['Wage and Hour', 'Compensation']

['Exemptions from Overtime/Minimum Wage', 'Overtime', 'Minimum Wage', 'Fair Labor Standards Act (FLSA)']

05/17/2022

...

DEPARTMENT OF LABOR

Wage and Hour Division

29 CFR Part 541

RIN 1235-AA11

Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales and Computer Employees

AGENCY: Wage and Hour Division, Department of Labor.

ACTION: Proposed rule and request for comments.

SUMMARY: The Fair Labor Standards Act (FLSA or Act) guarantees a minimum wage and overtime pay at a rate of not less than one and one-half times the employee's regular rate for hours worked over 40 in a workweek. While these protections extend to most workers, the FLSA does provide a number of exemptions. The Department of Labor (Department) proposes to update and revise the regulations issued under the FLSA implementing the exemption from minimum wage and overtime pay for executive, administrative, professional, outside sales, and computer employees. This exemption is referred to as the FLSA's “EAP” or “white collar” exemption. To be considered exempt, employees must meet certain minimum tests related to their primary job duties and be paid on a salary basis at not less than a specified minimum amount. The standard salary level required for exemption is currently $455 a week ($23,660 for a full-year worker) and was last updated in 2004.

By way of this rulemaking, the Department seeks to update the salary level to ensure that the FLSA's intended overtime protections are fully implemented, and to simplify the identification of nonexempt employees, thus making the EAP exemption easier for employers and workers to understand. The Department also proposes automatically updating the salary level to prevent the level from becoming outdated with the often lengthy passage of time between rulemakings. Lastly, the Department is considering whether revisions to the duties tests are necessary in order to ensure that these tests fully reflect the purpose of the exemption.

DATES: Submit written comments on or before September 4, 2015.

ADDRESSES: You may submit comments, identified by Regulatory Information Number (RIN) 1235-AA11, by either of the following methods: Electronic Comments: Submit comments through the Federal eRulemaking Portal http://www.regulations.gov. Follow the instructions for submitting comments. Mail: Address written submissions to Mary Ziegler, Director of the Division of Regulations, Legislation, and Interpretation, Wage and Hour Division, U.S. Department of Labor, Room S-3502, 200 Constitution Avenue NW., Washington, DC 20210. Instructions: Please submit only one copy of your comments by only one method. All submissions must include the agency name and RIN, identified above, for this rulemaking. Please be advised that comments received will become a matter of public record and will be posted without change to http://www.regulations.gov, including any personal information provided. All comments must be received by 11:59 p.m. on the date indicated for consideration in this rulemaking. Commenters should transmit comments early to ensure timely receipt prior to the close of the comment period as the Department continues to experience delays in the receipt of mail in our area. For additional information on submitting comments and the rulemaking process, see the “Public Participation” section of this document. For questions concerning the interpretation and enforcement of labor standards related to the FLSA, individuals may contact the Wage and Hour Division (WHD) local district offices (see contact information below). Docket: For access to the docket to read background documents or comments, go to the Federal eRulemaking Portal at http://www.regulations.gov.

FOR FURTHER INFORMATION CONTACT: Mary Ziegler, Director of the Division of Regulations, Legislation, and Interpretation, Wage and Hour Division, U.S. Department of Labor, Room S-3502, 200 Constitution Avenue NW., Washington, DC 20210; telephone: (202) 693-0406 (this is not a toll-free number). Copies of this proposed rule may be obtained in alternative formats (Large Print, Braille, Audio Tape or Disc), upon request, by calling (202) 693-0675 (this is not a toll-free number). TTY/TDD callers may dial toll-free 1-877-889-5627 to obtain information or request materials in alternative formats.

Questions of interpretation and/or enforcement of the agency's regulations may be directed to the nearest WHD district office. Locate the nearest office by calling WHD's toll-free help line at (866) 4US-WAGE ((866) 487-9243) between 8 a.m. and 5 p.m. in your local time zone, or log onto WHD's Web site at http://www.dol.gov/whd/america2.htm for a nationwide listing of WHD district and area offices.

Electronic Access and Filing Comments

Public Participation:This proposed rule is available through the Federal Register and the http://www.regulations.gov Web site. You may also access this document via WHD's Web site at http://www.dol.gov/whd/. To comment electronically on Federal rulemakings, go to the Federal eRulemaking Portal at http://www.regulations.gov, which will allow you to find, review, and submit comments on Federal documents that are open for comment and published in the Federal Register. You must identify all comments submitted by including “RIN 1235-AA11” in your submission. Commenters should transmit comments early to ensure timely receipt prior to the close of the comment period (11:59 p.m. on the date identified above in the DATES section); comments received after the comment period closes will not be considered. Submit only one copy of your comments by only one method. Please be advised that all comments received will be posted without change to http://www.regulations.gov, including any personal information provided.

SUPPLEMENTARY INFORMATION:

Table of Contents

I. Executive Summary

II. Background

A. What the FLSA Provides

B. Legislative History

C. Regulatory History

D. Overview of Existing Regulatory Requirements

III. Presidential Memorandum

IV. Need for Rulemaking

V. Proposed Regulatory Revisions

A. Setting the Standard Salary Level

B. Special Salary Tests

C. Inclusion of Nondiscretionary Bonuses in the Salary Level Requirement

D. Highly Compensated Employees

E. Automatically Updating the Salary Levels

F. Duties Requirements for Exemption

VI. Paperwork Reduction Act

VII. Analysis Conducted In Accordance With Executive Order 12866, Regulatory Planning and Review, and Executive Order 13563, Improving Regulation and Regulatory Review

A. Introduction

B. Methodology To Determine the Number of Potentially Affected EAP Workers

C. Determining the Revised Salary Level Test Values

D. Impacts of Revised Salary and Compensation Level Test Values

E. Automatic Updates

F. Duties Test

Appendix A: Methodology for Estimating Exemption Status

Appendix B: Additional Tables

VIII. Initial Regulatory Flexibility Analysis (IRFA)

A. Reasons Why Action by the Agency Is Being Considered

B. Statement of Objectives and Legal Basis for the Proposed Rule

C. Description of the Number of Small Entities to Which the Proposed Rule Will Apply

D. Projected Reporting, Recordkeeping, and Other Compliance Requirements of the Proposed Rule

E. Identification to the Extent Practicable, of All Relevant Federal Rules That May Duplicate, Overlap, or Conflict With the Proposed Rule

IX. Unfunded Mandates Reform Act Analysis

A. Authorizing Legislation

B. Assessment of Costs and Benefits

C. Summary of State, Local, and Tribal Government Input

D. Least Burdensome Option or Explanation Required

X. Executive Order 13132, Federalism

XI. Executive Order 13175, Indian Tribal Governments

XII. Effects on Families

XIII. Executive Order 13045, Protection of Children

XIV. Environmental Impact Assessment

XV. Executive Order 13211, Energy Supply

XVI. Executive Order 12630, Constitutionally Protected Property Rights

XVII. Executive Order 12988, Civil Justice Reform Analysis

Proposed Amendments to Regulatory Text

I. Executive Summary

The FLSA was passed to both guarantee a minimum wage and to limit the number of hours an employee could work without additional compensation. Section 13(a)(1), which excludes certain white collar employees from minimum wage and overtime pay protections, was included in the original Act in 1938. The exemption was premised on the belief that the exempted workers earned salaries well above the minimum wage and enjoyed other privileges, including above-average fringe benefits, greater job security, and better opportunities for advancement, setting them apart from workers entitled to overtime pay. The statute delegates to the Secretary of Labor the authority to define and delimit the terms of the exemption.

On March 13, 2014, President Obama signed a Presidential Memorandum directing the Department to update the regulations defining which white collar workers are protected by the FLSA's minimum wage and overtime standards. 79 FR 18737 (Apr. 3, 2014). Consistent with the President's goal of ensuring workers are paid a fair day's pay for a fair day's work, the memorandum instructed the Department to look for ways to modernize and simplify the regulations while ensuring that the FLSA's intended overtime protections are fully implemented.

Since 1940, the regulations implementing the white collar exemption have generally required each of three tests to be met for the exemption to apply: (1) The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed (the “salary basis test”); (2) the amount of salary paid must meet a minimum specified amount (the “salary level test”); and (3) the employee's job duties must primarily involve executive, administrative, or professional duties as defined by the regulations (the “duties test”).

One of the Department's primary goals in this rulemaking is updating the section 13(a)(1) exemption's salary requirements. The Department has updated the salary level requirements seven times since 1938, most recently in 2004. Under the current regulations, an executive, administrative, or professional employee must be paid at least $455 per week ($23,660 per year for a full-year worker) in order to come within the standard exemption; in order to come within the exemption for highly compensated employees (HCE), such an employee must earn at least $100,000 in total annual compensation.

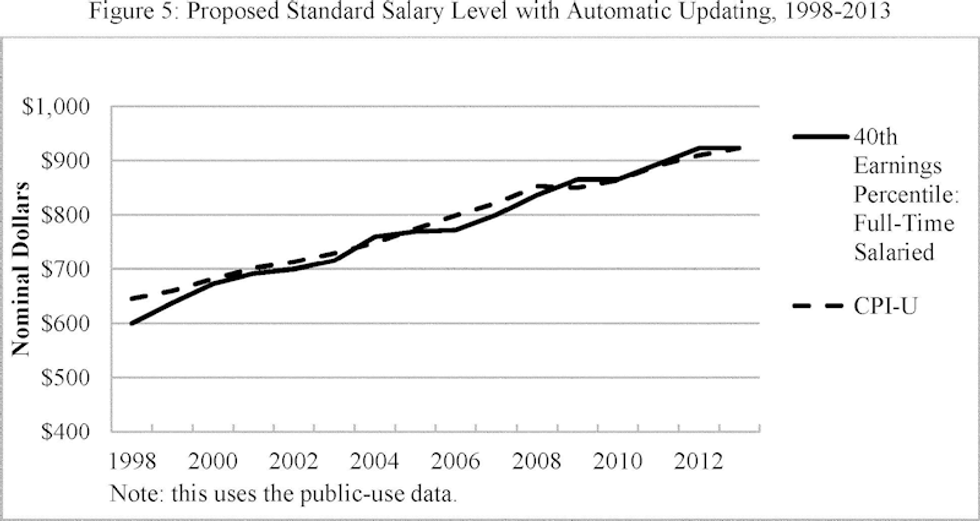

The Department has long recognized the salary level test as “the best single test” of exempt status. If left at the same amount over time, however, the effectiveness of the salary level test as a means of determining exempt status diminishes as the wages of employees entitled to overtime increase and the real value of the salary threshold falls. In order to maintain the effectiveness of the salary level test, the Department proposes to set the standard salary level equal to the 40th percentile of earnings for full-time salaried workers ($921 per week, or $47,892 annually for a full-year worker, in 2013).1 The Department is also proposing to set the highly compensated employee annual compensation level equal to the 90th percentile of earnings for full-time salaried workers ($122,148 annually). Furthermore, in order to prevent the levels from becoming outdated, the Department is proposing to include in the regulations a mechanism to automatically update the salary and compensation thresholds on an annual basis using either a fixed percentile of wages or the CPI-U.

1The BLS data set used to set the salary level for this rulemaking consists of earnings for full-time (defined as at least 35 hours per week) non-hourly paid employees. For the purpose of this rulemaking, the Department considers data representing compensation paid to non-hourly workers to be an appropriate proxy for compensation paid to salaried workers. The Department relied upon 2013 data in the development of the NPRM. The Department will update the data used in the Final Rule resulting from this proposal, which will change the dollar figures. If, after consideration of comments received, the Final Rule were to adopt the proposed salary level of the 40th percentile of weekly earnings, the Department would likely rely on data from the first quarter of 2016. The latest data currently available are for the first quarter of 2015, in which the 40th percentile of weekly earnings is $951, which translates into $49,452 for a full-year worker. Assuming two percent growth between the first quarter of 2015 and the first quarter of 2016, the Department projects that the 40th percentile weekly wage in the final rule would likely be $970, or $50,440 for a full-year worker.

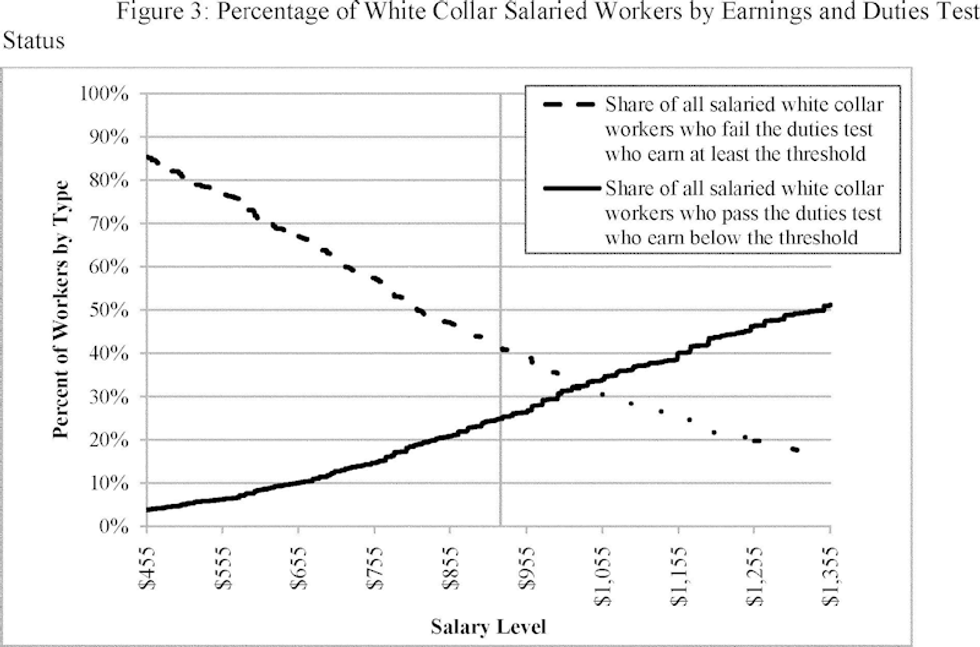

The Department is proposing to update the salary and compensation levels to ensure that the FLSA's intended overtime protections are fully implemented and to simplify the identification of overtime-protected and exempt employees, thus making the exemptions easier for employers and workers to understand. The proposed increase to the standard salary level is also intended to address the Department's conclusion that the salary level set in 2004 was too low to efficiently screen out from the exemption overtime-protected white collar employees when paired with the standard duties test. The Department believes that a standard salary level at the 40th percentile of all full-time salaried employees ($921 per week, or $47,892 for a full-year worker, in 2013) will accomplish the goal of setting a salary threshold that adequately distinguishes between employees who may meet the duties requirements of the EAP exemption and those who likely do not, without necessitating a return to the more detailed long duties test.2 The Department believes that the proposed salary compensates for the absence of a long test, which would have allowed employers to claim the exemption at a lower salary level, but only if they could satisfy a more restrictive duties test; moreover, it does so without setting the salary at a level that excludes from exemption an unacceptably high number of employees who meet the duties test. The Department also believes that, by reducing the number of workers for whom employers must apply the duties test to determine exempt status, this proposal is responsive to the President's directive to simplify the exemption. Similarly, the Department believes that the proposal to set the HCE total annual compensation level at the annualized value of the 90th percentile of weekly wages of all full-time salaried employees ($122,148 per year) will ensure that the HCE exemption continues to cover only employees who almost invariably meet all the other requirements for exemption. Finally, the Department proposes to automatically update the standard salary and compensation levels annually to ensure that they maintain their effectiveness going forward, either by maintaining the levels at a fixed percentile of earnings or by updating the amounts based on changes in the CPI-U. The Department believes that regularly updating the salary and compensation levels is the best method to ensure that these tests continue to provide an effective means of distinguishing between overtime-eligible white collar employees and those who may be bona fide EAP employees. The Department is not making specific proposals to modify the standard duties tests but is seeking comments on whether the tests are working as intended to screen out employees who are not bona fide EAP employees; in particular, the Department is concerned that in some instances the current tests may allow exemption of employees who are performing such a disproportionate amount of nonexempt work that they are not EAP employees in any meaningful sense.

2From 1949 until 2004 the regulations contained two different tests for exemption—a long duties test for employees paid a lower salary, and a short duties test for employees paid at a higher salary level.

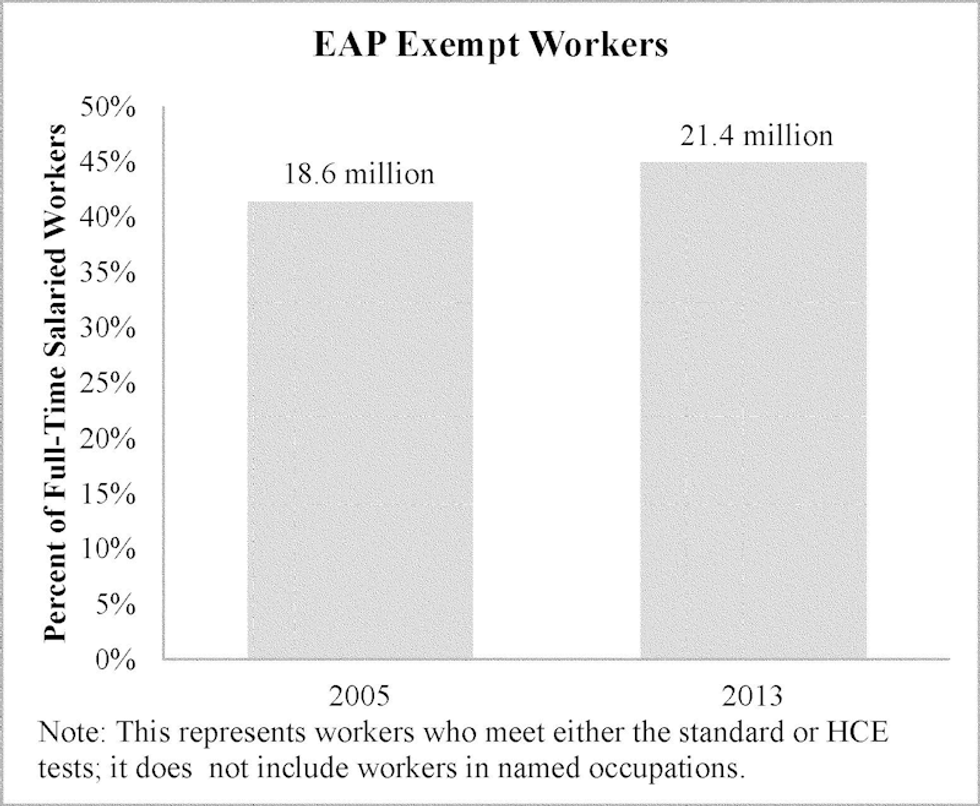

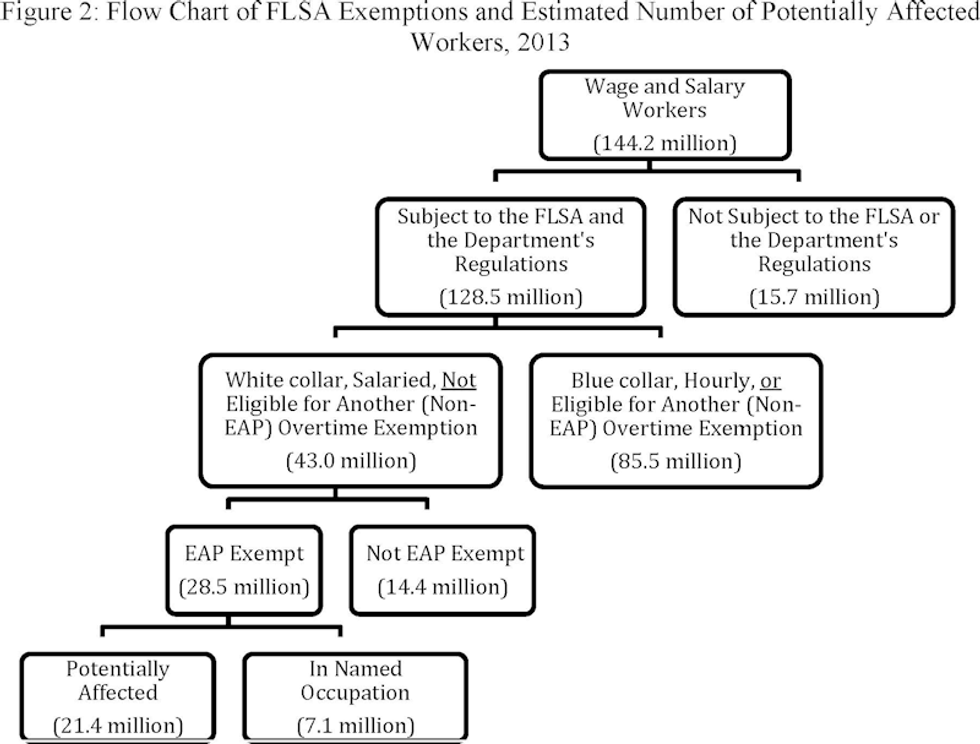

In 2013, there were an estimated 144.2 million wage and salary workers in the United States, of whom the Department estimates that 43.0 million are white collar salaried employees who may be impacted by a change to the Department's part 541 regulations. Of these workers, the Department estimates that 21.4 million are currently exempt EAP workers who are subject to the salary level requirement and may be potentially affected by the proposed rule.3

3White collar salaried workers not subject to the EAP salary level test include teachers, academic administrative personnel, physicians, lawyers, judges, and outside sales workers.

In Year 1 the Department estimates 4.6 million currently exempt workers who earn at least the current weekly salary level of $455 but less than the 40th earnings percentile ($921) would, without some intervening action by their employers, become entitled to minimum wage and overtime protection under the FLSA (Table ES1). Similarly, an estimated 36,000 currently exempt workers who earn at least $100,000 but less than the 90th earnings percentile ($122,148) per year and who meet the HCE duties test but not the standard duties test may also become eligible for minimum wage and overtime protection. In Year 10, with automatic updating of the salary levels, the Department projects that between 5.1 and 5.6 million workers will be affected by the change in the standard salary level test and between 33,000 and 42,000 workers will be affected by the change in the HCE total annual compensation test, depending on the updating methodology used (CPI-U or fixed percentile of wage earnings, respectively). Additionally, the Department estimates that an additional 6.3 million white collar workers who are currently overtime eligible because they do not satisfy the EAP duties tests and who currently earn at least $455 per week but less than the proposed salary level would have their overtime protection strengthened in Year 1 because their exemption status would be clear based on the salary test alone without the need to examine their duties.

Three direct costs to employers are quantified in this analysis: (1) Regulatory familiarization costs; (2) adjustment costs; and (3) managerial costs. Assuming a 7 percent discount rate, the Department estimates that average annualized direct employer costs will total between $239.6 and $255.3 million per year, depending on the updating methodology used as shown in (Table ES1). In addition to the direct costs, this proposed rulemaking will also transfer income from employers to employees in the form of higher earnings. Average annualized transfers are estimated to be between $1,178.0 and $1,271.4 million, depending on which of the two updating methodologies analyzed in this proposal is used. The Department also projects average annualized deadweight loss of between $9.5 and $10.5 million, and notes that the projected deadweight loss is small in comparison to the amount of estimated costs.

Impacts of the proposed rule extend beyond those quantitatively estimated. For example, a potential impact of the rule's proposed increase in the salary threshold is a reduction in litigation costs. Other unquantified transfers, costs, and benefits are discussed in section VII.D.vii.

| Cost/Transfera | Automatic updating methodb | Year 1 | Future yearsc | Average annualized value | ||

| Year 2 | Year 10 | 3% Real rate | 7% Real rate | |||

| Affected Workers (1,000s) | ||||||

| Standard | Percentile CPI-U | 4,646 4,646 | 4,747 4,634 | 5,568 5,062 | — — | — — |

| HCE | Percentile CPI-U | 36 36 | 36 35 | 42 33 | — — | — — |

| Costs and Transfers (Millions 2013$) | ||||||

| Direct employer costs | Percentile CPI-U | 592.7 592.7 | 188.8 181.1 | 225.3 198.6 | 248.8 232.3 | 255.3 239.6 |

| Transfersd | Percentile CPI-U | 1,482.5 1,482.5 | 1,160.2 1,126.4 | 1,339.6 1,191.4 | 1,271.9 1,173.7 | 1,271.4 1,178.0 |

| DWL | Percentile CPI-U | 7.4 7.4 | 10.8 10.3 | 11.2 9.7 | 10.5 9.6 | 10.5 9.5 |

| aCosts and transfers for affected workers passing the standard and HCE tests are combined. bThe percentile method sets the standard salary level at the 40th percentile of weekly earnings for full-time salaried workers and the HCE compensation level at the 90th percentile. The CPI-U method adjusts both levels based on the annual percent change in the CPI-U. cThese costs/transfers represent a range over the nine-year span. dThis is the net transfer from employers to workers. There may also be transfers of hours and income from some workers to other workers. Unquantified transfers, costs and benefits are addressed in Section VII. | ||||||

The Department believes that the proposed increase in the standard salary level to the 40th percentile of weekly earnings for full-time salaried workers and increasing the HCE compensation level to the 90th percentile of full-time salaried workers' earnings, combined with annual updating, is the simplest method for securing the effectiveness of the salary level as a bright-line for ensuring that employees entitled to the Act's overtime provisions are not exempted. The Department recognizes that the proposed standard salary threshold is lower than the historical average salary for the short duties test (the basis for the standard duties test) but believes that it will appropriately distinguish between overtime-eligible white collar salaried employees and those who may meet the EAP duties test without necessitating a return to the more rigorous long duties test. A standard salary threshold significantly below the 40th percentile, or the absence of a mechanism for automatically updating the salary level, however, would require a more rigorous duties test than the current standard duties test in order to effectively distinguish between white collar employees who are overtime protected and those who may be bona fide EAP employees. The Department believes that this proposal is the least burdensome but still cost-effective mechanism for updating the salary and compensation levels, and indexing future levels, and is consistent with the Department's statutory obligations.

II. Background

A. What the FLSA Provides

The FLSA generally requires covered employers to pay their employees at least the federal minimum wage (currently $7.25 an hour) for all hours worked, and overtime premium pay of one and one-half times the employee's regular rate of pay for all hours worked over 40 in a workweek.4 However, there are a number of exemptions from the FLSA's minimum wage and overtime requirements. Section 13(a)(1) of the FLSA, codified at 29 U.S.C. 213(a)(1), exempts from both minimum wage and overtime protection “any employee employed in a bona fide executive, administrative, or professional capacity . . . or in the capacity of outside salesman (as such terms are defined and delimited from time to time by regulations of the Secretary, subject to the provisions of [the Administrative Procedure Act] . . .).” The FLSA does not define the terms “executive,” “administrative,” “professional,” or “outside salesman.” Pursuant to Congress' grant of rulemaking authority, the Department in 1938 issued the first regulations at 29 CFR part 541, defining the scope of the section 13(a)(1) exemptions. Because Congress explicitly delegated to the Secretary of Labor the power to define and delimit the specific terms of the exemptions through notice and comment rulemaking, the regulations so issued have the binding effect of law. See Batterton v. Francis, 432 U.S. 416, 425 n.9 (1977).

4As discussed infra, the Department estimates that 128.5 million workers are subject to the FLSA and the Department's regulations. Most of these workers are covered by the Act's minimum wage and overtime pay protections.

The Department has consistently used its rulemaking authority to define and clarify the section 13(a)(1) exemptions. Since 1940, the implementing regulations have generally required each of three tests to be met for the exemptions to apply: (1) The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed (the “salary basis test”); (2) the amount of salary paid must meet a minimum specified amount (the “salary level test”); and (3) the employee's job duties must primarily involve executive, administrative, or professional duties as defined by the regulations (the “duties test”).

B. Legislative History

Although section 13(a)(1) exempts covered employees from both the FLSA's minimum wage and overtime requirements, its most significant impact is its removal of these employees from the Act's overtime protections. It is widely recognized that the general requirement that employers pay a premium rate of pay for all hours worked over 40 in a workweek is a cornerstone of the Act, grounded in two policy objectives. The first is to spread employment by incentivizing employers to hire more employees rather than requiring existing employees to work longer hours, thereby reducing involuntary unemployment. See, e.g., Davis v. J.P. Morgan Chase, 587 F.3d 529, 535 (2d Cir. 2009) (“The overtime requirements of the FLSA were meant to apply financial pressure to spread employment to avoid the extra wage and to assure workers additional pay to compensate them for the burden of a workweek beyond the hours fixed in the act.”) (internal quotation marks omitted). The second policy objective is to reduce overwork and its detrimental effect on the health and well-being of workers. See, e.g., Barrentine v. Arkansas-Best Freight System, Inc., 450 U.S. 728, 739 (1981) (“The FLSA was designed to give specific minimum protections to individual workers and to ensure that each employee covered by the Act would receive a fair day's pay for a fair day's work and would be protected from the evil of overwork as well as underpay.”) (internal quotation marks and brackets omitted).

Section 13(a)(1) was included in the original Act in 1938 and was based on provisions contained in the earlier National Industrial Recovery Act of 1933 (NIRA) and state law precedents. Specific references in the legislative history to the exemptions contained in section 13(a)(1) are scant. However, the exemptions were premised on the belief that the exempted workers typically earned salaries well above the minimum wage and were presumed to enjoy other privileges to compensate them for their long hours of work, such as above-average fringe benefits, greater job security, and better opportunities for advancement, setting them apart from the nonexempt workers entitled to overtime pay. See Report of the Minimum Wage Study Commission, Volume IV, pp. 236 and 240 (June 1981).5 Further, the type of work exempt employees performed was difficult to standardize to any time frame and could not be easily spread to other workers after 40 hours in a week, making enforcement of the overtime provisions difficult and generally precluding the potential job expansion intended by the FLSA's time-and-a-half overtime premium. Id.

5Congress created the Minimum Wage Study Commission as part of the Fair Labor Standards Amendments of 1977. See Sec. 2(e)(1), Public Law 95-151, 91 Stat. 1246 (Nov. 1, 1977). This independent commission was tasked with examining many FLSA issues, including the Act's minimum wage and overtime exemptions, and issuing a report to the President and to Congress with the results of its study.

The universe of employees eligible for the exemptions has fluctuated with amendments to the FLSA. Initially, persons employed in a “local retailing capacity” were exempt, but Congress eliminated that language from section 13(a)(1) in 1961 when the FLSA was expanded to cover retail and service enterprises. See Public Law 87-30, 75 Stat. 65 (May 5, 1961). Teachers and academic administrative personnel were added to the exemption when elementary and secondary schools were made subject to the FLSA in 1966. Sec. 214, Public Law 89-601, 80 Stat. 830 (Sept. 23, 1966). The Education Amendments of 1972 made the Equal Pay provisions, section 6(d) of the FLSA, expressly applicable to employees who were otherwise exempt from the FLSA under section 13(a)(1). Sec. 906(b)(1), Public Law 92-318, 86 Stat. 235 (June 23, 1972).

A 1990 enactment expanded the exemptions to include in the regulations defining exempt executive, administrative, and professional employees, computer systems analysts, computer programmers, software engineers, and similarly skilled professional workers, including those paid on an hourly basis if paid at least 61/2 times the minimum wage. Sec. 2, Public Law 101-583, 104 Stat. 2871 (Nov. 15, 1990). The compensation test for computer-related occupations was subsequently capped at $27.63 an hour (61/2 times the minimum wage in effect at the time) as part of the 1996 FLSA Amendments, when Congress enacted the new section 13(a)(17) exemption for such computer employees. Section 13(a)(17) also incorporated much of the regulatory language that resulted from the 1990 enactment. See 29 U.S.C. 213(a)(17), as added by the 1996 FLSA Amendments (Sec. 2105(a), Public Law 104-188, 110 Stat. 1755 (Aug. 20, 1996)).

C. Regulatory History

The FLSA became law on June 25, 1938, and the first version of part 541, setting forth the criteria for exempt status under section 13(a)(1), was issued that October. 3 FR 2518 (Oct. 20, 1938). Following a series of public hearings, which were discussed in a report issued by WHD,6 the Department published revised regulations in 1940, which, among other things, updated and expanded the salary level test. 5 FR 4077 (Oct. 15, 1940). Further hearings were convened in 1947, as discussed in a WHD-issued report,7 and revised regulations, which updated the salary levels required to meet the salary level test for the various exemptions, were issued in 1949. 14 FR 7705 (Dec. 24, 1949). An explanatory bulletin interpreting some of the terms used in the regulations was published as subpart B of part 541 in 1949. 14 FR 7730 (Dec. 28, 1949). In 1954, the Department issued revisions to the regulatory interpretations of the salary basis test. 19 FR 4405 (July 17, 1954). In 1958, based on another WHD-issued report,8 the regulations were revised to update the required salary levels. 23 FR 8962 (Nov. 18, 1958). Additional changes, including periodic salary level updates, were made to the regulations in 1961 (26 FR 8635, Sept. 15, 1961), 1963 (28 FR 9505, Aug. 30, 1963), 1967 (32 FR 7823, May 30, 1967), 1970 (35 FR 883, Jan. 22, 1970), 1973 (38 FR 11390, May 7, 1973), and 1975 (40 FR 7091, Feb. 19, 1975). Revisions to increase the salary levels in 1981 were stayed indefinitely by the Department. 46 FR 11972 (Feb. 12, 1981). In 1985, the Department published an Advance Notice of Proposed Rulemaking that reopened the comment period on the 1981 proposal and broadened the review to all aspects of the regulations, including whether to increase the salary levels, but this rulemaking was never finalized. 50 FR 47696 (Nov. 19, 1985).

6Executive, Administrative, Professional . . . Outside Salesman Redefined, Wage and Hour Division, U.S. Department of Labor, Report and Recommendations of the Presiding Officer (Harold Stein) at Hearings Preliminary to Redefinition (Oct. 10, 1940) (“Stein Report”).

7Report and Recommendations on Proposed Revisions of Regulations, Part 541, by Harry Weiss, Presiding Officer, Wage and Hour and Public Contracts Divisions, U.S. Department of Labor (June 30, 1949) (“Weiss Report”).

8Report and Recommendations on Proposed Revision of Regulations, Part 541, Under the Fair Labor Standards Act, by Harry S. Kantor, Presiding Officer, Wage and Hour and Public Contracts Divisions, U.S. Department of Labor (Mar. 3, 1958) (“Kantor Report”).

The Department revised the part 541 regulations twice in 1992. First, the Department created a limited exception from the salary basis test for public employees, permitting public employers to follow public sector pay and leave systems requiring partial-day deductions from pay for absences for personal reasons or due to illness or injury not covered by accrued paid leave, or due to budget-driven furloughs, without defeating the salary basis test required for exemption. 57 FR 37677 (Aug. 19, 1992). The Department also implemented the 1990 law requiring it to promulgate regulations permitting employees in certain computer-related occupations to qualify as exempt under section 13(a)(1) of the FLSA. 57 FR 46744 (Oct. 9, 1992); see Sec. 2, Public Law 101-583, 104 Stat. 2871 (Nov. 15, 1990).

On March 31, 2003, the Department published a Notice of Proposed Rulemaking proposing significant changes to the part 541 regulations. 68 FR 15560 (Mar. 31, 2003). On April 23, 2004, the Department issued a Final Rule (2004 Final Rule), which raised the salary level for the first time since 1975, and made other changes, some of which are discussed below. 69 FR 22122 (Apr. 23, 2004). Current regulations retain the three tests for exempt status that have been in effect since 1940: A salary basis test, a salary level test, and a job duties test.

D. Overview of Existing Regulatory Requirements

The regulations in part 541 contain specific criteria that define each category of exemption provided by section 13(a)(1) for bona fide executive, administrative, professional, outside sales employees, and teachers and academic administrative personnel. The regulations also define those computer employees who are exempt under section 13(a)(1) and section 13(a)(17).See§§541.400-.402. The employer bears the burden of establishing the applicability of any exemption from the FLSA's pay requirements. Job titles and job descriptions do not determine exempt status, nor does paying a salary rather than an hourly rate. To qualify for the EAP exemption, employees must meet certain tests regarding their job duties and generally must be paid on a salary basis of not less than $455 per week.9 In order for the exemption to apply, an employee's specific job duties and salary must meet all the requirements of the Department's regulations. The duties tests differ for each category of exemption.

9Alternatively, administrative and professional employees may be paid on a “fee basis.” This occurs where an employee is paid an agreed sum for a single job regardless of the time required for its completion. §541.605(a). Salary level test compliance for fee basis employees is assessed by determining whether the hourly rate for work performed (i.e., the fee payment divided by the number of hours worked) would total at least $455 per week if the employee worked 40 hours. See §541.605(b). Some employees, such as doctors and lawyers (§541.600(e)), teachers (§541.303(d); §541.600(e)), and outside sales employees (§541.500(c)), are not subject to a salary or fee basis test. Some, such as academic administrative personnel, are subject to a special, contingent salary level. See §541.600(c). There is also a separate salary level in effect for workers in American Samoa (§541.600(a)), and a special salary test for motion picture industry employees (§541.709).

The Department last updated the salary levels in the 2004 Final Rule, setting the standard test threshold at $455 per week for executive, administrative, and professional employees. Since its prior revision in 1975, the salary level tests had grown outdated and were thus no longer effective at distinguishing between exempt and nonexempt employees. Mindful that nearly 30 years had elapsed between salary level increases, and in response to commenter concerns that similar lapses would occur in the future, in the 2004 Final Rule the Department expressed the intent to “update the salary levels on a more regular basis.” 69 FR 22171.

Under the current part 541 regulations, an exempt executive employee must be compensated on a salary basis at a rate of not less than $455 per week and have a primary duty of managing the enterprise or a department or subdivision of the enterprise. §541.100(a)(1)-(2). An exempt executive must also customarily and regularly direct the work of at least two employees and have the authority to hire or fire, or the employee's suggestions and recommendations as to the hiring, firing, or other change of status of employees must be given particular weight. §541.100(a)(3)-(4).

An exempt administrative employee must be compensated on a salary or fee basis at a rate of not less than $455 per week and have a primary duty of the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer's customers. §541.200. An exempt administrative employee's primary duty must include the exercise of discretion and independent judgment with respect to matters of significance. Id.

An exempt professional employee must be compensated on a salary or fee basis at a rate of not less than $455 per week and have a primary duty of (1) work requiring knowledge of an advanced type in a field of science or learning customarily acquired by prolonged, specialized, intellectual instruction and study, or (2) work that is original and creative in a recognized field of artistic endeavor, or (3) teaching in a school system or educational institution, or (4) work as a computer systems analyst, computer programmer, software engineer, or other similarly-skilled worker in the computer field. §§541.300; 541.303; 541.400. An exempt professional employee must perform work requiring the consistent exercise of discretion and judgment, or requiring invention, imagination, or talent in a recognized field of artistic endeavor. §541.300(a)(2). The salary requirements do not apply to certain licensed or certified doctors, lawyers, and teachers. §§541.303(d); 541.304(d).

An exempt outside salesperson must be customarily and regularly engaged away from the employer's place of business and have a primary duty of making sales, or obtaining orders or contracts for services or for the use of facilities. §541.500. There are no salary or fee requirements for exempt outside sales employees. Id.

The 2004 Final Rule created a new “highly compensated” test for exemption. Under the HCE exemption, employees who are paid total annual compensation of at least $100,000 (which must include at least $455 per week paid on a salary or fee basis) are exempt from the FLSA's overtime requirements if they customarily and regularly perform at least one of the exempt duties or responsibilities of an executive, administrative, or professional employee identified in the standard tests for exemption. §541.601. The HCE exemption applies only to employees whose primary duty includes performing office or non-manual work; non-management production line workers and employees who perform work involving repetitive operations with their hands, physical skill, and energy are not exempt under this section no matter how highly paid. Id.

Employees who meet the requirements of part 541 are excluded from both the Act's minimum wage and overtime pay protections. As a result, employees may work any number of hours in the workweek and not be subject to the FLSA's minimum wage and overtime pay requirements. Some state laws have stricter exemption standards than those described above. The FLSA does not preempt any such stricter state standards. If a State establishes a higher standard than the provisions of the FLSA, the higher standard applies in that State. See 29 U.S.C. 218.

III. Presidential Memorandum

On March 13, 2014, President Obama signed a Presidential Memorandum directing the Department to update the regulations defining which “white collar” workers are protected by the FLSA's minimum wage and overtime standards. 79 FR 18737 (Apr. 3, 2014). The memorandum instructed the Department to look for ways to modernize and simplify the regulations while ensuring that the FLSA's intended overtime protections are fully implemented. As the President noted at the time, the FLSA's overtime protections are a linchpin of the middle class and the failure to keep the salary level requirement for the white collar exemption up-to-date has left millions of low-paid salaried workers without this basic protection.10 The current salary level threshold for exemption of $455 per week, or $23,660 annually, is below the poverty threshold for a family of four.11

10 http://www.whitehouse.gov/the-press-office/2014/03/13/fact-sheet-opportunity-all-rewarding-hard-work-strengthening-overtime-pr.

11 See http://www.census.gov/hhes/www/poverty/data/threshld/index.html. The current salary level is less than the 10th percentile of full-time salaried workers.

Following issuance of the memorandum, the Department embarked on an extensive outreach program, conducting listening sessions in Washington, DC, and several other locations, as well as by conference call. The listening sessions were attended by a wide range of stakeholders: Employees, employers, business associations, non-profit organizations, employee advocates, unions, state and local government representatives, tribal representatives, and small businesses. In these sessions the Department asked stakeholders to address, among other issues: (1) What is the appropriate salary level for exemption; (2) what, if any, changes should be made to the duties tests; and (3) how can the regulations be simplified.

Stakeholders representing employers expressed a wide variety of views on the appropriate salary level, ranging from a few who said the salary should not be raised, to several who noted their entry level managers already earned salaries far above the current annual salary level of $23,660. A number of representatives of national employers also noted regional variations in the salary levels they pay to EAP employees. Several employers encouraged the Department to consider nondiscretionary bonuses in determining whether the salary level is met, noting that such bonuses are a key part of exempt employees' compensation in their industries and contribute to an “ownership mindset.” Many employer stakeholders stated that they consider first-line managerial positions to be the gateway to developing their future senior managers and organizational leadership. A number of these employer stakeholders also raised concerns about changing currently exempt employees to nonexempt employees as a result of an increase in the salary requirement, stating that employees are attached to the perceived higher status of being in exempt salaried positions, and value the time flexibility and steady income that comes with such positions. These stakeholders also stressed the need for flexibility under the regulations, in particular emphasizing the value they place on a work culture that encourages managers to lead by example and “pitch in” to assist nonexempt employees. They stressed that changing the duties tests to limit exempt employees' ability to perform nonexempt work—such as California's 50 percent primary duty rule—would negatively impact the culture of the workplace, be difficult and costly to implement, and lead to increased litigation. They also noted the significant investment they made in reviewing employee classifications as a result of the 2004 Final Rule to determine whether employees met the revised duties tests. Finally, several employer representatives suggested that adding to the regulations additional examples of how the exemptions may apply to specific occupations would simplify employers' determinations of EAP exemption status.

Stakeholders representing employees universally endorsed the need to increase the salary level, noting that it has not been updated since 2004. Several employee advocates also stressed the need to index the salary level to ensure that it maintains its effectiveness as a demarcation line between exempt and overtime-eligible employees without having to rely on time consuming future rulemaking. Both individual employees and their representatives shared their concerns that some employers are taking advantage of exempt employees, requiring them to perform large amounts of routine work in order to keep down labor costs, and a few suggested that there needs to be a maximum hours cap for EAP exempt employees. They stressed that employees in “management” positions who are required to spend disproportionate amounts of time performing routine nonexempt tasks (ringing up customers, stocking shelves, bussing tables, cleaning stores and restaurants, etc., alongside or in place of front line workers) are not bona fide executives and do not, in fact, enjoy the flexibility and status traditionally associated with such positions and therefore are entitled to the overtime protections the FLSA was designed to provide. Employee advocates pointed to the California overtime rule as more protective of such workers.

While the HCE exemption was not a primary focus of any of the listening sessions, a number of business stakeholders stated that the $100,000 total annual compensation requirement was too high, and a few suggested that the duties test for the HCE exemption should be dropped and the exemption should be based on compensation level alone. In contrast, the employee stakeholders who addressed the issue argued that the HCE duties test was too lax and that the $100,000 total annual compensation requirement was too low, particularly in light of the wage gains at the top end of the earnings spectrum since 2004. Some employee advocates suggested eliminating the HCE exemption. While the outside sales exemption was also not a central focus of the sessions, several stakeholders representing employer interests argued that the distinction between inside and outside sales positions in the application of the EAP exemption does not reflect the realities of the modern workplace.12

12Section 13(a)(1) expressly includes within the EAP exemption “any employee employed . . . in the capacity of outside salesman.” 29 U.S.C. 213(a)(1). As discussed in the 2004 Final Rule, “the Administrator does not have statutory authority to exempt inside sales employees from the FLSA minimum wage and overtime requirements under the outside sales exemption.” 69 FR 22162.

The Department's outreach has made clear that there are also some widespread misconceptions about overtime eligibility under the FLSA. For example, many employers and employees mistakenly believe that payment of a salary automatically disqualifies an employee from entitlement to overtime compensation irrespective of the duties performed. Many employees are also unaware of the duties required to be performed in order for the exemption to apply. Additionally, many employers seem to mistakenly believe that nonexempt white collar employeesmustbe converted to hourly compensation. Similarly, other employers erroneously believe that they are prohibited from paying nondiscretionary bonuses to EAP employees, given that they cannot be used to satisfy the salary requirement. Some employers also mistakenly believe that the EAP regulations limit their ability to permit white collar employees to work part-time or job share.13 The Department believes that many of these misconceptions can be addressed through its education and outreach efforts.14

13As the Department has previously explained, there is no special salary level for EAP employees working less than full-time. 69 FR 22171. Employers, however, can pay white collar employees working part-time or job sharing a salary of less than the required EAP salary threshold and will not violate the Act so long as the salary equals at least the minimum wage for all hours worked and the employee does not work more than 40 hours a week. FLSA2008-1NA (Feb. 14, 2008).

14Such misconceptions are not new. In 1940 the Department responded to the related argument that employers would convert overtime-eligible white collar employees to hourly pay instead of more secure salaries, stating: “Without underestimating the general desirability of weekly or monthly salaries which enable employees to adjust their expenditures on the basis of an assured income (so long as they remain employed), there is little advantage in salaried employment if it serves merely as a cloak for long hours of work. Further, such salaried employment may well conceal excessively low hourly rates of pay.” Stein Report at 7.

Lastly, the Department notes that multiple stakeholders on both sides of the issue expressed frustration with the exempt/nonexempt terminology and asked the Department to consider more descriptive terms. The Department recognizes that the terms “exempt” and “nonexempt” are not intuitive and can be confusing to both employers and employees. In an attempt to address this concern, the Department uses the terms “overtime protected” and “overtime eligible” at times in this NPRM as synonyms for nonexempt, and “not overtime protected” and “overtime ineligible” as synonyms for exempt. While the Department will continue to use the terms exempt and nonexempt as technical terms to ensure accuracy and continuity, we will, where appropriate, endeavor to use these more descriptive terms to aid the regulated community. The Department also uses the term “EAP exemption” throughout this NPRM to reflect the section 13(a)(1) exemption for executive, administrative, and professional employees.

The discussions in the listening sessions have informed not just the development of this NPRM, but also the Department's understanding of the role of overtime in the modern workplace. Some of the issues raised in the listening sessions are specifically referenced below in the Department's proposals; some issues that were raised are either beyond the scope of this rulemaking or beyond the Department's authority under the FLSA. For example, several employers expressed concern that employees who would become newly entitled to overtime under a higher salary level requirement would lose the flexibility they currently enjoy to work remotely on electronic devices because of employer concerns about overtime liability. Because this concern involves compensation for hours worked by overtime-protected employees, it is beyond the scope of this rulemaking. The Department, however, understands the importance of this concern and will publish a Request for Information in the near future seeking information from stakeholders on the use of electronic devices by overtime-protected employees outside of scheduled work hours.

The Department appreciates the views of all the participants in the listening sessions and welcomes further input from the public in response to this NPRM. Finally, consistent with the President's commitment to a 21st-century regulatory system, the Department would consider conducting a retrospective review of the Final Rule resulting from this proposal at an appropriate time in the future.

IV. Need for Rulemaking

One of the Department's primary goals in this rulemaking is updating the section 13(a)(1) exemption's salary level requirement. A salary level test has been part of the regulations since 1938 and has been long recognized as “the best single test” of exempt status. Stein Report at 19, 42; see Weiss Report at 8-9; Kantor Report at 2-3. The salary an employer pays an employee provides “a valuable and easily applied index to the `bona fide' character of the employment for which exemption is claimed” and ensures that section 13(a)(1) of the FLSA “will not invite evasion of section 6 and section 7 for large numbers of workers to whom the wage-and-hour provisions should apply.” Stein Report at 19. The 1949 Weiss Report's statement remains true today: “The experience of [the Department] since 1940 supports the soundness of the inclusion of the salary criteria in the regulations.” Weiss Report at 8. In setting the salary level for the long test (which paired a lower salary with a limitation on the amount of non-exempt work an exempt worker could perform) the Department sought to provide a ready guide to assist employers in identifying employees who were unlikely to meet the duties tests for the exemptions.

The salary level's function in differentiating exempt from nonexempt employees takes on greater importance when there is only one duties test that has no limitation on the amount of nonexempt work that an exempt employee may perform, as has been the case since 2004. The Department set the standard salary level in 2004 equivalent to the former long test salary level, thus not adjusting the salary threshold to account for the absence of the more rigorous long duties test. The long test salary level was designed to operate as a ready guide to assist employers in identifying employees who were unlikely to meet the duties tests for the EAP exemption. The salary level required for exemption under section 13(a)(1) is currently $455 a week and has not been updated in more than 10 years. The annual value of the salary level ($23,660) is now lower than the poverty threshold for a family of four. If left at the same amount, the effectiveness of the salary level test as a means of helping determine exempt status diminishes as the wages of employees entitled to overtime pay increase and the real value of the salary threshold falls.

By way of this rulemaking, the Department seeks to update the salary level to ensure that the FLSA's intended overtime protections are fully implemented, and to simplify the identification of overtime-eligible employees, thus making the exemptions easier for employers and workers to understand. For similar reasons, the Department also proposes to update the total annual compensation required for the HCE exemption, since it too has been unchanged since 2004, and the current level could lead to inappropriate classification given the minimal duties test for that exemption.

In a further effort to respond to changing conditions in the workplace, the Department is also considering whether to allow nondiscretionary bonuses to satisfy some portion of the standard test salary requirement. Currently, such bonuses are only included in calculating total annual compensation under the HCE test, but some stakeholders have urged broader inclusion, pointing out that in some industries, particularly the retail and restaurant industries, significant portions of salaried EAP employees' earnings may be in the form of such bonuses.

The Department also proposes automatically updating the salary levels based on changes in the economy to prevent the levels from becoming outdated with the often lengthy passage of time between rulemakings. The Department proposes to automatically update the standard salary test, the annual compensation requirement for highly compensated employees, and the special salary levels for American Samoa and for motion picture industry employees, in order to ensure the continued utility of these tests over time. As explained in the Weiss Report, the salary test is only a strong measure of exempt status if it is up to date, and a weakness of the salary test is that increases in wage rates and salary levels over time gradually diminish its effectiveness. See Weiss Report at 8. In the 1970 rulemaking, in response to a comment requesting that the regulations provide for annual review and updating of the salary level, the Department noted that the idea “appears to have some merit particularly since past practice has indicated that approximately 7 years elapse between amendment of these salary requirements,” but concluded that such a proposal would require further study. 35 FR 884. In the 2004 Final Rule, the Department declined to adopt a process for automatically updating the salary level and instead stated our intent “in the future to update the salary levels on a more regular basis” as we did prior to 1975. Yet competing regulatory priorities, overall agency workload, and the time-intensive nature of the notice and comment process have hindered the Department's ability to achieve this goal, which would require nearly continuous future rulemaking. A rule providing for automatic updates to the salary level using a methodology that has been subject to notice and comment rulemaking would maintain the utility of the dividing line set by the salary level without the need for frequent rulemaking. This modernization of the regulations would provide predictability for employers and employees by replacing infrequent, and thus more drastic, salary level increases with gradual changes occurring at set intervals. Regular annual increases in the salary and compensation levels, instead of large changes that result from sporadic rulemaking, will provide more certainty and stability for employers.

The Department is also considering revisions to the duties tests in order to ensure that they fully reflect the purpose of the exemption. Possible revisions include requiring overtime-ineligible employees to spend a specified amount of time performing their primary duty (e.g., a 50 percent primary duty requirement as required under California state law) or otherwise limiting the amount of nonexempt work an overtime-ineligible employee may perform, and adding to the regulations additional examples illustrating how the exemption may apply to particular occupations. As previously discussed, during listening sessions held in advance of this proposed rule, the Department asked stakeholders what, if any, changes should be made to the existing duties tests for exemption. Stakeholders from the business community, while noting the uncertainty caused by litigation surrounding their application of the current duties tests, generally advocated for no changes to the current duties tests and raised specific concerns about the difficulty of imposing any limit on the amount of nonexempt work that exempt employees may perform. These stakeholders indicated that the uncertainty which would result from any changes in the duties tests would be much more problematic than the challenges encountered with the current tests. Employees and stakeholders representing employee interests, however, generally advocated for stricter requirements to ensure that overtime-ineligible employees spend a sufficient amount of time performing exempt duties, and do not spend excessive amounts of time on nonexempt work. These stakeholders argued that such requirements would clarify the application of the exemption and restore overtime protection to employees whose duties are not, in fact, those of a bona fide executive, administrative, or professional employee. Several business stakeholders also suggested that adding additional examples of how the exemptions apply to particular occupations would simplify application of the exemption for employers and increase the clarity of the current duties tests.

V. Proposed Regulatory Revisions

The Department's current proposal focuses primarily on updating the salary and compensation levels by proposing that the standard salary level be set at the 40th percentile of weekly earnings for full-time salaried workers, proposing to increase the HCE annual compensation requirement to the annualized value of the 90th percentile of weekly earnings of full-time salaried workers, and proposing a mechanism for automatically updating the salary and compensation levels going forward to ensure that they will continue to provide a useful and effective test for exemption. While the primary regulatory changes proposed are in §§541.600 and 541.601, additional conforming changes are proposed to update references to the salary level throughout part 541 as well as to update the special salary provisions for American Samoa and the motion picture industry. The proposal also discusses the inclusion of nondiscretionary bonuses to satisfy a portion of the standard salary requirement but does not propose specific regulatory changes. Additionally, the proposal discusses the duties tests, requests comments on the current requirements, and solicits suggestions for additional occupation examples, but does not make any specific proposals for revisions to these sections.

A. Setting the Standard Salary Level

i. History

The FLSA became law on June 25, 1938, and the first version of part 541, issued later that year, set a minimum salary level of $30 per week for executive and administrative employees. 3 FR 2518. Since 1938, the Department has increased the salary levels seven times—in 1940, 1949, 1958, 1963, 1970, 1975, and 2004. See Table A. While the Department's method for calculating the salary level has evolved to fulfill its mandate, the purpose of the salary level requirement has remained consistent—to define and delimit the scope of the executive, administrative, and professional exemptions. 29 U.S.C. 213(a)(1). The Department has long recognized that the salary paid to an employee is the “best single test” of exempt status (Stein Report at 19) and that setting a minimum salary threshold provides a “ready method of screening out the obviously nonexempt employees” while furnishing a “completely objective and precise measure which is not subject to differences of opinion or variations in judgment.” Weiss Report at 8-9. The Department reaffirmed this position in the 2004 Final Rule, explaining that the “salary level test is intended to help distinguish bona fide executive, administrative, and professional employees from those who were not intended by Congress to come within these exempt categories[,]” and reiterating that any increase in the salary level must “have as its primary objective the drawing of a line separating exempt from nonexempt employees.” 69 FR 22165.

| Date enacted | Long test | Short test (all) | ||

| Executive | Administrative | Professional | ||

| 1938 | $30 | $30 | ||

| 1940 | 30 | 50 | $50 | |

| 1949 | 55 | 75 | 75 | $100 |

| 1958 | 80 | 95 | 95 | 125 |

| 1963 | 100 | 100 | 115 | 150 |

| 1970 | 125 | 125 | 140 | 200 |

| 1975 | 155 | 155 | 170 | 250 |

| Standard Test | ||||

| 2004 | $455 | |||

In 1940, the Department maintained the $30 per week salary level set in 1938 for executive employees, increased the salary level for administrative employees, and established a salary level for professional employees. The Department used salary surveys from federal and state government agencies, experience gained under the National Industrial Recovery Act, and federal government salaries to determine the salary level that was the “dividing line” between employees performing exempt and nonexempt work. Stein Report at 9, 20-21, 31-32. The Department recognized that the salary level falls within a continuum of salaries that overlaps the outer boundaries of exempt and nonexempt employees. Specifically, the Department stated:

To make enforcement possible and to provide for equity in competition, a rate should be selected in each of the three definitions which will be reasonable in the light of average conditions for industry as a whole. In some instances the rate selected will inevitably deny exemption to a few employees who might not unreasonably be exempted, but, conversely, in other instances it will undoubtedly permit the exemption of some persons who should properly be entitled to the benefits of the act.

Id. at 6. Taking into account the average salary levels for employees in numerous industries, and the percentage of employees earning below these amounts, the Department set the salary level for each exemption slightly below the “dividing line” suggested by these averages.

In 1949, the Department again looked at salary data from state and federal agencies, including the Bureau of Labor Statistics (BLS). The data reviewed included wages in small towns and low-wage industries, earnings of federal employees, average weekly earnings for exempt employees, starting salaries for college graduates, and salary ranges for different occupations such as bookkeepers, accountants, chemists, and mining engineers. Weiss Report at 10, 14-17, 19-20. The Department noted that the “salary level adopted must exclude the great bulk of nonexempt persons if it is to be effective”. Id. at 18. Recognizing that the “increase in wage rates and salary levels” since 1940 had “gradually weakened the effectiveness of the present salary tests as a dividing line between exempt and nonexempt employees,” the Department calculated the percentage increase in weekly earnings from 1940 to 1949, and then adopted new salary levels “at a figure slightly lower than might be indicated by the data” in order to protect small businesses. Id. at 8, 14. The Department also cautioned that “a dividing line cannot be drawn with great precision but can at best be only approximate.” Id. at 11

In 1949, the Department also established a second, less-stringent duties test for each exemption, but only for those employees who were paid at or above a higher “short test” salary level. Those paid above the higher salary level were exempt if they also met a “short” duties test, which lessened the duties requirements for exemption.15 The rationale for this short test was that employees who met the higher salary level were more likely to meet all the requirements for exemption, and thus a “short-cut test for exemption . . . would facilitate the administration of the regulations without defeating the purposes of section 13(a)(1).” Id. at 22-23. Employees who met only the lower “long test” salary level, and not the higher short test salary level, were still required to satisfy the default “long” duties test, which included a 20 percent limitation on the amount of nonexempt work that could be performed by an exempt employee. While the long test salary level was set based on an analysis of the defined sample, the short test salary level was set in relation to the long test salary. The existence of separate short and long tests—with short test salary levels ranging from approximately 130 to 180 percent of the long test salary levels—remained part of the Department's regulations until 2004.16 See Table A.

15These higher salary levels are presented under the “Short Test” heading in Table A.

16The smallest ratio was in 1963 between the long test salary requirement for professionals ($115) and the short test salary level ($150). The largest ratio was in 1949 between the long test salary requirement for executives ($55) and the short test salary level ($100).

In setting the long test salary level in 1958, the Department considered data collected during 1955 WHD investigations on the “actual salaries paid” to employees who “qualified for exemption” (i.e., met the applicable salary and duties tests), grouped by geographic region, broad industry groups, number of employees, and city size, and supplemented with BLS and Census data to reflect income increases of white collar and manufacturing employees during the period not covered by the Department's investigations. Kantor Report at 6. The Department then set the salary level tests for exempt employees “at about the levels at which no more than about 10 percent of those in the lowest-wage region, or in the smallest size establishment group, or in the smallest-sized city group, or in the lowest-wage industry of each of the categories would fail to meet the tests.” Id. at 6-7. In other words, the Department set the salary level so that only a limited number of workers performing EAP duties (about 10 percent) in the lowest-wage regions and industries would fail to meet the salary level test and therefore be overtime protected. In laying out this methodology, the Department echoed comments from the Weiss Report that the salary tests “simplify enforcement by providing a ready method of screening out the obviously nonexempt employees[,]” and that “[e]mployees that do not meet the salary test are generally also found not to meet the other requirements of the regulations.” Id. at 2-3. The Department also noted that in our experience misclassification of overtime-protected employees occurs more frequently when the salary levels have “become outdated by a marked upward movement of wages and salaries.” Id. at 5.

The Department followed a similar methodology when determining the appropriate long test salary level increase in 1963, using data regarding salaries paid to exempt workers collected in a 1961 WHD survey. 28 FR 7002. The salary level for executive and administrative employees was increased to $100 per week, for example, when the 1961 survey data showed that 13 percent of establishments paid one or more exempt executives less than $100 per week, and 4 percent of establishments paid one or more exempt administrative employees less than $100 a week. 28 FR 7004. The professional exemption salary level was increased to $115 per week, when the 1961 survey data showed that 12 percent of establishments surveyed paid one or more professional employees less than $115 per week. Id. The Department noted that these salary levels approximated the same percentages used in 1958:

Salary tests set at this level would bear approximately the same relationship to the minimum salaries reflected in the 1961 survey data as the tests adopted in 1958, on the occasion of the last previous adjustment, bore to the minimum salaries reflected in a comparable survey, adjusted by trend data to early 1958. At that time, 10 percent of the establishments employing executive employees paid one or more executive employees less than the minimum salary adopted for executive employees and 15 percent of the establishments employing administrative or professional employees paid one or more employees employed in such capacities less than the minimum salary adopted for administrative and professional employees.

Id.

The Department continued to use a similar methodology when updating the long test salary level in 1970. After examining data from 1968 WHD investigations, 1969 BLS wage data, and information provided in a report issued by the Department in 1969 that included salary data for executive, administrative, and professional employees,17 the Department increased the long test salary level for executive employees to $125 per week when the salary data showed that 20 percent of executive employees from all regions and 12 percent of executive employees in the West earned less than $130 a week. 35 FR 884-85. The Department also increased the long test salary levels for administrative and professional employees to $125 and $140, respectively.

17 Earnings Data Pertinent to a Review of the Salary Tests for Executive, Administrative and Professional Employees As Defined in Regulations Part 541, (1969), cited in 34 FR 9935.

In 1975, instead of following these prior approaches, the Department set the long test salary levels based on increases in the Consumer Price Index (CPI), although the Department adjusted the salary level downward “in order to eliminate any inflationary impact.” 40 FR 7091. As a result of this recalibration of the 1970 levels, the long test salary level for the executive and administrative exemptions was set at $155, while the professional level was set at $170. The salary levels adopted were intended as interim levels “pending the completion and analysis of a study by [BLS] covering a six month period in 1975[,]” and were not meant to set a precedent for future salary level increases. Id. at 7091-92. Although the Department intended to increase the salary levels after completion of the BLS study of actual salaries paid to employees, the envisioned process was never completed, and the “interim” salary levels remained unchanged for the next 29 years.

As reflected in Table A, the short test salary level increased in tandem with the long test level throughout the various rulemakings since 1949. Because the short test was designed to capture only those white collar employees whose salary was high enough to indicate a stronger likelihood of exempt status and thus warrant a less stringent duties requirement, the short test salary level was always set significantly higher than the long test salary level. Thus, in 1975 while the long test salary levels ranged from $155 to $170, the short test level was $250.

The salary level test was most recently updated in 2004, when the Department abandoned the concept of separate long and short tests, opting instead for one “standard” test, and set the salary level under a new standard duties test at $455 for executive, administrative, and professional employees. Due to the lapse in time between the 1975 and 2004 rulemakings, the salary threshold for the long duties tests (i.e., the lower salary level) did not reflect salaries being paid in the economy and had become ineffective at distinguishing between overtime-eligible and overtime-ineligible white collar employees. For example, at the time of the 2004 Final Rule, the salary levels for the long duties tests were $155 for executive and administrative employees and $170 for professional employees, while a full-time employee working 40 hours per week at the federal minimum wage ($5.15 per hour) at that time earned $206 per week. 69 FR 22164. Even the short test salary level at $250 per week was not far above the minimum wage.

The Department in the 2004 Final Rule based the new “standard” duties tests on the short duties tests (which did not limit the amount of nonexempt work that could be performed), and tied them to a single salary test level that was updated from the long test salary (which historically had been paired with a cap on nonexempt work). 69 FR 22164, 22168-69; see also 68 FR 15570 (“Under the proposal, the minimum salary level to qualify for exemption from the FLSA minimum wage and overtime requirements as an executive, administrative, or professional employee would be increased from $155 per week to $425 per week. This salary level would be referred to as the ‘standard test,’ thus eliminating the ‘short test’ and ‘long test’ terminology. The separate, higher salary level test for professional employees also would be eliminated.”). The Department concluded that it would be burdensome to require employers to comply with a more complicated long duties test given that the passage of time had rendered the long test salary level largely obsolete. 69 FR 22164; 68 FR 15564-65. The Department believed at the time that the new standard test salary level accounted for the elimination of the long duties test. 69 FR 22167.

In determining the new salary level in 2004, the Department reaffirmed our oft-repeated position that the salary level is the “best single test” of exempt status. 69 FR 22165. Consistent with prior rulemakings, the Department relied on actual earnings data and set the salary level near the lower end of the current range of salaries. Specifically, the Department used Current Population Survey (CPS) data that encompassed most salaried employees, and set the salary level to exclude roughly the bottom 20 percent of these salaried employees in each of the subpopulations: (1) The South and (2) the retail industry. Although several prior salary levels were based on salaries of approximately the lowest 10 percent of exempt salaried employees (the Kantor method), the Department stated that the change in methodology was warranted in part to account for the elimination of the short and long duties tests, and because the utilized data sample included nonexempt salaried employees, as opposed to only exempt salaried employees. However, as the Department acknowledged, the salary arrived at by this method was, in fact, equivalent to the salary derived from the Kantor method. 69 FR 22168. Based on the adopted methodology, the Department ultimately set the salary level for the new standard test at $455 per week.

In the 2004 Final Rule the Department also created a test for highly compensated employees, which provided a minimal duties test for workers within the highest compensation range. Reasoning that an especially high salary level negated the need for a probing duties analysis, the Department provided that employees who earned at least $100,000 in total annual compensation (of which at least $455 was paid weekly on a salary or fee basis) were covered by the exemption if they customarily and regularly spent time on one or more exempt duties, and were not engaged in manual work. 69 FR 22172.

In summary, the regulatory history reveals a common methodology used, with some variations, to determine appropriate salary levels. In almost every case, the Department examined a broad set of data on actual wages paid to salaried employees and then set the salary level at an amount slightly lower than might be indicated by the data. In 1940 and 1949, the Department looked to the average salary paid to the lowest level of exempt employees. Beginning in 1958, the Department set salary levels to exclude approximately the lowest-paid 10 percent of exempt salaried employees in low-wage regions, employment size groups, city size, and industry sectors, and we followed a similar methodology in 1963 and 1970. The levels were based on salaries in low-wage categories in order to protect the ability of employers in those areas and industries to utilize the exemptions and in order to mitigate the impact of higher-paid regions and sectors. In 1975, the Department increased the salary levels based on changes in the CPI, adjusting downward to eliminate any potential inflationary impact. 40 FR 7091 (“However, in order to eliminate any inflationary impact, the interim rates hereinafter specified are set at a level slightly below the rates based on the CPI.”). In 2004, the Department raised the salary level to $455 per week using earnings data of full-time salaried employees (both exempt and nonexempt) in the South and in the retail sector. As in the past, the use of lower-salary data sets was intended to accommodate those businesses for which salaries were generally lower due to geographic or industry-specific reasons. This most recent revision eliminated the short and long duties requirements in favor of a standard duties test for each exemption and a single salary level for executive, administrative, and professional employees.