...

(a) Persons who must pay fees. (1) Manufacturers submitting a TSCA section 5 notice to EPA shall remit for each such notice the applicable fee identified in paragraph (c) of this section in accordance with the procedures in paragraphs (f) and (g) of this section.

(2) Manufacturers and processors of chemical substances and mixtures required to submit information for these chemical substances and mixtures under a TSCA section 4(a) test order or enforceable consent agreement, or manufacturers of chemical substances and mixtures required to submit information for these chemical substance and mixtures under a TSCA section 4(a) test rule, shall remit for each such test rule, order, or enforceable consent agreement the applicable fee identified in paragraph (c) of this section in accordance with the procedures in paragraphs (f) and (g) of this section. Manufacturers of a chemical substance subject to a test rule under TSCA section 4(a) are exempted from fee payment requirements in this section, if they meet one or more of the exemptions under this paragraphs (a)(2)(i) through (v) of this section on or after the certification cutoff date identified in paragraph (b)(6) of this section and do not conduct manufacturing outside of those exemptions after the certification cutoff dates or if they meet the exemptions under paragraph (a)(2)(vi) of this section for the five-year period preceding publication of the preliminary list and do not conduct manufacturing outside of that exemption during the five-year period preceding publication of the preliminary list; and the exemptions are only available if the manufacturer will meet one or more of the exemptions in this paragraph (a)(2)(i) through (vi) in the successive five years; and will not conduct manufacturing outside of the exemptions in paragraphs (a)(2)(i) through (v) of this section in the successive five years or will meet the exemption in paragraph (a)(2)(vi) of this section in the successive five years:

(i) Import articles containing that chemical substance;

(ii) Produce that chemical substance as a byproduct that is not later used for commercial purposes or distributed for commercial use;

(iii) Manufacture that chemical substance as an impurity as defined in 40 CFR 704.3;

(iv) Manufacture that chemical substance as a non-isolated intermediate as defined in 40 CFR 704.3;

(v) Manufacture small quantities of that chemical substance solely for research and development, as defined in 40 CFR 700.43; or

(vi) Manufacture that chemical substance in quantities below a 1,100 lbs annual production volume as described in §700.43, unless all manufacturers of that chemical substance manufacture that chemical in quantities below a 1,100 lbs annual production volume as defined in §700.43, in which case this exemption is not applicable.

(3) Manufacturers of a chemical substance that is subject to a risk evaluation under section 6(b) of the Act, shall remit for each such chemical risk evaluation the applicable fee identified in paragraph (c) of this section in accordance with the procedures in paragraphs (f) and (g) of this section. Manufacturers of a chemical substance subject to risk evaluation under section 6(b) of the Act are exempted from fee payment requirements in this section, if they meet one or more of the exemptions under paragraphs (a)(3)(i) through (v) of this section on or after the certification cutoff date identified in paragraph (b)(6)(i) of this section and do not conduct manufacturing outside of those exemptions after the certification cutoff dates or if they meet the exemptions under paragraph (a)(3)(vi) of this section for the five-year period preceding publication of the preliminary list and do not conduct manufacturing outside of that exemption during the five-year period preceding publication of the preliminary list; and the exemptions are only available if the manufacturer will meet one or more of the exemptions in paragraphs (a)(3)(i) through (vi) of this section in the successive five years and will not conduct manufacturing outside of the exemptions in paragraphs (a)(3)(i) through (v) of this section in the successive five years or will meet the exemption in paragraph (a)(3)(vi) of this section in the successive five years:

(i) Import articles containing that chemical substance;

(ii) Produce that chemical substance as a byproduct that is not later used for commercial purposes or distributed for commercial use;

(iii) Manufacture that chemical substance as an impurity as defined in 40 CFR 704.3;

(iv) Manufacture that chemical substance as a non-isolated intermediate as defined in 40 CFR 704.3;

(v) Manufacture small quantities of that chemical substance solely for research and development, as defined in §700.43; or

(vi) manufacture that chemical substance in quantities below a 2,500 lbs annual production volume as described in §700.43, unless all manufacturers of that chemical substance manufacture that chemical in quantities below a 2,500 lbs annual production volume as defined in §700.43, in which case this exemption is not applicable.

(4) Processors submitting a SNUN or TME under TSCA section 5 to EPA shall remit for each such notice the applicable fee identified in paragraph (c) of this section in accordance with the procedures in paragraphs (f) and (g) of this section.

(5) Processors of chemical substances and mixtures subject to a TSCA section 4(a) test rule, test order, or enforceable consent agreement in association with a SNUN submission referenced in paragraph (a)(4) of this section shall remit for each such test rule, order, or enforceable consent agreement the applicable fee identified in paragraph (c) of this section in accordance with the procedures in paragraphs (f) and (g) of this section.

(b) Identifying manufacturers subject to fees—(1) In general. For purposes of identifying manufacturers subject to fees for section 4 test rules and section 6 EPA-initiated risk evaluations, EPA will publish a preliminary list of manufacturers identified through a review of data sources described in paragraph (b)(2) of this subsection; provide an opportunity for public comment; and publish a final list specifying the manufacturers responsible for payment.

(2) Data sources. To compile the preliminary list, EPA will rely on information submitted to the Agency (such as the information submitted under sections 5(a), 8(a), 8(b), and to the Toxics Release Inventory) as well as other information available to the Agency, including publicly available information or information submitted to other agencies to which EPA has access. To be able to include the most recent CDR data and to account for annual or other typical fluctuations in manufacturing, EPA will use the five most recent years of data submitted or available to the Agency to develop the preliminary list.

(3) Publication of preliminary list. (i) For risk evaluations initiated by EPA under section 6, the preliminary list will be published at the time of final designation of the chemical substance as a High-Priority Substance.

(ii) For test rules under section 4, the preliminary list will be published with the proposed test rule.

(4) Public comment period. Following publication of the preliminary list, EPA will provide a period of public comment that is no less than 30 days.

(5) Self-identification. All manufacturers other than those listed in paragraphs (a)(2)(i) through (iii) and (a)(3)(i) through (iii) of this section who have manufactured (including imported) the chemical substance in the previous five years must submit notice to EPA, irrespective of whether they are included in the preliminary list specified in paragraph (b)(3) of this section. The notice must be submitted electronically via EPA's Central Data Exchange (CDX), the Agency's electronic reporting portal, using the Chemical Information Submission System (CISS) reporting tool, and must contain the following information:

(i) Contact information. The name and address of the submitting company, the name and address of the authorized official for the submitting company, and the name and telephone number of a person who will serve as technical contact for the submitting company and who will be able to answer questions about the information submitted by the company to EPA.

(ii) Certification of cessation. If a manufacturer has manufactured in the five-year period preceding publication of the preliminary list but has ceased manufacture prior to the certification cutoff dates identified in paragraph (b)(6) of this section and will not manufacture the substance again in the successive five years, the manufacturer may submit a certification statement attesting to these facts. If EPA receives such a certification statement from a manufacturer, the manufacturer will not be included in the final list of manufacturers described in paragraph (b)(7) of this section and will not be obligated to pay the fee under this section.

(iii) Certification of no manufacture. If a manufacturer is identified on the preliminary list but has not manufactured the chemical in the five-year period preceding publication of the preliminary list, the manufacturer may submit a certification statement attesting to these facts. If EPA receives such a certification statement from a manufacturer, the manufacturer will not be included in the final list of manufacturers described in paragraph (b)(7) of this section and will not be obligated to pay the fee under this section.

(iv) Certification of meeting exemption. If a manufacturer is identified on the preliminary list and exclusively meets one or more of the exemptions as described in paragraph (a)(2) or (a)(3) of this section, the manufacturer must submit a certification statement attesting to these facts in order to not be included in the final list of manufacturers described in paragraph (b)(7) of this section. If a manufacturer is not on a preliminary list and exclusively meets one or more of the exemptions as described in paragraph (a)(2) or (a)(3) of this section, the manufacturer may submit a certification statement attesting to these facts. If EPA receives such a certification statement from a manufacturer, the manufacturer will not be included in the final list of manufacturers described in paragraph (b)(7) of this section and will not be obligated to pay the fee under this section, unless all manufacturers of that chemical substance meet the exemption as described in (a)(2)(vi) or (a)(3)(vi) of this section.

(v) Production volume. If a manufacturer has not submitted certification of cessation, as described in paragraph (b)(5)(ii) of this section, or certification of no manufacture, as described in paragraph (b)(5)(iii) of this section, for purposes of identifying manufacturers subject to fees for TSCA section 6 EPA-initiated risk evaluations and does not meet one or more of the exemptions in paragraph (a)(3)(i) through (v) of this section, the manufacturer must submit their production volume as defined in 40 CFR 700.43 for the applicable substance for the three calendar years prior to publication of the preliminary list. Only production volume reported to EPA prior to the final list being published will be used in determining fees described in §700.45(f).

(6) Certification cutoff date. (i) For a section 6 EPA-initiated risk evaluation, the cutoff date for purposes of paragraph (b)(5)(ii) of this section is the day prior to initiation of the prioritization process for the applicable chemical substance.

(ii) For a section 4 test rule, the cutoff date for purposes of paragraph (b)(5)(ii) of this section is the day prior to publication of the proposed test rule for the applicable chemical substance.

(7) Publication of final list. EPA expects to publish a final list of manufacturers to identify the specific manufacturers subject to the applicable fee. This list will indicate if additional manufacturers self-identified pursuant to paragraph (b)(5) of this section, if other manufacturers were identified through credible public comment, and if manufacturers submitted certification of cessation, no manufacture, or meeting exemption pursuant to paragraph (b)(5)(ii), (iii), or (iv) of this section. The final list will be published no later than concurrently with the final scope document for risk evaluations initiated by EPA under TSCA section 6, and with the final test rule for test rules under TSCA section 4. EPA may modify the list after the publication of the final list.

(8) Effect of final list. Manufacturers who are listed on the final list are subject to the applicable fee identified in paragraph (c) of this section.

(9) Identifying manufacturers for other fee categories. For Section 4 Test Orders and enforceable consent agreements, and Section 6 Manufacturer-Requested Risk Evaluations, EPA will not conduct the identification process described in paragraphs (b)(1) through (8) of this section, as manufacturers self-identify through a submission or are already otherwise known to Agency. However, those manufacturers are required to provide an information submission to EPA for the purposes of fee administration. The notice must be submitted electronically via the Agency's electronic reporting software (e.g., Central Data Exchange (CDX)) and must contain the manufacturers: Full name, address, telephone number and email address. Timing of this submission must be as follows:

(i) For section 4 test orders and enforceable consent agreements, the informational submission in this paragraph (b)(9) must be provided within 30 days following notification from EPA.

(ii) For section 6 manufacturer-requested risk evaluations, the informational submission in this paragraph (b)(9) is required as part of the procedural process for making such requests, and must be completed at the time of making the request.

(10) Recordkeeping. After April 22, 2024:

(i) All manufacturers other than those listed in paragraph (a)(2)(i) through (v) or (a)(3)(i) through (v) of this section must maintain production volume records related to compliance with paragraph (b)(5)(v) of this section. These records must be maintained for a period of five years from the date notice is submitted pursuant to paragraph (b)(5) of this section.

(ii) Those manufacturers that are exempt from fee payment requirements pursuant to paragraph (a)(2)(iv) or (a)(3)(iv) of this section must maintain manufacturing and other business records related to compliance with the exemption criteria described in paragraph (a)(2)(iv) or (a)(3)(iv) of this section, respectively. These records must be maintained for a period of five years from the date the notice is submitted pursuant to paragraph (b)(5) of this section.

(iii) Those manufacturers that are exempt from fee payment requirements pursuant to paragraph (a)(2)(v) or (a)(3)(v) of this section must maintain manufacturing and other business records related to compliance with the exemption criteria described in paragraph (a)(2)(v) or (a)(3)(v) of this section, respectively, such as production volume, plans of study, information from research and development notebooks, study reports, or notice solely for research and development use. These records must be maintained for a period of five years from the date the notice is submitted pursuant to paragraph (b)(5) of this section.

(iv) Those manufacturers that are exempt from fee payment requirements pursuant to paragraph (a)(2)(vi) or (a)(3)(vi) of this section must maintain production volume records related to compliance with the exemption criteria described in paragraph (a)(2)(vi) or (a)(3)(vi) of this section, respectively. These records must be maintained for a period of five years from the date the notice is submitted pursuant to paragraph (b)(5) of this section.

(c) Fees for the 2024, 2025, and 2026 fiscal years. Persons shall remit fee payments to EPA as follows:

(1) Small business concerns. Small business concerns shall remit fees as follows:

(i) Premanufacture notice and consolidated premanufacture notice. Persons shall remit a fee totaling $6,480 for each premanufacture notice (PMN) or consolidated PMN submitted in accordance with part 720 of this chapter.

(ii) Significant new use notice. Persons shall remit a fee totaling $6,480 for each significant new use notice (SNUN) submitted in accordance with part 721 of this chapter.

(iii) Exemption application. Persons shall remit a fee totaling $2,180 for each of the following exemption requests submitted under TSCA section 5:

(A) Low releases and low exposures exemption or LoREX request submitted to EPA pursuant to section 5(a)(1) of the Act in accordance with §723.50(a)(1)(ii) of this chapter.

(B) Low volume exemption or LVE request submitted to EPA pursuant to section 5(a)(1) of the Act in accordance with §723.50(a)(1)(i) of this chapter.

(C) Test marketing exemption or TME application submitted to EPA pursuant to section 5 of the Act in accordance with §§725.300 through 725.355 of this chapter.

(D) TSCA experimental release application or TERA application submitted to EPA pursuant to section 5 of the Act for research and development activities involving microorganisms in accordance with §§725.200 through 725.260 of this chapter.

(E) Tier II exemption application submitted to EPA pursuant to section 5 of the Act in accordance with §§725.428 through 725.455 of this chapter.

(iv) Instant photographic film article exemption notice. Persons shall remit a fee totaling $2,180 for each instant photographic film article exemption notice submitted in accordance with §723.175 of this chapter.

(v) Microbial commercial activity notice and consolidated microbial commercial activity notice. Persons shall remit a fee totaling $6,480 for each microbial commercial activity notice (MCAN) or consolidated MCAN submitted in accordance with §§725.25 through 725.36 of this chapter.

(vi) Persons shall remit a total of twenty percent of the applicable fee under paragraph (c)(2)(vi), (vii) or (viii) of this section for a test rule, test order, or enforceable consent agreement.

(vii) Persons shall remit a total fee of twenty percent of the applicable fee under paragraphs (c)(2)(ix) of this section for an EPA-initiated risk evaluation.

(viii) Persons shall remit the total fee under paragraph (c)(2)(x) or (xi) of this section, as applicable, for a manufacturer-requested risk evaluation.

(2) Others. Persons other than small business concerns shall remit fees as follows:

(i) PMN and consolidated PMN. Persons shall remit a fee totaling $37,000 for each PMN or consolidated PMN submitted in accordance with part 720 of this chapter.

(ii) SNUN. Persons shall remit a fee totaling $37,000 for each significant new use notice submitted in accordance with part 721 of this chapter.

(iii) Exemption applications. Persons shall remit a fee totaling $10,870 for each of the following exemption requests, and modifications to previous exemption requests, submitted under section 5 of the Act:

(A) Low releases and low exposures exemption or LoREX request submitted to EPA pursuant to section 5(a)(1) of the Act in accordance with §723.50(a)(1)(ii) of this chapter.

(B) Low volume exemption or LVE request submitted to EPA pursuant to section 5(a)(1) of the Act in accordance with §723.50(a)(1)(i) of this chapter.

(C) Test marketing exemption or TME application submitted to EPA pursuant to section 5 of the Act in accordance with §§725.300 through 725.355 of this chapter, unless the submitting company has graduated from EPA's Sustainable Futures program, in which case this exemption fee is waived.

(D) TSCA experimental release application or TERA application submitted to EPA pursuant to section 5 of the Act for research and development activities involving microorganisms in accordance with §§725.200 through 725.260 of this chapter.

(E) Tier II exemption application submitted to EPA pursuant to section 5 of the Act in accordance with §§725.428 through 725.455 of this chapter.

(iv) Instant photographic film article exemption notice. Persons shall remit a fee totaling $10,870 for each exemption notice submitted in accordance with §723.175 of this chapter.

(v) MCAN and consolidated MCAN. Persons shall remit a fee totaling $37,000 for each MCAN or consolidated MCAN submitted in accordance with §§725.25 through 725.36 of this chapter.

(vi) Test rule. Persons shall remit a fee totaling $50,000 for each test rule.

(vii) Test order. Persons shall remit a fee totaling $25,000 for each test order.

(viii) Enforceable consent agreement. Persons shall remit a fee totaling $50,000 for each enforceable consent agreement.

(ix) EPA-initiated chemical risk evaluation. Persons shall remit a fee totaling $4,287,000.

(x) Manufacturer-requested risk evaluation of a Work Plan Chemical. Persons shall remit an initial fee of $1,414,924, a second payment of $1,414,924, and final payment to total 50% of the actual costs of this activity, in accordance with the procedures in paragraph (g) of this section. The final payment amount will be determined by EPA, and invoice issued to the requesting manufacturer.

(xi) Manufacturer-requested risk evaluation of a non-work plan chemical. Persons shall remit an initial fee of $2,829,847, a second payment of $2,829,847, and final payment to total 100% of the actual costs of the activity, in accordance with the procedures in paragraph (g) of this section. The final payment amount will be determined by EPA, and invoice issued to the requesting manufacturer.

(d) Fees for 2026 fiscal year and beyond. (1) Fees for the 2026 and later fiscal years will be adjusted on a three-year cycle by multiplying the fees in paragraph (c) of this section by the current PPI index value with a base year of 2024 using the following formula:

FA = F × I

Where:

FA = the inflation-adjusted future year fee amount.

F = the fee specified in paragraph (c) of this section.

I = Producer Price Index for Chemicals and Allied Products inflation value with 2024 as a base year.

(2) Updated fee amounts for PMNs, SNUNs, MCANs, exemption notices, exemption applications, and manufacturer-requested risk evaluation requests apply to submissions received by the Agency on or after October 1 of every three-year fee adjustment cycle beginning in fiscal year 2024 (October 1, 2023). Updated fee amounts also apply to test rules, test orders, enforceable consent agreements and EPA-initiated risk evaluations that are “noticed” on or after October 1 of every three-year fee adjustment cycle, beginning in fiscal year 2026.

(3) The Agency will initiate public consultation through notice-and-comment rulemaking prior to making fee adjustments beyond inflation. If it is determined that no additional adjustment is necessary beyond for inflation, EPA will provide public notice of the inflation-adjusted fee amounts through posting to the Agency's web page by the beginning of each three-year fee adjustment cycle (October 1, 2026, October 1, 2029, etc.). If the Agency determines that adjustments beyond inflation are necessary, EPA will provide public notice of that determination and the process to be followed to make those adjustments.

(e) No fee required. Persons are exempt from remitting any fee for Tier I exemption submissions under §725.424 and polymer exemption reports submitted under §723.250 of this chapter.

(f) Multiple parties, including joint submitters and consortia. (1) Joint submitters of a TSCA section 5 notice are required to remit the applicable fee identified in paragraph (c) of this section for each section 5 notice submitted. Only one fee is required for each submission, regardless of the number of joint submitters for that notice. To qualify for the fee identified in paragraph (c)(1) of this section, each joint submitter of a TSCA section 5 notice must qualify as a small business concern under §700.43 of this chapter.

(2) Any consortium formed to split the cost of the applicable fee under section 4 of the Act is required to remit the appropriate fee identified in paragraph (c) of this section for each test rule, test order, or enforceable consent agreement regardless of the number of manufacturers and/or processors in that consortium. For the consortium to qualify for the fee identified in paragraph (c)(1) of this section, each person in the consortium must qualify as a small business concern under §700.43 of this chapter. Failure to submit fee payment pursuant to this paragraph, or to provide notice of failure to reach agreement pursuant to paragraph (f)(2)(v) of this section constitutes a violation by each consortium member.

(i) The consortium must identify a principal sponsor and provide notification to EPA that a consortium has formed. The notification must be accomplished within 90 days of the publication date of a test rule under section 4 of the Act, or within 90 days of the effective date of a test order under section 4 of the Act, or within 90 days of the signing of an enforceable consent agreement under section 4 of the Act. EPA may permit additional entities to join an existing consortium after the expiration of the notification period if the principal sponsor provides updated notification.

(ii) Notification must be submitted electronically via the Agency's electronic reporting software—Central Data Exchange (CDX)—and include the following information:

(A) Full name, address, telephone number and signature of principal sponsor;

(B) Name(s) and contact information for each manufacturer and/or processor associating with the consortium.

(iii) It is up to the consortium to determine how fees will be split among the persons in the consortium.

(iv) Consortia are strongly encouraged to set lower fees for small business concerns participating in the consortium.

(v) If a consortium is unable to come to terms on how fees will be split among the persons in the consortium, the principal sponsor must notify EPA in writing before the end of the notification period in paragraph (f)(2)(i) of this section.

(vi) If a consortium provides notice to EPA under paragraph (f)(2)(v) of this section that they failed to reach agreement on payment, EPA will assess fees to all persons as individuals described under paragraph (f)(4) of this section.

(3) Any consortium formed to split the cost of the applicable fee supporting a risk evaluation under section 6(b) of the Act is required to remit the appropriate fee identified in paragraph (c) of this section for each risk evaluation, regardless of the number of manufacturers in that consortium. For the consortium to qualify for the fee identified in paragraph (c)(1)(vii) of this section, each person in the consortium must qualify as a small business concern under §700.43 of this chapter. Failure to provide notice or submit fee payment pursuant to this paragraph (f)(3) constitutes a violation by each consortium member.

(i) Notification must be provided to EPA that a consortium has formed. The notification must be accomplished within 90 days of the publication of the final scope of a chemical risk evaluation under section 6(b)(4)(D) of the Act or within 90 days of EPA providing notification to a manufacturer that a manufacturer-requested risk evaluation has been granted. EPA may permit additional entities to join an existing consortium after the expiration of the notification period if the principal sponsor provides updated notification.

(ii) Notification must be submitted electronically via the Agency's electronic reporting software—Central Data Exchange (CDX)—and include the following information:

(A) Full name, address, telephone number and signature of principal sponsor;

(B) Name(s) and contact information for each manufacturer and/or processor associating with the consortium.

(iii) It is up to the consortium to determine how fees will be split among the persons in the consortium.

(iv) Consortia are strongly encouraged to set lower fees for small business concerns participating in the consortium.

(v) If a consortium is unable to come to terms on how fees will be split among the persons in the consortium, the principal sponsor must notify EPA in writing before the end of the notification period in paragraph (f)(3)(i) of this section.

(vi) If a consortium provides notice to EPA under paragraph (f)(3)(v) of this section that they failed to reach agreement on payment, EPA will assess fees to all persons as individuals as described under paragraph (f)(4) of this section.

(4) If multiple persons are subject to fees triggered by section 4 or 6(b) of the Act and no consortium is formed, EPA will determine the portion of the total applicable fee to be remitted by each person subject to the requirement.

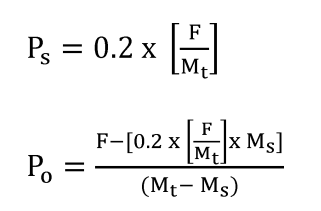

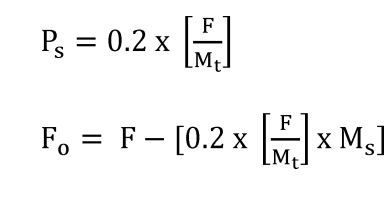

(i) Each person's share of the applicable fees triggered by section 4 of the Act specified in paragraph (c) of this section shall be in proportion to the total number of manufacturers and/or processors of the chemical substance, with lower fees for small businesses:

Where:

P s = the portion of the fee under paragraph (c) of this section that is owed by a person who qualifies as a small business concern under §700.43 of this chapter.

P o = the portion of the fee owed by a person other than a small business concern.

F = the total fee required under paragraph (c) of this section.

M t = the total number of persons subject to the fee requirement.

M s = the number of persons subject to the fee requirement who qualify as a small business concern.

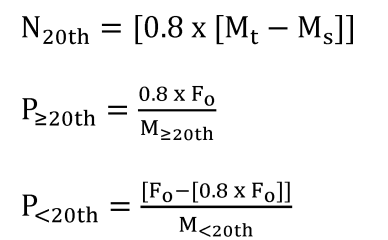

(ii) Each person's share of the applicable fees triggered by section 6(b) of the Act specified in paragraph (c) of this section shall be in proportion to the total number of manufacturers and their reported production volume as described in §700.45(b)(v) of the chemical substance, with lower fees for small businesses:

(iii) Remaining manufacturers ( i.e., those that do not qualify as a small business concern) are then ranked in ascending order (from lowest to highest) based on reported production volume as described in §700.45(b)(v). Each remaining manufacturer is assigned a number with 1 for lowest production volume, 2 for second lowest production volume, etc.

| Manufacturer(s) | Assigned No. (N) |

|---|---|

| Manufacturer with lowest production volume | 1 |

| Manufacturer with 2nd lowest production volume | 2 |

| Manufacturer with 3rd lowest production volume | 3 |

| . . . etc. |

Where:

P s = the portion of the fee under paragraph (c) of this section that is owed by a person who qualifies as a small business concern under §700.43 of this chapter.

P ≥20th = the portion of the fee owed by a person other than a small business concern in the top 20th percentile.

P <20th = the portion of the fee owed by a person other than a small business concern not in the top 20th percentile.

F = the total fee required under paragraph (c) of this section.

M t = the total number of persons subject to the fee requirement.

M s = the number of persons subject to the fee requirement who qualify as a small business concern.

N 20th = The assigned number as illustrated in Table 1 to the manufacturer(s) with a production volume as described in §1.45(b)(v) at which the manufacturers with production volume greater than or equal to are in the top 20th percentile.

M ≥20th = the total number of persons with production volume as described in 700.45(b)(v) greater than or equal to the manufacturer(s) with a production volume as N 20th .

M <20th = the total number of persons with production volume as described in 700.45(b)(v) less than the manufacturer(s) with a production volume as N 20th .

F o = the total fee required under paragraph (c) of this section by all person(s) other than a small business concern.

(iv) In the event there are three or less manufacturers identified for a chemical substance, EPA will distribute the fee evenly among those three or less fee payers, regardless of production volume.

(v) In the event the number assigned to the top 20th percentile is not an integer, EPA will round to the nearest integer to determine the manufacturer(s) with the reported production volume as described in §700.45(b)(v) greater than or equal to the top 20th percentile.

(vi) In the event multiple manufacturers report the same production volume as described in §700.45(b)(v) and are greater than or equal to the top 20th percentile, EPA will include all manufacturers with that same production volume in the fee calculation for the top 20th percentile group.

(5) If multiple persons are subject to fees triggered by section 4 of the Act and some inform EPA of their intent to form a consortium while others choose not to associate with the consortium, EPA will take the following steps to allocate fee amounts:

(i) Count the total number of manufacturers, including the number of manufacturers within any consortia; divide the total fee amount by the total number of manufacturers; and allocate equally on a per capita basis to generate a base fee;

(ii) Provide all small businesses who are either not associated with a consortium, or associated with an all- small business consortium, with an 80% discount from the base fee referenced previously;

(iii) Calculate the total remaining fee and total number of remaining manufacturers by subtracting out the discounted fees and the number of small businesses identified;

(iv) Reallocate the remaining fee across those remaining individuals and groups in equal amounts, counting each manufacturer in a consortium as one person; and

(v) Inform consortia and individuals of their requisite fee amount. Small businesses in a successfully-formed consortium, other than a consortium of all small businesses, will not be afforded the 80% discount by EPA, but consortia managers are strongly encouraged to provide a discount for small business concerns.

(6) If multiple persons are subject to fees triggered by section 6(b) of the Act and some inform EPA of their intent to form a consortium while others choose not to associate with the consortium, EPA will take the following steps to allocate fee amounts:

(i) Count the total number of manufacturers, including the number of manufacturers within any consortia; divide the total fee amount by the total number of manufacturers; and allocate equally on a per capita basis to generate a base fee;

(ii) Provide all small businesses who are either not associated with a consortium, or associated with an all-small business consortium, with an 80% discount from the base fee referenced previously;

(iii) Calculate the total remaining fee and total number of remaining manufacturers by subtracting out the discounted fees and the number of small businesses identified;

(iv) Place remaining manufacturers in ascending order (from lowest to highest) based on reported production volume as described in §700.45(b)(v). Assign each remaining manufacturer a number with 1 for lowest production volume, 2 for second lowest production volume, etc.;

(v) Determine the manufacturer(s) in the top 20th percentile by multiplying the total number of remaining manufacturers by 0.8. then comparing that number to the manufacturer(s) with that assigned number as described in paragraph (f)(6)(iv) of this section;

(vi) Reallocate 80% of the total remaining fee evenly across that manufacturer(s) with a production volume amount equal to or larger than that manufacturer(s) (the top 20th percentile), counting each manufacturer in a consortium as one person;

(vii) Reallocate the remaining fee evenly across the remaining manufacturers, counting each manufacturer in a consortium as one person; and

(viii) Inform consortia and individuals of their requisite fee amount. Small businesses in a successfully formed consortium, other than a consortium of all small businesses, will not be afforded the 80% discount by EPA, but consortia managers are strongly encouraged to provide a discount for small business concerns.

(g) Remittance procedure. (1) Electronic payment. Each remittance under this section shall be paid electronically in U.S. dollars, using one of the electronic payment methods supported by the Department of the Treasury's Pay.gov online electronic payment service, or any applicable additional or successor online electronic payment service offered by the Department of Treasury.

(2) Fees incurred prior to October 18, 2018. Timing of payment for fees incurred between October 1, 2018 and October 18, 2018. Fees required by paragraph (c) of this section for which the fee-triggering action or event occurred between October 1, 2018, and October 18, 2018 shall be paid in response to invoices EPA will send within 30 days of October 18, 2018.

(3) Fees incurred after October 18, 2018. Timing of payment for fees incurred after October 18, 2018. Fees required by paragraph (c) of this section for which the fee-triggering action or event occurred after October 18, 2018 shall be paid at the following time:

(i) Test orders and test rules. The applicable fee specified in paragraph (c) of this section shall be paid in full not later than 180 days after the effective date of a test rule or test order under section 4 of the Act.

(ii) Enforceable consent agreements. The applicable fee specified in paragraph (c) of this section shall be paid in full not later than 120 days after the signing of an enforceable consent agreement under section 4 of the Act.

(iii) Section 5 notice. The applicable fee specified in paragraph (c) of this section shall be paid in full immediately upon submission of a TSCA section 5 notice.

(iv) Risk evaluations. (A) For EPA-initiated risk evaluations, the applicable fee specified in paragraph (c) of this section shall be paid in two installments, with the first payment of 50% due 180 days after publishing the final scope of a risk evaluation and the second payment for the remainder of the fee due 545 days after publishing the final scope of a risk evaluation under section 6(b)(4)(D) of the Act.

(B) For manufacturer-requested risk evaluations under section 6(b)(4)(C)(ii) of the Act, the applicable fees specified in paragraph (c) of this section shall be paid as follows:

(1) The applicable fee specified in paragraph (c) of this section shall be paid in three installments. The first payment shall be due no later than 180 days after EPA provides the submitting manufacture(s) notice that it has granted the request.

(2) The second payment shall be due no later than 545 days after EPA provides the submitting manufacturer(s) notice that it has granted the request.

(3) The final payment shall be due no later than 30 days after EPA publishes the final risk evaluation.

(4) Payment identity. (i) Persons who submit a TSCA section 5 notice shall place an identifying number and a payment identity number on the front page of each TSCA section 5 notice submitted. The identifying number must include the letters “TS” followed by a combination of 6 numbers (letters may be substituted for some numbers). The payment identity number may be a “Pay.gov” transaction number used to transmit the fee. The same TS number and the submitter's name must appear on the corresponding fee remittance under this section. If a remittance applies to more than one TSCA section 5 notice, the person shall include the name of the submitter and a new TS number for each TSCA section 5 notice to which the remittance applies, and the amount of the remittance that applies to each notice.

(ii) Persons who are required to submit a letter of intent to conduct testing per §790.45 of this chapter shall place a payment identity number on the front page of each letter submitted. The identifying number must include the letters “TS” followed by a combination of 6 numbers (letters may be substituted for some numbers). The payment identity number may be a “Pay.gov” transaction number used to transmit the fee. The same TS number and the submitter's name must appear on the corresponding fee remittance under this section. If a remittance applies to more than one letter of intent to conduct testing, the person shall include the name of the submitter and a new TS number for each letter of intent to conduct testing to which the remittance applies, and the amount of the remittance that applies to each letter of intent.

(iii) Persons who sign an enforceable consent agreement per §790.60 of this chapter shall place a payment identity number within the contents of the signed agreement. The identifying number must include the letters “TS” followed by a combination of 6 numbers (letters may be substituted for some numbers). The payment identity number may be a “Pay.gov” transaction number used to transmit the fee. The same TS number and the submitter's name must appear on the corresponding fee remittance under this section. If a remittance applies to more than one enforceable consent agreement, the party or parties shall include the name of the submitter(s) and a new TS number for each enforceable consent agreement to which the remittance applies, and the amount of the remittance that applies to each enforceable consent agreement.

(5) Small business certification. (i) Each person who remits the fee identified in paragraph (c)(1) of this section for a PMN, consolidated PMN, or SNUN shall insert a check mark for the statement, “The company named in part 1, section A is a small business concern under 40 CFR 700.43 and has remitted a fee of $6,480 in accordance with 40 CFR 700.45(c).” under “CERTIFICATION” on page 2 of the Premanufacture Notice for New Chemical Substances (EPA Form 7710–25).

(ii) Each person who remits the fee identified in paragraph (c)(1) of this section for a LVE, LoREX, TERA, TME, or Tier II exemption request under TSCA section 5 shall insert a check mark for the statement, “The company named in part 1, section A is a small business concern under 40 CFR 700.43 and has remitted a fee of $2,180 in accordance with 40 CFR 700.45(c).” in the exemption application.

(iii) Each person who remits the fee identified in paragraph (c)(1) of this section for an exemption notice under §723.175 of this chapter shall include the words, “The company or companies identified in this notice is/are a small business concern under 40 CFR 700.43 and has/have remitted a fee of $2,180 in accordance with 40 CFR 700.45(c).” in the certification required in §723.175(i)(1)(x) of this chapter.

(iv) Each person who remits the fee identified in paragraph (c)(1) of this section for a MCAN or consolidated MCAN for a microorganism shall insert a check mark for the statement, “The company named in part 1, section A is a small business concern under 40 CFR 700.43 and has remitted a fee of $6,480 in accordance with 40 CFR 700.45(c).” in the certification required in §725.25(b) of this chapter.

(6) Payment certification statement. (i) Each person who remits a fee identified in paragraph (c)(2) of this section for a PMN, consolidated PMN, or SNUN shall insert a check mark for the statement, “The company named in part 1, section A has remitted the fee of $37,000 specified in 40 CFR 700.45(c).” under “CERTIFICATION” on page 2 of the Premanufacture Notice for New Chemical Substances (EPA Form 7710–25).

(ii) Each person who remits a fee identified in paragraph (c)(2) of this section for a LVE, LoREX, TERA, TME, or Tier II exemption request under TSCA section 5 shall insert a check mark for the statement, “The company named in part 1, section A has remitted the fee of $10,870 specified in 40 CFR 700.45(c).” in the exemption application.

(iii) Each person who remits the fee identified in paragraph (c)(2) of this section for an exemption notice under §723.175 of this chapter shall include the words, “The company or companies identified in this notice has/have remitted a fee of $10,870 in accordance with 40 CFR 700.45(c).” in the certification required in §723.175(i)(1)(x) of this chapter.

(iv) Each person who remits the fee identified in paragraph (c)(2) of this section for a MCAN for a microorganism shall insert a check mark for the statement, “The company named in part 1, section A has remitted the fee of $37,000 in accordance with 40 CFR 700.45(c).” in the certification required in §725.25(b) of this chapter.

(h) Full fee refunds. EPA will refund, in totality, any fee paid for a section 5 notice whenever the Agency determines:

(1) That the chemical substance that is the subject of a PMN, consolidated PMN, exemption request, or exemption notice, is not a new chemical substance as of the date of submission of the notice,

(2) In the case of a SNUN, that the notice was not required,

(3) That as of the date of submission of the notice: The microorganism that is the subject of a MCAN or consolidated MCAN is not a new microorganism; nor is the use involving the microorganism a significant new use; or

(4) When the Agency fails to make a determination on a notice by the end of the applicable notice review period under §720.75 or §725.50 of this chapter, unless the Agency determines that the submitter unduly delayed the process, or

(5) When the Agency fails to approve, or deny an exemption request within the applicable period under §720.38(d), §723.50(g), or §725.50(b) of this chapter, unless the Agency determines that the submitter unduly delayed the process.

(i) Partial fee refunds. (1) If a TSCA section 5 notice is withdrawn during the first 10 business days after the beginning of the applicable review period under §720.75(a) of this chapter, the Agency will refund all but 25% of the fee as soon as practicable.

(2) Once withdrawn, any future submission related to the TSCA section 5 notice must be submitted as a new notice.

(3) If EPA determines that the initial payment for a manufacturer-requested risk evaluation exceed the applicable fee in paragraph (c) of this section, EPA will refund the difference.

[62 FR 17931, Apr. 11, 1997; 75 FR 784 Jan. 6, 2010; 83 FR 52714, Oct. 17, 2018; 98 FR 12974, Feb. 21, 2024]