['Recordkeeping']

['Recordkeeping']

02/18/2025

...

DEPARTMENT OF TRANSPORTATION

Federal Motor Carrier Safety Administration

49 CFR Part 371

[Docket No. FMCSA-2023-0257]

RIN 2126-AC63

Transparency in Property Broker Transactions

AGENCY: Federal Motor Carrier Safety Administration (FMCSA), Department of Transportation (DOT).

ACTION: Notice of proposed rulemaking (NPRM).

SUMMARY: FMCSA proposes amendments to its property broker rules in response to petitions for rulemaking from the Owner-Operator Independent Drivers Association (OOIDA) and the Small Business in Transportation Coalition (SBTC). Under current regulations, the parties to a brokered freight transaction have a right to review the broker's record of the transaction, which stakeholders often refer to as “broker transparency.” Contracts between brokers and motor carriers frequently contain waivers of this right. OOIDA requested that FMCSA promulgate a requirement that property brokers provide an electronic copy of each transaction record automatically within 48 hours after the contractual service has been completed, and explicitly prohibit brokers from including any provision in their contracts that requires a motor carrier to waive its rights to access the transaction records. SBTC requested that FMCSA prohibit brokers of property from coercing or requiring parties to brokers' transactions to waive their right to review the record of the transaction as a condition for doing business and prohibit the use of clause(s) exempting the broker from having to comply with this transparency requirement. Though the proposed rule is responsive to the petitions in reinforcing the broker transparency requirement, the proposed provisions differ from those requested by OOIDA and SBTC. The proposed rule would revise the regulatory text to make clear that brokers have a regulatory obligation to provide transaction records to the transacting parties on request. The proposal would also make changes to the format and content of the records.

DATES: Comments must be received on or before March 20, 2025.

ADDRESSES: You may submit comments identified by Docket Number FMCSA-2023-0257 using any of the following methods:

- Federal eRulemaking Portal: Go to https://www.regulations.gov/docket/FMCSA-2023-0257/document. Follow the online instructions for submitting comments.

- Mail: Dockets Operations, U.S. Department of Transportation, 1200 New Jersey Avenue SE, West Building, Ground Floor, Washington, DC 20590-0001.

- Hand Delivery or Courier: Dockets Operations, U.S. Department of Transportation, 1200 New Jersey Avenue SE, West Building, Ground Floor, Washington, DC 20590-0001, between 9 a.m. and 5 p.m., Monday through Friday, except Federal holidays. To be sure someone is there to help you, please call (202) 366-9317 or (202) 366-9826 before visiting Dockets Operations.

- Fax: (202) 493-2251.

FOR FURTHER INFORMATION CONTACT: Mr. Michael Evans, Transportation Specialist, Commercial Enforcement Division, Office of Safety, FMCSA, 1200 New Jersey Avenue SE, Washington, DC 20590-0001; (202) 568-0530; michael.evans@dot.gov. If you have questions on viewing or submitting material to the docket, call Dockets Operations at (202) 366-9826.

SUPPLEMENTARY INFORMATION:

FMCSA organizes this NPRM as follows:

I. Public Participation and Request for Comments

A. Submitting Comments

B. Viewing Comments and Documents

C. Privacy

D. Comments on the Information Collection

II. Executive Summary

A. Purpose and Summary of the Regulatory Action

B. Summary of Major Provisions

C. Costs and Benefits

III. Abbreviations

IV. Legal Basis

V. Background

A. History of Property Broker Regulations

B. History of the Current Rulemaking

C. Related Actions

VI. Discussion of Proposed Rulemaking and Comments

A. Proposed Rulemaking

B. Comments and Agency Responses

C. Issues on Which the Agency Seeks Further Comment

VII. Section-by-Section Analysis

A. Section 371.2 Definitions.

B. Section 371.3 Records To Be Kept by Brokers

VIII. Regulatory Analyses

A. E.O. 12866 (Regulatory Planning and Review), E.O. 13563 (Improving Regulation and Regulatory Review), E.O. 14094 (Modernizing Regulatory Review), and DOT Regulatory Policies and Procedures

B. Advance Notice of Proposed Rulemaking

C. Regulatory Flexibility Act

D. Assistance for Small Entities

E. Unfunded Mandates Reform Act of 1995

F. Paperwork Reduction Act

G. E.O. 13132 (Federalism)

H. Privacy

I. E.O. 13175 (Indian Tribal Governments)

J. National Environmental Policy Act of 1969

K. Rulemaking Summary

I. Public Participation and Request for Comments

A. Submitting Comments

If you submit a comment, please include the docket number for this NPRM (FMCSA-2023- 0257), indicate the specific section of this document to which your comment applies, and provide a reason for each suggestion or recommendation. You may submit your comments and material online or by fax, mail, or hand delivery, but please use only one of these means. FMCSA recommends that you include your name and a mailing address, an email address, or a phone number in the body of your document so FMCSA can contact you if there are questions regarding your submission.

To submit your comment online, go to https://www.regulations.gov/docket/FMCSA-2023-0257/document, click on this NPRM, click “Comment,” and type your comment into the text box on the following screen.

If you submit your comments by mail or hand delivery, submit them in an unbound format, no larger than 81/2 by 11 inches, suitable for copying and electronic filing.

FMCSA will consider all comments and material received during the comment period.

Confidential Business Information (CBI)

CBI is commercial or financial information that is both customarily and actually treated as private by its owner. Under the Freedom of Information Act (5 United States Code (U.S.C.) 552), CBI is exempt from public disclosure. If your comments responsive to the NPRM contain commercial or financial information that is customarily treated as private, that you actually treat as private, and that is relevant or responsive to the NPRM, it is important that you clearly designate the submitted comments as CBI. Please mark each page of your submission that constitutes CBI as “PROPIN” to indicate it contains proprietary information. FMCSA will treat such marked submissions as confidential under the Freedom of Information Act, and they will not be placed in the public docket of the NPRM. Submissions containing CBI should be sent to Brian Dahlin, Chief, Regulatory Evaluation Division, Office of Policy, FMCSA, 1200 New Jersey Avenue SE, Washington, DC 20590-0001 or via email at brian.g.dahlin@dot.gov. At this time, you need not send a duplicate hardcopy of your electronic CBI submissions to FMCSA headquarters. Any comments FMCSA receives not specifically designated as CBI will be placed in the public docket for this rulemaking.

B. Viewing Comments and Documents

To view any documents mentioned as being available in the docket, go to https://www.regulations.gov/docket/FMCSA-2023-0257/document and choose the document to review. To view comments, click this NPRM, then click “Browse Comments.” If you do not have access to the internet, you may view the docket online by visiting Dockets Operations on the ground floor of the DOT West Building, 1200 New Jersey Avenue SE, Washington, DC 20590-0001, between 9 a.m. and 5 p.m., Monday through Friday, except Federal holidays. To be sure someone is there to help you, please call (202) 366-9317 or (202) 366-9826 before visiting Dockets Operations.

C. Privacy

In accordance with 5 U.S.C. 553(c), DOT solicits comments from the public to better inform its regulatory process. DOT posts these comments, including any personal information the commenter provides, to www.regulations.gov as described in the system of records notice DOT/ALL 14 (Federal Docket Management System (FDMS)), which can be reviewed at https://www.transportation.gov/individuals/privacy/privacy-act-system-records-notices. The comments are posted without edit and are searchable by the name of the submitter.

D. Comments on the Information Collection

Written comments and recommendations for the information collection discussed in this NPRM should be sent within 60 days of publication to www.reginfo.gov/public/do/PRAMain. Find this information collection by clicking the link that reads “Currently under Review—Open for Public Comments.”

II. Executive Summary

A. Purpose and Summary of the Regulatory Action

Property brokers match motor carriers with shippers, which can create new business opportunities for motor carriers and transportation solutions for shippers. This business model can also lead to an asymmetry of information between parties, which in turn can affect the contracting process by limiting parties' ability to negotiate for their desired terms. 1 These risks can lead to market inefficiencies, such as decreased freight capacity or decreased market competition, which can arise when parties lack material information about the transaction. FMCSA and its predecessor agencies have attempted to address these problems by requiring property brokers to keep certain records of their transactions and make the records available to motor carriers and shippers involved in those transactions. Making the records available to the transacting parties, sometimes referred to as “broker transparency,” is meant to inform business decisions and enable self-policing of abuses that may arise.

1 Asymmetric information exists when one party in a transaction has more information than the other, which can result in a market failure. Asymmetric information provides an advantage to one side of a market over the other when negotiating a transaction. OMB Circular No. A-4, p. 17 (Nov. 9, 2023).

The Agency has received rulemaking petitions and other input from the public, however, that indicate many motor carriers cannot review the brokers' transaction records as the broker recordkeeping regulation intends. Brokers often include provisions in their contracts with motor carriers that require motor carriers to waive their ability to review broker records. In addition, even without waiver clauses, motor carriers often face practical hurdles in accessing records that they should be able to review under the current regulations. As a result of the SBTC and OOIDA petitions, the Agency reviewed its property broker recordkeeping requirements and is proposing certain amendments to those requirements. The proposed amendments are intended to reinforce broker transparency for motor carriers and to better tailor the required contents of the records to the purpose of broker transparency.

The current and proposed regulations are based on the Agency's authority to regulate the procurement of interstate transportation, which includes authority over property brokers and their arrangement of transportation. The Agency has the authority to collect information from brokers and require them to keep certain records. The Agency also has authority over the registration of property brokers, and when registering them, to determine whether the broker is willing and able to comply with all applicable regulations, including the recordkeeping regulations. In exercising its authority over brokers, the Agency is required to provide for the protection of motor carriers and shippers. The proposed rule would use and implement this authority by revising the broker recordkeeping requirements to further protect motor carriers and promote efficiency within the motor carrier transportation system.

B. Summary of Major Provisions

FMCSA proposes several amendments to 49 CFR 371.3, “Records to be kept by brokers.” The first proposed provision would require property brokers to keep their records in an electronic format. This provision would serve the purpose of broker transparency by making it easier for motor carriers and shippers to review broker records on request, and remotely, as compared to the current practice of some brokers who respond to transparency requests by making only physical records available at their principal place of business. The Agency believes that many brokers already maintain their records in an electronic format.

The second proposed provision would modernize and tailor the required contents of the records to better achieve broker transparency. The current requirement uses a distinction between brokerage and non-brokerage services, which is rooted in a previous regulatory approach. FMCSA proposes eliminating this distinction and instead requiring that the records contain, for each shipment in the transaction, all charges and payments connected to the shipment, including a description, amount, and date. This is substantially similar to the current requirement but removes the outdated distinction. The record would also be required to include any claims connected to the shipment, such as a shipper's claims for damage or delay. This amendment would ensure the parties have full visibility into the payments, fees, and charges associated with the transaction so they can resolve issues and disputes among themselves without resorting to costlier remedies.

The third proposed provision would clarify the obligation imposed on brokers to respond to requests for transaction records and the process parties must follow when requesting and supplying such records. The current regulation frames the broker transparency requirement as a right, given to the transacting parties, to review the records. The proposed amendment would reframe broker transparency as a regulatory duty imposed on brokers to provide records to the transacting parties.

The fourth proposed provision would require brokers to provide the records required to be maintained under §371.3(a) within 48 hours when a party to the transaction requests those records. This provision is intended to ensure that the requesting party receives the records in a timely manner, to support the resolution of issues around service or payment.

C. Costs and Benefits

Broker transparency is intended to enable efficient outcomes in the transportation industry by providing the material information necessary for the transacting parties to make informed business decisions. Broker transparency also supports the efficient resolution of disputes between parties. Though the current regulations are meant to provide broker transparency, the Agency has heard through numerous listening sessions and comments from motor carriers that broker transparency is rare in practice. The Agency believes the revisions to the regulation will make it more likely that brokers will comply with their regulatory duty to provide information. The Agency analyzes these potential benefits qualitatively and seeks further information and data from the public to better analyze the benefits.

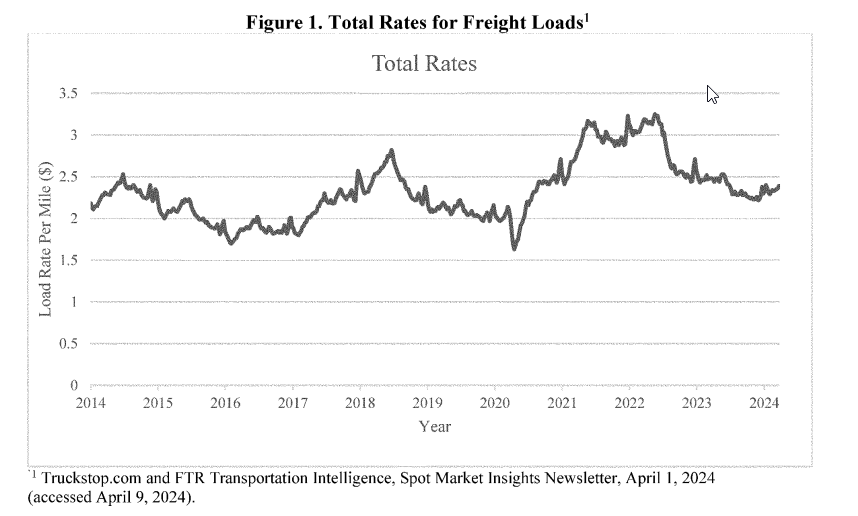

Some motor carriers believe that increased broker transparency would have a material effect on negotiated freight rates. The Agency believes that other market factors, rather than the availability of additional information through broker transparency, are likely dominant in setting freight rates. However, the Agency has not ruled out the possibility that motor carriers and shippers could negotiate for better rates over time using the broker transparency information. The Agency seeks further comment on this issue.

The Agency believes that the cost of the proposed rule would be minimal. Based upon its interactions with brokers, the Agency believes that most brokers already keep records electronically and that these records already contain the information that would be required by the proposed rule. The Agency believes that brokers already provide information and documents, e.g., rate confirmation documents, to motor carriers. The Agency believes that these current practices can be adjusted, at relatively low cost, to provide broker transparency information within 48 hours of request. The Agency analyzes these potential costs qualitatively and seeks further information and data from the public to better analyze the costs. The Agency does not believe that this rule would be economically significant.

III. Abbreviations

API Application programming interface

BLS Bureau of Labor Statistics

COVID-19 Coronavirus disease 2019

DOJ Department of Justice

DOT Department of Transportation

DTSA Defend Trade Secrets Act of 2016

EDI Electronic data interchange

FHWA Federal Highway Administration

FMCSA Federal Motor Carrier Safety Administration

FR Federal Register

HHG Household goods

ICC Interstate Commerce Commission

IT Information technology

MATS Mid-America Trucking Show

NAICS North American Industry Classification System

NCCDB National Consumer Complaint Database

NPRM Notice of proposed rulemaking

OIRA Office of Information and Regulatory Affairs

OMB Office of Management and Budget

OOIDA Owner-Operator Independent Drivers Association

PIA Privacy Impact Assessment

PII Personally identifiable information

PPP Paycheck Protection Program

PTA Privacy Threshold Assessment

SAS Service Annual Survey

SBA Small Business Administration

SBTC Small Business in Transportation Coalition

Secretary Secretary of Transportation

TIA Transportation Intermediaries Association

UMRA Unfunded Mandates Reform Act of 1995

U.S.C. United States Code

IV. Legal Basis

The Secretary of Transportation (Secretary) has general jurisdiction to establish regulations concerning the procurement by property brokers of for-hire transportation in interstate or foreign commerce (49 U.S.C. 13501). The Secretary is authorized to obtain information from motor carriers, brokers, and other related parties that the Secretary determines is necessary to ensure a transportation system that meets the needs of the United States (49 U.S.C. 13101 and 13301(b)).

The Secretary has broad authority to adopt regulations to carry out the requirements of the commercial statutes in Title 49 U.S.C., subtitle IV, part B (49 U.S.C. 13301(a)). Some of the needs articulated in the national transportation policy (49 U.S.C. 13101) include encouraging fair competition and reasonable rates for transportation by motor carriers of property; promoting efficiency in the motor carrier transportation system; enabling efficient and well-managed motor carriers to earn adequate profits, attract capital, and maintain fair wages and working conditions; and improving and maintaining a sound, safe, and competitive privately owned motor carrier system. The Secretary is also authorized to prescribe the form of any required records prepared or compiled by brokers, including those related to movement of traffic and receipts and expenditures of money, and the time period for preservation of such records (49 U.S.C. 14122). Furthermore, under 49 U.S.C. 13904(e), regulations applicable to brokers “shall provide for the protection of motor carriers and shippers by motor vehicle.” 2

2 The previous version of the statute (located at 49 U.S.C. 13904(c)) only required the Secretary to provide for the protection of shippers by motor vehicle in broker regulations. The Moving Ahead for Progress in the 21st Century Act (MAP-21), Public Law 112-141 (July 6, 2012), amended this provision to include the protection of motor carriers as a requirement for regulations applicable to brokers. Sec. 32916, Public Law 112-141, 126 Stat. 820 (July 6, 2012).

In recent years, many motor carriers, industry-wide, have expressed concern about their inability to access records pertaining to their transactions with brokers. The inability to obtain these records from brokers has led to financial harm, including but not limited to, an inability to present a proper defense when shippers or brokers allege problems with a shipment. Because FMCSA's mandate under 49 U.S.C. 13904 specifically includes providing for the protection of motor carriers with respect to broker regulations, and because a records-transmittal regulation would protect both motor carriers and shippers, FMCSA's promulgation of such a regulation is authorized by 49 U.S.C. 13904(e).

This rulemaking is intended to address an asymmetry of information between brokers, shippers, and motor carriers that affects the ability of all parties to participate effectively in a fair, efficient transportation system. FMCSA intends to modernize regulations applicable to broker recordkeeping and disclosure while complying with the requirement in 49 U.S.C. 13904(e) to ensure that the regulations provide for the protection of motor carriers and shippers. FMCSA relies on the statutory authorities cited above.

Authority to carry out the functions and exercise the authorities cited above is delegated to the FMCSA Administrator under 49 CFR 1.87(a)(1)-(3) and (5)-(6).

V. Background

FMCSA regulates property brokers, defined as persons who, for compensation, arrange or offer to arrange the transportation of property by an authorized motor carrier (49 CFR 371.2(a)). The property broker regulations include recordkeeping requirements, for each transaction, at 49 CFR 371.3 “Records to be kept by brokers.” A brokered transaction for transportation of property involves at least a shipper seeking to have the property transported, a carrier willing to transport the property, and a broker who arranges the transportation. There may be separate contracts between the broker and the shipper and between the broker and the carrier, but the broker, carrier, and shipper are all party to the same brokered transaction for the purpose of the broker recordkeeping regulation. The relationship between the parties is further explained in the Property Broker Practices NPRM (45 FR 31140, 31141, May 12, 1980). Under the broker recordkeeping regulation, FMCSA requires brokers to make certain transaction records available to the transacting parties, that is, the shipper, the motor carrier, and any other party to the brokered property transaction. The availability of this information is sometimes referred to as “broker transparency.” The term should not be misunderstood to mean public disclosure of the information, i.e., “public transparency.”

FMCSA proposes to amend the broker transparency requirement. FMCSA initiated the rulemaking based on the grant of two rulemaking petitions regarding broker transparency, and the Agency has also received input on the topic through several related actions. The petitions and related actions are summarized below. The broker transparency regulation has a long history, with several predecessor rules and regulations. The regulatory history is summarized below.

A. History of Property Broker Regulations

Congress tasked the Interstate Commerce Commission (ICC) with regulating the motor carrier industry in the Motor Carrier Act of 1935, which included regulating property brokers operating in the industry (Pub. L. 74-255). The ICC issued its initial rule regulating brokers in 1949 (14 FR 2833, May 28, 1949). The rule was based on an ICC report entitled Practices of Property Brokers (Ex Parte MC-39, 49 Motor Carrier Cases (MCC) 277 (May 16, 1949)). The report contemplated imposing a cap on broker commissions to address concerns over alleged excesses. The ICC postponed implementation of a cap because it lacked information to determine an appropriate upper limit. In the interim, the ICC believed that concerns over commissions could be addressed by having brokers maintain a public schedule of services with their maximum charges for brokerage services. The cap was not pursued further, and the interim solution persisted, as described in the follow-on report “Practices of Property Brokers” (Ex Parte MC-39, 53 MCC 633 (Dec. 27, 1951)).

The property broker regulations remained unmodified for several decades, except for a recodification that relocated them within Title 49, from part 167 to part 1045 (49 FR 20003, Dec. 20, 1967). On May 12, 1980, the ICC published an NPRM to revise the property broker regulations (45 FR 31140). This proposed rule sought to eliminate unnecessary regulations and to modify regulations that were unnecessarily restrictive. The intent generally aligned with the purpose of the Motor Carrier Act of 1980 (Pub. L. 96-296), which was not in force at the time, but which was enacted a few months later, on July 1, 1980. The ICC made this connection clear in the final rule published on October 17, 1980 (45 FR 68941). That rule explained that Congress had given the ICC the general mandate to open up the bargaining process between shippers and motor carriers, and it sought to remove unnecessary restrictions which might impede the free operation of the marketplace. The ICC viewed its revisions to the property broker regulations as consistent with those goals. The rulemaking put into place regulations that are substantially similar to FMCSA's current property broker regulations.

The final rule included a revised 49 CFR 1045.3, which had the same requirements as the current 49 CFR 371.3 in all significant respects, including the recordkeeping requirement placed on brokers and the right of each party to the transaction to review the record. In discussing the revisions to the required records in the NPRM, the ICC stated that the primary purpose of the recordkeeping requirements was to ascertain whether improper rebating activities were taking place, and it noted that the proposed rule also included revisions to the rebating rules (45 FR 31140). When the ICC issued the original property broker regulations, it was concerned with a form of indirect rebating where brokers would undercharge for services to shippers as a means to secure and control the shippers' traffic and make up for the undercharging by charging motor carriers instead (49 MCC 277, 317-18). In the 1980 NPRM, the ICC stated that this concern over indirect rebating was no longer valid, and it revised the rebating regulations accordingly (45 FR 31140, 31141).

After explaining the revisions to the required record contents, the ICC then explained the addition of the right-to-review requirement as a replacement for more complex requirements in §§1045.5, 1045.6, and 1045.10 (45 FR 31140). The ICC explained that §1045.5, which required brokers to make their maximum prices for brokerage services publicly available and to adhere to those prices, could be rendered ineffective by brokers giving a wide price range instead (45 FR 31140, 31141). The same was true of §1045.6, which set forth similar restrictions on prices for non-brokerage services. In removing these regulations in favor of the new §1045.3(c), the ICC explained that the new regulation would enable parties to determine what portion of their bill was related to the broker's services (45 FR 31140, 31141). Section 1045.10 prohibited brokers from charging both the shipper and the carrier for a service without first advising both parties of the details of the charges. The ICC stated that this requirement was unnecessary and potentially burdensome since proper notification could delay service, particularly when the broker was trying to arrange freight transportation on an expedited basis, and it was replaced by the right to review in §1045.3(c) (45 FR 31140, 31141). The broker regulations remain substantially the same as when they were amended in 1980.

In 1996, pursuant to the ICC Termination Act (Pub. L. 104-88), responsibility for certain transportation regulations was transferred from the ICC to DOT and delegated by DOT to FHWA (61 FR 54706, Oct. 21, 1996). This transfer and redesignation included part 1045, which was moved to part 371. Part 371 was subject to a minor technical amendment in 1997 but has remained otherwise unchanged since that time (62 FR 15417, Apr. 1, 1997). FMCSA assumed responsibility for part 371 when the Agency was created by the Motor Carrier Safety Improvement Act of 1999 (Pub. L. 106-159), and the Secretary subsequently delegated authority to administer 49 U.S.C. chapters 131, 133, 135, and 139 to the FMCSA Administrator (65 FR 220, Jan. 4, 2000).

B. History of the Current Rulemaking

On May 6, 2020, the Small Business in Transportation Coalition (SBTC) petitioned the Department to initiate a rulemaking amending the broker transparency regulation. SBTC described §371.3, the broker transparency regulation, as providing motor carriers with a “right to know” the rate offered by the broker as a proportion of the rate paid by the shipper to the broker. SBTC raised concerns about the widespread practice of brokers including clauses in their contracts that waive a carrier's rights under §371.3(c). Transparency is necessary for a market to operate in an ethical and fair manner, SBTC argued, and the prevalence of waiver clauses undercuts that transparency. As a remedy, the petition proposed prohibiting brokers from requiring waiver of broker transparency as a condition of doing business. SBTC's petition referenced the economic impacts of the COVID-19 national emergency, impacts that were being acutely felt when the petition was filed in May 2020.

On May 19, 2020, the Owner-Operator Independent Drivers Association (OOIDA) petitioned the Department to initiate a rulemaking amending the broker transparency regulation. The petition sought two changes to §371.3. First, the petition proposed adding a requirement that brokers provide a copy of the transaction record required under §371.3(a), in an electronic format, within 48 hours of the service being completed. Second, the petition proposed prohibiting brokers from including clauses in their contracts that waive motor carriers' rights to access the transaction records required under 371.3. The petition argued that the prevalence of waiver clauses and instances of retaliation by brokers against motor carriers seeking to exercise their rights under §371.3(c) undercut the transparency envisioned by §371.3. As with the SBTC petition, the OOIDA petition referenced the economic conditions affecting truckers at the time. Both petitions for rulemaking are included in the docket for this rulemaking.

FMCSA published a notice in the Federal Register on August 19, 2020, requesting public comment on OOIDA's and SBTC's rulemaking petitions (85 FR 51145). On October 16, 2020, the Agency extended the comment period by 30 days (85 FR 65898). The Agency received 1,391 comments on OOIDA's and SBTC's rulemaking petitions by the end of the extended comment period. The public commented on the transparency of charges and payments, broker margins, freedom of contract, pricing confidentiality, and the history of the broker transparency regulation. These issues are discussed below in Section VI.B., Comments and Agency Responses. On March 16, 2023, FMCSA granted OOIDA's and SBTC's rulemaking petitions. In the letters granting the SBTC and OOIDA petitions, FMCSA made clear that, while the Agency found good cause to open a rulemaking to amend 49 CFR 371.3, the proposed rule would not necessarily include the changes SBTC or OOIDA sought. The letters granting the petitions are available in the docket for this rulemaking.

C. Related Actions

In the time between the filing and grant of these petitions several related actions have provided the Agency with further information about broker transparency and wider context of the rulemaking. The related actions also indicate that the concerns surrounding broker transparency have persisted beyond the specific economic conditions of the freight industry in 2020.

Shortly after the OOIDA and SBTC petitions were filed, the Transportation Intermediaries Association (TIA) filed a rulemaking petition on August 4, 2020, seeking the elimination of §371.3(c) and requesting guidance on dispatch services. Only the portion directed towards the elimination of §371.3(c) is relevant to this rulemaking. 3 The TIA petition argued that the regulation is outdated given the changes in the brokered freight industry since the regulation was introduced in 1980. The petition further argued that broker transparency jeopardizes the confidentiality of proprietary pricing, and that motor carriers have sufficient information about prevailing rates to make informed business decisions without needing the records required by §371.3.

3 FMCSA issued guidance on the definitions of “broker” and “bona fide agent,” including guidance on the role dispatch services play in the transportation industry and clarification on when such entities must register as brokers, on November 16, 2023 (88 FR 39368).

The Agency published a request for public comments regarding TIA's petition on November 25, 2020 (85 FR 75280) and received 179 comments in response. These comments were substantially similar to those filed in response to the OOIDA and SBTC petitions. FMCSA denied TIA's petition on March 17, 2023. 4 In denying the petition, the Agency stated that TIA's proposal would be contrary to the stated transportation policy goals in 49 U.S.C. 13101, including promotion of fairness and efficiency in the transportation industry.

4 The petition for rulemaking and denial letters are available in the docket for this rulemaking.

While the SBTC, OOIDA, and TIA petitions were pending, FMCSA held a public listening session on October 28, 2020, regarding the three petitions and property brokers in general (85 FR 64613, Oct. 13, 2020). FMCSA received 76 written comments in response to the Federal Register notice announcing the listening session. During the listening session, participants expressed concerns about freight rates, disclosure of confidential pricing information, motor carriers directly soliciting shippers, so-called “double brokering,” record-keeping costs, comparisons to other industries, charge backs, and detention time fees.

The Agency has received additional input from the public on the topic of broker transparency in several other contexts. In March 2023, the Agency held a listening session at the Mid-America Trucking Show (MATS) shortly after granting the SBTC and OOIDA petitions. 5 Despite the Agency's public statement that the listening session would focus on other broker matters, including financial responsibility, public commenters at MATS focused on broker transparency. Many of the transparency related concerns were consistent with those raised in the comments on the OOIDA and SBTC rulemaking petitions in 2020, suggesting that the issues raised at the time of the public comment period for those petitions had not subsided as of March 2023.

5 The transcript of the listening session is available in the docket for this rulemaking.

The topic of broker transparency has also appeared in the comments received on other proposed rules. 6 While comments are most useful to the Agency when directed towards the subject matter of the public notice to which they respond, the Agency acknowledges these ancillary comments as evidence of continuing concerns around broker transparency.

6 See, e.g., Comment FMCSA-2023-0268-0026 (comment on “Fees for the Unified Carrier Registration Plan and Agreement”) available at https://www.regulations.gov/comment/FMCSA-2023-0268-0026; comment FMCSA-2016-0102-0351 (comment on “Broker and Freight Forwarder Financial Responsibility”) available at https://www.regulations.gov/comment/FMCSA-2016-0102-0351.

VI. Discussion of Proposed Rulemaking and Comments

FMCSA proposes this rulemaking in response to OOIDA's and SBTC's petitions. The NPRM differs in certain ways from the provisions sought by OOIDA and SBTC, as discussed below. The rulemaking is also informed by the comments received in response to the petitions, as well as in the related actions detailed elsewhere in this NPRM. The comments, input from related actions, and the Agency's responses are discussed after the provisions of the proposed rulemaking.

A. Proposed Rulemaking

To address the concerns over broker transparency raised in the rulemaking petitions and subsequent public comments, FMCSA proposes the following amendments to §371.3, “Records to be kept by brokers,” presented in the order in which they would appear in the section. The Agency also proposes a conforming amendment to §371.2, “Definitions.”

Sections 371.2 and 371.3 apply to all property brokers FMCSA regulates, as would the proposed amendments. Property brokers are divided between household goods (HHG) brokers, who arrange the transportation of personal property between homes, and non-HHG (i.e., general freight) brokers. FMCSA believes that the broker transparency regulation should continue to apply equally to HHG brokers and general freight brokers, and the Agency has not identified any rationale for imposing different transparency requirements on HHG brokers versus general freight brokers. The comments received to date do not raise any broker transparency concerns unique to HHG brokers, and the Agency seeks comment on this issue.

1. Brokers Must Keep Records in an Electronic Format

FMCSA proposes requiring that the records covered by §371.3(a) be kept in an electronic format to promote compliance with the broker transparency requirement in §371.3(c). The Agency is aware of brokers avoiding meaningful compliance with §371.3(c) by making the required records available for inspection only at their principal place of business, which often makes inspection by the motor carrier difficult or impossible. By requiring that the records be kept in an electronic format, the Agency intends to remedy this issue. Because the Agency, based on its interactions with various brokers, believes that most freight brokers already keep their records in an electronic format, this requirement should not impose a significant burden on these brokers. FMCSA believes that electronic recordkeeping may not be as common among household goods brokers and seeks comment on what burden, if any, would be imposed upon those brokers if electronic recordkeeping were required.

2. Revisions to the Required Contents of Brokers' Records

Within the recordkeeping requirements of §371.3, paragraph (a) specifies the details that the records must contain. The Agency proposes the following revisions to ensure that the records are tailored to the needs of the parties, therefore better addressing the concerns of motor carriers while not imposing unnecessary recordkeeping burdens on brokers.

Date of Payment

The Agency proposes adding the date of payment from both the shipper to the broker and from the broker to the carrier. Some brokers commented that they bear significant risk because they tender payment to motor carriers prior to receiving payment from shippers, for instance, in a situation where the carrier is paid within 3 days of delivering a load, but the shipper has 30 days to pay the broker. On the other hand, motor carriers have commented about not being paid by brokers in a timely manner, often in the context of a charge back or other contractual dispute over whether the carrier performed their duties adequately under the contract. Including the date of payment would provide transparency to all parties about the benefits and risks of the carrier's payment structure. It would also provide motor carriers with necessary information in the event they experience charge backs or other instances of nonpayment, because the carrier would be better able to understand any deductions the shipper may have made to the payment it remitted to the broker and to verify that those deductions correspond to the charge back against the carrier.

Elimination of Brokerage Service vs. Non-Brokerage Service Distinction

The Agency proposes eliminating the distinction between brokerage services and non-brokerage services in §371.3(a) by removing current paragraph (5) and revising paragraph (4). This distinction was originally made by the ICC in its 1949 rule, which was based on the “Practices of Property Brokers” report. As explained in the report, the ICC was contemplating a cap on brokers' commissions. The ICC distinguished between brokerage and non-brokerage services to support implementation of the cap and to prevent brokers from circumventing it through charges for non-brokerage services. The contemplated cap was deferred from the 1949 rule and ultimately never adopted. Despite this, the distinction between brokerage and non-brokerage services was included as part of the rule and has remained in the regulations ever since.

The Agency believes that the distinction between brokerage and non-brokerage services is unnecessary for the purposes of the broker transparency regulation and proposes removing the distinction in favor of a simpler itemization requirement described below. The term non-brokerage service is defined at §371.2(d), and used only in §371.3(a)(5), so the Agency also proposes removing the definition of non-brokerage service, which would no longer be used.

Itemization of Charges and Fees

The Agency proposes clarifying that the records must itemize all charges and fees associated with the brokerage service, to include an amount and description of each charge and fee. Brokers would also be required to itemize any penalties assessed in connection with the shipment, for example, a penalty for late delivery or cargo damage. This revision is intended to ensure the parties have visibility into the payments, fees, and charges associated with the transaction, and can resolve issues and disputes without resorting to costlier remedies.

3. Brokers Must Provide Records Upon Request

In their petitions, both OOIDA and SBTC sought an explicit ban on waivers of the requirements in 371.3(c). However, as a general principle, parties are permitted to waive any right unless Congress, by statute, specifically makes a right non-waivable. The Agency has not identified any statutory provision in which Congress expressly barred waivers in this context, and therefore the Agency has not included the requested language in the revised regulation. The petitions did, however, identify inconsistencies between this regulation and the rest of part 371, which the Agency intends to address through this rulemaking. To this end, the Agency proposes amending the language of §371.3(c) to more accurately describe the regulatory obligation imposed on brokers and the process for requesting and supplying transaction records.

When the ICC issued the broker transparency regulation in 1980, it stated that it would enable the elimination of other, more complex regulations. One of the major provisions eliminated, former 49 CFR 1045.10, related to the duties and obligations of a broker, which included giving fair advice to shippers and not misrepresenting or making false promises about the services motor carriers would provide; not misrepresenting or giving false information to motor carriers about the commodities in the shipment; advising both the shipper and carrier of the amount and basis of any compensation being received from the other; exercising due diligence in carrying out the terms of its contracts with shippers and motor carriers and ensuring prompt payment; and paying any freight charges in full to the carrier or carriers without deduction for any amount due to the broker from such carrier or carriers. The ICC was clear that its intention was not to eliminate these duties and responsibilities entirely, but rather that providing shippers and carriers with the ability to review the transaction records would ensure that brokers were acting honestly and fairly.

By phrasing the requirement as a private “right to review,” the original regulation did not prohibit a broker from requiring a waiver of the private “right to review” as a condition of brokering a load to a motor carrier and did not contain an enforcement mechanism for the Agency to enforce the private “right to review.” However, FMCSA believes the original wording did not adequately capture the ICC's intent that brokers continue to comply with those duties and obligations, particularly disclosure of such records to shippers and motor carriers who find value in such information. To address these concerns, FMCSA has reframed the disclosure requirement as a regulatory obligation, as the Agency believes this more closely aligns with the original intent of the regulation. Moreover, a regulated entity must adhere to the regulations and cannot “disguise its regulatory obligations as contractual ones.” Taylor Energy Co. LLC v. United States, 975 F.3d 1303, 1306 (Fed. Cir. 2020). These changes would also ensure that the language in §371.3(c) is consistent with the other broker requirements in part 371.

The proposed amendments to §371.3(c) would clarify that brokers maintain a continuing duty to act fairly and honestly, and that visibility into the transaction records is the mechanism by which shippers and carriers can ensure that brokers are complying with this duty. The requirement to provide the records upon request would thus be made explicit as a regulatory obligation. The proposed rule would not, however, prohibit brokers from including confidentiality clauses in their contracts with motor carriers. As long as brokers are complying with the requirement to disclose records upon request, the parties may negotiate and reach agreements regarding non-disclosure of the information to non-parties.

4. Records Must Be Provided Within 48 Hours of Request

As discussed in the comments, the Agency is aware of brokers avoiding meaningful compliance with the regulation by delaying the availability of records for review, and by restricting access for review to their principal place of business. The Agency proposes amending §371.3(c) to require that records must be provided within 48 hours. This amendment is intended to provide the requestor with the records in a timely fashion, which enables the use of the records to resolve any issues around service or payment. By requiring the broker to “provide” records electronically, this amendment is intended to prevent a broker from only making its records available for review at its principal place of business or another, potentially inconvenient, location. Instead, the amendment plainly places the responsibility of delivering the information to the requestor on the broker.

B. Comments and Agency Responses

In the notice requesting public comment on OOIDA's and SBTC's rulemaking petitions (85 FR 51145, Aug. 19, 2020), the Agency posed a series of questions regarding the rulemaking sought by the petitions. FMCSA received a large number of comments in response to the notice, and in subsequent related actions, many responsive to the questions posed and others raising additional issues for the Agency's consideration. The comments expressed a range of views from motor carriers, brokers, and other interested parties, and the Agency's proposed rulemaking is informed by this input.

1. The Agency's Authority Over Broker Transparency

The first question the Agency posed in the notice regarding the rulemaking petitions referenced FMCSA's existing authorities related to brokers (49 U.S.C. 13101-14916) and asked what statutory provisions, if any, would be carried out by the regulatory changes requested petitioners requested. Both successful petitioners, OOIDA and SBTC, indicated that FMCSA has existing authority to carry out the proposed changes in the petitions for rulemaking. OOIDA indicated Congress has required the Secretary, and hence FMCSA, to regulate brokers to protect motor carriers, including requiring brokers to have a bond as found in 49 U.S.C. 13904(e) and (f), as detailed in OOIDA's petition. SBTC indicated FMCSA already has existing authority to act on these petitions for rulemaking under U.S.C. 13101 through 14916, and more specifically, 49 U.S.C. 14906, which addresses evasion of regulation by motor carriers and brokers.

Few commenters responded directly to the Agency's questions about authority. Of those who did, most indicated that FMCSA has a mission to promote safe operation of commercial motor vehicles, and any form of market regulation falls outside of this mission. Scopelitis, a national transportation law firm, for example, indicated there is no need for the existing regulations in a highly competitive industry, much less the proposed addition of even more regulatory burden.

FMCSA also asked how a rule restricting the rights of private parties (e.g., brokers) from including certain terms in their agreements would align with the Agency's statutory authority. Few commenters directly addressed this question. TIA and MODE Transportation, for example, indicated that 49 U.S.C. 14101 provides brokers the option to include a waiver provision. The applicability of 49 U.S.C. 14101 is discussed in Section VI.B.8. The National Association of Small Trucking Companies did not cite a specific statute but indicated that dictating the terms of contracts between private parties was beyond FMCSA's authority. In contrast, OOIDA and SBTC commented that FMCSA has the authority to restrict private parties from including a waiver under FMCSA's existing authority. Overall, there was substantial disagreement on this question.

FMCSA response: As discussed in Section IV. Legal Basis, the Agency has the authority to establish certain regulations for property brokers. The Agency believes that the proposed rule, which revises the recordkeeping regulations for property brokers, falls squarely within this authority. Comments that characterize broker transparency as beyond the Agency's authority and unrelated to safety oversimplify both the Agency's authority and the purpose of broker transparency. FMCSA and its predecessor agencies have long been responsible for regulating certain commercial aspects of motor carrier transportation, including broker recordkeeping.

2. FMCSA Enforcement Role

Question two asked how a rulemaking expanding FMCSA's enforcement of a requirement that brokers automatically disclose financial details about each transaction to the motor carrier transporting the load, as requested in the OOIDA and SBTC petitions, would align with the statutes identified above (i.e., 49 U.S.C. 13301 and 14122).

In its comments on the petitions, CR England Logistics stated that the rulemakings proposed by OOIDA and SBTC do not align with existing FMCSA statutes. TIA indicated that disclosure of financial details is in direct conflict with 49 U.S.C. 14101(b), in addition to Congressional intent. A small number of commenters, such as TIA, stated disclosure of commission, a violation of §371.3, has not been an issue. TIA further stated there have been no complaints made to DOT's National Consumer Complaint Database (NCCDB) for a violation of a broker not disclosing its commission under §371.3(c). OOIDA stated FMCSA would not experience additional burdens by adopting the changes proposed in the petitions and already has existing authority to do so under 49 U.S.C. 13904 and 14122.

FMCSA response: The Agency believes that the proposed rulemaking is an appropriate exercise of its authority that builds on the current recordkeeping requirements. Since the filing of these petitions, broker transparency has become a topic of intense interest in the transportation industry. According to Agency records, at least 32 complaints were received from 2018 through 2020. The Agency receives complaints through NCCDB and other sources. As detailed above, FMCSA believes the language of the original regulation does not accurately describe the transacting parties' rights and burdens, and that a broker's obligation to provide records is not premised on any inherent right of the carrier or shipper to receive those records, but rather on the Agency's statutory authority to protect motor carriers in connection with its broker recordkeeping regulations.

FMCSA has several options for enforcing these regulations. In order to register with FMCSA, brokers must agree to comply with all applicable regulations (49 U.S.C. 13904(a)(2)), and FMCSA has the authority to suspend or revoke a broker's operating authority for willful failure to comply with a condition of registration (49 U.S.C. 13905(d)(2)(A)(iii)). FMCSA may also decline to renew a broker's registration if the broker has demonstrated it is not willing or able to comply with the regulations.

The Agency has a further option to seek a civil penalty for regulatory violations. The penalty schedule in 49 CFR part 386 Appendix B already sets out penalties for violations of FMCSA's commercial regulations in paragraph (g), as well as penalties for evasion in paragraph (i). The existing penalties cover violations of this proposed rule, so FMCSA does not propose a new enforcement mechanism or alter the current penalty schedule as part of this rulemaking. FMCSA is aware that the Department of Justice (DOJ) must bring certain enforcement actions for civil penalties on behalf of FMCSA. 7 However, parties may still file complaints with FMCSA for the Agency to investigate, take enforcement action within its existing authorities, and refer to DOJ as appropriate.

7 See In the Matter of Darlene Riojas, Manuel J. Riojas, Four Star Trucking, Inc., 7 Star Transport, LLC—Order Dismissing Three Charges for Lack of Subject Matter Jurisdiction, and Reserving Ruling on Other Summary Judgment Requests, Docket No. FMCSA-2012-0174-0056 (May 8, 2019). This decision is available on the internet at https://www.regulations.gov/document/FMCSA-2012-0174-0056.

The Agency's exercise of authority to regulate broker recordkeeping, including its issuance of broker transparency regulations, is not in conflict with 49 U.S.C. 14101(b). That statute permits shippers and carriers to waive certain rights and remedies by contract, but for reasons discussed in section VI.B.8. of this NPRM, the Agency believes brokers are not shippers within the meaning set out by 49 U.S.C. 14101(b). Because the statute does not relate to brokers, it does not conflict with the Agency's broker transparency regulations. Congress has also expressed its clear intent in 49 U.S.C. 13904(e) for the Agency to issue regulations applicable to brokers that provide protection for shippers and motor carriers, consistent with the Agency's responsibility to carry out the objectives of the national transportation policy and its general authority to regulate brokers of property.

3. Broker Size as Related to Transparency

The third question in the notice was whether the transparency issues raised by OOIDA and SBTC are limited to small brokers or large brokers (e.g., brokers with revenues above a certain threshold, brokers with a certain number of transactions, etc.) or whether they are more widespread such that the rulemaking should cover all brokers, regardless of size. The fourth question assumed that transparency issues were primarily associated with large brokers and asked what revenue threshold FMCSA should consider for the applicability of any new requirements. It also asked how the Agency could obtain accurate information about brokers' revenues.

Of the commenters that responded directly to the third question, the majority indicated that the proposed rule should apply equally to large and small brokers. These commenters included brokers and trade associations, such as England Logistics and OOIDA, and a large number of individuals involved in the trucking industry.

A smaller number of commenters responding to question four indicated that freight brokers, particularly large brokers, due to their size and resources, are taking advantage of the current situation. However, most commenters did not differentiate based on the size of the broker but rather stated that brokers as a whole were not transparent and were not treating motor carriers fairly.

FMCSA response: The Agency believes that the proposed broker transparency requirements should apply to all brokers, regardless of size, as is the case with the current regulation. The Agency believes that a lack of broker transparency causes problems whether the broker who arranged the transportation is large or small.

4. Cost of Providing Transaction Records

The fifth question posed related to the most efficient and effective means for brokers to provide information, automatically and electronically, to motor carriers. The Agency asked whether each broker should have, for example, a stand-alone system with motor carriers receiving an email from the broker after the contractual service has been completed, or whether the brokers should be allowed to satisfy the request with partnerships or networks through which registered brokers would upload transaction information which would then be automatically transmitted via the network to the registered carrier associated with the transaction. The sixth question, related to the fifth, was a request for cost estimates for implementing an information technology (IT) solution to accomplish OOIDA's request, either through stand-alone systems run by individual brokers, or systems operated by groups of brokers notifying the individual motor carriers utilizing any of the brokers within the group.

The majority of the commenters agreed that electronic transmission is the most efficient means for brokers to provide information. However, one commenter, MODE Transportation, indicated that implementing an electronic or IT solution is not required to solve the transparency issue and was never envisioned when §371.3 was developed. Echo Global Logistics stated that much of the information sought through broker transparency is already publicly available, including rate information from aggregators like DAT.com and required financial reports from publicly-held brokers. Echo Global Logistics argued that, given the public availability of this information, the cost of developing and maintaining an electronic reporting system to comply with the petitioners' proposed regulations is not justifiable.

There was disagreement among commenters as to whether a proposed electronic system should be stand alone or a current electronic format(s) which the broker may already be using. Some commenters mentioned use of existing electronic formats, such as email, spreadsheets, faxes, which are in common use to meet a proposed electronic requirement. However, most brokers that commented indicated that dedicated stand-alone systems such as an electronic data interchange (EDI) or application programming interface (API) are just as likely to be already in use by many freight brokers, and these systems provide the necessary data privacy and security. England Logistics mentioned that the data transmitted could potentially be trade secrets and therefore would require more intensive IT systems to protect.

In terms of cost, most commenters indicated that, if the use of a standalone system such as EDI or API were required, it would have a cost impact on those brokers which do not have such systems in place already. Both Axle and Lange Logistics indicated this cost impact may affect small businesses more profoundly than others.

Five commenters directly responded to question six and provided a cost estimate for brokers to establish an electronic system to transmit records. Trinity Logistics and Tucker Worldwide estimated a cost of $2,500 to $10,000 per carrier setup. TIA further provided an estimated cost example of a broker that utilizes 5,000 motor carriers in their database, using their own existing IT system (presumably EDI- or API-based), would incur a cost of $12.5 million to $50 million for implementation. ArcBest indicated personnel and equipment required to implement the electronic information transfer would be $500,000 per broker.

FMCSA response: FMCSA is not proposing to prescribe a specific type of electronic system brokers must use, provided the system complies with 49 CFR 390.32, “Electronic documents and signatures.” The Agency finds that the requirements listed there are appropriate in the context of the broker recordkeeping requirements and sees a benefit in having a consistent standard for electronic documents. FMCSA's experience in reviewing brokers' records shows that most records covered by §371.3(a), including bills of lading, are already kept in electronic format, though paper bills of lading may still be occasionally used. Thus, the burden on parties to keep and transmit transaction records electronically is expected to be minimal.

The proposed rule does not include an automatic disclosure provision. FMCSA believes that the cost estimates provided in response to question 6, which were related to developing an IT solution for automatic disclosure within 48 hours of the completion of contractual obligations, are overestimated. Since the rule does not include an automatic disclosure provision and records would only be provided upon request within 48 hours, the Agency expects that the costs would be significantly lower because brokers' existing systems, either as currently implemented or with minor modification, could be used to fulfill these requirements. However, the Agency lacks specific data to quantify these costs and is seeking public comments on the cost estimates for this proposal.

In response to the comment that much of the information brokers would have to provide is already publicly available, FMCSA notes that information found on publicly held brokers' financial reports is not transaction specific. While reviewing this information could give shippers and motor carriers a general sense of the state of the freight brokerage industry, it does not provide them with information about the loads they have consigned or hauled. Rate aggregation websites provide pricing information that carriers may find useful in deciding whether to accept an offer to haul a prospective load, but it is also not a substitute for broker transparency information. In particular, it would not provide shipper, carrier, or bill of lading information for a particular shipment, nor would it provide carriers with any information about chargebacks or other fees assessed against them in connection with a particular delivery. FMCSA therefore does not believe relying on publicly-available information is an adequate substitute for the information disclosure proposed in this rule.

5. Economic Benefits to Motor Carriers and Costs to Brokers

Both rulemaking petitions linked broker transparency to concerns over carrier revenue and broker margins, and the notice requesting public comment sought input on these concerns. Margins, as discussed in this proposed rulemaking, refer to the division of a shipper's payment between the broker and the motor carrier, expressed as a percentage. SBTC stated that, in the context of the economic impact of the COVID-19 national emergency, freight rates had dropped drastically, yet brokers, in at least a few instances, were making large margins on freight. SBTC stated that it did not seek regulations limiting the amounts or percentages brokers earn, but it viewed broker transparency as essential to making sure market forces operate ethically and fairly. The OOIDA petition raised similar concerns. The notice asked for quantitative estimates of the economic benefits that would likely be achieved by motor carriers if FMCSA adopted the rules requested by OOIDA and SBTC, including how much additional revenue motor carriers might receive on a per-transaction basis. The notice also sought quantitative estimates of the economic costs to brokers or others, including how much profit reduction on a per-transaction basis brokers would experience and what percentage of the costs would be passed through to shippers or motor carriers.

Only a few commenters responded to these questions. OOIDA estimated that the additional revenue a carrier would earn in an individual transaction would be between tens to thousands of dollars, depending on the specifics of the transaction. This estimate was preceded by a discussion of increased convenience and a decrease in unfair billing practices, and it is unclear how OOIDA's estimated additional revenue was apportioned among the increase in convenience, the decrease in unfair billing practices, greater negotiating power for motor carriers, or other factors. Few of the comments from small motor carriers contained responsive estimates, and several motor carriers noted that the current lack of broker transparency meant that they do not have access to the transaction information necessary to provide an informed estimate. Brokers commented that motor carriers would not receive any economic benefit from the proposed transparency rulemaking. Brokers provided estimates of the cost to comply with OOIDA's proposal based on information technology and staffing costs but did not provide an estimate of the economic impact due to changes to freight rates, profit reduction on a per-transaction basis for brokers, or percentage of costs that would be passed through to shippers or motor carriers.

Although the Agency received few quantitative estimates of the economic benefits of broker transparency to motor carriers and the economic costs to brokers, many comments addressed carrier revenue and broker margins. Motor carriers commented on the prevailing low freight rates at the time and provided examples of offers of one dollar or less per mile. Motor carriers described the impact of these low rates. For example, some comments stated that the offered rates make it difficult to cover motor carriers' operating expenses, including maintaining equipment in safe working condition. Some comments also described low rates as a contributor to undue stress on drivers and unsafe operating practices. Many comments from motor carriers characterized the rates as inequitable given the difficulty of the work they do and value of the service they provide. Many of these comments identified brokers as responsible, at least in part, for low rates and many characterized the brokers' business practices as deceitful. Carriers also say they cannot operate a profitable business unless they haul brokered loads, and some have reported taking brokered loads at a loss, citing the need for revenue to service business debts. In addition, many motor carriers expressed concern that they lack negotiating power to exclude transparency waiver provisions from contracts and, if they exercise their right to view the transaction records, brokers will select other motor carriers to work with and refuse to do business with them in the future.

Many comments from motor carriers support the broker transparency proposals in the petitions as a remedy for the issues they raised. Some comments state that increased broker transparency would allow motor carriers to negotiate higher rates. Many comments simply supported broker transparency as a means for increasing carrier revenue, without describing how revenue would increase as a result of transparency. Other comments suggested modifying the rules requested by OOIDA and SBTC to address their concerns about low rates more directly, including several suggestions to provide the broker transparency information when the parties are negotiating a rate, before the service is provided. Some of these comments stated that the transparency information would not be useful to the carrier after the transportation service had been provided.

Some motor carriers did not support broker transparency and stated that the information is irrelevant to motor carriers because the only pricing information they need is the offered rate. Other commenters proposed a rule limiting broker margins to a certain percentage of the price paid by the shipper.

Many of the comments from brokers challenged the assertions made in the petitions and other comments regarding freight rates and broker margins. Broker commenters also argued that low freight rates are not a result of high broker margins but rather a result of broad market forces, particularly the short-term acute economic impact of the COVID-19 national emergency. They disputed claims about price gouging by identifying a variety of factors that influence the price a broker sets for a load. Brokers also explained that their contracts with shippers are typically for a set period, often one year, while their contracts with motor carriers are typically shorter, often on a load-by-load basis. As a result, the broker's margin for a load covered by the shipper contract will fluctuate based on the spot market, so that the broker may have a higher margin on some loads and a lower, sometimes negative, margin on other loads. Brokers also explained that their margins should not be equated with profitability and described the various expenses incurred to provide brokerage services to shippers. These expenses would not be reflected in the broker transparency information.

Many of the comments from brokers stated that the rulemaking the petitions sought would not have the claimed effect of increasing carrier revenue. These comments stated that broker transparency would not increase freight rates. They also stated that load boards and other commonly available services already provide motor carriers with enough information regarding freight availability, traffic lanes, market rate information, seasonality adjustments, and so on to make informed business decisions, rendering the records available under §371.3 unnecessary. Some comments added that motor carriers can decline to take a load if the offered rate is too low to be profitable. In response, some comments explained that motor carriers with leased trucks may accept unprofitable loads to secure revenue, even as that revenue is not profitable.

Since the comment period closed, FMCSA has received further input regarding broker transparency. This input includes further expressions of concern regarding low prevailing freight rates, and of the belief that the low freight rates are caused, at least in part, by high broker margins. There is continued interest from motor carriers in broker transparency as a solution to low prevailing rates.

FMCSA response: The purpose of the proposed rule is not to provide an economic benefit to motor carriers, nor to impact broker margins. However, the Agency considers the economic impacts of the proposed rule as part of its mandated regulatory analysis. The comments received to date do not conclusively establish what the economic impact of the proposed rule would be. As with the current rule, the proposed rule would give shippers and carriers the option to access information about a brokered freight transaction after the parties have negotiated the terms of the contract and the transaction is complete but would not require disclosure prior to that time, nor would it require automatic disclosure. The information provided would allow the carrier to compare the amount that the shipper paid the broker to the amount that the broker paid the carrier but would not set or limit rates or brokers' margins. By clarifying the regulatory obligation for brokers to provide the transaction records, the proposed rule would make the information enumerated at §371.3(a) available to all parties participating in a brokered freight transaction.

Although the Agency cannot determine, with the currently available information, what economic impact the proposed rule would have, two main theories can be derived from the comments. Under one theory, broker transparency would not provide an economic benefit to motor carriers even if such transparency was widespread. Motor carriers would not have access to the transparency information when determining whether to accept a brokered load at the broker's offered price or when negotiating the price of a load with a broker. The information, provided after the fact, would not change the price of the load. The information may not have an impact on the price of future loads for a variety of reasons. The carrier may not find the information from past transactions useful when negotiating prices for future loads offered by the same broker or loads offered by other brokers. If, based on the transparency information, the carrier chose not to accept future loads from that broker, the carrier might not be able to find higher-paying loads from other brokers. Relatedly, the broker in that scenario may be able to find other motor carriers willing to accept the load, even if one carrier refuses to work with them.

Under the second theory, broker transparency would provide an economic benefit to motor carriers if such transparency was more widely available. The broker transparency information might impact the price of future loads that the carrier accepts. Motor carriers may be able to negotiate a higher price if they can apply their knowledge from previous loads to negotiations for future loads from the same broker or future loads with similar characteristics. Brokers may have to accept the higher price if they cannot find other motor carriers. Although the transparency information would not be publicly available, a broker might develop a reputation among motor carriers for offering low rates relative to the price paid by the shipper. If that reputation deterred motor carriers from taking loads, the broker may have to offer higher rates to place their loads. At least one broker highlighted concerns that transparency information could result in motor carriers directly soliciting shippers, bypassing brokers for future loads. The ICC considered this issue when it adopted the current regulations in 1980, emphasizing that motor carriers and shippers are free to deal directly with each other and “[o]nly where the shipper finds that it can get better service from the broker will it stay with the broker” (45 FR 68941, Oct. 17, 1980).

There exists a possibility that transparency information could reduce the exclusive knowledge that brokers bring to a transaction if shippers and motor carriers collect transparency information over time. If the Agency were to assume that the broker's exclusive knowledge is considered value-added and therefore currently captured in broker margins, then increased transparency with this proposal could result in downward pricing pressure on broker margins from motor carriers, shippers, or both.

As discussed in section VI.B.4, above, FMCSA does not view the information available on load boards or through other publicly available sources to be an adequate substitute for the transaction-specific information set out in this proposed rule. Shippers and motor carriers have an interest in knowing details about their particular shipments, especially when problems with a shipment arise or the compensation received differs from the contractual amount. Broker transparency provides the retrospective transaction-specific detail on completed loads necessary to resolve these issues. By contrast, the prevailing rate information available on load boards for prospective loads is useful for making informed decisions about which offers to accept but is not useful in addressing issues with completed loads.

From the comments received, the Agency cannot determine whether either of these theories would prove correct under the proposed rule. The actual impact may be somewhere in between these theories, or both theories may be incorrect. If broker transparency remained rare under the proposed rule, there may not be any economic impact. The Agency seeks further comment to better estimate the economic impact of the proposed rule.

6. Transparency of Charge Backs, Accessorial Fees, and Surcharges

The broker transparency comments brought up several issues not raised in the petitions or in the notice. One issue was the transparency of charge backs. Several comments described questionable claims in situations where a carrier delivered a load, got a clean bill of lading from the receiver, and then later had a claim, or “charge back,” on the load from the broker despite the clean bill of lading. Motor carriers contend that these claims often lack sufficient explanation or description of the reason for the charge back, and the motor carriers find it difficult to contest them, particularly when their payment for transporting the load is withheld unless they accede to the claim. In situations where the contracts include cross-collateralization provisions, payment for other loads transported by the same carrier for the same broker may also be withheld unless the claim is accepted.

Other comments described issues with detention charges and fuel surcharges, where the rates and conditions of the fees that brokers charge shippers are different than the rates and conditions of payments remitted to the carrier, despite the fees being premised on the carrier's operating costs. As an example, fees for detention time are premised on the operating costs of keeping a truck idle while waiting to load or unload, costs that include the driver's time. One commenter described a situation where the broker charged the shipper for detention time after the first hour, at a rate of $50 per hour, but paid the carrier for detention only after 4 hours, and at a rate of $35 per hour. Comments from motor carriers expressed similar concerns regarding fuel surcharges.

FMCSA response: The practices identified in the comments are concerning because, depending on their prevalence, they may significantly disrupt the efficiencies and opportunities offered by brokered freight transactions. Broker transparency seems to be a useful tool in addressing these concerns, by providing parties to a brokered transaction visibility into the associated payments, fees, and charges, enabling the parties to resolve issues and disputes among themselves without resorting to costlier remedies. If a claim is made against a shipment, the carrier should be able to understand the basis of the claim, not just to dispute questionable claims, and in instances of well-founded claims, to take precautions with future shipments and thereby avoid such claims. On the remittance of surcharges, there may be a reasonable justification for a broker to remit less than the full amount of a surcharge received from a shipper to a carrier, but the carrier should be able to see that difference, particularly when the surcharge is premised on the carrier's operating costs.

In addressing broker transparency, FMCSA cannot replace prudent business judgment and cannot guarantee the trustworthiness of every shipper, broker, and carrier. However, the brokered freight transportation industry requires a certain degree of trust to operate efficiently. Trust is eroded when motor carriers are prevented from seeing the charges and payments associated with the service they are providing. In addition to creating mistrust, unsubstantiated and specious charges levied on motor carriers divert resources to paying or litigating the charges, that could otherwise be spent providing safe and efficient transportation.

7. Confidentiality of Pricing