['Toxic Substances Control Act - EPA']

['Toxic Subtances Control Act - EPA', 'Toxic Substances - EPA']

05/13/2024

...

ENVIRONMENTAL PROTECTION AGENCY

40 CFR Part 700

[EPA-HQ-OPPT-2020-0493; FRL-7911-04-OCSPP]

RIN 2070-AK64

Fees for the Administration of the Toxic Substances Control Act (TSCA)

AGENCY: Environmental Protection Agency (EPA).

ACTION: Supplemental notice of proposed rulemaking.

SUMMARY: The Environmental Protection Agency (EPA) is issuing this document to modify and supplement its proposed rule issued on January 11, 2021, in which the Agency proposed updates and adjustments to the 2018 Fee Rule established under the Toxic Substances Control Act (TSCA). With over five years of experience administering the TSCA amendments of 2016, EPA is publishing this document to ensure that the fees charged accurately reflect the level of effort and resources needed to implement TSCA in the manner envisioned by Congress when it reformed the law. Additionally, the purpose of this document is to propose narrowing certain proposed exemptions for entities subject to the EPA-initiated risk evaluation fees and propose exemptions for the test rule fee activities; to propose modifications to the self-identification and reporting requirements for EPA-initiated risk evaluation and test rule fees; to propose a partial refund of fees for premanufacture notices withdrawn at any time after the first 10 business days during the assessment period of the chemical; to propose modifications to EPA's proposed methodology for the production volume-based fee allocation for EPA-initiated risk evaluation fees in any scenario where a consortium is not formed; to propose expanding the fee requirements to companies required to submit information for test orders; to propose modifying the fee payment obligations to require payment by processors subject to test orders and enforceable consent agreements (ECA); to propose extending the timeframe for test order and test rule payments; as well as to propose changes to the fee amounts and the estimate of EPA's total costs for administering TSCA.

DATES: Comments must be received on or before January 17, 2023.

ADDRESSES: Submit your comments, identified by docket identification (ID) number EPA-HQ-OPPT-2020-0493, through the Federal eRulemaking Portal at https://www.regulations.gov. Follow the online instructions for submitting comments. Do not submit electronically any information you consider to be Confidential Business Information (CBI) or other information whose disclosure is restricted by statute. Additional instructions on commenting and visiting the docket, along with more information about dockets generally, is available at https://www.epa.gov/dockets.

FOR FURTHER INFORMATION CONTACT:

For technical information contact: Marc Edmonds, Existing Chemicals Risk Management Division (7404M), Office of Pollution Prevention and Toxics, Environmental Protection Agency, 1200 Pennsylvania Ave. NW, Washington, DC 20460-0001; telephone number: (202) 566-0758; email address: edmonds.marc@epa.gov.

For general information contact: The TSCA-Hotline, ABVI-Goodwill, 422 South Clinton Ave., Rochester, NY 14620; telephone number: (202) 554-1404; email address: TSCA-Hotline@epa.gov.

SUPPLEMENTARY INFORMATION:

I. Executive Summary

A. Does this action apply to me?

You may be affected by this action if you manufacture (including import), process, or distribute in commerce a chemical substance (or any combination of such activities) and are required to submit information to EPA under TSCA sections 4 or 5, or if you manufacture a chemical substance that is the subject of a risk evaluation under TSCA section 6(b).The following list of North American Industry Classification System (NAICS) codes is not intended to be exhaustive, but rather provides a guide to help readers determine whether this document applies to them.

Potentially affected entities may include companies found in major NAICS groups:

- Chemical Manufacturers (NAICS code 325).

- Petroleum and Coal Products (NAICS code 324).

- Chemical, Petroleum and Merchant Wholesalers (NAICS code 424).

If you have any questions regarding the applicability of this action, please consult the technical person listed under FOR FURTHER INFORMATION CONTACT.

B. What is the Agency's authority for taking this action?

TSCA, 15 U.S.C. 2601 et seq., as amended by the Frank R. Lautenberg Chemical Safety for the 21st Century Act of 2016 (Pub. L. 114-182) (Ref. 1), provides EPA with authority to establish fees to defray, or provide payment for, a portion of the costs associated with administering TSCA sections 4, 5, and 6, as amended, as well as the costs of collecting, processing, reviewing, and providing access to and protecting from disclosure as appropriate under TSCA section 14 information on chemical substances under TSCA. EPA is required in TSCA section 26(b)(4)(F) to review and, if necessary, adjust the fees every three years, after consultation with parties potentially subject to fees, to ensure that funds are sufficient to defray part of the cost of administering TSCA. EPA is issuing this supplemental notice of proposed rulemaking under TSCA section 26(b), 15 U.S.C. 2625(b).

C. What action is the Agency taking?

After establishing fees under TSCA section 26(b), TSCA requires EPA to review and, if necessary, adjust the fees every three years, after consultation with parties potentially subject to fees. This document describes proposed changes to 40 CFR part 700, subpart C as promulgated in the 2018 Fee Rule (Ref. 2) and explains the methodology by which these proposed changes to TSCA fees were determined. This supplemental notice of proposed rulemaking adds to and modifies the proposed rulemaking issued on January 11, 2021 (“the 2021 Proposal”) (Ref. 3). EPA is proposing to narrow certain proposed exemptions for entities subject to the EPA-initiated risk evaluation fees and propose exemptions for test rule fee activities; to modify the self-identification and reporting requirements for EPA-initiated risk evaluation and test rule fees; to institute a partial refund of fees for premanufacture notices withdrawn at any time after the first 10 business days during the assessment period of the chemical; to modify EPA's proposed methodology for the production volume-based fee allocation for EPA-initiated risk evaluation fees in any scenario where a consortium is not formed; to expand the fee requirements to companies required to submit information for test orders; to modify the fee payment obligations to require payment by processors subject to test orders and ECA; to extend the timeframe for test order and test rule payments; and to change the fee amounts and the estimate of EPA's total costs for administering TSCA sections 4, 5, 6, and 14.

D. Why is the Agency taking this action?

The fees collected under TSCA are intended to achieve the goals articulated by Congress by providing a sustainable source of funds for EPA to fulfill its legal obligations under TSCA sections 4, 5, and 6 and with respect to information management under TSCA section 14. Information management includes “collecting, processing, reviewing, and providing access to and protecting from disclosure as appropriate under [section 14] information on chemical substances under [TSCA]. In 2021, EPA proposed changes to the TSCA fee requirements established in the 2018 Fee Rule based upon TSCA fee implementation experience and proposed to adjust the fee amounts based on changes to program costs and inflation and to address certain issues related to implementation of the fee requirements (Ref. 3). EPA consulted and met with stakeholders that were potentially subject to fees, including several meetings with individual stakeholders and a public webinar in February 2021. Additional information on stakeholder engagement can be found in the 2021 Proposal Unit III.A.1 (Ref. 3). EPA is hosting another public engagement after the publication of this proposed rule where EPA will hear from stakeholders on the proposed TSCA fees. This engagement and the previous stakeholder outreach will inform EPA's final rule.

This supplemental proposal takes into consideration comments received in response to the 2021 Proposal which EPA plans to respond to, along with comments received on this notice, when EPA finalizes the rule. Based on these comments, adjustments to EPA's cost estimates, and experience implementing the 2018 Fee Rule, EPA is issuing this supplemental notice and is requesting comments on the proposed provisions and primary alternative provisions described herein that would add to or modify the 2021 Proposal. TSCA allows the Agency to collect approximately but not more than 25 percent of its costs for eligible TSCA activities via fees; however, fee revenue has been roughly half of the estimated costs for eligible activities than EPA estimated in the 2018 Fees Rule. The reason for the shortfall was, in part, that EPA used estimates of the costs based on what the Agency had historically spent on implementing TSCA prior to the 2016 amendments, not what it would cost the Agency to implement TSCA in the manner envisioned and directed by Congress in the Lautenberg Amendments. In the first four years following the 2016 law's enactment, EPA also did not conduct a comprehensive budget analysis designed to estimate the actual costs of implementing the amended law until the spring of 2021. In this notice, EPA is proposing to revise its cost estimate to adequately account for the anticipated costs of meeting its statutory mandates, which are based on the comprehensive analysis conducted in 2021. These proposed revisions are designed to ensure fee amounts capture approximately but not more than 25 percent of the costs of administering certain TSCA activities, fees are distributed equitably among fee payers when multiple fee payers are identified by revising the fee allocation methodology for EPA-initiated risk evaluations, and fee payers are identified via a transparent process.

E. What are the estimated incremental impacts of this action?

EPA has evaluated the potential incremental economic impacts of the 2021 Proposal, as modified by this supplemental notice for FY 2023 through FY 2025. The “Economic Analysis of the Supplemental Notice of Proposed Rule for Fees for the Administration of the Toxic Substances Control Act” (Economic Analysis) (Ref. 4) is available in the docket and is briefly summarized here.

- Benefits. The principal benefit of the 2021 Proposal, as modified by this supplemental notice, is to provide EPA a sustainable source of funding necessary to administer certain provisions of TSCA.

- Cost. The annualized fees collected from industry under the proposed cost estimate described in this supplemental notice are approximately $45.47 million (at both 3 percent and 7 percent discount rates [Note: The annualized fee collection is independent of the discount rate.]), excluding fees collected for manufacturer-requested risk evaluations. Total annualized fee collection was calculated by multiplying the estimated number of fee-triggering events anticipated each year by the corresponding fees (Ref. 4). Total annual fee collection for manufacturer-requested risk evaluations is estimated to be $3.01 million for chemicals included in the 2014 TSCA Work Plan (TSCA Work Plan) (based on the assumed potential for two requests over the three-year period) and approximately $2.99 million for chemicals not included in the TSCA Work Plan (based on the assumed potential for one request over the three-year period) (Refs. 4 and 5). EPA analyzed a three-year period because the statute requires EPA to reevaluate and adjust, as necessary, the fees every three years.

- Small entity impact. EPA estimates that 29 percent of section 5 submissions will be from small businesses that are eligible to pay the section 5 small business fee because they meet the definition of “small business concern.” Total annualized fee collection from small businesses submitting notices under section 5 is estimated to be $666,810 (Ref. 4). For sections 4 and 6, reduced fees paid by eligible small businesses and fees paid by non-small businesses may differ because the fee paid by each entity would be dependent on the number of entities identified per fee-triggering event and production volume of that chemical substance. EPA estimates that average annual fee collection from small businesses for fee-triggering events under section 4 and section 6 would be approximately $103,574 and $2,896,351, respectively (Ref. 4). For each of the three years covered by this proposed rule, EPA estimates that total fee revenue collected from small businesses will account for about 6 percent of the approximately $52 million total fee collection, for an annual average total of approximately $3 million.

- Environmental justice. Although not directly impacting environmental justice-related concerns, the fees will enable the Agency to better protect human health and the environment, including in helping minority, low-income, tribal, or indigenous populations in the United States that potentially experience disproportionate environmental harms and risks, and supporting the fair treatment and meaningful involvement of all people regardless of race, color, national origin, or income with respect to the development, implementation and enforcement of environmental laws, regulations and policies involving TSCA. EPA identifies and addresses environmental justice concerns by providing for fair treatment and meaningful involvement in the implementation of the TSCA program and addressing unreasonable risks from chemical substances.

- Effects on State, local, and Tribal governments. The proposed rule would not have any significant or unique effects on small governments, or federalism or tribal implications.

F. What should I consider as I prepare my comments for EPA?

- Submitting CBI. Do not submit CBI information to EPA through https://www.regulations.gov or email. Clearly mark the part or all of the information that you claim to be CBI. For CBI information in a disk or CD-ROM that you mail to EPA, mark the outside of the disk or CD-ROM as CBI and then identify electronically within the disk or CD-ROM the specific information that is claimed as CBI. In addition to one complete version of the comment that includes information claimed as CBI, a copy of the comment that does not contain the information claimed as CBI must be submitted for inclusion in the public docket. Information so marked will not be disclosed except in accordance with procedures set forth in 40 CFR part 2.

- Tips for preparing your comments. When preparing and submitting your comments, see the commenting tips at https://www.epa.gov/dockets/commenting-epa-dockets#tips.

II. Background

TSCA authorizes EPA to establish, by rule, fees for certain fee-triggering activities under TSCA sections 4, 5, and 6. In so doing, the Agency must set lower fees for small business concerns and establish the fees at a level such that they will offset approximately but not more than 25 percent of the Agency's costs to carry out a broader set of activities under TSCA sections 4, 5, and 6 and relevant information management activities under TSCA section 14. In addition, in the case of manufacturer-requested risk evaluations, the Agency is directed to establish fees sufficient to defray 50 percent of the costs associated with conducting a manufacturer-requested risk evaluation on a chemical substance included in the TSCA Work Plan, and 100 percent of the costs of conducting a manufacturer-requested risk evaluation for all other chemicals. EPA is also required in TSCA section 26(b)(4)(F) to review and adjust, as necessary, the fees every three years.

On January 11, 2021, EPA proposed updates and adjustments to the 2018 Fee Rule (Ref. 2). This included proposed modifications to the TSCA fees and fee categories for fiscal years (FY) 2023, 2024, and 2025, and explained the methodology by which these TSCA fees were determined. EPA proposed to add three new fee categories: a Bona Fide Intent to Manufacture or Import Notice (Bona Fide Notice), a Notice of Commencement of Manufacture or Import (NOC), and an additional fee associated with test orders. In addition, EPA proposed exemptions for entities subject to certain fee triggering activities, including: (1) an exemption for research and development activities; (2) an exemption for entities manufacturing less than 2,500 pounds (lbs) of a chemical subject to an EPA-initiated risk evaluation; (3) an exemption for manufacturers of chemical substances produced as a non-isolated intermediate; and (4) exemptions for manufacturers of a chemical substance subject to an EPA-initiated risk evaluation if the chemical substance is imported in an article, produced as a byproduct, or produced or imported as an impurity. EPA proposed to update its cost estimates for administering TSCA and individual fee calculation methodologies. EPA also proposed a production volume-based fee allocation for EPA-initiated risk evaluation fees in any scenario where a consortium is not formed and proposed to require export-only manufacturers to pay fees for EPA-initiated risk evaluations. EPA also proposed various changes to the timing of certain activities required throughout the fee payment process.

EPA requested public comments on its proposal through February 25, 2021, and later extended the comment period through March 27, 2021 (86 FR 10918). EPA received a total of 43 comments. Of the 43 submissions, there were two comment submissions and five oral comments associated with a public webinar hosted on February 18, 2021 (Ref. 6) and three requests for a comment period extension. Based on comments received on the proposed rule, stakeholder engagement, and EPA's continued experience in implementing the 2018 Fee Rule (e.g., through collection of fees associated with EPA-initiated risk evaluations for the 20 High Priority Substances (https://www.epa.gov/tsca-fees/tsca-fees-epa-initiated-risk-evaluations), EPA is supplementing its proposal.

III. Proposed Changes

A. Agency Costs for the Administration of TSCA

As explained in Unit I.D. of this document, TSCA allows the Agency to collect approximately but not more than 25 percent of its costs for eligible TSCA activities via fees; however, fee revenue has been approximately half of what was estimated in the 2018 Fees Rule. Therefore, EPA is revising its cost estimates to account for the resources needed for anticipated implementation efforts. The Lautenberg amendments of 2016 were the first major overhaul of the TSCA statute in forty years. The Lautenberg Act promised a broad array of far-reaching improvements to America's chemical safety infrastructure by requiring EPA to use strengthened TSCA authorities to protect human health and the environment more effectively from risks. EPA's early implementation efforts included establishing key rules laying out the framework under which EPA would act in implementing the amendments, initiating the first 10 multi-year risk evaluations of existing chemicals in commerce, developing a process for making required determinations on all TSCA section 5 notices, and refreshing the TSCA inventory of chemicals in commerce. However, EPA faces challenges in TSCA implementation that stem from new requirements established through the 2016 Lautenberg amendments.

The primary reason for these implementation challenges is a lack of resources. Although EPA has the authority to offset approximately but not more than 25 percent of the Agency's costs to carry out a broader set of activities under TSCA sections 4, 5, and 6 and relevant information management activities under TSCA section 14, the 2018 Fee Rule did not include the collection of any fees for the first 10 TSCA risk evaluations [Note: EPA will not be collecting fees for the first 10 TSCA risk evaluation.] and the baseline cost estimates that drove the fee amounts in that rule were selected by using the costs for implementing TSCA before the law was amended and thus before EPA was required to carry out any of its new responsibilities. In other words, the baseline cost estimates EPA chose were based on what EPA spent on implementing TSCA before it was amended in 2016, not what it would cost the Agency to implement the revised law in the manner envisioned and directed by Congress, resulting in an artificially-low baseline cost estimate. In the first four years following the 2016 law's enactment, EPA also did not conduct a comprehensive budget analysis designed to estimate the actual costs of implementing the amended law until the spring of 2021. Thus, the 2018 Fee Rule, and particularly, the Rule's failure to collect any fees associated with any of the first 10 risk evaluations resulted in collection of roughly half of the (artificially-low) baseline costs EPA has the authority to collect, resulting in additional implementation challenges discussed in the following paragraphs.

Under TSCA section 5, EPA conducts risk assessments and risk management activities for hundreds of new chemical submissions per year to assess the safety of such chemicals before they enter commerce and take action to prevent unreasonable risk. However, due to resource constraints, EPA has a backlog of delayed reviews. The backlog of delayed cases continues to increase and drives competition for Agency resources with new incoming cases. The backlog is due to both a change made by the 2016 amendments, which shifted the Agency's past practice of conducting initial “screening” reviews of chemicals for risk and only making risk determinations on about 20 percent of the new chemical submittals it received to the new statutory requirement to make such determinations on 100 percent of submittals, and the absence of the additional resources required to implement 2016 amendments. This will ensure that new chemicals entering commerce do not present an unreasonable risk to human health and the environment under the conditions of use.

Additional funding collected through TSCA fees will help EPA reduce the backlog of delayed reviews, support additional work for new cases, and provide necessary support to address new chemicals-related, such as those for chemicals like per- and polyfluoroalkyl substances (PFAS) actions.

Under TSCA section 6, EPA is responsible for developing existing chemical risk evaluations, including for chemicals designated as High-Priority Substances through prioritization. TSCA requires evaluations to be completed in three and a half years from the date of initiation of the risk evaluation. EPA experienced significant implementation challenges and missed the statutory deadlines for nine of the first 10 chemical substance risk evaluations, which primarily resulted from the start-up time needed to develop an approach for implementing the Lautenberg Act and scaling up to handle 10 simultaneous risk evaluations. Additionally, as previously noted, no fees were collected for the first 10 risk evaluations, further limiting the resources available to conduct this work. Going forward, EPA has a statutory requirement to ensure that risk evaluations are being conducted on at least 20 High-Priority Substances and an additional number of manufacturer-requested chemicals. Experience has shown that at current funding and staffing levels, 20 risk evaluations will not be completed within the statutory timeframe. Collecting additional resources through TSCA fees will enable EPA to significantly improve on-time performance and quality.

Improved performance (timeliness and quality) in developing risk evaluations is also contingent on obtaining needed data in a timely manner. Increased resources will support issuance of additional TSCA section 4 test orders to close any relevant data gaps identified in the Prioritization process or the Scoping stage of the risk evaluation process for High-Priority Substances or to advance additional information development activities through TSCA section 4, such as the issuance of test order for certain PFAS, as informed by the National PFAS Testing Strategy (Ref. 7). Delivering data that enables the completion of risk evaluations on a timelier basis may also improve EPA's delivery of the risk reduction benefits through earlier development and issuance of risk management actions and may thereby increase benefits to human health and the environment.

Under TSCA section 14, EPA is required to review and make determinations regarding the validity of a significant portion of CBI claims. EPA reviews, processes, and provides access to and/or protects CBI from disclosure, as appropriate, on information reported under TSCA. The CBI review requirements of TSCA section 14 apply to submissions to EPA under TSCA, including sections 4, 5, 6, 8, and 12. Increased resources will ensure EPA continues to establish improved processes, systems, and procedures to enable submitters to provide the information required when making CBI claims and to facilitate EPA's review, where applicable, under TSCA section 14.

To offset approximately but not more than 25 percent of the Agency's costs, and for the various reasons listed throughout this document and in Unit III.B., EPA is proposing to revise its costs estimates to adequately account for the anticipated costs of meeting its statutory mandates, which are based on a comprehensive analysis conducted in 2021. The estimate includes anticipated implementation efforts and resources, which EPA sees as consistent with recommendations and statements made previously by the Office of Inspector General (OIG), the Government Accountability Office (GAO) and Congress. For example, the 2020 EPA OIG report, titled “Lack of Planning Risks EPA's Ability to Meet Toxic Substances Control Act Deadlines,” recommends that EPA include the “anticipated” implementation efforts and financial and staff resources when planning for work conducted under the Lautenberg amendments of 2016, particularly for existing chemicals work (Ref. 8). The GAO, in its 2021 report titled “Dedicated Leadership Needed to Address Limited Progress in Most High-Risk Areas,” acknowledged that a lack of resources has impacted EPA's ability to successfully implement TSCA. The report also stated that EPA needs to conduct planning to make sure it has the resources and plans in place to facilitate progress on risk evaluations and other work implementing TSCA (Ref. 9). In a joint explanatory statement in Congress's FY 2022 omnibus spending bill, Congress reminded the Agency that the Lautenberg Act established a shared responsibility for the taxpayer and industry to contribute their share to support the TSCA program. In addition, Congress encouraged the Agency to properly consider full costs in its deliberations, in line with the Lautenberg Act's intent (Ref. 10).

B. Program Cost Estimates and Activity Assumptions

EPA calculated fees by estimating the total annual costs of carrying out relevant activities under TSCA sections 4, 5, and 6 (excluding the costs of manufacturer-requested risk evaluations) and conducting relevant information management activities under TSCA section 14; identifying the full cost amount to be defrayed by fees under TSCA section 26(b) (i.e., 25 percent of those annual costs); and allocating that amount across the fee-triggering events in TSCA sections 4, 5, and 6. In addition, EPA affords small businesses an approximately 80 percent discount, in accordance with TSCA section 26(b)(4)(A).

The estimated annual Agency costs of carrying out relevant activities under TSCA sections 4, 5, and 6 and relevant information management activities under TSCA section 14 in the 2021 Proposal were based on cost data from FY 2019 and 2020 which were the first full FY after EPA implemented a time reporting system that tracks employee hours worked on administering TSCA. However, this estimate did not include any costs of TSCA section 6(a) risk management activities that are now required to be underway for the first 10 chemical substances or that will be required for any of the 20 High Priority Substances for which the Agency finds unreasonable risks. Since the proposed rule was published, EPA has developed a more accurate estimate of its anticipated costs to implement TSCA in the manner envisioned by Congress when it amended the law in 2016. The estimate is informed by the Agency's experience administering TSCA since 2016, factors in the Agency's failure to meet the statutory deadlines for 9 of the first 10 existing chemical risk evaluations and consistent challenges meeting the requirements associated with reviewing new chemicals, and thus includes what the Agency believes is a much more reliable estimate of the resources needed for the anticipated implementation efforts than the inaccurate cost estimate that was previously used. Changes to program cost estimates are discussed in the following sections and in more detail in the 2022 TSCA Fees Technical Support Document (TSD) (Ref. 11).

Total Agency costs of carrying out relevant activities under TSCA sections 4, 5, 6 and relevant information management activities under TSCA section 14 are estimated at approximately $181.9 million each year (which differs from the $87.5 million discussed in the 2021 Proposal). Based on the new cost estimates, EPA anticipates collecting approximately 25 percent of that, or $45.5 million each year (which differs from the $22 million discussed in the 2021 Proposal) in fees collected from all fee-triggering events, except manufacturer-requested risk evaluations (MRREs). The increase in costs from the 2021 Proposal is due to multiple factors on top of the lack of a comprehensive analysis of baseline costs until 2021 as has already been discussed in this Unit. For example, estimates in the 2021 Proposal did not include any costs of TSCA section 6(a) risk management activities that are now required to be underway for the first 10 chemical substances or that will be required for any of the 20 High Priority Substances for which the Agency finds unreasonable risks, which resulted in EPA significantly underestimating TSCA section 6 Agency costs. In addition, the estimate from the 2021 Proposal did not include costs for EPA's plan to develop and implement a multi-year collaborative research program under section 5, which is explained in more detail in this Unit.

For new chemical submissions under TSCA section 5, EPA has now formulated a per unit cost estimate that was not included in the 2021 Proposal. The updated estimate provides a more comprehensive accounting of program implementation, which includes, but is not limited to: (1) costs incurred by EPA for multiple rounds of revisions to the risk assessment due to late submission of information or rebuttals by companies, (2) multiple rounds of risk management actions, redactions and posting of final reports to meet transparency commitments while safeguarding CBI, (3) IT infrastructure maintenance and enhancement to ensure the quality and safeguard of data collection, storage and reporting, staffing and contractor support from supporting offices such as the Office of General Counsel (OGC), the Office of Enforcement and Compliance Assurance (OECA), and the Office of Research and Development (ORD), among others, and (4) other operational costs that were not previously captured or fully itemized. The anticipated direct and indirect program costs associated with relevant activities under TSCA sections 4, 5, and 6 and relevant information management activities under TSCA section 14 for FY 2023 through FY 2025, are listed in Table 1 below.

| Annual costs | |

|---|---|

| TSCA section 4 | $7,383,300 |

| TSCA section 5 | 54,162,600 |

| TSCA section 6 (excluding manufacturer-requested risk evaluations). | 88,251,500 |

| TSCA section 14 | 1,783,800 |

| Agency Indirect Costs | 30,316,200 |

| Total | $181,897,400 |

| Table Note: The indirect cost rate is estimated at 20 percent for the purposes of this analysis. | |

1. Program Costs

To determine the program costs for implementing relevant activities under TSCA sections 4, 5, and 6 and relevant information management activities under TSCA section 14, the Agency accounted for the direct costs, both intramural and extramural, for those activities.

Intramural costs are those costs related to the efforts exerted by EPA staff and management in operating the program, collecting and processing information and funds, conducting reviews, and related activities. Extramural costs are those costs related to the acquisition of contractors to conduct activities such as analyzing data, developing IT systems, and supporting the TSCA Help Desk.

The Agency then added indirect costs to the direct program cost estimates. The Agency used an indirect cost rate of 20 percent to calculate the indirect costs associated with all direct program cost estimates for TSCA sections 4, 5, and 6 and relevant information management activities under TSCA section 14 based on EPA's indirect cost methodology as required by Federal Accounting Standards Advisory Board's Statement of Federal Financial Accounting Standards No. 4: Managerial Cost Accounting Standards and Concepts (Ref. 12).

a. TSCA Section 4 Program Costs

TSCA permits the Agency to undertake test rules, test orders, and enforceable consent agreements (ECA). Developing these regulatory actions is a complex, time-consuming, and resource-intensive process involving many scientific and regulatory considerations. EPA must establish what information is required, inventory what reasonably available information EPA has that would address EPA's needs, what testing will provide such information, and what test protocols—such as the Organisation for Economic Co-operation and Development (OECD) test guidelines—can generate such information. Standard globally recognized test guidelines may sometimes be appropriate to inform certain data needs, however, other times, EPA may need to look elsewhere such as at New Approach Methods or even develop new protocols because of the spectrum of data needs and multiple technical considerations that go into determining testing requirements. Additionally, the Agency must satisfy the requirements of the statute to reduce vertebrate testing (i.e., the use of vertebrate animals in testing to generate chemical information to assess risks to health or the environment posed by substances or mixtures), which may involve the use of New Approach Methods. Ultimately, EPA seeks to ensure that the testing required generates useful, high-quality data. For example, depending on the complexity of the chemical substance(s) or mixture(s) that is(are) the subject of a test order, EPA estimates that developing and issuing a test order generally takes a minimum six months of personnel fully allocated (assuming one to two personnel depending on the complexity of the test order and the number of recipients of the test order) and an array of technical personnel from different disciplines partially allocated to doing test order work. The complexity associated with a chemical substance(s) or mixture(s) made the subject of a test order is influenced by EPA's grasp of the scientific and market data on and analytical methods applicable to the chemical(s). Further resources are also needed to administer the test orders after they have been issued (e.g., answering questions related to its requirements, reviewing submissions, etc.); the number of resources needed for such activities varies depending on the complexity of the testing requirements and the number of recipients.

EPA's limited resources have hampered the Agency from effectively exercising those authorities (e.g., in support of the prioritization of the 20 High-priority Substances). In addition, EPA intends to expand the use of Section 4 authorities significantly moving forward to inform prioritization of substances for risk evaluation and develop the most scientifically-sound risk evaluations of those chemical substances. Additional resources will facilitate the Agency's exercise of these authorities under TSCA. Therefore, to estimate the costs associated with TSCA section 4 activities, the Agency relied upon prior experience with the past test orders, test rules and ECAs, and considered anticipated costs to cover future TSCA section 4 activities. Based on past experience and anticipated costs, EPA has calculated the total program costs for TSCA section 4 activities to be approximately $7.38 million annually. More information about EPA's estimated TSCA section 4 costs basis can be found in the TSD (Ref. 11).

b. TSCA Section 5 Program Costs

Under the 2016 amendments to TSCA, EPA must review and make a determination pertaining to all new chemical substances or significant new uses of chemicals submitted under TSCA section 5(a) before they can proceed to the marketplace. Previously, EPA conducted initial reviews of TSCA section 5 notices and determined whether further review was needed, and made an interim finding following the initial review. Before the 2016 amendments, about 80 percent of new chemical reviews were halted at this `interim' stage and were allowed into commerce without further review. Following the 2016 amendments to TSCA, EPA modified its review processes such that all TSCA section 5 notices go through a full risk assessment and receive a risk determination, and therefore the Agency no longer makes interim findings.

EPA estimates that it will receive 210 premanufacture notices (PMNs), significant new use notices (SNUNs), and microbial commercial activity notices (MCANs) per year, and another 290 exemption notices and applications per year. EPA's cost estimates for administering TSCA section 5 include the costs associated with processing and retaining records related to NOC submissions, as well as the costs of pre-notice consultations, processing and reviewing applications, retaining records, and related activities. This estimate is based on a projected 185 full-time equivalents (FTEs) and extramural support needed for these actions. Costs estimates for administering TSCA section 5 activities also include EPA's plan to develop and implement a multi-year collaborative research program to modernize the information used in performing risk assessments for new chemical substances under TSCA and bring innovative science to the review of the new chemicals before they can enter the marketplace. More information related to this research program can be found in the TSD (Ref. 11). These activities and additional funding needs resulted in EPA proposing higher fees for TSCA section 5 activities in this document.

Based on past experience and anticipated costs, EPA has estimated the total program costs for TSCA section 5 activities to be approximately $54.2 million annually in FY 2023 through FY 2025. More information about EPA's estimated TSCA section 5 costs basis can be found in the TSD (Ref. 11).

c. TSCA Section 6 Program Costs

EPA has the authority under TSCA section 26(b) to collect fees to recover costs for TSCA section 6 activities including prioritization, risk evaluations, and risk management rulemaking. TSCA section 6 cost estimates have been informed by the Agency's experience conducting evaluations for the first 10 chemical substances to undergo risk evaluation under amended TSCA, by the Agency's experience prioritizing and developing the scope of the risk evaluations of the 20 chemicals designated as High-Priority Substances in December 2019, and by the Agency's initial and ongoing experience with risk management actions addressing unreasonable risks identified in the first 10 chemical substance risk evaluations. Cost estimates for risk management activities have also been informed by EPA's recent risk management actions on several chemicals under TSCA section 26(l)(4) authority, including development of the proposed rules regarding the use of N-methylpyrrolidone and methylene chloride in paint and coating removal, and the use of trichloroethylene in both commercial vapor and aerosol degreasing and for spot cleaning in dry cleaning facilities, and the development of the final rule regarding methylene chloride in consumer paint and coating removal.

During the public comment period on the 2021 Proposal, EPA received comments stating that EPA underestimated the TSCA section 6 costs. For example, commenters stated that EPA inappropriately relied on narrow, partially completed risk management actions to inform the cost of its current and future risk management actions (Docket Number EPA-HQ-OPPT-2020-0493). Commenters also raised concerns stating that EPA had not reconciled the costs for administering section 6 activities which had been reduced compared to the 2018 Fee Rule despite the increase in risk management workload. Additionally, EPA's estimates did not include any costs of TSCA section 6(a) risk management activities for the first 10 chemical substances or 20 High Priority Substances in the proposal which resulted in EPA underestimating TSCA section 6 Agency costs. Therefore, EPA is proposing to include recent risk management activities into the TSCA section 6 program cost estimates. Although section 6 cost estimates were informed by risk management and risk evaluation activities for the first 10 chemicals, EPA will not be recovering fees for those chemicals. Adding more recent and comprehensive risk management costs and the anticipated increases associated with prioritization and risk evaluation costs, as described previously and in more detail in the TSD, would result in the estimated annual cost to administer TSCA section 6 to be approximately $88 million per year, except the MRREs.

In the case of manufacturer-requested risk evaluations, the Agency is directed to establish fees sufficient to defray 50 percent of the costs associated with conducting a manufacturer-requested risk evaluation on a chemical substance included in the TSCA Work Plan, and 100 percent of the costs of conducting a manufacturer-requested risk evaluation for all other chemicals. EPA is also required in TSCA section 26(b)(4)(F) to review and adjust, as necessary, the fees every three years. The Agency intends to collect fees to recover 50 percent or 100 percent of the actual costs incurred by EPA in conducting chemical risk evaluations requested by manufacturers, depending on whether the chemical substance is included in the TSCA Work Plan. EPA expects the amount collected will be approximately $4.40 million per risk evaluation for chemicals on the TSCA Work Plan and $8.98 million per risk evaluation for chemicals not on the TSCA Work Plan.

d. Costs of Collecting, Processing, Reviewing, and Providing Access to and Protecting From Disclosure as Appropriate Under TSCA Section 14 Information on Chemical Substances

EPA is making minimal changes to estimates of program costs of collecting, processing, reviewing, and providing access to and protecting from disclosure as appropriate under TSCA section 14 information on chemical substances that were previously described in the 2021 Proposal. More information about specific activities considered when developing this estimate for activities under section 14 can be found in the 2021 Proposal (Ref. 3).

The annual cost estimate of collecting, processing, reviewing, and providing access to and protecting from disclosure as appropriate information on chemical substances under section 14 of TSCA, including 8.6 FTE and extramural costs, from FY 2023 through FY 2025 is approximately $1.8 million (Ref. 4).

2. Indirect Costs

Indirect costs are the intramural and extramural costs that are not accounted for in the direct program costs, but are important to capture because of their necessary enabling and supporting nature, and so that EPA's proposed fees will accomplish full cost recovery up to that provided by law. Indirect costs typically include such cost items as accounting, budgeting, payroll preparation, personnel services, purchasing, centralized data processing, and rent.

EPA included indirect costs in its estimate of total Agency costs pursuant to OMB Circular A-25 (Ref. 13) which states that agencies should collect the full costs when setting fees. In addition, section 6(d)(1) explains that full costs include all direct and indirect costs to the Federal Government. EPA describes how an indirect cost rate is determined annually according to EPA's indirect cost methodology and as required by Federal Accounting Standards Advisory Board's Statement of Federal Financial Accounting Standards No. 4: Managerial Cost Accounting Standards and Concepts in the 2021 Proposal. An indirect cost rate of 20 percent was applied to direct program costs of work conducted by EPA's Office of Chemical Safety and Pollution Prevention. Some of the direct program costs included in the estimates for TSCA sections 4, 5, and 6 and collecting, processing, reviewing, and providing access to and protecting from disclosure as appropriate under TSCA section 14 information on chemical substances are for work performed in other Agency offices (e.g., the Office of Research and Development and the Office of General Counsel). Appropriate indirect cost rates were applied to those cost estimates and are based on EPA's existing indirect cost methodology. Indirect cost rates are calculated each year and therefore subject to change. Indirect costs of approximately $30 million were included in the program cost estimates in the previous sections.

3. Total Costs of Fee-Triggering Events

The annual estimated costs for fee categories under TSCA section 4, including both direct and indirect program costs, are shown in Table 2. Note that the costs presented in Tables 2 through 4 include only the costs of fee triggering events and do not include costs associated with activities such as CBI reviews and alternative testing methods development. Costs associated with those activities are part of the overall costs of administering relevant activities under TSCA sections 4, 5, and 6 and relevant information management activities under TSCA section 14 and, as such, are included in the overall cost estimates provided previously in Table 1.

The Agency believes it is reasonable to assume that approximately 75 test orders per year will be initiated between FY 2023 and FY 2025. Approximately 45 of these test orders are expected to be associated with the Agency's actions on PFAS. In addition, the EPA assumed two test rules and two ECAs between FY 2023 and FY 2025.

| $ Total costs | Payroll | $ Non-payroll | FTE | |

|---|---|---|---|---|

| TSCA Section 4 Activities | $7,383,300 | $4,878,000 | $2,505,300 | 27.9 |

| *Table Note: Numbers may not add due to rounding. | ||||

The estimated annual costs for fee categories under TSCA section 5, including both direct and indirect program costs are shown in Table 3. EPA estimates that it will receive 210 PMNs, SNUNs, and MCANs per year, and another 290 exemption applications per year. EPA's cost estimates for administering TSCA section 5 include the costs associated with processing and retaining records related to a NOC submission, as well as the costs of pre-notice consultations, processing and reviewing applications, retaining records, and related activities.

| $ Total costs | Payroll | $ Non-payroll | FTE | |

|---|---|---|---|---|

| TSCA Section 5 Activities | $54,162,600 | $32,370,000 | $21,792,600 | 185.2 |

| *Table Note: Numbers may not add due to rounding. | ||||

The estimated annual costs for fee categories under TSCA section 6, including both program and indirect costs are shown in Table 4. EPA estimates that the EPA's workforce will be involved in at least 3 MRRE and at least 20 EPA‐initiated chemical risk evaluations at all times.

| $ Total costs | Payroll | $ Non-payroll | FTE | |

|---|---|---|---|---|

| TSCA Section 6 | ||||

| TSCA Section 6 Prioritization | $8,820,900 | $6,254,000 | $2,566,900 | 35.9 |

| EPA-initiated Risk Evaluation | 54,877,100 | 28,291,100 | 26,585,900 | 161.40 |

| Manufacturer-requested Risk Evaluation | 7,483,200 | 3,857,900 | 3,625,400 | 22.0 |

| TSCA Section 6 Risk Management | 24,553,500 | 13,536,000 | 11,017,500 | 77.3 |

| Totals | 95,734,700 | 51,939,000 | 43,795,700 | 296.6 |

| *Table Note: Numbers may not add due to rounding. | ||||

C. Fee Amounts

While TSCA allows the Agency to collect approximately but not more than 25 percent of its costs for eligible TSCA activities via fees, to date, EPA has collected roughly half of that amount due to the insufficiencies of the current fees rule. These proposed revisions are designed to ensure fee amounts capture approximately but not more than 25 percent of the costs of TSCA activities, fees are distributed equitably, and fee payers are identified via a transparent process. Although TSCA allows EPA to recover approximately but not more than 25 percent of its costs of implementing certain provisions of TSCA, the percentage applies to the total aggregate cost and does not preclude EPA from recovering an amount above or below 25 percent of the costs for each section of TSCA.

As discussed in the 2021 Proposal, the existing and proposed fee categories are fee-triggering events that result in obligations to pay fees but do not encompass all activities under TSCA sections 4, 5, 6, and 14 that incur costs to the Agency (e.g., costs of administering TSCA section 14, risk management activities under section 6, prioritization of chemicals for evaluation, support for alternative testing and methods development and enhancement). However, costs for all relevant activities are included in the total Agency costs estimate, even those not discussed in this document (e.g., specific TSCA work with other EPA offices). Therefore, EPA is proposing fee amounts to ensure these costs would be captured, not just the costs of the fee-triggering events. EPA is also proposing new fee amounts to capture the higher proportion (in percentage) of the estimated costs of TSCA section 6 activities and ensure EPA fees are set to recover approximately but not more than 25 percent of the total cost for implementing the relevant sections of TSCA.

After estimating the annual costs of administering relevant activities under TSCA sections 4, 5, 6, and relevant information management activities under TSCA section 14, the Agency had to determine how the costs would be allocated over the narrower set of activities under TSCA sections 4, 5, and 6 that trigger a fee. The Agency took an approach to determining fees that tied the payment of fees to individual distinct activity types or “fee-triggering events.”

The proposed fee amounts are described in Table 5.

| Fee category | 2018 Fee rule | Current fees1 | 2022 Supplemental proposed rule |

|---|---|---|---|

| Test order | $9,800 2 | $11,650 | $25,000. |

| Test rule | $29,500 | $35,080 | $50,000. |

| Enforceable consent agreement | $22,800 | $27,110 | $50,000. |

| PMN and consolidated PMN, SNUN, MCAN and consolidated MCAN | $16,000 | $19,020 | $45,000. |

| LoREX, LVE, TME, Tier II exemption, TERA, Film Articles | $4,700 | $5,590 | $13,200. |

| EPA-initiated risk evaluation | $1,350,000 | Two payments resulting in $2,560,000 | Two payments resulting in $5,081,000. |

| Manufacturer-requested risk evaluation on a chemical included in the TSCA Work Plan | Initial payment of $1.25M, with final invoice to recover 50% of actual costs | Two payments of $945,000, with final invoice to recover 50% of actual costs | Two payments of $1,497,000, with final invoice to recover 50% of actual costs. |

| Manufacturer-requested risk evaluation on a chemical not included in the TSCA Work Plan | Initial payment of $2.5M, with final invoice to recover 100% of actual costs | Two payments of $1.89M, with final invoice to recover 100% of actual costs | Two payments of $2,993,000, with final invoice to recover 100% of actual costs. |

| 1The current fees reflect an adjustment for inflation required by TSCA. The adjustment went into effect on January 1, 2022. | |||

| 2In 2018 final rule, the fees for TSCA section 4 test orders and test rules were incorrectly listed as $29,500 for test orders and $9,800 for test rules. The 2021 Proposal proposes to correct this error by changing the fees for TSCA section 4 test orders to $9,800 and TSCA section 4 test rules to $29,500. | |||

1. Fee Amounts for TSCA Section 4 Activities

EPA is proposing changes to the fees associated with TSCA section 4 activities. Additional justification for fee triggering activities associated with each TSCA section is discussed within this Unit. In addition, in the 2021 Proposal, EPA proposed an additional fee category under TSCA section 4 for amended test orders. EPA is proposing to remove this new fee category (discussed in further detail in Unit III.D).

EPA is proposing fees that, based on the expected activity levels of the three fee categories for TSCA section 4 activities, will defray 26.4 percent of the program costs described in the previous paragraphs, or approximately $1.94 million. The proportion (in percentage) of the estimated cost of the activity is slightly higher for fees for TSCA section 4 (26.3 percent) to ensure EPA is recovering the required 25 percent of the total cost for implementing the relevant sections of TSCA in light of collecting less than 25 percent of costs for section 5 activities as explained in Unit III.C.2.

2. Fee Amounts for TSCA Section 5 Activities

EPA currently sets two fee amounts for TSCA section 5 activities—one for notices (PMNs, SNUNs, and MCANs), and one for exemptions which include low exposure/low release exemptions (LoREXs), low volume exemptions (LVEs), test-marketing exemptions (TMEs), certain microorganism Tier II exemptions (Tier II), and TSCA experimental release applications (TERAs). In the 2021 Proposal, EPA proposed two additional fee categories under TSCA section 5, one for Bona Fide Notices and the other for NOCs. EPA is proposing to remove those two new fee categories (discussed in further detail in Unit III.D), as well as proposing to increase the fee amounts under TSCA section 5 activities. Specifically, EPA is proposing an increase to the fees for PMNs, consolidated PMNs, SNUNs, MCANs, consolidated MCANs, LoREXs, LVEs, TMEs, Tier II, TERAs, and film article exemptions.

Additional funding collected through TSCA section 5 fees will help EPA reduce the backlog of delayed reviews and support additional work for new cases. As previously noted, these delays result from a years-long absence of the additional resources required to implement the 2016 amendments, which shifted the Agency's past practice of making risk determinations on about 20 percent of the new chemical submittals it received to a requirement to make such determinations on 100 percent of submittals. The fee increases for TSCA section 5 activities, if finalized as proposed in this document, would also shift costs for administering TSCA section 5 away from fees for TSCA section 6 actions. EPA proposed to increase TSCA section 6 fees to recover costs for TSCA section 5 activities in the 2021 Proposal. As newly proposed, the fees for TSCA section 5 activities amount to approximately 18 percent of the estimated costs of the activities and are described in Table 5. EPA is proposing to collect less than 25 percent of the costs for section 5 activities to lessen the impact due to the increase in section 5 fee amounts since 2018. For example, before the 2018 Fee Rule the fee for a PMN was $2,500. The fee was increased to $16,000 in the 2018 Fee Rule and will be increased further to $45,000 under this proposal. Due to the significant increase since 2018, is proposing to reduce the impact of increased section 5 fees by collecting less than 25 percent of the implementation costs for section 5. EPA is requesting comment on its proposal to recover less than 25 percent of the costs for implementing TSCA section 5.

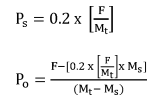

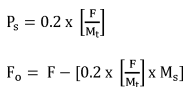

EPA also accounted for full (100 percent) refunds that may be provided when estimating the total fees collected and in setting the fee amounts. Full refunds may be provided for notices or exemptions when EPA determines a submission is not a new chemical substance, new microorganism, or significant new use, or when the Agency fails to make a determination on a notice by the end of the applicable notice review period. In addition, EPA is proposing to refund 20 percent of the user fee to the submitter if a notice is withdrawn after 10 business days after the beginning of the applicable review period, but prior to EPA initiating risk management on the chemical substance. The 20 percent refund is based on the allocation of resources needed for risk assessment and risk management of chemical substances under TSCA section 5 where 80 percent of costs are associated with risk assessment and 20 percent with risk management. Based on the number of PMNs withdrawn during FY 2020 and 2021, EPA estimates that approximately 23 percent of PMNs are withdrawn during review (discussed in further detail in Unit III.E).

3. Fee Amounts for TSCA Section 6 Activities

EPA collects one fee amount for EPA-initiated risk evaluations. Based on the expected activity levels of this fee category, this will defray 38.4 percent of the estimated program costs. As explained in Unit III.C.2, EPA is collecting under 25 percent of the costs for section 5 activities. For this reason and to ensure EPA is recovering the required 25 percent of the total cost for implementing the relevant sections of TSCA, the proportion (in percentage) of the estimated cost of EPA-initiated risk evaluations that are recovered by fees is higher (38.4 percent) than the other fee triggering activities. EPA takes an actual cost approach for manufacturer-requested risk evaluations, whereby the requesting manufacturer (or requesting consortia of manufacturers) would be obligated to pay either 50 percent or 100 percent of the actual costs of the activity, depending on whether the chemical was listed on the TSCA Work Plan or not, respectively.

Based on additional cost estimates for risk management and anticipated increases associated with prioritization and risk evaluation costs, as described in Unit III.B.1.a., estimated Agency costs for TSCA section 6 activities have increased to $88,251,500 per year with fee collections of $33,890,270 for EPA-initiated risk evaluations. EPA is proposing to increase the EPA-initiated risk evaluation fees from the 2021 Proposal of $2,560,000 to $5,081,000 (or from $1.35 million in the 2018 Fee Rule). This payment would be collected over two installments, the first payment of 50 percent to be due 180 days after EPA publishes the final scope of a chemical risk evaluation and the second payment due not later than 545 days after EPA publishes the final scope of a chemical risk evaluation, as proposed in the 2021 Fee Proposal.

As stated previously, EPA takes an actual cost approach for manufacturer-requested risk evaluations. In addition, EPA proposed in the 2021 Proposal to separate the manufacturer-requested risk evaluation payments into three installments with the total fee paid reflecting the actual cost. Based on that proposed installment plan and the estimated costs of these risk evaluations, two payments of $1,497,000 then invoiced for the remainder is being proposed for chemicals on the TSCA Work Plan and two payments of $2,993,000 with final invoice for the remainder is being proposed for chemicals not listed on the TSCA Work Plan.

D. Fee Categories

Under the 2018 Fee Rule, EPA has eight distinct fee categories: (1) test orders, (2) test rules, and (3) Enforceable Consent Agreements (ECAs), all under TSCA section 4; (4) notices and (5) exemptions, both under TSCA section 5; and (6) EPA-initiated risk evaluations; (7) manufacturer-requested risk evaluations for chemicals on the TSCA Work Plan; and (8) manufacturer-requested risk evaluations for chemicals not on the TSCA Work Plan, all under TSCA section 6. The activities in these categories are fee-triggering events (other than the first 10 risk evaluations) that result in obligations to pay fees under the 2018 Fee Rule.

In the 2021 Proposal, EPA proposed two additional fee categories under TSCA section 5, Bona Fide Notices and NOCs, and one additional fee category for TSCA section 4 amended test orders. After considering public comments received on the 2021 Proposal, and in an effort to keep the fee structure simple by reducing the number of fee categories, EPA is proposing not to finalize the new fee categories for Bona Fide Notices, NOCs, and amended test orders.

The cost associated with NOCs will continue to be captured with those of PMNs, MCANs, and SNUNs, as they were under the 2018 Fee Rule. EPA believes these fees are better captured under the proposed fee increase for existing TSCA section 5 categories. In addition, while EPA envisioned the additional fee for amended test orders to create an incentive for manufacturers to submit facially complete data outlined under TSCA section 4, in order to simplify the TSCA section 4 fee structure EPA is proposing to remove the amended test order fees. Because the costs incurred by EPA to review resubmitted data are included in the Agency's total program cost estimate, these costs will be captured under other fees.

E. Refund for Withdrawal During Review

In addition to increasing the TSCA section 5 fees for PMNs, SNUNs, and MCANs, EPA is proposing to refund 20 percent of the user fee to the submitter if a notice is withdrawn after 10 business days after the beginning of the applicable review period, but prior to EPA initiating risk management on the chemical substance. In the 2018 Fee Rule, EPA established a partial refund (i.e., 75 percent of the fee amount) for TSCA section 5 submissions withdrawn during the first 10 business days after the beginning of the applicable review period (83 FR 52694, October 17, 2019). EPA is proposing an amendment to add a partial refund of 20 percent for TSCA section 5 submissions withdrawn after the first 10 business days during the assessment period of the chemical but before EPA begins any necessary risk management. This newly proposed refund is in addition to the already existing refund of 75% for notices withdrawn in the first 10 business days established under the 2018 Fee Rule. After EPA concludes the risk assessment for a TSCA section 5 submission, the Agency will provide the submitter notice that the risk assessment has been completed and the submitter will then have five business days to withdraw their notice for a partial refund of 20 percent. After 5 business days from receiving the notice that the risk assessment has been completed, if the company wishes to withdraw a notice, no refund will be given.

When EPA's review leads to a determination that one or more conditions of use may present an unreasonable risk and EPA lacks sufficient information to permit a reasoned evaluation of the health and environmental effects of the PMN substance, or on the basis of insufficient information alone, the Agency will issue a section 5(e) order to address potential risks and may require testing for additional information. After learning of the Agency's determination and risk management actions, a submitter may no longer wish to pursue the commercialization of the chemical substance, depending on the potential risks identified and any risk mitigation likely required to address those risks.

EPA's proposal to refund 20 percent of the fee is based on the allocation of resources needed for risk assessment and risk management of chemical substances under TSCA section 5. EPA's cost estimates for administering TSCA section 5 include the costs of processing, reviewing, and making determinations, and the Agency's costs of taking any regulatory action such issuing an order and a TSCA section 5 significant new use rule (SNUR). Approximately 80 percent of the cost associated with reviewing a new chemical substance is due to activities associated with risk assessment, while approximately 20 percent of the cost is associated with risk management activities. EPA is not able to issue refunds for the entire fee amount because significant work begins as soon as EPA receives the PMN. As described in the 2018 Proposed Fee Rule (83 FR 8212; February 26, 2018), up to three significant milestones of the PMN review process can take place within 10 business days (Ref. 14). The Chemical Review/Search Strategy Meeting occurs between Day 8 and 12; the Structure Activity Team Meeting occurs between Day 9 and 13; and Development of Exposure/Release Assessments occurs between Day 10 and 19. Due to concerns with administrative burden and potential delays in issuing refunds, EPA will not calculate and refund a unique amount for each withdrawn submission. By adding this option for a refund of 20 percent, submitters will be able to recoup part of the cost associated with submitting a notice for chemicals they decide to withdraw during the review period. Based on the cases withdrawn during FY 2020 and 2021, EPA estimates that approximately 23 percent of cases are withdrawn during review. However, EPA anticipates this percentage could be much higher if submitters had the opportunity to obtain a partial refund when risk assessment results and likely risk management actions are known. Withdrawals and refunds provided under such circumstances would prevent the need for EPA to conduct risk assessment rework and executing unneeded risk management actions. Risk assessment rework requires EPA to re-analyze some or all the information supporting a risk assessment in order to factor in new information, causing substantial delay to the review process for that substance and delays staff from initiating or completing risk assessment work on other new chemical substances. The Agency requests comment on this new partial refund process for the review of TSCA section 5 notices.

F. Methodology for Calculating Fees for EPA-Initiated Risk Evaluations

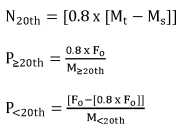

In 2018, the TSCA Fee Rule established a methodology for allocating fees to manufacturers of chemicals subject to EPA-initiated risk evaluations in which EPA distributes the fees evenly among manufacturers, while giving an 80 percent discount for manufacturers that qualify as a small business concern. In January 2021, EPA proposed a production volume-based approach for fee allocation for EPA-initiated risk evaluations under TSCA section 6. Specifically, EPA proposed to reallocate the remaining fee, after allocating the fees for small businesses, across the remaining manufacturers, based on their percentage of total volume produced of that chemical minus the amount produced by the small businesses. EPA continues to believe that using production volume in calculating TSCA section 6 fee allocations will result in a more equitable distribution of fees and better account for the wide variation in production volume sometimes associated with a particular chemical substance, but is proposing modifications to the methodology included in the 2021 Proposal as described in the following section.

1. Description of the Proposed Regulatory Action

While 10 commenters supported EPA's proposed volume-based fee allocation methodology, nine commenters did not support the proposed methodology or expressed concern over unintentional disclosure of CBI under the proposed methodology, stating that collecting and reporting production volumes to EPA could force companies to involuntarily disclose CBI. In response to these comments, EPA is proposing to modify the proposed fee allocation methodology to protect potential submissions of CBI. The modified approach includes ranking the fee-payers that do not qualify as a small business concern by their reported production volume, then assigning fees based on those rankings. The non-small business manufacturers in the top 20th percentile ranking would pay 80 percent of the total fee, distributed evenly among these manufacturers. EPA believes this methodology is equitable, accounts for various fee payer scenarios, protects CBI, and ensures EPA is collecting approximately but not more than 25 percent of applicable program costs. These proposed changes would ensure that the manufacturers of the largest quantity of production volume for a chemical undergoing risk evaluation pay the majority of the obligated fee. In addition, this proposed approach reflects EPA's review of the distribution of production volume data reported across individual producers for the 20 High-Priority Substances and the first 10 chemical substances, and EPA believes it is consistent with the distribution of fee payers expected for any one EPA-initiated risk evaluation expected in the future. EPA is requesting comment on the methodology outlined below, including whether the approach is a more equitable way of distributing fees.

In any scenario where all manufacturers of the chemical substance undergoing the EPA-initiated risk evaluation do not form a single consortium, EPA would take the following steps to allocate fees:

Step 1: Count the total number of manufacturers, including the number of manufacturers within any consortia.

Step 2: Divide the total fee amount by the total number of manufacturers to generate a base fee.

Step 3: Provide all small businesses who are either (a) not associated with a consortium, or (b) associated with an all-small business consortium, with an 80 percent discount from the base fee.

Step 4: Calculate the total remaining fee amount and the total number of remaining manufacturers that will share the fee by subtracting out the discounted fees and the number of small businesses identified.

Step 5: Place remaining manufacturers in ascending order (from lowest to highest production volume based on their average annual production volume from the three calendar years prior to the publication of the preliminary list).

Step 6: Assign each remaining manufacturer a number with 1 for lowest production volume, 2 for second lowest production volume, etc.

Step 7: Multiply the total number of remaining manufacturers by 0.8.

Step 8: Determine the manufacturer(s) in the top 20th percentile spot by comparing the number derived from Step 7 to the manufacturer(s) with the assigned number derived in Step 5. Manufacturers with an assigned number under Step 6 that is equal to or larger than the number in Step 7 are in the top 20th percentile.

Step 9: Reallocate 80 percent of the remaining fee evenly across manufacturers in the top 20th percentile determined in Step 8, counting each manufacturer in a consortium as one person.

Step 10: Reallocate the remaining fee evenly across the remaining manufacturers, counting each manufacturer in a consortium as one person.

In addition, EPA is proposing to require reporting of average production volume over the past three years instead of four years as stated in the 2021 Proposal (Ref. 3). This proposed change would alleviate additional concerns over potential CBI disclosure by further separating the production volume submissions under this rule from other potentially public production volume reporting (e.g., CDR) which could be used in conjunction with data reported under this proposal to estimate a manufacturer's production volume. The reduction to 3-year production volume average would address multiple commenters' concerns that collecting and reporting production volume is burdensome. In addition, EPA is proposing that the production volume calculation be based on the three previous calendar years prior to the publication of the preliminary list, instead of the year self-identification and/or certification was made. This change is being made to alleviate potential confusion that may arise due to inconsistencies with other timeframe provisions in this rulemaking (additional discussion on those timeframes can be found in Unit III.G). If finalized as proposed, applicable manufacturers would be required to report their average production volume using the past three calendar years of production volume data.

These proposed changes would eliminate all expected potential disclosure of production volume that may be claimed as CBI. However, in the rare event of multiple fee payers submitting under the same parent company and asserting a CBI claim for production volume, and/or multiple companies reporting the exact same amount of a competitor, EPA would mask the company names on the final list for that chemical to protect disclosure.

EPA is not proposing these calculation and methodology changes for the fee allocations under TSCA section 4 activities. Fees for section 4 activities are significantly lower than those for a risk evaluation and, therefore, less burdensome, obviating the need to allocate the fees based on production volume. As described in steps one through three previously in this Unit, EPA is also not proposing the production volume-based methodology for manufacturers of a chemical substance undergoing an EPA-initiated risk evaluation that qualify as a small business concern. These entities would be provided an 80 percent discount from the “base fee” calculated as described in the 2018 Fee Rule (40 CFR 700.45(f)).

2. Description of the Primary Alternative Regulatory Action Considered

Commenters have expressed concerns over the burden of calculating and reporting production volume in order to comply with the self-identification and recordkeeping requirements in the 2021 Proposal. As a primary alternative regulatory action, EPA is considering the use of the ranking methodologies as described previously but requiring reporting of production volume ranges instead of averages. These ranges would be consistent with those ranges used to show aggregate national production volume of a chemical under EPA's Chemical Data Reporting (CDR). EPA believes reporting these ranges would be easier for industry to calculate and would ensure CBI is always protected since only ranges would be used. However, these ranges are large, which could result in many manufacturers paying the same share of the fees, negating the point of creating a production volume-based fee to improve distribution of fees and to make fees more equitable. EPA is requesting comment on this alternative and on whether ranges narrower than the ones used for CDR would be feasible or appropriate to use under the described circumstances.

G. Exemptions for Fees Associated With EPA-Initiated Risk Evaluations

In the 2021 Proposal, EPA proposed six fee exemptions for manufacturers of chemical substances undergoing EPA-initiated risk evaluation. These proposed exemptions would apply to: (1) Importers of articles containing a chemical substance; (2) Producers of a chemical substance as a byproduct; (3) Manufacturers (including importers) of a chemical substance as an impurity; (4) Producers of a chemical as a non-isolated intermediate; (5) Manufacturers (including importers) of small quantities of a chemical substance solely for research and development; and (6) Manufacturers (including importers) of chemical substances with production volume less than 2,500 lbs. EPA proposed that the volume threshold exemption would not apply when all manufacturers of that chemical substance manufacture in quantities below 2,500 lbs (See 40 CFR 700.45(a)(3)(vi) of the 2021 Proposal). EPA is proposing modifications to the exemptions included in the 2021 Proposal as described in the following section.

Twenty-seven industry commenters supported one or more of EPA's proposed exemptions for EPA-initiated risk evaluation fees for byproducts, impurities, and non-isolated intermediates and many also suggested that EPA use existing TSCA definitions to identify those that are subject to exemptions (e.g., conform the byproducts definition to match other TSCA programs and use 40 CFR 720.30(g) or 720.30(h)(2)) (EPA-HQ-OPPT-2020-0493). EPA is proposing regulatory action aimed to narrow one of the six proposed exemptions (producers of a chemical substance as a byproduct) and to include self-identification requirements for manufacturers (including importers) of chemical substances with production volume less than 2,500 lbs. EPA is proposing to modify the byproduct exemption to, “producers of a chemical substance as a byproduct that is not later used for commercial purposes or distributed for commercial use.” By narrowing the byproduct exemption to include only manufacturers of byproducts that are not later used for commercial purposes or distributed for commercial use, EPA could still collect fees from producers of chemicals that are then sold or used for commercial purposes. In addition, EPA believes those producers of byproducts that are later used in commerce or distributed for commercial use by that manufacturer will not encounter the same issues and concerns with the self-identification requirements as described in EPA's memorandum issued on March 18, 2020 (Ref. 15) previously discussed in the 2021 Proposal since those producers knowingly produce the byproduct before it is introduced into the market (86 FR 1899) (Ref. 3). The byproduct exemption, with these proposed changes, would address challenges with self-identification raised by stakeholders as it relates to identifying and tracking byproducts that are unintentionally or coincidentally produced (40 CFR 700.45(b)(5)).

Twelve industry commenters specifically supported the 2,500 lbs production volume exemption for EPA-initiated risk evaluation fees. However, three of those commenters requested additional clarification or modification of the provision where the exemption would not apply for the EPA-initiated risk evaluation fee for that chemical substance because all manufacturers are low-volume manufacturers (described in the proposed regulations at 40 CFR 700.45(a)(3)(vi)) (EPA-HQ-OPPT-2020-0493). Specifically, one commenter requested clarification of whether, in this case, additional time to make fee payments would be granted to low-volume manufacturers that would otherwise have qualified for this exemption. The commenter asked if low-volume producers would be subject to reduced fees considering the financial burden risk evaluation fees would impose on low-volume manufacturers. Finally, the commenter sought clarification of the procedural steps that will occur and how manufacturers would be notified if they are all low-volume manufacturers (EPA-HQ-OPPT-2020-0493-0034). Another commenter requested that EPA clarify the timeframes associated with the 2,500 lb exemption, specifically on the proposed provision where all identified manufacturers meet the exemption criteria (EPA-HQ-OPPT-2020-0493-0059).