructions for submitting comments.

- Fax: (202) 693-1313 (for comments of six pages or less).

- Mail: Debra A. Carr, Director, Division of Policy and Program Development, Office of Federal Contract Compliance Programs, Room C-3325, 200 Constitution Avenue NW., Washington, DC 20210.

Instructions: Please submit your comments by only one method. Receipt of submissions will not be acknowledged; however, the sender may request confirmation that a submission was received by telephoning OFCCP at (202) 693-0103 (voice) or (202) 693-1337 (TTY) (these are not toll-free numbers). All comments received by OFCCP, including any personal information provided, will be available for public inspection during normal business hours at Room C-3325, 200 Constitution Avenue NW., Washington, DC 20210, or via the Internet at www.regulations.gov. Upon request, individuals who require assistance viewing comments are provided appropriate aids such as readers or print magnifiers. Copies of this NPRM are available in the following formats: Large print, electronic file on computer disk, and audiotape. To schedule an appointment to review the comments and/or to obtain this NPRM in an alternate format, please contact OFCCP at the telephone numbers or address listed above.

FOR FURTHER INFORMATION CONTACT: Debra A. Carr, Director, Division of Policy and Program Development, Office of Federal Contract Compliance Programs, 200 Constitution Avenue NW., Room C-3325, Washington, DC 20210. Telephone: (202) 693-0103 (voice) or (202) 693-1337 (TTY).

SUPPLEMENTARY INFORMATION:

Executive Summary

Purpose

The OFCCP proposes to amend the regulation found at 41 CFR 60-1.7 by adding a requirement that certain Federal contractors and subcontractors (hereinafter “contractors”) submit additional, readily available data in a new “Equal Pay Report.” This report would require the submission of summary data on employee compensation by sex, race, ethnicity, specified job categories, and other relevant data points such as hours worked, and the number of employees. The OFCCP believes that collecting and strategically using this summary data would have a significant deterrent effect and impact on OFCCP's enforcement program. Voluntary compliance and self-assessments by Federal contractors are critical components of this NPRM given the vast number of establishments subject to OFCCP's jurisdiction in comparison to the agency's modest personnel and other resources. The agency estimates that, based solely on 2012 EEO-1 Report data, more than 116,000 establishments are subject to its jurisdiction because they have at least 50 employees and a contract or subcontract in the amount of $50,000 or more. However, this NPRM proposes to cover a subset of these establishments. Informed by the aggregate industry-based data that OFCCP will make available to them, Federal contractors will have the opportunity to conduct meaningful self-assessments of their compensation practices and policies, and make any necessary pay adjustments or other compensation modifications prior to an OFCCP compliance evaluation. Specifically, this NPRM will enhance the quality and quantity of data OFCCP collects. This data, in addition to data collected from publicly available sources, such as the Bureau of Labor Statistics (BLS), are critical to developing a data-driven approach for identifying and focusing OFCCP's evaluations and resources on Federal contractors that have potentially discriminatory compensation differences when compared to an objective industry standard.

This NPRM reflects extensive stakeholder input collected prior to and during a 2011 Advance Notice of Proposed Rulemaking, specific criteria stated in a Presidential Memorandum issued on April 8, 2014, and additional stakeholder input collected during listening sessions held following the release of the Presidential Memorandum (the Memorandum).1 In the Memorandum, President Barack Obama directed the U.S. Department of Labor (DOL) to develop a compensation data collection proposal that would: (1) Maximize the efficiency and effectiveness of the agency's enforcement and its ability to focus on more likely violators; (2) minimize, to the extent feasible, the burden on Federal contractors and subcontractors, especially small businesses and small nonprofit organizations; and (3) use the data collected to encourage greater voluntary compliance and to identify and analyze industry trends. The Memorandum also encouraged the Department to develop a proposal that relies on existing reporting requirements and frameworks to the extent feasible, and to consider available independent studies regarding the collection of compensation data.

1Presidential Documents, Memorandum of April 8, 2014, “Advancing Pay Equality Through Compensation Data Collection,” Memorandum for the Secretary of Labor, April 11, 2014 (79 FR 20751).

Data collection and analysis of data are likely to serve as a disincentive for noncompliance, and are, therefore, effective deterrents. One recent report found that deterring violations before they occur is one part of an “overall enforcement policy.”2 However, deterrence is not often “incorporated as a central component of how investigations are targeted, conducted, and followed up on, or in the way that penalties are assessed and levied.”3 Similarly, researchers have described deterrence as the “second foundation of traditional enforcement” with the potential to protect vulnerable workers and influence employers' behavior related to the broad goal of improving workplace compliance.4 Research in this area has found that deterrence can effectively inform how enforcement agencies select and conduct investigations.5

2David Weil, Improving Workplace Conditions Through Strategic Enforcement, May 2010, at 2, available at http://www.dol.gov/whd/resources/strategicEnforcement.pdf (last accessed July 4, 2014).

3 Id.

4 Id. at 13.

5 Id.

The disclosure of compensation data summarized at the industry level enables contractors and subcontractors to assess their compensation structure along with those of others in the same industry, and provide useful data to current and potential employees. Some of these employers will not want to be identified as having pay standards that are significantly lower or different from those of their industry peers, since this may encourage valuable employees to consider moving to other employers, or discourage applicants who see that higher paying jobs may be available elsewhere. Employers do not want to be known as one of the lowest paying members of their industry, and may voluntarily change their pay structure.

OFCCP, through this NPRM, seeks to imbed deterrence into its existing three-prong enforcement framework which consists of: (1) Conducting compliance evaluations and complaint investigations, and obtaining remedies for victims of discrimination; (2) Issuing policy, technical assistance, and subregulatory guidance that is legally sound and effective; and (3) Strategically developing relationships and sharing information with contractors and workers about their respective rights and legal obligations.

In order to integrate deterrence into the first of the three prongs, that is, its compliance evaluations process, OFCCP will collect and analyze contractor summary compensation data to establish objective industry standards for identifying potential discrimination in employee compensation.6 OFCCP will use these standards to determine which contractors it will prioritize and schedule for compliance evaluations. This prioritization will be based on the amount of difference or variance between a contractor's pay standards when compared to the appropriate industry standards. By requiring contractors and subcontractors to report the data, OFCCP believes that some of these employers will voluntarily change their employment policies and practices. When coupling this collection of data with its proposed use, that is, using it to establish and make public objective industry standards that can indicate whether a contractor or subcontractor is at higher risk for possible compensation violations, OFCCP believes that more contractors will voluntarily change their policies and practices.7 These contractors will rightfully assume that OFCCP is strengthening its enforcement in the area of compensation discrimination; therefore, they will likely take voluntary measures to ensure that they are in compliance should they be scheduled for an OFCCP compliance evaluation.

6A contractor's compensation practices, standing, or position relative to the “objective industry standards” do not constitute a violation of OFCCP's laws or regulations, and no violation, sanction or penalty is imposed based on a contractor's ability to meet or exceed the standard. This standard is a tool OFCCP may use to inform and refine its scheduling process for compliance evaluations.

7Mark A. Cohen, Empirical Research on the Deterrent Effect of Environmental Monitoring and Enforcement, 30 ELR 10245, 10247-10250 (2000) (finding that empirical studies demonstrate the effectiveness of government activities such as enforcement and compliance monitoring have a deterrent effect; a general deterrent effect exists when the regulated believe that they have a higher probability of being monitored; monitoring the behavior of regulated entities based on assessed noncompliance risk level has a deterrent effect); Executive Office of the President, Office of Drug Control Policy, Measuring the Deterrent Effect of Enforcement Operations on Drug Smuggling, 1991-1999, (August 2001), available at https://www.ncjrs.gov/ondcppubs/publications/pdf/measure_deter_effct.pdf (last accessed June 23, 2014) (a deterrent effect exists with increased penalties and targeted enforcement operations); Diane Del Guercio, Elizabeth R. Odders-White & Mark J. Ready, The Deterrence Effect of SEC Enforcement Intensity on Illegal Insider Trading, (Sept. 2013) (providing direct evidence that aggressive enforcement deters illegal activity).

Integration of deterrence into the second prong of OFCCP's enforcement policy comes through not only the proposals in this NPRM but also through OFCCP's ongoing commitment to providing the contractors' human resources (HR) and compliance officials with access to technical assistance materials and training that supports compliance with OFCCP's regulations. It has been OFCCP's experience that HR and compliance officials often drive compliance within an organization, as they are often the sponsor or champion for compliance within the company. As such, training them and supporting their compliance work is critically important to greater deterrence and voluntary compliance.

Finally, as to the third prong of OFCCP's enforcement framework, routinely sharing aggregate compensation data at the industry and/or labor market level with contractors should drive some additional portion of the contractor community to engage in voluntary self-assessments of their compensation practices and make needed corrections.8 OFCCP plans to share summary industry standards information with the public annually, as soon as practicable. Moreover, OFCCP plans to provide training and technical assistance to contractors that explain the standards and how contractors could use them to conduct self-assessments of their compensation practices and differences.9

8Mark A. Cohen, Empirical Research on the Deterrent Effect of Environmental Monitoring and Enforcement, 30 ELR 10245, 10250 (2000) (sharing information is an important enforcement tool because it can change firm behavior; information disclosure has an important deterrent effect).

9These voluntary assessments should not be confused with and do not take the place of the assessments required of contractors' affirmative action programs under OFCCP's regulations.

Consistent with this overall view of transparency, a 2010 study found that the Wage and Hour Division (WHD) of the U.S. Department of Labor could potentially increase its deterrence effects by being more transparent about its enforcement activities.10 More specifically, the report concludes that greater transparency about investigation activities underway or the targeting of certain geographic areas by WHD, and information about closed investigations “potentially increase deterrence effects not only among employer networks, but also through spreading the word to workers in a local area.”11 Consequently, OFCCP anticipates that by making publicly available the industry standards used to prioritize contractors for enforcement actions, and its overall emphasis on compensation discrimination enforcement, the agency will also see positive deterrence effects.

10David Weil, Improving Workplace Conditions Through Strategic Enforcement, May 2010, at 83, available at http://www.dol.gov/whd/resources/strategicEnforcement.pdf (last accessed July 4, 2014) (among the study recommendations were making investigation activities in a geographic area more transparent, and increasing public access to data on closed case investigations or industry initiatives to create a deterrent effect).

11 Id.

Yet another possible deterrence effect exists when OFCCP generally exercises its enforcement authority. When OFCCP finds and remedies violations during a scheduled compliance evaluation, because the contractor has not voluntarily changed its behavior, a preventive deterrent effect is the result. When OFCCP finds and remedies violations by contractors, they may be prohibited from, and thus prevented from, continuing their discriminatory practices. This enforcement approach is tantamount to “preventive” deterrence because the expectation is that at least some of these violators are prevented from continuing their unlawful conduct for some period.

Deterrence, unlike enforcement actions, is proactive in nature. As such, it can prevent jobs from being denied or lost, prevent workers from being unfairly compensated, and prevent individuals and their families from being placed in financial jeopardy due to employment discrimination. This NPRM is one means of enabling OFCCP to collect the data it needs to strategically prioritize compliance evaluations, and share that data, as appropriate, to support voluntary changes in contractor employment behaviors.12 Collecting this readily available compensation information will permit OFCCP to identify and prioritize contractors and subcontractors that are likely to have possible compensation violations, and strategically deploy its enforcement resources to investigate those contractors. In an era of increased demand for productivity with dwindling resources, this enhanced data collection will inure to the benefit of both OFCCP and compliant Federal contractors and subcontractors.

12Archon Fung, Mary Graham & David Weil, Full Disclosure: The Perils and Promise of Transparency, Cambridge University Press (2007).

Legal Authority

Originally issued in 1965, and amended several times in the intervening years, the purpose of Executive Order 11246 is twofold. First, the Executive Order prohibits employment discrimination on the basis of race, color, religion, sex, sexual orientation, and gender identity and national origin against employees and applicants by covered Federal contractors and subcontractors.13 Second, it requires that each covered Federal contractor and subcontractor take affirmative action to ensure equal opportunity in employment. The nondiscrimination and affirmative action obligations of Federal contractors cover all aspects of employment, including rates of pay and other compensation.

13On July 21, 2014, the President signed Executive Order 13672 amending Executive Order 11246 to include nondiscrimination based on sexual orientation and gender identity. This Order requires that a regulation be prepared within 90 days of the date of the Order. Though the new Executive Order is effective immediately, the protections apply to contracts entered into on or after the effective date of the new DOL regulation.

The requirements in Executive Order 11246 generally apply to any business or organization that: (1) Holds a single Federal contract, subcontract, or Federally assisted construction contract in excess of $10,000; (2) has Federal contracts or subcontracts with a combined total exceeding $10,000 in any 12-month period; or (3) holds Government bills of lading, serves as a depository of Federal funds, or is an issuing and paying agency for U.S. savings bonds and notes in any amount. Pursuant to the Executive Order, the award of a Federal contract comes with a number of responsibilities. Section 202 of the Executive Order requires every contractor to agree to: (1) Comply with all provisions of the Executive Order and the rules, regulations, and relevant orders of the Secretary of Labor; (2) provide all information and reports required by the Executive Order and implementing rules, regulations, and orders; and (3) provide access to its books, records, and accounts to the Secretary of Labor for the purpose of investigation to ascertain compliance with such rules, regulations, and orders. Under Section 203 of the Executive Order, the Secretary of Labor has broad authority to require compliance reports from contractors that contain such information regarding their practices, employment policies, programs, and employment statistics, in such form as the Secretary of Labor may prescribe. Likewise, the implementing regulations at 41 CFR 60-1.12(a) provide that the Director of OFCCP may require a contractor to keep employment or other records, including records on compensation and other rates of pay by race and gender, and must supply this information to OFCCP upon request. A contractor in violation of the Executive Order may have its contracts canceled, suspended, terminated, or may be subject to debarment.

Major Proposed Provisions in the NPRM

The regulation at 41 CFR 60-1.7 sets forth the existing requirement that certain Federal contractors and subcontractors submit an annual Employer Information Report EEO-1 (EEO-1 Report), a standard Federal report on workforce demographics that is jointly promulgated by OFCCP and the Equal Employment Opportunity Commission (EEOC). The NPRM proposes the following major provisions:

- Amending the regulation at 41 CFR 60-1.7 by adding a requirement that employers who file EEO-1 Reports, have more than 100 employees, and a contract, subcontract, or purchase order amounting to $50,000 or more that covers a period of at least 30 days, including modifications, submit two columns of additional information to the EEO-1 Report in a new Equal Pay Report to OFCCP.14 The report requires the submission of summary data on employee compensation by sex, race, ethnicity, specified job categories, and other relevant data points such as hours worked, and the number of employees.

14Any reference to contractor obligations under the proposed rule described in this NPRM also apply to first tier nonconstruction subcontractors and construction subcontractors that satisfy the employee and contract size coverage criteria in the proposed rule. - Requiring that covered Federal contractors and subcontractors electronically submit the proposed Equal Pay Report using a web-based data tool. OFCCP will establish a process for requesting an exemption to the electronic filing requirement.

- Requiring contract bidders to make a representation related to whether they currently hold a Federal contract or subcontract that requires them to file the proposed Equal Pay Report and, if so, whether they filed the report for the most recent reporting period.

- Extending existing agency sanctions to Federal contractors and subcontractors for the failure to file timely, complete, and accurate Equal Pay Reports, and the representation of compliance.

OFCCP is also interested in amending the regulation to 41 CFR 60-1.7 by adding a requirement that employers who file the Department of Education's Integrated Postsecondary Education Data System (IPEDS) report, have more than 100 employees, and have a contract, subcontract, or purchase order amounting to $50,000 or more that covers a period of at least 30 days, including modifications, also file OFCCP's proposed Equal Pay Report. OFCCP is particularly interested in comments related to the need to collect additional compensation data from postsecondary academic institutions in light of the scope of their existing reporting obligations with the U.S. Department of Education. Consequently, information relevant to the feasibility of using IPEDS data to satisfy the objectives of this NPRM is particularly helpful on the issue of the scope of coverage.

OFCCP proposes sharing summary industry standards information with the public annually, as soon as practicable. Moreover, OFCCP plans to provide training and technical assistance to contractors that explain the standards and how contractors could use them to conduct their self-assessments. This information could reflect the industry and/or labor market, or some other relevant aggregate grouping of the data received by OFCCP.15 The published data will be made available to support and encourage genuine, in-depth, contractor self-assessments of their compensation policies and practices. OFCCP believes that the publication of data for contractors to use would significantly promote deterrence and voluntary compliance with their obligations under Executive Order 11246. The advancement of the societal goals of nondiscrimination in the workplace, and closing the pay gap, are the by-products of deterrence and compliance. Therefore, OFCCP is interested in comments on the cost to contractors of conducting these self-assessments of the data provided pursuant to the Equal Pay Report against published industry standards. These voluntary compensation difference assessments are not substitutions for mandatory assessments required by other provisions in Part 60.

15The data could be made available at industry, labor market or other grouping levels based on OFCCP's assessment of the actual data it receives, and whether or not external data sources are used.

Costs, Benefits and Transfers

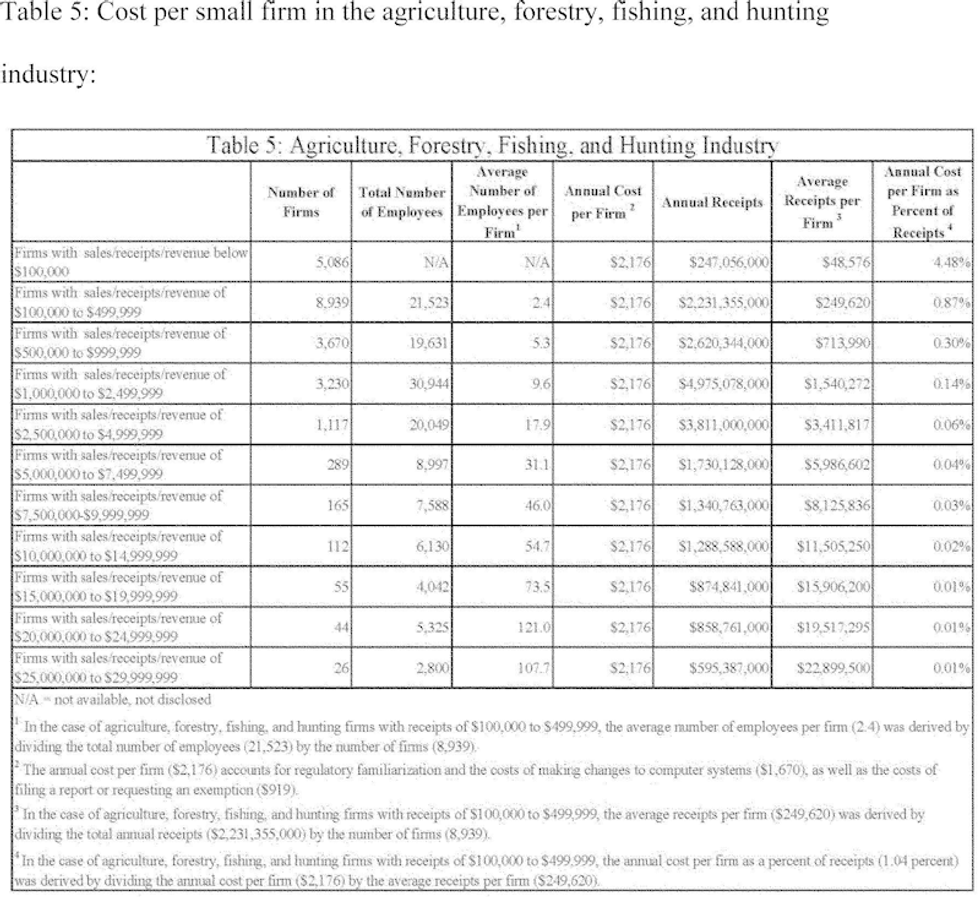

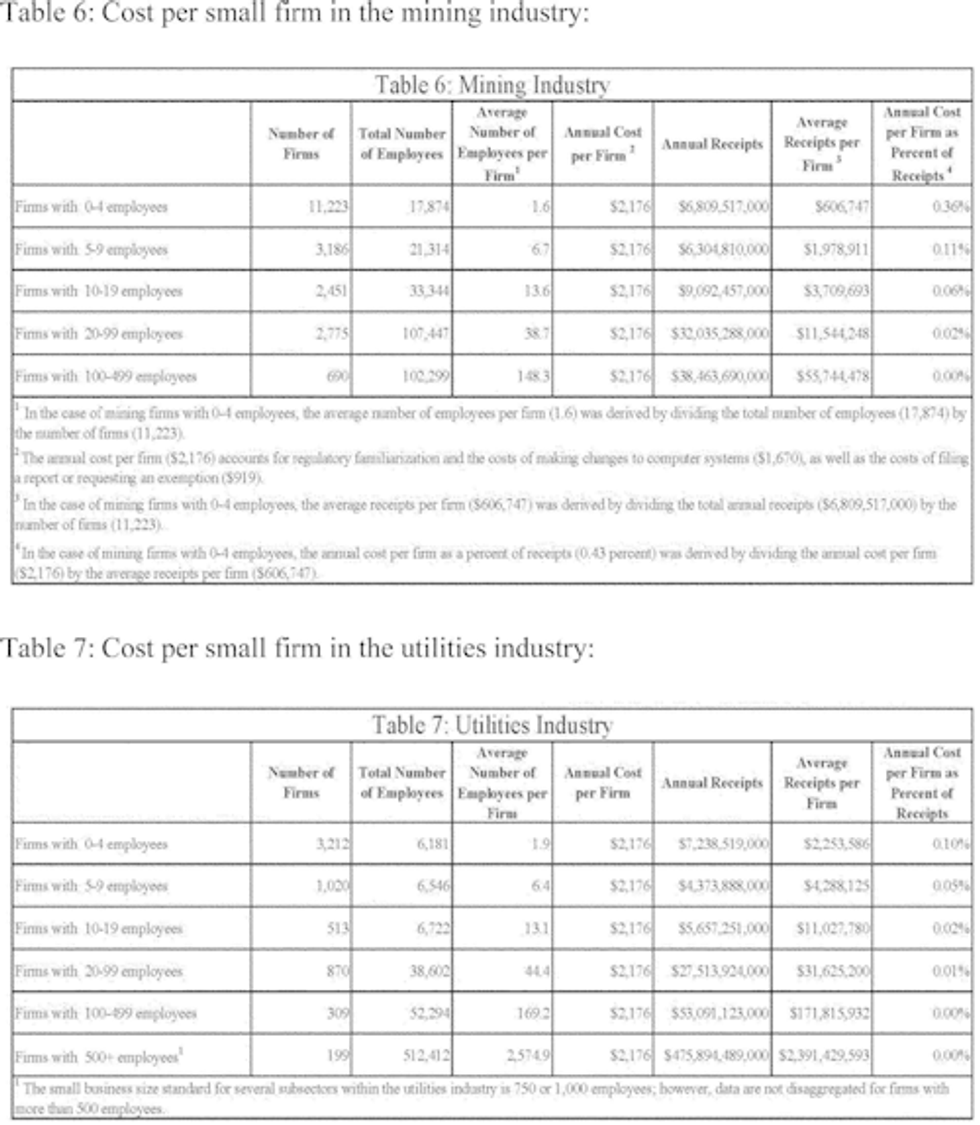

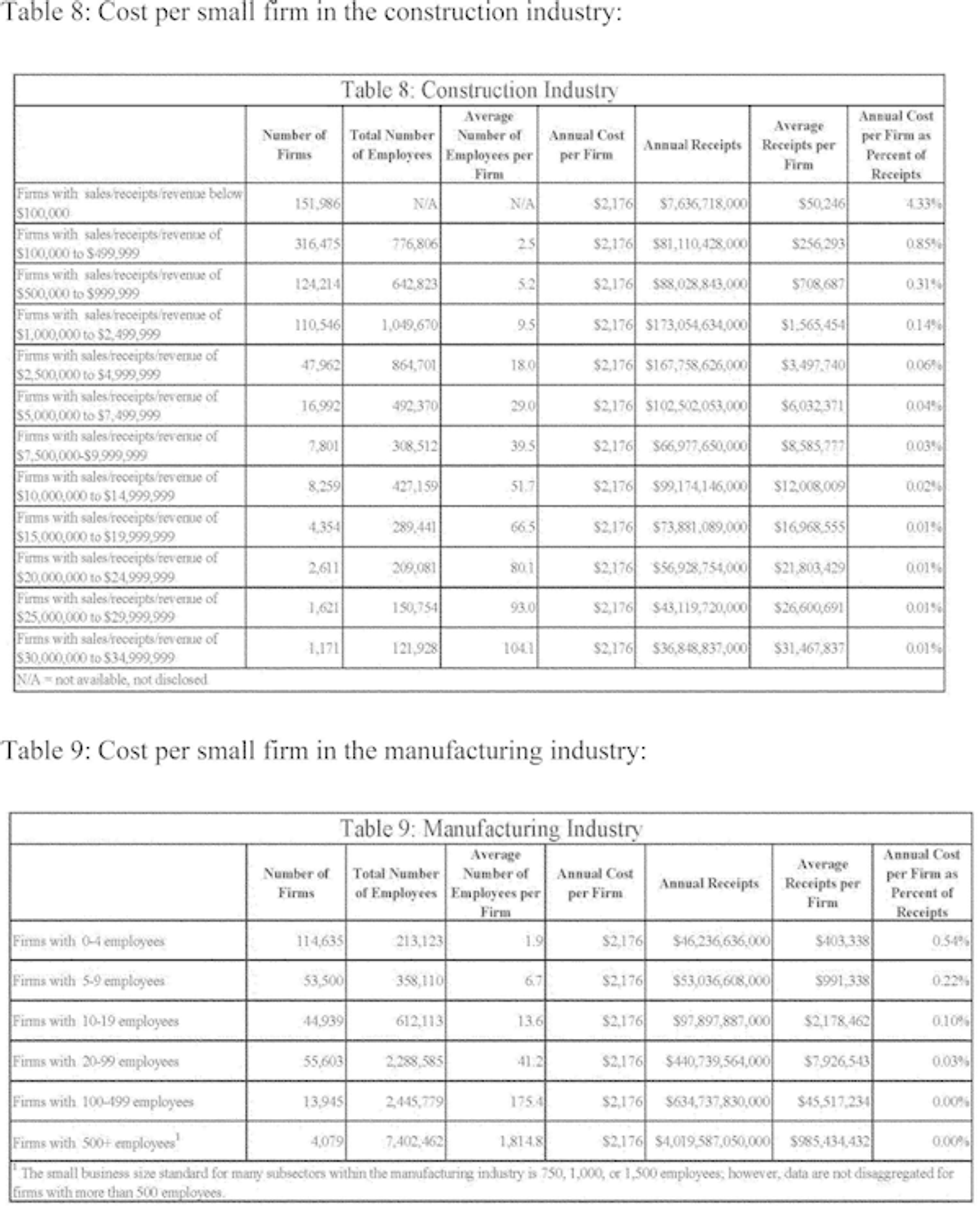

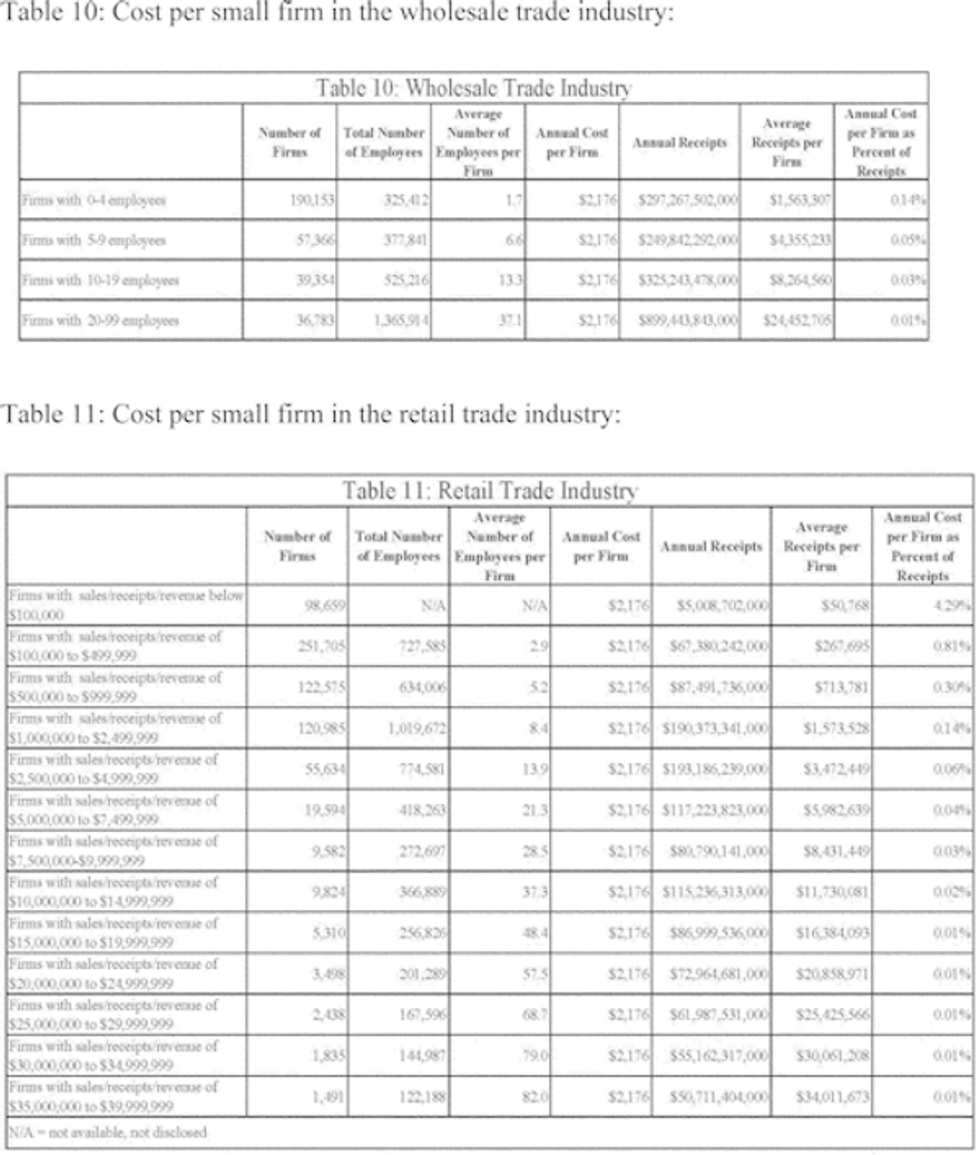

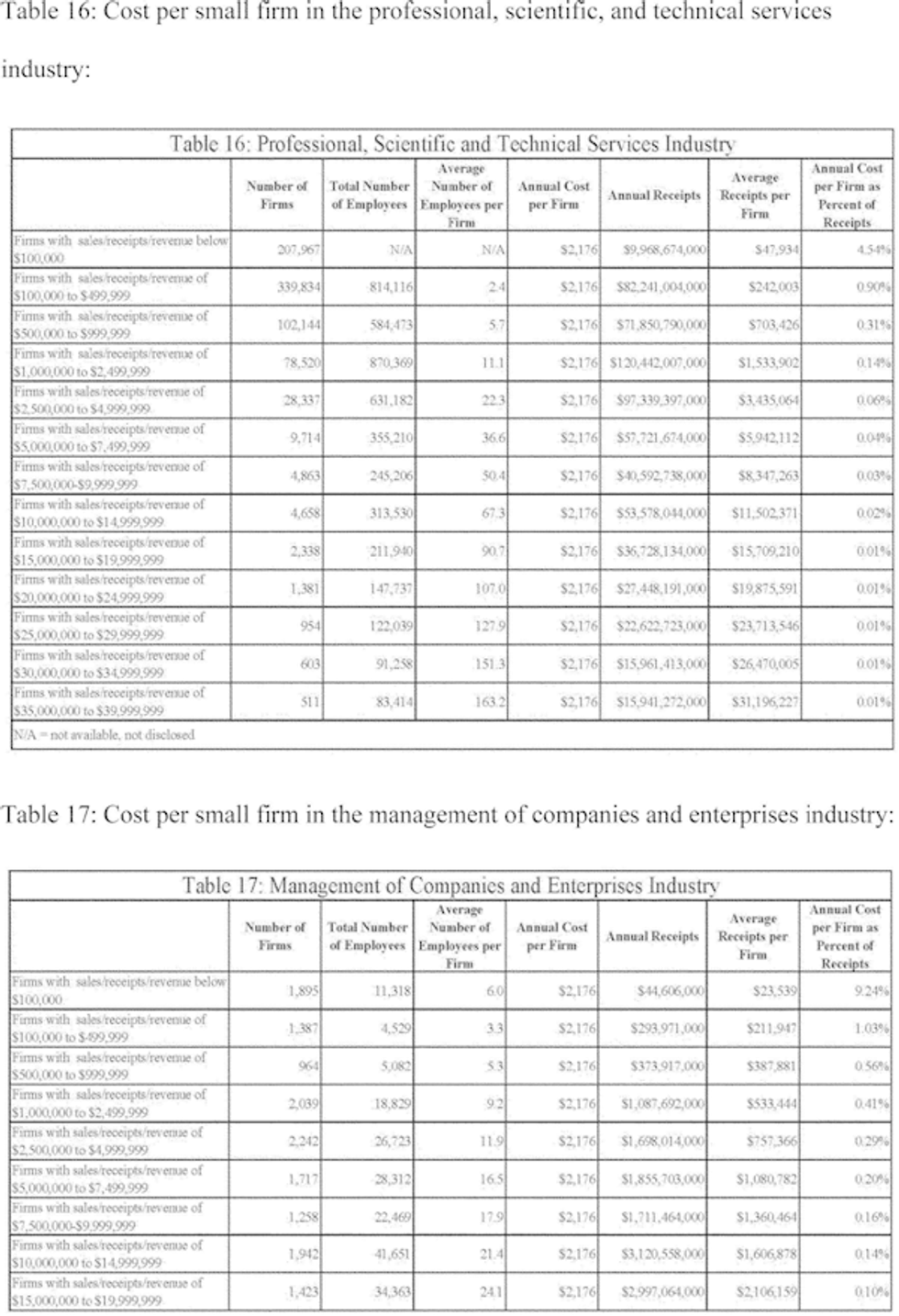

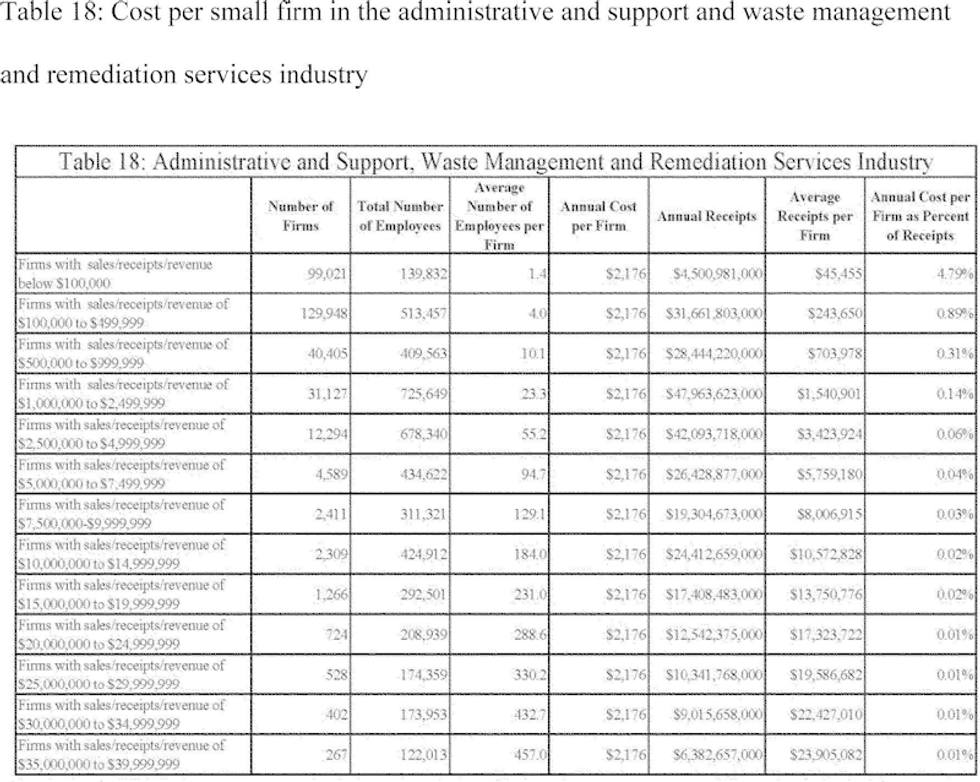

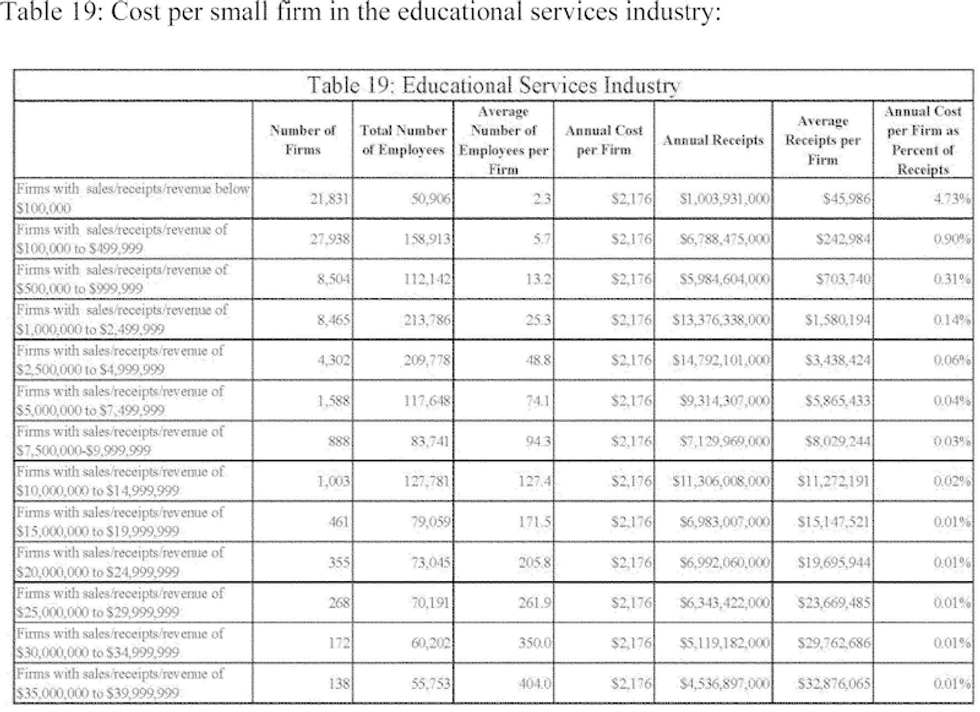

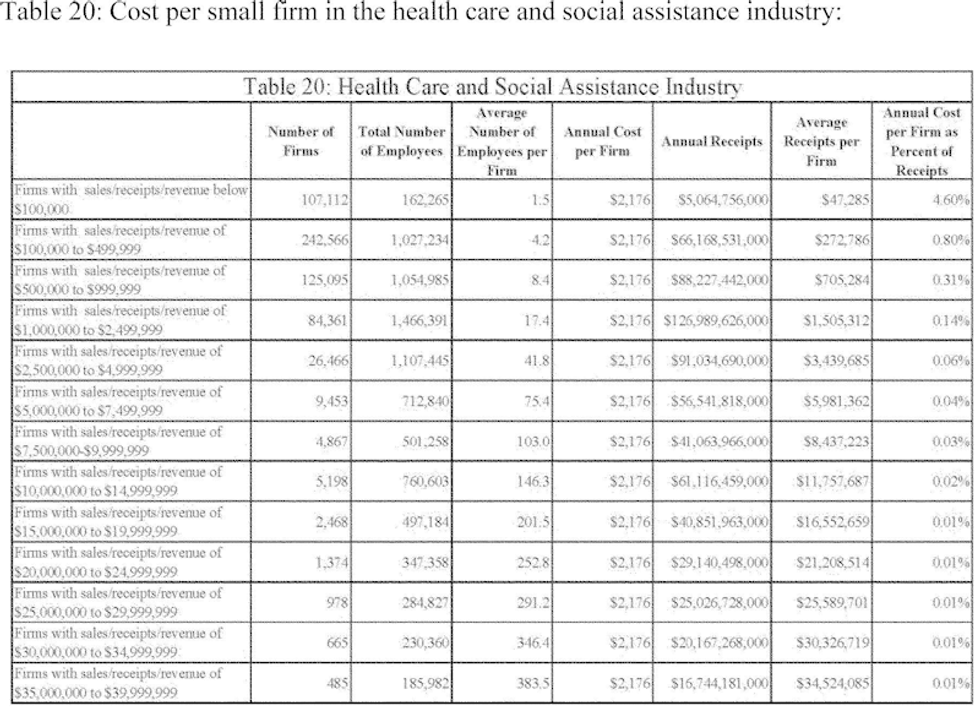

The table below displays the estimated costs associated with the implementation of this NPRM. OFCCP estimates that the proposed cost of the NPRM is $684 per contractor establishment or $2,176 per contractor company.

| Frequency | Description | Estimated cost |

|---|---|---|

| One-Time Burden | Regulatory familiarization, modifications to contractor personnel tracking systems, and changes to the contractor's bidder representation process | $33,591,233 |

| Annual Recurring Burden | Contractors completing the proposed report and contractors requesting exemption from electronic filing | 12,654,414 |

| Annual Operations and Maintenance Costs | The cost of filing the exemption request | 4,542 |

| Cost to the Government | The cost of additional staffing and updating information systems | 3,759,696 |

| Total Cost of the Proposed Rule | 50,009,885 |

Note that the first-year cost of the proposed rule is $46,250,189, which includes the one-time burden, annual recurring, and annual operations and maintenance costs. The goals of the proposed rule are:

- Increasing contractor self-assessment of compensation policies and practices, and expanding voluntary compliance with OFCCP's regulations, to advance OFCCP's mission of ensuring nondiscrimination in employment and decreasing the pay gap between males and females and between people on the basis of race.

- Providing probative compliance information, including data on industry and/or labor market standards, to promote industry-wide deterrence within the Federal contractor community and lead to modified compliance behavior in the compensation arena.

- Making data-driven enforcement decisions that support the efficient use of limited enforcement resources. OFCCP will strategically deploy its resources to focus on conducting compliance evaluations of contractors that are more likely to have compensation discrimination violations.

- Shifting, to the maximum extent possible, compliance evaluation costs from contractors that are likely to be in compliance with OFCCP's existing regulations prohibiting pay discrimination to contractors that are more likely not to be in compliance.

- Contributing to the stability of working Americans by helping minimize the pay gap and promoting broad societal policy objectives of nondiscrimination and equal pay. Providing workers victimized by discrimination the opportunity to obtain the best possible remedies and relief. OFCCP anticipates increasing its capacity to identify more violations and obtain prompt remedies through a better-informed scheduling process for the estimated 4,000 compliance evaluations it conducts annually.

Social science research also suggests that anti-discrimination law has broad social benefits. Workers who are capable of successfully enforcing their rights and obtaining redress experience these benefits, as do the workforce and the country's economy as a whole. In general, discrimination is incompatible with an efficient labor market. Discrimination interferes with the ability of workers to find jobs that match their skills and abilities and to secure wages that are consistent with a well-functioning marketplace.16 Discrimination also harms employers, by artificially restricting the pool of available talent, by diluting the critical reward structure that relates compensation to actual job performance, and by adding unnecessary costs. For example, employers may prefer to select certain categories of workers based on bias and end up with less qualified or able employees.17 Discriminatory decisions are thought to be the result of functioning with limited information. This lack of information may drive employers to use group-based characteristics as shortcuts in making decisions, or as statistical proxies for other qualifications. Both can lead to inefficient outcomes.18 Favoritism or limited information can result in pay disparities when it causes employers to reward certain categories of employees based on bias rather than merit. Discrimination may reflect market failure, where collusion or other anti-discriminatory practices allow majority group members to shift the costs of discrimination to minority group members.19

16Shelley J. Lundberg & Richard Starz, Private Discrimination and Social Intervention in Competitive Labor Markets, 73 Am. Econ. Rev. 340 (1983); Dennis J. Aigner & Glen G. Cain, Statistical Theories of Discrimination in Labor Markets, 30 Indus. and Labor Relations Rev. 175 (1977).

17Gary Becker, “The Economics of Discrimination” (1957).

18Marianne Bertrand & Sendhil Mullainathan, Are Emily and Brendan More Employable Than Lakisha and Jamal? A Field Experiment on Labor Market Discrimination, 94 Am. Econ. Rev. 991 (2004); Ian Ayres & Peter Siegelman, Race and Gender Discrimination in Bargaining for a New Car, 85(3) Am. Econ. Rev. (1995); Stewart Schwab, Statistical Discrimination, 76 Am. Econ. Rev. 228 (1986).

19Kenneth J. Arrow, What Has Economics to Say about Racial Discrimination? 12 The Journal of Economic J. Econ. Perspectives 91 (1998).

Consequently, effective anti-discrimination enforcement can promote economic efficiency and growth. For example, a number of scholars have documented the benefits of the civil rights movement and the adoption of Title VII of the Civil Rights Act of 1964 on the economic prospects of workers and the larger economy.20 One recent study estimated that improved workforce participation by women and minorities, including through adoption of civil rights laws and changing social norms, accounts for 15-20 percent of aggregate wage growth between 1960 and 2008.21

20J. Hoult Verkerke, “Free to Search,” 105 Harvard Law Review Harv. L. Rev. 2080 (1992); James J. Heckman & Brook S. Payner, “Determining the Impact of Federal Anti-Discrimination Policy on the Economic Status of Blacks: A Study of South Carolina,” 79 American Economic Review Am. Econ. Rev. 138 (1989).

21C. Hsieh et. al., The Allocation of Talent and U.S. Economic Growth, NBER Working Paper (2013).

Background

The OFCCP is a civil rights and worker protection agency that enforces one Executive Order and two laws that prohibit employment discrimination and require affirmative action by companies doing business with the Federal Government.22 Specifically, Federal contractors must engage in affirmative action and provide equal employment opportunity without regard to race, color, religion, sex, national origin, disability, or status as a protected veteran. The Vietnam Era Veterans' Readjustment Assistance Act of 1974 (VEVRAA), as amended, prohibits employment discrimination against certain protected veterans. Section 503 of the Rehabilitation Act of 1973 (section 503), as amended, prohibits employment discrimination against individuals with disabilities. Executive Order 11246, as amended, prohibits employment discrimination on the basis of race, religion, color, national origin, sex, sexual orientation, and gender identity.23 Compensation discrimination is one form of discrimination prohibited by the Executive Order.

22Executive Order 11246, Sept. 24, 1965, 30 FR 12319, 12935, 3 CFR, 1964-1965, as amended; Section 503 of the Rehabilitation Act of 1973, as amended, 29 U.S.C. 793, (section 503); and the Vietnam Era Veterans' Readjustment Assistance Act of 1974, as amended, 38 U.S.C. 4212 (VEVRAA).

23On July 21, 2014, the President signed Executive Order 13672 amending Executive Order 11246 to include nondiscrimination based on sexual orientation and gender identity. This Order requires that a regulation be prepared within 90 days of the date of the Order. Though the new Executive Order is effective immediately, the protections apply to contracts entered into on or after the effective date of the new DOL regulation.

Although laws protecting workers from pay discrimination have been in effect for more than 50 years, pay discrimination still exists. Pay discrimination is a real problem that continues to plague American working families. For example, looking at annual earnings reveals large gaps, where women working full-time earn approximately 77 cents on the dollar compared with men.24 According to the latest BLS data, the weekly median earnings of women are about 82 percent of that for men.25 While research has found that many factors contribute to the wage gap, such as occupational preferences, pay discrimination remains a significant problem for the working poor and the middle class.

24U.S. Bureau of the Census, Income, Poverty and Health Insurance Coverage in the United States, Current Population Reports 2012 (Sept. 2013), available at http://www.census.gov/prod/2013pubs/p60-245.pdf.

25Bureau of Labor Statistics, U.S. Department of Labor, Current Population Survey, Labor Force Statistics from Current Population Survey, available at http://www.bls.gov/cps/earnings.htm#demographics; Updated quarterly CPS earnings figures by demographics by quarter for sex through the end of 2013 available at http://www.bls.gov/news.release/wkyeng.t01.htm. Based on Current Population Survey data, in 2012, among married women who worked full-time, median weekly earnings were $751. Among married men who worked full time, median weekly earnings were $981. Among married men and women in 2012, weekly earnings for fathers and mothers with children under age 6 were $935 and $765, respectively. Weekly earnings for married men with no children under age 18 were $973, compared with $748 for married women with no children under age 18. Bureau of Labor Statistics, U.S. Department of Labor, The Editor's Desk, Median weekly earnings by sex, marital status, and presence and age of own children under 18 in 2012, available at http://www.bls.gov/opub/ted/2013/ted_20131203.htm (last accessed March 28, 2014).

Research also reveals a wage gap amongst various racial groups. At the end of 2013, median weekly earnings for African-American men working at full-time jobs were $646 per week, only 72.1 percent of the median for white men ($896).26 Further, a study based on the hiring pattern of workers in the state of New Jersey found that African Americans, when re-entering the job market after periods of unemployment, are offered lower wages when compared to their white counterparts.27 The study showed that the pay gap between these groups is typically 30 percent.28 Controlling for various factors such as skills and previous earnings, the study found that up to a third of this pay gap could be attributed to racial discrimination in the labor market.29 Similarly, a study based on National Longitudinal Survey data, found that the pay gap between African Americans and whites continues to exist, even after controlling for abilities and schooling choices.30

26Bureau of Labor Statistics, Usual Weekly Earnings of Wage and Salary Workers, Fourth Quarter 2013, available at http://www.bls.gov/news.release/pdf/wkyeng.pdf, January 22, 2014 (last accessed March 28, 2014).

27Roland G. Fryer Jr. et al., Racial Disparities in Job Finding and Offered Wages (2013), at 27, available at, http://scholar.harvard.edu/files/fryer/files/racial_disparities_in_job_finding_and_offered_wages.pdf (last accessed April 29, 2014).

28 Id.at 29.

29 Id.

30Sergio Urzua, Racial Labor Market Gaps: The Role of Abilities and Schooling Choices, 43.4 J. Hum. Resources, 919, 919-971.

For Hispanic men, the wage gap is approximately 67 cents when compared to non-Hispanic white men.31 Many of the studies analyzing pay disparities for the Hispanic populations focus on differences in education and age as compared to white workers.32 However, even after analyzing the effect of these factors, these studies showed that these factors do not entirely account for the pay gap for Hispanics.33

31Additional calculations by race and sex based on 2012 Person Income Table PINC-10. Wage and Salary Workers—People 15 Years Old and Over, by Total Wage and Salary Income in 2012, Work Experience in 2012, Race, Hispanic Origin, and Sex, available at https://www.census.gov/hhes/www/cpstables/032013/perinc/pinc10_000.htm (comparison of median wage for workers working 50 or more weeks); Bureau of Labor Statistics 2012 CPS data, available at http://www.bls.gov/cps/earnings.htm#demographics (last accessed on March 28, 2014).

32Richard Fry & B. Lindsay Lowell, The Wage Structure of Latino-Origin Groups across Generations, 45 Indus. Relations 2 (2006); Abelardo Rodriguez & Stephen Devadoss, Wage Gap between White Non-Latinos and Latinos by Nativity and Gender in the Pacific Northwest, U.S.A., 4 Journal of Management and Sustainability 1 (2014).

33 Id.

The wage gap is significantly greater for many women of color. BLS data reveals that African-American women make approximately 68 cents, Latinas make approximately 59 cents, and Asian-American women make approximately 87 cents for every dollar earned by a non-Hispanic white man.34 Comparable figures, based on Census data, are 64 cents for African-American women, 56 cents for Latinas, and 86 cents for Asian-American women.35 Women of color also earn less than men within their racial and ethnic groups.36

34Current Population Survey, Earnings by Demographics 2012, available at http://www.bls.gov/cps/earnings.htm#demographics (last accessed March 28, 2014

35Additional calculations by race and sex based on 2012 Person Income Table PINC-10. Wage and Salary Workers—People 15 Years Old and Over, by Total Wage and Salary Income in 2012, Work Experience in 2012, Race, Hispanic Origin, and Sex, available at https://www.census.gov/hhes/www/cpstables/032013/perinc/pinc10_000.htm (comparison of median wage for workers working 50 or more weeks); Bureau of Labor Statistics 2012 CPS data, available at http://www.bls.gov/cps/earnings.htm#demographics (last accessed on March 28, 2014).

36According to 2013 CPS usual weekly earnings data, African-American women earn 88 cents on the dollar compared with African-American men, Hispanic women earn 80 cents on the dollar compared with Hispanic men, AAPI women earn 75 cents on the dollar compared with AAPI men, and white women earn 74 cents on the dollar compared with white men. Calculated by the DOL Chief Economist Office from CPS ORG Annual Averages.

Regardless of how it is measured, over time, the significance of the differences in compensation for women and men becomes increasingly evident. According to one analysis by the Department of Labor, a typical 25-year-old woman working full-time would have already earned $5,000 less over the course of her working career than a typical 25-year old man.37 If that earnings gap is not corrected, by age 65, she will have lost hundreds of thousands of dollars over her working years.38 Decades of research shows this wage gap remains even after accounting for factors like the type of work people do, and qualifications such as education and experience.39 Moreover, while some women may work fewer hours or take time out of the workforce because of family responsibilities, there is research suggesting that discrimination and not just choices can lead to women with children earning less.40 At the current rate of progress, researchers estimate it will take until 2057 to close the gender pay gap.41

37Calculated by the Department of Labor based on CPS usual weekly earnings of wage and salary workers by sex. The cumulative lost earnings compare the difference in median earnings for full time workers who worked 52 weeks out of the year.

38White House Council on Women and Girls, The Key to an Economy Built to Last (April 2012), available at http://www.whitehouse.gov/sites/default/files/email-files/womens_report_final_for_print.pdf.

39A March 2011 White House report entitled Women in America: Indicators of Social and Economic Well-Being, found that while earnings for women and men typically increase with higher levels of education, male-female pay gap persists at all levels of education for full-time workers (35 or more hours per week), according to 2009 BLS wage data. Potentially nondiscriminatory factors can explain some of the gender wage differences. See, e.g., June Elliot O'Neill, The Gender Gap in Wages, Circa 2000, Am. Econ. Rev. (May 2003). Even so, after controlling for differences in skills and job characteristics, women still earn less than men. Explaining Trends in the Gender Wage Gap, A Report by the Council of Economic Advisers (June 1998). Ultimately, the research literature still finds an unexplained gap exists even after accounting for potential explanations, and finds that the narrowing of the pay gap for women has slowed since the 1980s. Joyce P. Jacobsen, The Economics of Gender 44 (2007); Francine D. Blau & Lawrence M. Kahn, The U.S. gender pay gap in the 1990s: Slowing convergence, 60 Industrial and Labor Relations Review 45 (2006).

40Shelley J. Correll, Stephen Benard, & In Paik, “Getting a Job: Is There a Motherhood Penalty?,” 112 American Journal of Sociology 1297 (2007).

41Institute for Women's Policy Research, At Current Pace of Progress, Wage Gap for Women Expected to Close in 2057 (April 2013), available at http://www.iwpr.org/publications/pubs/at-current-pace-of-progress-wage-gap-for-women-expected-to-close-in-2057.

Although occupational segregation is an important contributing factor to the gender pay gap,42 women earn less than men even within occupations. In a recent study of newly trained doctors, after considering the effects of specialty, practice setting, work hours and other factors, the gender pay gap was nearly $17,000 in 2008.43 Catalyst, a nonprofit organization working for more gender-inclusive workplaces, reviewed 2011 government data showing a gender pay gap for women lawyers,44 and that data confirms that the gap exists for a range of professional and technical occupations.45 A study by the Institute for Women's Policy Research, based on information from BLS, found that women frequently earn less than men within the same occupation.46 Despite differences in the types of jobs women and men typically perform, women earn less than men in occupations commonly filled by men such as managers, software developers, and CEOs. Women even earn less than men in those occupations commonly filled by women such as teachers, nurses, and receptionists. In a recent review of 2010 Census data, Bloomberg identified a particularly large pay gap in the financial sector.47

42White House Equal Pay Task Force, Fifty Years After the Equal Pay Act (June 2013), available at http://www.whitehouse.gov/sites/default/files/equalpay/equal_pay_task_force_progress_report_june_2013_new.pdf.

43Anthony T. LoSasso, et al, The $16,819 Pay Gap For Newly Trained Physicians: The Unexplained Trend of Men Earning More Than Women,30 Health Affairs 193 (2011), available at http://content.healthaffairs.org/content/30/2/193.abstract.

44Catalyst Inc., Women in Law in the U.S. (March 2013), available at http://www.catalyst.org/knowledge/women-law-us (last accessed on April 24, 2014).

45Bureau of Labor Statistics, Median weekly earnings of full-time wage and salary workers by detailed occupation and sex (2013), available at http://www.bls.gov/cps/cpsaat39.pdf.

46Ariane Hegewisch, Claudia Williams, & Vanessa Harbin, The Gender Wage Gap by Occupation (2012), available at http://www.iwpr.org/publications/pubs/the-gender-wage-gap-by-occupation-1/.

47Bloomberg L.P., Wall Street Jobs Show Largest Gender Gap in Pay (2014), available at http://www.bloomberg.com/video/88496286-wall-street-jobs-show-largest-gender-gap-in-pay.html (last accessed on April 24, 2014).

While occupational differences explain some of the gender wage gap, discrimination and other barriers play a role.48 The significant underrepresentation of women in the highly compensated science, technology, engineering, and mathematics fields is one of many factors that can explain the overall average gender pay gap. However, a Department of Commerce study found that, after using statistical methods to account for workers' age, educational attainment, and region of residence, women who successfully enter these fields still earn less than their male counterparts.49 Further, research has identified perceived hostility and fewer promotional opportunities for women as important reasons for female underrepresentation.50 As the Council of Economic Advisors explained in a 2013 report issued by the White House Equal Pay Task Force: “While occupational segregation is sometimes described as a simple matter of women's choices, historical patterns of exclusion and discrimination paint a more complex picture . . . occupational segregation may be due [in part] to discrimination that can take several forms, including outright refusal to hire, severe harassment of women in non-traditional jobs, or policies and practices that screen qualified women out of positions but are not job-related.”51

48Francine D. Blau & Lawrence M. Kahn, The U.S. gender pay gap in the 1990s: Slowing convergence, 60 Industrial and Labor Relations Review 45 (2006) (estimate occupational differences may account for about half of the gender wage gap; the extent to which occupational differences reflect choice or potential discrimination is not addressed by this analysis).

49U.S. Department of Commerce, Economics and Statistics Administration. Women in STEM: A Gender Gap to Innovation (August 2011).

50Weinberger, Catherine J. An Economist's Perspective on Women in the IT Workforce. Encyclopedia of Gender and Information Technology (2006); Hunt, J., Why do Women Leave Science and Engineering? NBER Working Paper (2010).

51White House Equal Pay Task Force, Fifty Years After the Equal Pay Act (June 2013), available at http://www.whitehouse.gov/sites/default/files/equalpay/equal_pay_task_force_progress_report_june_2013_new.pdf.

Fewer dollars for workers and their families means a real loss of economic security, at a time when no family can afford to be earning less. Historically, data show that women are generally poorer than men. The poverty rates for unmarried female head of households with children are significantly higher than most poverty rates. Looking as far back as 1966, poverty rates for unmarried female head of households with children have been consistently two to three times higher than the overall male and female poverty rates.52 In 2009, 28 percent of unmarried working women with children had incomes below the poverty threshold compared to 6 percent for male workers.53 According to one report, average annual earnings for women between 2009 and 2011 could have increased from $36,129 to $42,380 (or by 17 percent) annually if the wage gap had been closed.54 This increase, in turn, could have reduced the poverty rate for working women by almost 50 percent.55 Examining mean annual earnings, mean family income, and poverty rates from 2009 through 2011, the data on poverty rates for working single mothers, working single women living alone, and working married women demonstrate that closing the pay gap for these groups could also reduce their poverty rates. After pay adjustments, working single mother poverty rates would have decreased by 13.7 percent, the rate for the working single women living alone group would have dropped by 6.4 percent, and working married women poverty rates would have decreased by 1.3 percent.56 It is, therefore, very likely that eliminating or significantly reducing the wage gap will have an overall positive impact on the poverty rates and financial stability of these groups of women and their families.

52U.S. Department of Commerce, Economic and Statistics Administration, and the Executive Office of the President, Office of Management and Budget, for the White House Council on Women and Girls, Women in American: Indicators of Social and Economic Well-Being, March 2011 available at http://www.whitehouse.gov/administration/eop/cwg/data-on-women (last accessed on March 28, 2014).

53 Id. at 14.

54Heidi Hartman, Ph.D., Jeffrey Hayes, Ph.D., & Jennifer Clark, How Equal Pay for Working Women Would Reduce Poverty and Grow the American Economy, Briefing Paper IWPR #C411, Institute for Women's Policy Research, January 2014. The calculations are based on Current Population Survey Annual Social and Economic supplements, 2010-2012, for calendar years 2009-2011. The dollar valuations are in 2012 dollars.

55 Id.

56 Id.

As research suggests, because discrimination is one of the factors contributing to the pay gap, improving the ability of Federal civil rights enforcement agencies such as OFCCP to identify and remedy pay discrimination is a critical element of a broader strategy for closing that gap—particularly in light of its substantial social cost. To advance that goal, in 2010, President Obama convened the National Equal Pay Task Force (the Task Force), which includes the Department of Labor, Department of Justice, the EEOC and the Office of Personnel Management, to provide a coordinated Federal response to pay discrimination. In its “Recommendations and Action Plan,” the Task Force developed a number of recommendations to address the persistent challenges to enforcement of Federal laws prohibiting compensation discrimination.57

57 See National Equal Pay Enforcement Task Force Report, available at http://www.whitehouse.gov/sites/default/files/rss_viewer/equal_pay_task_force.pdf (last visited March 25, 2014).

In addition to deterring unlawful behavior and incentivizing the adoption of compensation policies and procedures, better and more comprehensive compensation data can substantially improve enforcement of anti-pay discrimination laws. Indeed, a key Task Force recommendation is that the Federal Government collect data on the private workforce to better understand the scope of the pay gap, and focus enforcement resources on employers that are more likely to be out of compliance with Federal laws prohibiting wage discrimination. The Task Force noted that the “lack of data makes identifying wage discrimination difficult and undercuts enforcement efforts.”58 The Task Force recommendations urge OFCCP to devise a strategy to collect compensation data from Federal contractors and subcontractors, where feasible, in a manner that minimizes the burden on employers.59

58 Id.

59 Id.

Identifying and remedying compensation discrimination has been integral to OFCCP's mission for many years. OFCCP primarily enforces contractors' compliance with Executive Order 11246, including its prohibition on compensation discrimination, by conducting compliance evaluations of Federal contractors and subcontractors each year. These compliance evaluations analyze workforce data, employment practices, and records that OFCCP requires contractors and subcontractors to keep and produce upon request. These recordkeeping requirements specifically include information on compensation such as wages, salaries, commissions, and bonuses.60 As part of a compliance evaluation, OFCCP may request and review compensation data from specific contractor establishments, including, as appropriate, detailed compensation data on individual employees, and investigate contractor pay practices, even without a specific discrimination complaint.

6041 CFR 60-1.12. In addition, OFCCP uses a Scheduling Letter and Itemized Listing to request records and information for the desk audit portion of its compliance evaluations. Authorization of a revised Scheduling Letter and Itemized Listing is pending with the Office of Budget and Management (OMB) as an information collection request under OMB Control Number 1250-0003.

In searching for pay discrimination violations, OFCCP is limited to the data provided by the nearly 4,000 contractors and subcontractors it evaluates annually. This cohort is a small fraction of the more than 116,000 establishments that are estimated to fall under OFCCP's jurisdiction.61 In the absence of a comprehensive, accurate database that captures all Federal contractors and subcontractors, the agency must develop its own list of contractors and subcontractors for compliance evaluations, using a neutral selection process. OFCCP develops this list by using multiple sources of information such as Federal acquisition and procurement databases, EEO-1 reports, Dun & Bradstreet (D&B) data, and the U.S. Census Bureau tabulations. Statistical thresholds such as industry type and employee counts of Federal contractor establishments are also used. The list may be further refined by applying a number of neutral factors such as contract expiration date and contract value on the number of establishments per contractor that will be scheduled in any one cycle.

61The estimate of 116,000 establishments is based on the number of “Yes” answers to Question 3 on the 2012 EEO-1 Report to whether they have at least 50 employees and a contract or subcontract in the amount of $50,000 or more. OFCCP's proposed new reporting requirement will only effect a subset of this 116,000 establishment population; Specifically, those with more than 100 employees and contractor or subcontracts in the amount of $50,000 or more. In other rulemakings, OFCCP is using an estimate of 500,000 establishments because those proposed rules apply to all covered establishments and not just those filing EEO-1 reports with more than 100 employees as proposed in this NPRM. This 500,000 estimate is used elsewhere is based on the General Services Administration's (GSA) System for Acquisition Management (SAM) database that includes grants as well as contracts that would not be covered by OFCCP because they do not meet the minimum contract value of $10,000 for OFCCP jurisdiction.

Despite the labor-intensive development of the scheduling list, OFCCP is currently unable to determine the true likelihood of compliance with OFCCP's regulations, including the prohibition against compensation discrimination found in Executive Order 11246. The Equal Pay Report data will allow OFCCP to assess a broad array of compensation-related employment practices, such as differences in promotion, initial placement or job assignment, and pay. The pay practices would not just include salary but incentives or other earnings opportunities. OFCCP can use the representation data in EEO-1 reports to identify potential hiring or affirmative action violations, but cannot provide insight into potential compensation violations.

There are voluntary compliance and enforcement benefits associated with collecting more data. For example, contractors could benefit from the potential cost savings. OFCCP currently estimates that a significant proportion of the establishments it evaluates annually are compliant with the nondiscrimination requirements of Executive Order 11246. Thus, some contractors and subcontractors may incur less burden hours and costs in preparing for and undergoing evaluations. If a contractor's compensation differences are within an acceptable range, when compared to the industry standard, OFCCP would not likely prioritize it for a compliance evaluation. Developing a data-driven scheduling process for compliance evaluations is more efficient and will likely reduce compliance costs for some contractors.

The collection of the data will allow OFCCP to conduct analysis and establish objective industry standards that it will make available to contractors and others. Contractors are encouraged to use this information to conduct self-assessments by comparing their pay to the industry standards, identifying indicators of potential issues, examining their pay practices to determine if problems or potential violations actually exists, and taking voluntarily steps to make needed corrections. Moreover, OFCCP will offer training and other assistance on the use of the standards for self-assessments.

Who Must File the Equal Pay Report

Contractors that are required to file EEO-1 reports, have more than 100 employees, have a contract, subcontract, or purchase order amounting to $50,000 or more that covers a period of at least 30 days, including modifications, would file the Equal Pay Report. This generally includes:

- Private employers that:

- Are prime contractors or first tier subcontractors, and have a contract, subcontract, or purchase order amounting to $50,000 or more;62 or

- serve as a depository of Government funds in any amount, or

- is a financial institution that is an issuing and paying agent for U.S. Savings Bonds and Notes.

- Private employers that are not covered by the exemption under 41 CFR 60-1.5.

62A construction subcontractor at any tier must file the EEO-1 Report annually if it has a contract or subcontract of $50,000 or more.

Single establishment employers file one EEO-1 Report for their single location. Multi-establishment employers with several locations file additional EEO-1 reports; one for the headquarters location, a report for each establishment with more than 50 employees, and a report for each establishment with fewer than 50 employees or an Establishment List providing the name and locations of each of these locations with fewer than 50 employees. However, EEO-1 filers with 100 or fewer employees are exempt from the OFCCP filing requirement. Multi-establishment employers must also file a Consolidated Report that consolidates all of the employment data submitted for their various establishments and their headquarters. OFCCP evaluates contractors by establishment. This NPRM would require that each establishment, including the headquarters location, file a single Equal Pay Report. Unlike in EEO-1 reporting, no headquarters Consolidated Report is required.

OFCCP is considering requiring institutions of higher education to file the Equal Pay Report if they are required to file IPEDS reports with the Department of Education, have a contract, subcontract, or purchase order amounting to $50,000 or more that covers a period of at least 30 days, including modifications, and have more than 100 employees.63 The IPEDS reports collect data on faculty and staff by race and ethnicity using eight designations and by gender.64 However, the IPEDS system collects limited data on compensation by demographics. IPEDS requires reporting of base pay for faculty positions, excluding medical school faculty, only by sex.65 Requiring institutions of higher education to file the Equal Pay Report would expand compensation data collection to staff and all faculty positions, significantly increasing the number of workers covered by the report. In addition, using the Equal Pay Report framework would allow cross tabulation by race, and would go beyond reporting base pay. Key considerations for applying the data collection requirement to institutions of higher education include whether to use the IPEDS occupational categories, which differ from the EEO-1 job categories, and how to account for work hours.66

63National Center for Education Statistics, U.S. Department of Education, Institute of Education Sciences, https://surveys.nces.ed.gov/ipeds/ (last accessed June 19, 2014).

64The designations for race and ethnicity are Hispanic/Latino, American Indian or Alaska Native, Asian, Black or African American, White, Two or More Races. Race/ethnicity and gender data are collected on students and completers of covered institutions; OFCCP is not seeking student and completers data.

65National Center for Education Statistics, U.S. Department of Education, Institute of EducationSciences, https://surveys.nces.ed.gov/IPEDS/VisInstructions.aspx?survey=1&id=30043&show=all#chunk_1612 (last accessed July 24, 2014).

66IPEDS uses categories aligned with the 2010 Standard Occupation Codes, https://surveys.nces.ed.gov/IPEDS/VisInstructions.aspx?survey=1&id=30043&show=all#chunk_1596 (last accessed July 24, 2014), and limits reporting on salary to full time workers, based on contract length (9, 10, 11 or 12 months), https://surveys.nces.ed.gov/IPEDS/VisInstructions.aspx?survey=1&id=30043&show=all#chunk_1612 (last accessed July 24, 2014).

OFCCP's proposed report harmonizes in many ways with the format of the EEO-1 Report. It also proposes to rely on existing IRS compensation reporting by using W-2 earnings as the source of compensation data. OFCCP believes that the Federal contractors and subcontractors that are required to submit the IPEDS reports are still highly likely to have the W-2 earnings information, business processes and information technology (IT) systems in place that could store and generate the specific information OFCCP is proposing to obtain through the Equal Pay Report. Accordingly, OFCCP is interested in comments on the following issues concerning a potential reporting requirement for postsecondary academic institutions:

- The proposal in the NPRM and any alternatives, including the feasibility of using a single Equal Pay Report format for all covered Federal contractors and how that could be implemented should postsecondary academic institutions (i.e., IPEDS filers meeting the proposed Equal Pay Report thresholds) be covered by the Equal Pay Report requirements,

- the cost and benefits, both qualitative and quantitative, of covering postsecondary academic institutions but deferring their reporting obligation for some period of time, and the estimated cost to these institutions for reporting their data using EEO-1 job categories, and

- the estimated number of IPEDS filers that could be covered by the proposed Equal Pay Report.67

67The OFCCP notes that it has not found a reliable source for the number of IPEDS filers that meet the more than 100 employee threshold covered by the Equal Pay Report.

What, When and How To File the Equal Pay Report

Using the Equal Pay Report, OFCCP proposes to collect three pieces of information related to calculating aggregate W-2 earnings for each group of workers within the EEO-1 job categories:

- The total number of workers within a specific EEO-1 job category by race, ethnicity and sex;

- total W-2 earnings defined as the total individual W-2 earnings for all workers in the job category by race, ethnicity, and sex; and

- total hours worked defined as the total number of hours worked for all workers in the job category by race, ethnicity and sex.

This Equal Pay Report itself would annually require the submission of summary employee compensation data, by sex, race, ethnicity, and specified job categories from Federal contractors, as well as other relevant data points that would include hours worked and number of employees. In an effort to harmonize the Equal Pay Report with the existing EEO-1 reporting requirement, the Equal Pay Report includes the same workforce demographic data (e.g., the identical seven race and ethnicity categories, sex, and company identification information),68 the same ten EEO-1 job categories,69 the same exemptions, and the same definition of “employee.”70 As with the EEO-1 Report, both full-time and part-time employees would be included in the Equal Pay Report, and Federal contractors and subcontractors would have to represent that they are in compliance with their reporting obligation.71 Electronic submission of the report is being required, and OFCCP is proposing to create a hardship exemption for contractors unable to perform electronic submission. Similar provisions exist for EEO-1 reporting.

68The seven race and ethnicity designations in the EEO-1 Report are Hispanic/Latino, White (non-Hispanic), Black or African American, Native Hawaiian or Other Pacific Islander, Asian, American Indian or Alaska Native, and Two or More Races. See Equal Employment Opportunity, Employer Information Report EEO-1, Section D: Employment Data.

69 Id. The ten job categories are: Executive/Senior Level Officials and Managers, First/Mid-Level Officials and Managers, Professionals, Technicians, Sales Workers, Administrative Support Workers, Craft Workers, Operatives, Laborers and Helpers, and Service Workers.

70The term “employee” on the EEO-1 report is defined as “any individual on the payroll of an employer who is an employee for purposes of the employers withholding of Social Security taxes except insurance sales agents who are considered to be employees for such purposes solely because of the provisions of 26 U.S.C. 3121(d)(3)(B) (the Internal Revenue Service Code). Leased employees are included in this definition. Leased Employee means a permanent employee provided by an employment agency for a fee to an outside company for which the employment agency handles all personnel tasks including payroll, staffing, benefit payments and compliance reporting. The employment agency shall, therefore, include leased employees in its EEO-1 report. The term employee SHALL NOT include persons who are hired on a casual basis for a specified time, or for the duration of a specified job (for example, persons at a construction site whose employment relationship is expected to terminate with the end of the employees work at the site); persons temporarily employed in any industry other than construction, such as temporary office workers, mariners, stevedores, lumber yard workers, etc., who are hired through a hiring hall or other referral arrangement, through an employee contractor or agent, or by some individual hiring arrangement, or persons (EXCEPT leased employees) on the payroll of an employment agency who are referred by such agency for work to be performed on the premises of another employer under that employers direction and control. Equal Employment Opportunity Commission, Equal Employment Opportunity, Standard Form 100, Employer Information Report EEO-1, Instruction Booklet.

71 Id.

There are, however, some differences between the EEO-1 and the proposed Equal Pay Report. The EEO-1 uses a “snapshot” approach that requires employers to include in their report only those employees from one pay period between the months of July and September of the current survey year. The proposed Equal Pay Report, however, covers a full calendar year from January 1 through December 31. The Equal Pay Report includes summary compensation data using total W-2 earnings paid as of the end of each calendar year for each worker who was included in the contractor's EEO-1 report for that year. The use of summary W-2 earnings data for the calendar year aligns with the period covered under a contractor's W-2 filings. Workers no longer employed as of December 31 would still be included in the report. The EEO-1 Report does not collect summary or individual employee compensation data. While OFCCP proposes a report filing window of January 1 to March 31 of the following year in order to obtain W-2 compensation data for the full year, the EEO-1 Report requires filing and certification by September 30.72 OFCCP seeks public comment on this proposal, including:

72The proposed reporting period and report filing window discussed here for the Equal Pay Report are not specified in the text of the proposed regulation. Instead, these details will be in the ICR authorizing the collection and reporting of data using the report.

- The January 1 through December 31 reporting period, the March 31 filing deadline, and any additional cost resulting from these dates not aligning with the EEO-1 reporting dates, and

- the amount of additional cost contractors could incur from the proposed requirement for contractors to include on their Equal Pay Report the employees reported on their EEO-1 Report.

Collecting summary data from contractors as described here should contribute to minimizing the burden and cost of reporting incurred by Federal contractors and subcontractors. OFCCP is also seeking to reduce the burden associated with retrieving that data by using the same definition of compensation that is used to reportW-2 earnings to the Internal Revenue Service (IRS). Thus, the expectation is that Federal contractors will not incur burden and cost related to collecting and producing new or different compensation data.

Contractors would be required to keep their Equal Pay Reports for a period of not less than two years from the date of the making of the report. However, if the contractor has fewer than 150 employees or does not have a contract of at least $150,000, this retention period is one year.

They would also have to make a representation related to whether they are currently a Federal contractor or subcontractor, and whether that they filed the report with OFCCP from the most recent reporting period when bidding on a Federal contract or subcontract. OFCCP proposes to apply sanctions in 60-1.4(a) and (b) and 60-1.27 to a failure to file a timely, complete and accurate Equal Pay Report and make the appropriate representations.

Confidentiality of the Equal Pay Report Data

The Freedom of Information Act, to the maximum extent that the information is exempt, would protect the information reported by contractors, including the summary compensation data. It is the practice of OFCCP not to release contractor data where (1) The contractor is still in business, and (2) the contractor indicates, and through the Department of Labor's review process it is determined, that the data are confidential and sensitive and that the release of data would subject the contractor to commercial harm. In the NPRM, OFCCP proposes creating the authority to publish aggregate information based on compensation data collected from the Equal Pay Report, such as ranges or averages by industry, labor market, or other groupings, but only in such a way as not to reveal any particular establishment's or individual employee's data. OFCCP proposes that it would analyze the information collected on the Equal Pay Reports and, along with other available data, develop objective industry-based standards for compensation differences, and prioritize contractors and subcontractors for evaluation whose summary data show discrepancies that indicate possible compensation violations.

Additional Information

Bidders on Federal contracts and subcontracts will be required to state whether they currently have a Federal contract or subcontract that requires them to create affirmative action programs, and file EEO-1 and Equal Pay Reports. If so, the contractor or subcontractor must state whether it has prepared the affirmative action programs; filed the EEO-1 Report(s) for the most recent reporting period with the Joint Reporting Committee; and whether it filed an Equal Pay Report for the most recent reporting period with OFCCP.

The NPRM also proposes making technical amendments to §60-1.7, as explained in the Section-by-Section Analysis. Those amendments would conform other related recordkeeping provisions in §60-1.7 to the proposed new reporting requirement, as well as update them to reflect current agency practice.

In addition, to ensure that the costs and burdens of this rule are minimized to the extent feasible, OFCCP requests public comment on an alternative reporting framework. This alternative would utilize a single report that would fulfill contractors' reporting obligations under this rule and the EEO-1. This single report would collect all the information currently included on the EEO-1, as well as summary compensation information and other appropriate data elements for the purposes of meeting the objectives of this rule. OFCCP would coordinate with EEOC on how the single report could be collected, which agency would collect the single report, and the timing of the collection. OFCCP invites public comment on:

- The feasibility of this alternative framework,

- the possible content and design of the single report, and how the report could meet the needs of both OFCCP and EEOC,

- the degree to which using a single report could both minimize burden and effectively meet the objectives of this rule, and

- the possible administrative, procurement and other modifications needed to implement a single report alternative.

Calculation of Objective and Reliable Standards for Assessing Contractor Pay Gaps

OFCCP proposes using the data it collects in the Equal Pay Report, in conjunction with other information available through existing resources such as labor market survey data, to generate reliable and objective industry standards for assessing individual contractor compensation data and conducting contractor self-assessments. After receiving the Equal Pay Reports from covered contractors, OFCCP proposes to aggregate each contractor's summary data with those of peer employers by industry to construct the objective industry standards. Labor market data would also be used to create the objective industry standard. As proposed, these standards would include the total number of employees in each EEO-1 occupational category from all the Equal Pay Reports submitted by contractors in a particular industry group, as well as the industry group's total W-2 pay and total hours worked, and the mean hourly wage calculated as total W-2 pay divided by total hours worked. This information would be determined separately by race and gender. OFCCP proposes to compare each contractor's summary statistics to the relevant objective industry standard. OFCCP is more likely to prioritize contractors for compliance evaluations with pay gaps that are greater than the standard.

Because OFCCP anticipates that Equal Pay Report data may have fewer observations in certain industries or job categories, and because it is self-reported data on contractors only, considering information available in these other data sources may inform and improve the analysis of reported contractor compensation data by providing a larger economic context. OFCCP is interested in related comments such as:

- The use objective industry standards and using contractor pay gaps that are greater than the standards to focus or prioritize contractors for compliance evaluations,

- the feasibility of using external data along with the Equal Pay Report data to develop the objective industry standards,73

73The actual Equal Pay Report and instructions will be published in an Information Collection Request (ICR). OFCCP encourages comments on the proposed report. - the potential benefits and limitations of using supplementary external data sets for this purpose, and

- the existence of other potentially useful supplemental data sources, in addition to ACS and BLS data.

Using just Equal Pay Report data alone has the benefit of focusing specifically on the pay gap among Federal contractors, which may or may not be different from employers generally. It is simpler to use Equal Pay Report data alone and the calculations would be easier to understand. However, contractors operate in a larger labor market and industry environment, and using supplemental data sources allows consideration of these broader trends. The potential benefits of using supplemental general labor market data is that they are typically based on well-understood samples from large populations of firms and are developed in a general survey context. This makes the data less prone to non-response bias that may occur when collecting pay data to enforce an anti-discrimination legal mandate. In addition, by using this data, OFCCP can likely determine the extent to which the pay practices of Federal contractors demonstrate important differences when compared to the pay practices of all employers generally. OFCCP cannot glean this information when only looking at Equal Pay Report data.

Incorporating supplemental data sources supports OFCCP's ability to refine its contractor pay gap standards to use for comparison purposes.74 For example, the agency could develop better standards for specific industries using North American Industry Classification System (NAICS) codes and the Equal Pay Report's job, sex, race and ethnicity categories.75 Where feasible and appropriate, OFCCP could also refine the standards by geographic locations such as state, Metropolitan Statistical Area (MSA),76 and by contractor size.77 OFCCP would use these standards to prioritize contractors for scheduling compliance evaluations; these standards would also be made publicly available to support contractor voluntary compliance.

74The regulations enforcing VEVRAA also use a related but distinct concept of developing a benchmark linked to external labor market data, a different approach to measurement and calculation than the one discussed here.

75In some cases, sample size considerations and data limitations may require aggregating race categories for calculating metrics or for making selections. Where possible, the agency proposes to maintain separate measures for each race/ethnicity grouping in the Equal Pay Report.

76Because the pay gap is a ratio, and because some industries are also correlated to specific geographic areas, it may be less necessary to have location-specific metrics. Sample size considerations, as explained below, may also affect the ability to calculate metrics at all possible levels of analysis. However, to the extent local labor market characteristics, such as the race/ethnicity distributions in different parts of the country, may affect the pay gap, it may be important to assess the role of geographic location when constructing measures and/or making selections or conducting voluntary compliance.

77OFCCP would review the data submitted by contractors to determine whether there are enough actual differences in the reported pay gap by contactor size, after accounting for industry and job category, to justify separate measures.

OFCCP anticipates that the Equal Pay Reports for some contractors will contain sparse cells because certain combinations of job category and demographics will have only a few workers. Certain EEO-1 job category groupings summarized by race or ethnicity and gender may be much smaller than others, especially when further subdivided by industry or other variables. Small cell sizes may arise on the current EEO-1 Report, or the proposed Equal Pay Report for a variety of reasons: Sales workers or craft workers may be less prevalent in certain industries, some geographic regions may have fewer members of specific racial or ethnic groups than others, and smaller contractors will generally report summary data on behalf of fewer workers in each group. This is an unavoidable reality when studying aggregate wage data of the kind OFCCP intends to collect.