['Air Programs']

['Acid Rain', 'Air Quality']

08/29/2022

...

§74.40 Establishment of opt-in source allowance accounts.

(a) Establishing accounts. Not earlier than the date on which a combustion or process source becomes an affected unit under this part and upon receipt of a request for a compliance account under paragraph (b) of this section, the Administrator will establish a compliance account (unless the source that includes the opt-in source already has a compliance account or the opt-in source has, under §74.4(c), a different designated representative than the designated representative for the source) and allocate allowances in accordance with subpart C of this part for combustion sources or subpart D of this part for process sources.

(b) Request for opt-in account. The designated representative of the opt-in source shall, on or after the effective date of the opt-in permit as specified in §74.14(d), submit a letter requesting the opening of an compliance account (unless the source that includes the opt-in source already has a compliance account or the opt-in source has, under §74.4(c), a different designated representative than the designated representative for the source)to the Administrator.

[60 FR 17115, Apr. 4, 1995, as amended at 70 FR 25336, May 12, 2005]

§74.41 Identifying allowances.

(a) Identifying allowances. Allowances allocated to an opt-in source will be assigned a serial number that identifies them as being allocated under an opt-in permit.

(b) Submittal of opt-in allowances for auction. (1) An authorized account representative may offer for sale in the spot auction under §73.70 of this chapter allowances that are allocated to opt-in sources, if the allowances have a compliance use date earlier than the year in which the spot auction is to be held and if the Administrator has completed the deductions for compliance under §73.35(b) for the compliance year corresponding to the compliance use date of the offered allowances.

(2) Authorized account representatives may not offer for sale in the advance auctions under §73.70 of this chapter allowances allocated to opt-in sources.

§74.42 Limitation on transfers.

(a) With regard to a transfer request submitted for recordation during the period starting January 1 and ending with the allowance transfer deadline in the same year, the Administrator will not record a transfer of an opt-in allowance that is allocated to an opt-in source for the year in which the transfer request is submitted or a subsequent year.

(b) With regard to a transfer request during the period starting with the day after an allowance transfer deadline and ending December 31 in the same year, the Administrator will not record a transfer of an opt-in allowance that is allocated to an opt-in source for a year after the year in which the transfer request is submitted.

[70 FR 25336, May 12, 2005]

§74.43 Annual compliance certification report.

(a) Applicability and deadline. For each calendar year in which an opt-in source is subject to the Acid Rain emissions limitations, the designated representative of the opt-in source shall submit to the Administrator, no later than 60 days after the end of the calendar year, an annual compliance certification report for the opt-in source.

(b) Contents of report. The designated representative shall include in the annual compliance certification report the following elements, in a format prescribed by the Administrator, concerning the opt-in source and the calendar year covered by the report:

(1) Identification of the opt-in source;

(2) An opt-in utilization report in accordance with §74.44 for combustion sources and §74.45 for process sources;

(3) A thermal energy compliance report in accordance with §74.47 for combustion sources and §74.48 for process sources, if applicable;

(4) Shutdown or reconstruction information in accordance with §74.46, if applicable;

(5) A statement that the opt-in source has not become an affected unit under §72.6 of this chapter;

(6) At the designated representative's option, the total number of allowances to be deducted for the year, using the formula in §74.49, and the serial numbers of the allowances that are to be deducted; and

(7) In an annual compliance certification report for a year during 1995 through 2005, at the designated representative's option, for opt-in sources that share a common stack and whose emissions of sulfur dioxide are not monitored separately or apportioned in accordance with part 75 of this chapter, the percentage of the total number of allowances under paragraph (b)(6) of this section for all such affected units that is to be deducted from each affected unit's compliance subaccount; and

(8) In an annual compliance certification report for a year during 1995 through 2005, the compliance certification under paragraph (c) of this section.

(c) Annual compliance certification. In the annual compliance certification report under paragraph (a) of this section, the designated representative shall certify, based on reasonable inquiry of those persons with primary responsibility for operating the opt-in source in compliance with the Acid Rain Program, whether the opt-in source was operated during the calendar year covered by the report in compliance with the requirements of the Acid Rain Program applicable to the opt-in source, including:

(1) Whether the opt-in source was operated in compliance with applicable Acid Rain emissions limitations, including whether the opt-in source held allowances, as of the allowance transfer deadline, in its compliance subaccount (after accounting for any allowance deductions or other adjustments under §73.34(c) of this chapter) not less than the opt-in source's total sulfur dioxide emissions during the calendar year covered by the annual report;

(2) Whether the monitoring plan that governs the opt-in source has been maintained to reflect the actual operation and monitoring of the opt-in source and contains all information necessary to attribute monitored emissions to the opt-in source;

(3) Whether all the emissions from the opt-in source or group of affected units (including the opt-in source) using a common stack were monitored or accounted for through the missing data procedures and reported in the quarterly monitoring reports in accordance with part 75 of this chapter;

(4) Whether the facts that form the basis for certification of each monitor at the opt-in source or group of affected units (including the opt-in source) using a common stack or of an opt-in source's qualifications for using an Acid Rain Program excepted monitoring method or approved alternative monitoring method, if any, have changed;

(5) If a change is required to be reported under paragraph (c)(4) of this section, specify the nature of the change, the reason for the change, when the change occurred, and how the unit's compliance status was determined subsequent to the change, including what method was used to determine emissions when a change mandated the need for monitoring recertification; and

(6) When applicable, whether the opt-in source was operating in compliance with its thermal energy plan as provided in §74.47 for combustion sources and §74.48 for process sources.

[60 FR 17115, Apr. 4, 1995, as amended at 70 FR 25337, May 12, 2005]

§74.44 Reduced utilization for combustion sources.

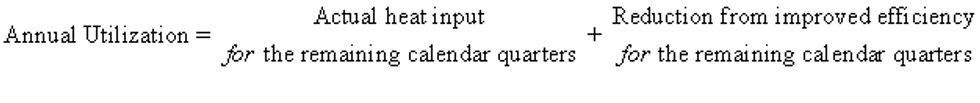

(a) Calculation of utilization—(1) Annual utilization. (i) Except as provided in paragraph (a)(1)(ii) of this section, annual utilization for the calendar year shall be calculated as follows:

Annual Utilization = Actual heat input Reduction from improved efficiency

where,

(A) “Actual heat input” shall be the actual annual heat input (in mmBtu) of the opt-in source for the calendar year determined in accordance with appendix F of part 75 of this chapter.

(B) “Reduction from improved efficiency” shall be the sum of the following four elements: Reduction from demand side measures that improve the efficiency of electricity consumption; reduction from demand side measures that improve the efficiency of steam consumption; reduction from improvements in the heat rate at the opt-in source; and reduction from improvement in the efficiency of steam production at the opt-in source. Qualified demand side measures applicable to the calculation of utilization for opt-in sources are listed in appendix A, section 1 of part 73 of this chapter.

(C) “Reduction from demand side measures that improve the efficiency of electricity consumption” shall be a good faith estimate of the expected kilowatt hour savings during the calendar year for such measures and the corresponding reduction in heat input (in mmBtu) resulting from those measures. The demand side measures shall be implemented at the opt-in source, in the residence or facility to which the opt-in source delivers electricity for consumption or in the residence or facility of a customer to whom the opt-in source's utility system sells electricity. The verified amount of such reduction shall be submitted in accordance with paragraph (c)(2) of this section.

(D) “Reduction from demand side measures that improve the efficiency of steam consumption” shall be a good faith estimate of the expected steam savings (in mmBtu) from such measures during the calendar year and the corresponding reduction in heat input (in mmBtu) at the opt-in source as a result of those measures. The demand side measures shall be implemented at the opt-in source or in the facility to which the opt-in source delivers steam for consumption. The verified amount of such reduction shall be submitted in accordance with paragraph (c)(2) of this section.

(E) “Reduction from improvements in heat rate” shall be a good faith estimate of the expected reduction in heat rate during the calendar year and the corresponding reduction in heat input (in mmBtu) at the opt-in source as a result of all improved unit efficiency measures at the opt-in source and may include supply-side measures listed in appendix A, section 2.1 of part 73 of this chapter. The verified amount of such reduction shall be submitted in accordance with paragraph (c)(2) of this section.

(F) “Reduction from improvement in the efficiency of steam production at the opt-in source” shall be a good faith estimate of the expected improvement in the efficiency of steam production at the opt-in source during the calendar year and the corresponding reduction in heat input (in mmBtu) at the opt-in source as a result of all improved steam production efficiency measures. In order to claim improvements in the efficiency of steam production, the designated representative of the opt-in source must demonstrate to the satisfaction of the Administrator that the heat rate of the opt-in source has not increased. The verified amount of such reduction shall be submitted in accordance with paragraph (c)(2) of this section.

(G) Notwithstanding paragraph (a)(1)(i)(B) of this section, where two or more opt-in sources, or two or more opt-in sources and Phase I units, include in their annual compliance certification reports their good faith estimate of kilowatt hour savings or steam savings from the same specific measures:

(1) The designated representatives of all such opt-in sources and Phase I units shall submit with their annual compliance certification reports a certification signed by all such designated representatives. The certification shall apportion the total kilowatt hour savings or steam savings among such opt-in sources and Phase I units.

(2) Each designated representative shall include in its annual compliance certification report only its share of kilowatt hour savings or steam savings.

(ii) For an opt-in source whose opt-in permit becomes effective on a date other than January 1, annual utilization for the first year shall be calculated as follows:

where “actual heat input” and “reduction from improved efficiency” are defined as set forth in paragraph (a)(1)(i) of this section but are restricted to data or estimates for the “remaining calendar quarters”, which are the calendar quarters that begin on or after the date the opt-in permit becomes effective.

(2) Average utilization. Average utilization for the calendar year shall be defined as the average of the annual utilization calculated as follows:

(i) For the first two calendar years after the effective date of an opt-in permit taking effect on January 1, average utilization will be calculated as follows:

(A) Average utilization for the first year = annual utilizationyear 1

where “annual utilizationyear 1” is as calculated under paragraph (a)(1)(i) of this section.

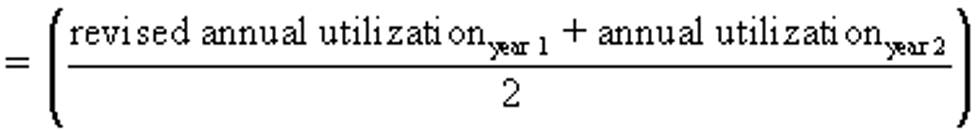

(B) Average utilization for the second year

where,

“revised annual utilizationyear 1” is as submitted for the year under paragraph (c)(2)(i)(B) of this section and adjusted under paragraph (c)(2)(iii) of this section;

“annual utilizationyear 2” is as calculated under paragraph (a)(1)(i) of this section.

(ii) For the first three calendar years after the effective date of the opt-in permit taking effect on a date other than January 1, average utilization will be calculated as follows:

(A) Average utilization for the first year after opt-in = annual utilizationyear 1

where “annual utilizationyear 1” is as calculated under paragraph (a)(1)(ii) of this section.

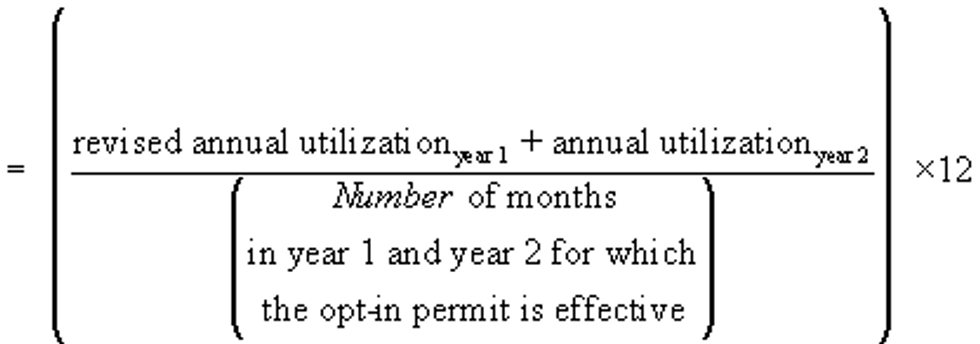

(B) Average utilization for the second year after opt-in

where,

“revised annual utilizationyear 1” is as submitted for the year under paragraph (c)(2)(i)(B) of this section and adjusted under paragraph (c)(2)(iii) of this section; and

“annual utilizationyear 2” is as calculated under paragraph (a)(1)(ii) of this section.

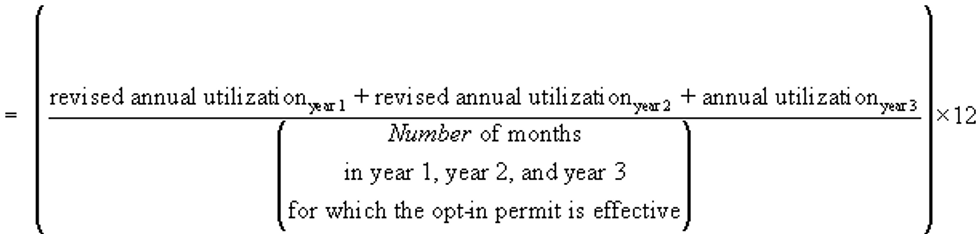

(C) Average utilization for the third year after opt-in

where,

“revised annual utilizationyear 1” is as submitted for the year under paragraph (c)(2)(i)(B) of this section and adjusted under paragraph (c)(2)(iii) of this section; and

“revised annual utilizationyear 2” is as submitted for the year under paragraph (c)(2)(i)(B) of this section and adjusted under paragraph (c)(2)(iii) of this section; and

“annual utilizationyear 3” is as calculated under paragraph (a)(1)(ii) of this section.

(iii) Except as provided in paragraphs (a)(2)(i) and (a)(2)(ii) of this section, average utilization shall be the sum of annual utilization for the calendar year and the revised annual utilization, submitted under paragraph (c)(2)(i)(B) of this section and adjusted by the Administrator under paragraph (c)(2)(iii) of this section, for the two immediately preceding calendar years divided by 3.

(b) Determination of reduced utilization and calculation of allowances—(1) Determination of reduced utilization. For a year during which its opt-in permit is effective, an opt-in source has reduced utilization if the opt-in source's average utilization for the calendar year, as calculated under paragraph (a) of this section, is less than its baseline.

(2) Calculation of allowances deducted for reduced utilization. If the Administrator determines that an opt-in source has reduced utilization for a calendar year during which the opt-in source's opt-in permit is in effect, the Administrator will deduct allowances, as calculated under paragraph (b)(2)(i) of this section, from the compliance subaccount of the opt-in source's Allowance Tracking System account.

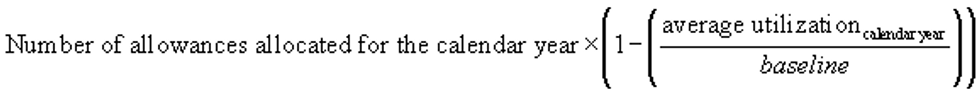

(i) Allowances deducted for reduced utilization =

(ii) The allowances deducted shall have the same or an earlier compliance use date as those allocated under subpart C of this part for the calendar year for which the opt-in source has reduced utilization.

(c) Compliance —(1) Opt-in Utilization Report. The designated representative for each opt-in source shall submit an opt-in utilization report for the calendar year, as part of its annual compliance certification report under §74.43, that shall include the following elements in a format prescribed by the Administrator:

(i) The name, authorized account representative identification number, and telephone number of the designated representative of the opt-in source;

(ii) The account identification number in the Allowance Tracking System of the source that includes the opt-in source;

(iii) The opt-in source's annual utilization for the calendar year, as defined under paragraph (a)(1) of this section, and the revised annual utilization, submitted under paragraph (c)(2)(i)(B) of this section and adjusted under paragraph (c)(2)(iii) of this section, for the two immediately preceding calendar years;

(iv) The opt-in source's average utilization for the calendar year, as defined under paragraph (a)(2) of this section;

(v) The difference between the opt-in source's average utilization and its baseline;

(vi) The number of allowances that shall be deducted, if any, using the formula in paragraph (b)(2)(i) of this section and the supporting calculations;

(2) Confirmation report. (i) If the annual compliance certification report for an opt-in source includes estimates of any reduction in heat input resulting from improved efficiency as defined under paragraph (a)(1)(i) of this section, the designated representative shall submit, by July 1 of the year in which the annual compliance certification report was submitted, a confirmation report, concerning the calendar year covered by the annual compliance certification report. The Administrator may grant, for good cause shown, an extension of the time to file the confirmation report. The confirmation report shall include the following elements in a format prescribed by the Administrator:

(A) Verified reduction in heat input. Any verified kwh savings or any verified steam savings from demand side measures that improve the efficiency of electricity or steam consumption, any verified reduction in the heat rate at the opt-in source, or any verified improvement in the efficiency of steam production at the opt-in source achieved and the verified corresponding reduction in heat input for the calendar year that resulted.

(B) Revised annual utilization. The opt-in source's annual utilization for the calendar year as provided under paragraph (c)(1)(iii) of this section, recalculated using the verified reduction in heat input for the calendar year under paragraph (c)(2)(i)(A) of this section.

(C) Revised average utilization. The opt-in source's average utilization as provided under paragraph (c)(1)(iv) of this section, recalculated using the verified reduction in heat input for the calendar year under paragraph (c)(2)(i)(A) of this section.

(D) Recalculation of reduced utilization. The difference between the opt-in source's recalculated average utilization and its baseline.

(E) Allowance adjustment. The number of allowances that should be credited or deducted using the formulas in paragraphs (c)(2)(iii)(C) and (D) of this section and the supporting calculations; and the number of adjusted allowances remaining using the formula in paragraph (c)(2)(iii)(E) of this section and the supporting calculations.

(ii) Documentation. (A) For all figures under paragraphs (c)(2)(i)(A) of this section, the opt-in source must provide as part of the confirmation report, documentation (which may follow the EPA Conservation Verification Protocol) verifying the figures to the satisfaction of the Administrator.

(B) Notwithstanding paragraph (c)(2)(i)(A) of this section, where two or more opt-in sources, or two or more opt-in sources and Phase I units include in the confirmation report under paragraph (c)(2) of this section or §72.91(b) of this chapter the verified kilowatt hour savings or steam savings defined under paragraph (c)(2)(i)(A) of this section, for the calendar year, from the same specific measures:

(1) The designated representatives of all such opt-in sources and Phase I units shall submit with their confirmation reports a certification signed by all such designated representatives. The certification shall apportion the total kilowatt hour savings or steam savings as defined under paragraph (c)(2)(i)(A) of this section for the calendar year among such opt-in sources and Phase I units.

(2) Each designated representative shall include in the opt-in source's confirmation report only its share of the verified reduction in heat input as defined under paragraph (c)(2)(i)(A) of this section for the calendar year under the certification under paragraph (c)(2)(ii)(B)(1) of this section.

(iii) Determination of reduced utilization based on confirmation report. (A) If an opt-in source must submit a confirmation report as specified under paragraph (c)(2) of this section, the Administrator, upon such submittal, will adjust his or her determination of reduced utilization for the calendar year for the opt-in source. Such adjustment will include the recalculation of both annual utilization and average utilization, using verified reduction in heat input as defined under paragraph (c)(2)(i)(A) of this section for the calendar year instead of the previously estimated values.

(B) Estimates confirmed. If the total, included in the confirmation report, of the amounts of verified reduction in the opt-in source's heat input equals the total estimated in the opt-in source's annual compliance certification report for the calendar year, then the designated representative shall include in the confirmation report a statement indicating that is true.

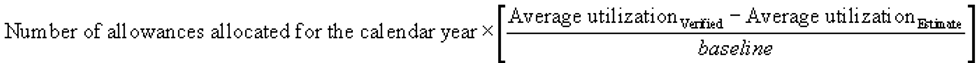

(C) Underestimate. If the total, included in the confirmation report, of the amounts of verified reduction in the opt-in source's heat input is greater than the total estimated in the opt-in source's annual compliance certification report for the calendar year, then the designated representative shall include in the confirmation report the number of allowances to be credited to the compliance account of the source that includes the opt-in source calculated using the following formula:

Allowances credited for the calendar year in which the reduced utilization occurred =

where,

Average Utilizationestimate = the average utilization of the opt-in source as defined under paragraph (a)(2) of this section, calculated using the estimated reduction in the opt-in source's heat input under (a)(1) of this section, and submitted in the annual compliance certification report for the calendar year.

Average Utilizationverified = the average utilization of the opt-in source as defined under paragraph (a)(2) of this section, calculated using the verified reduction in the opt-in source's heat input as submitted under paragraph (c)(2)(i)(A) of this section by the designated representative in the confirmation report.

(D) Overestimate. If the total of the amounts of verified reduction in the opt-in source's heat input included in the confirmation report is less than the total estimated in the opt-in source's annual compliance certification report for the calendar year, then the designated representative shall include in the confirmation report the number of allowances to be deducted from the compliance account of the source that includes the opt-in source, which equals the absolute value of the result of the formula for allowances credited under paragraph (c)(2)(iii)(C) of this section.

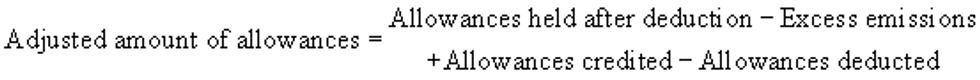

(E) Adjusted allowances remaining. Unless paragraph (c)(2)(iii)(B) of this section applies, the designated representative shall include in the confirmation report the adjusted amount of allowances that would have been held in the compliance account of the source that includes the opt-in source if the deductions made under §73.35(b) of this chapter had been based on the verified, rather than the estimated, reduction in the opt-in source's heat input, calculated as follows:

where:

“Allowances held after deduction” shall be the amount of allowances held in the compliance account of the source that includes the opt-in source after deduction of allowances was made under §73.35(b) of this chapter based on the annual compliance certification report.

“Excess emissions” shall be the amount (if any) of excess emissions determined under §73.35(b) for the calendar year based on the annual compliance certification report. “Allowances credited” shall be the amount of allowances calculated under paragraph (c)(2)(iii)(C) of this section.

“Allowances deducted” shall be the amount of allowances calculated under paragraph (c)(2)(iii)(D) of this section.

(1) If the result of the formula for “adjusted amount of allowances” is negative, the absolute value of the result constitutes excess emissions of sulfur dioxide. If the result is positive, there are no excess emissions of sulfur dioxide.

(2) If the amount of excess emissions of sulfur dioxide calculated under “adjusted amount of allowances” differs from the amount of excess emissions of sulfur dioxide determined under §73.35 of this chapter based on the annual compliance certification report, then the designated representative shall include in the confirmation report a demonstration of:

(i) The number of allowances that should be deducted to offset any increase in excess emissions or returned to the account for any decrease in excess emissions; and

(ii) The amount of the excess emissions penalty (excluding interest) that should be paid or returned to the account for the change in excess emissions.

(3) The Administrator will deduct immediately from the compliance account of the source that includes the opt-in source the amount of allowances that he or she determines is necessary to offset any increase in excess emissions or will return immediately to the compliance account of the source that includes the opt-in source the amount of allowances that he or she determines is necessary to account for any decrease in excess emissions.

(4) The designated representative may identify the serial numbers of the allowances to be deducted or returned. In the absence of such identification, the deduction will be on a first-in, first-out basis under §73.35(c)(2) of this chapter and the identification of allowances returned will be at the Administrator's discretion.

(5) If the designated representative of an opt-in source fails to submit on a timely basis a confirmation report, in accordance with paragraph (c)(2) of this section, with regard to the estimate of reductions in heat input as defined under paragraph (c)(2)(i)(A) of this section, then the Administrator will reject such estimate and correct it to equal zero in the opt-in source's annual compliance certification report that includes that estimate. The Administrator will deduct immediately, on a first-in, first-out basis under §73.35(c)(2) of this chapter, the amount of allowances that he or she determines is necessary to offset any increase in excess emissions of sulfur dioxide that results from the correction and will require the owners and operators of the opt-in source to pay an excess emission penalty in accordance with part 77 of this chapter.

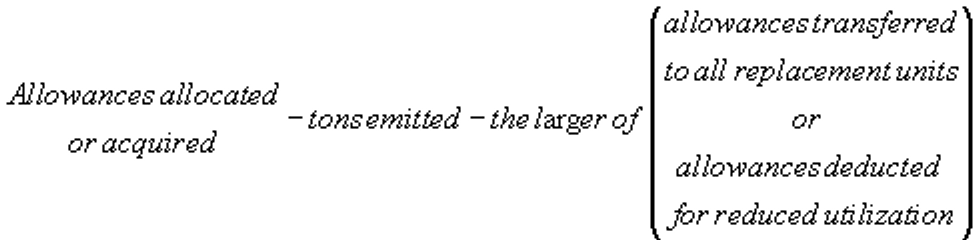

(F) If the opt-in source is governed by an approved thermal energy plan under §74.47 and if the opt-in source must submit a confirmation report as specified under paragraph (c)(2) of this section, the adjusted amount of allowances that should remain in the compliance account of the source that includes the opt-in source shall be calculated as follows:

Adjusted amount of allowances =

where,

“Allowances allocated or acquired” shall be the number of allowances held in the compliance account of the source that includes the opt-in source at the allowance transfer deadline plus the number of allowances transferred for the previous calendar year to all replacement units under an approved thermal energy plan in accordance with §74.47(a)(6).

“Tons emitted” shall be the total tons of sulfur dioxide emitted by the opt-in source during the calendar year, as reported in accordance with subpart F of this part for combustion sources.

“Allowances transferred to all replacement units” shall be the sum of allowances transferred to all replacement units under an approved thermal energy plan in accordance with §74.47 and adjusted by the Administrator in accordance with §74.47(d)(2).

“Allowances deducted for reduced utilization” shall be the total number of allowances deducted for reduced utilization as calculated in accordance with this section including any adjustments required under paragraph (c)(iii)(E) of this section.

[60 FR 17115, Apr. 4, 1995, as amended at 63 FR 18841, Apr. 16, 1998; 70 FR 25337, May 12, 2005]

§74.45 Reduced utilization for process sources. [Reserved]

§74.46 Opt-in source permanent shutdown, reconstruction, or change in affected status.

(a) Notification. (1) When an opt-in source has permanently shutdown during the calendar year, the designated representative shall notify the Administrator of the date of shutdown, within 30 days of such shutdown.

(2) When an opt-in source has undergone a modification that qualifies as a reconstruction as defined in §60.15 of this chapter, the designated representative shall notify the Administrator of the date of completion of the reconstruction, within 30 days of such completion.

(3) When an opt-in source becomes an affected unit under §72.6 of this chapter, the designated representative shall notify the Administrator of such change in the opt-in source's affected status within 30 days of such change.

(b) Administrator's action. (1) The Administrator will terminate the opt-in source's opt-in permit and deduct allowances as provided below in the following circumstances:

(i) When an opt-in source has permanently shutdown. The Administrator shall deduct allowances equal in number to and with the same or earlier compliance use date as those allocated to the opt-in source under §74.40 for the calendar year in which the shut down occurs and for all future years following the year in which the shut down occurs; or

(ii) When an opt-in source has undergone a modification that qualifies as a reconstruction as defined in §60.15 of this chapter. The Administrator shall deduct allowances equal in number to and with the same or earlier compliance use date as those allocated to the opt-in source under §74.40 for the calendar year in which the reconstruction is completed and all future years following the year in which the reconstruction is completed; or

(iii) When an opt-in source becomes an affected unit under §72.6 of this chapter. The Administrator shall deduct allowances equal in number to and with the same or earlier compliance use date as those allocated to the opt-in source under §74.40 for the calendar year in which the opt-in source becomes affected under §72.6 of this chapter and all future years following the calendar year in which the opt-in source becomes affected under §72.6; or

(iv) When an opt-in source does not renew its opt-in permit. The Administrator shall deduct allowances equal in number to and with the same or earlier compliance use date as those allocated to the opt-in source under §74.40 for the calendar year in which the opt-in source's opt-in permit expires and all future years following the year in which the opt-in source's opt-in permit expires.

(2) [Reserved]

[60 FR 17115, Apr. 4, 1995, as amended at 70 FR 25337, May 12, 2005]

§74.47 Transfer of allowances from the replacement of thermal energy - combustion sources.

(a) Thermal energy plan—(1) General provisions. The designated representative of an opt-in source that seeks to qualify for the transfer of allowances based on the replacement of thermal energy by a replacement unit shall submit a thermal energy plan subject to the requirements of §72.40(b) of this chapter for multi-unit compliance options and this section. The effective period of the thermal energy plan shall begin at the start of the calendar quarter (January 1, April 1, July 1, or October 1) for which the plan is approved and end December 31 of the last full calendar year for which the opt-in permit containing the plan is in effect.

(2) Applicability. This section shall apply to any designated representative of an opt-in source and any designated representative of each replacement unit seeking to transfer allowances based on the replacement of thermal energy.

(3) Contents. Each thermal energy plan shall contain the following elements in a format prescribed by the Administrator:

(i) The calendar year and quarter that the thermal energy plan takes effect, which shall be the first year and quarter the replacement unit(s) will replace thermal energy of the opt-in source;

(ii) The name, authorized account representative identification number, and telephone number of the designated representative of the opt-in source;

(iii) The name, authorized account representative identification number, and telephone number of the designated representative of each replacement unit;

(iv) The account identification number in the Allowance Tracking System of the source that includes the opt-in source;

(v) The account identification number in the Allowance Tracking System of each source that includes a replacement unit;

(vi) The type of fuel used by each replacement unit;

(vii) The allowable SO2 emissions rate, expressed in lbs/mmBtu, of each replacement unit for the calendar year for which the plan will take effect. When a thermal energy plan is renewed in accordance with paragraph (a)(9) of this section, the allowable SO2 emission rate at each replacement unit will be the most stringent federally enforceable allowable SO2 emissions rate applicable at the time of renewal for the calendar year for which the renewal will take effect. This rate will not be annualized;

(viii) The estimated annual amount of total thermal energy to be reduced at the opt-in source, including all energy flows (steam, gas, or hot water) used for any process or in any heating or cooling application, and, for a plan starting April 1, July 1, or October 1, such estimated amount of total thermal energy to be reduced starting April 1, July 1, or October 1 respectively and ending on December 31;

(ix) The estimated amount of total thermal energy at each replacement unit for the calendar year prior to the year for which the plan is to take effect, including all energy flows (steam, gas, or hot water) used for any process or in any heating or cooling application, and, for a plan starting April 1, July 1, or October 1, such estimated amount of total thermal energy for the portion of such calendar year starting April 1, July 1, or October 1 respectively;

(x) The estimated annual amount of total thermal energy at each replacement unit after replacing thermal energy at the opt-in source, including all energy flows (steam, gas, or hot water) used for any process or in any heating or cooling application, and, for a plan starting April 1, July 1, or October 1, such estimated amount of total thermal energy at each replacement unit after replacing thermal energy at the opt-in source starting April 1, July 1, or October 1 respectively and ending December 31;

(xi) The estimated annual amount of thermal energy at each replacement unit, including all energy flows (steam, gas, or hot water) used for any process or in any heating or cooling application, replacing thermal energy at the opt-in source, and, for a plan starting April 1, July 1, or October 1, such estimated amount of thermal energy replacing thermal energy at the opt-in source starting April 1, July 1, or October 1 respectively and ending December 31;

(xii) The estimated annual total fuel input at each replacement unit after replacing thermal energy at the opt-in source and, for a plan starting April 1, July 1, or October 1, such estimated total fuel input after replacing thermal energy at the opt-in source starting April 1, July 1, or October 1 respectively and ending December 31;

(xiii) The number of allowances calculated under paragraph (b) of this section that the opt-in source will transfer to each replacement unit represented in the thermal energy plan.

(xiv) The estimated number of allowances to be deducted for reduced utilization under §74.44;

(xv) Certification that each replacement unit has entered into a legally binding steam sales agreement to provide the thermal energy, as calculated under paragraph (a)(3)(xi) of this section, that it is replacing for the opt-in source. The designated representative of each replacement unit shall maintain and make available to the Administrator, at the Administrator's request, copies of documents demonstrating that the replacement unit is replacing the thermal energy at the opt-in source.

(4) Submission. The designated representative of the opt-in source seeking to qualify for the transfer of allowances based on the replacement of thermal energy shall submit a thermal energy plan to the permitting authority by no later than six months prior to the first calendar quarter for which the plan is to be in effect. The thermal energy plan shall be signed and certified by the designated representative of the opt-in source and each replacement unit covered by the plan.

(5) Retirement of opt-in source upon enactment of plan. (i) If the opt-in source will be permanently retired as of the effective date of the thermal energy plan, the opt-in source shall not be required to monitor its emissions upon retirement, consistent with §75.67 of this chapter, provided that the following requirements are met:

(A) The designated representative of the opt-in source shall include in the plan a request for an exemption from the requirements of part 75 in accordance with §75.67 of this chapter and shall submit the following statement: “I certify that the opt-in source (“is” or “will be”, as applicable) permanently retired on the date specified in this plan and will not emit any sulfur dioxide or nitrogen oxides after such date.”

(B) The opt-in source shall not emit any sulfur dioxide or nitrogen oxides after the date specified in the plan.

(ii) Notwithstanding the monitoring exemption discussed in paragraph (a)(5)(i) of this section, the designated representative for the opt-in source shall submit the annual compliance certification report provided under paragraph (d) of this section.

(6) Administrator's action. If the permitting authority approves a thermal energy plan, the Administrator will annually transfer allowances to the compliance account of each source that includes a replacement unit, as provided in the approved plan.

(7) Incorporation, modification and renewal of a thermal energy plan. (i) An approved thermal energy plan, including any revised or renewed plan that is approved, shall be incorporated into both the opt-in permit for the opt-in source and the Acid Rain permit for each replacement unit governed by the plan. Upon approval, the thermal energy plan shall be incorporated into the Acid Rain permit for each replacement unit pursuant to the requirements for administrative permit amendments under §72.83 of this chapter.

(ii) In order to revise an opt-in permit to add an approved thermal energy plan or to change an approved thermal energy plan, the designated representative of the opt-in source shall submit a plan or a revised plan under paragraph (a)(4) of this section and meet the requirements for permit revisions under §72.80 and either §72.81 or §72.82 of this chapter.

(8) Termination of plan. (i) A thermal energy plan shall be in effect until the earlier of the expiration of the opt-in permit for the opt-in source or the year for which a termination of the plan takes effect under paragraph (a)(8)(ii) of this section.

(ii) Termination of plan by opt-in source and replacement units. A notification to terminate a thermal energy plan in accordance with §72.40(d) of this chapter shall be submitted no later than December 1 of the calendar year for which the termination is to take effect.

(iii) If the requirements of paragraph (a)(8)(ii) of this section are met and upon revision of the opt-in permit of the opt-in source and the Acid Rain permit of each replacement unit governed by the thermal energy plan to terminate the plan pursuant to §72.83 of this chapter, the Administrator will adjust the allowances for the opt-in source and the replacement units to reflect the transfer back to the opt-in source of the allowances transferred from the opt-in source under the plan for the year for which the termination of the plan takes effect.

(9) Renewal of thermal energy plan. The designated representative of an opt-in source may renew the thermal energy plan as part of its opt-in permit renewal in accordance with §74.19.

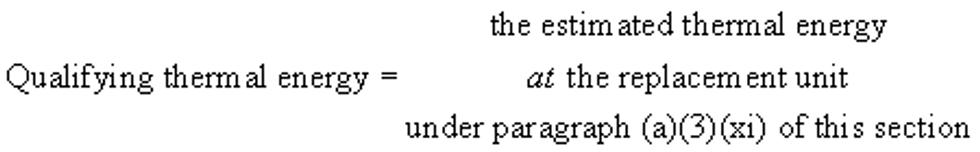

(b) Calculation of transferable allowances—(1) Qualifying thermal energy. The amount of thermal energy credited towards the transfer of allowances based on the replacement of thermal energy shall equal the qualifying thermal energy and shall be calculated for each replacement unit as follows:

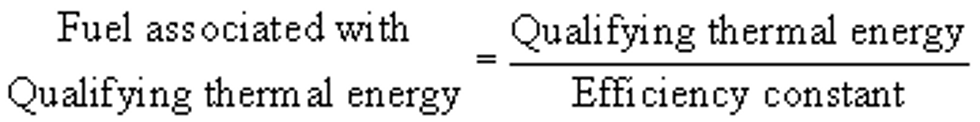

(2) Fuel associated with qualifying thermal energy. The fuel associated with the qualifying thermal energy at each replacement unit shall be calculated as follows:

where,

“Qualifying thermal energy” for the replacement unit is as defined in paragraph (b)(1) of this section;

“Efficiency constant” for the replacement unit

= 0.85, where the replacement unit is a boiler

= 0.80, where the replacement unit is a cogenerator

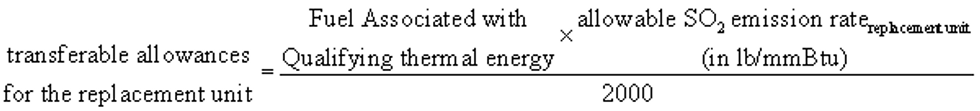

(3) Allowances transferable from the opt-in source to each replacement unit. The number of allowances transferable from the opt-in source to each replacement unit for the replacement of thermal energy is calculated as follows:

where,

“Allowable SO2 emission rate” for the replacement unit is as defined in paragraph (a)(3)(vii) of this section;

“Fuel associated with qualifying thermal energy” is as defined in paragraph (b)(2) of this section;

(c) Transfer prohibition. The allowances transferred from the opt-in source to each replacement unit shall not be transferred from the compliance account of the source that includes the replacement unit of the replacement unit to any other Allowance Tracking System account.

(d) Compliance—(1) Annual compliance certification report. (i) As required for all opt-in sources, the designated representative of the opt-in source covered by a thermal energy plan must submit an opt-in utilization report for the calendar year as part of its annual compliance certification report under §74.44(c)(1).

(ii) The designated representative of an opt-in source must submit a thermal energy compliance report for the calendar year as part of the annual compliance certification report, which must include the following elements in a format prescribed by the Administrator:

(A) The name, authorized account representative identification number, and telephone number of the designated representative of the opt-in source;

(B) The name, authorized account representative identification number, and telephone number of the designated representative of each replacement unit;

(C) The account identification number in the Allowance Tracking System of the source that includes the opt-in source;

(D) The account identification number in the Allowance Tracking System of each source that includes a replacement unit;

(E) The actual amount of total thermal energy reduced at the opt-in source during the calendar year, including all energy flows (steam, gas, or hot water) used for any process or in any heating or cooling application;

(F) The actual amount of thermal energy at each replacement unit, including all energy flows (steam, gas, or hot water) used for any process or in any heating or cooling application, replacing the thermal energy at the opt-in source;

(G) The actual amount of total thermal energy at each replacement unit after replacing thermal energy at the opt-in source, including all energy flows (steam, gas, or hot water) used for any process or in any heating or cooling application;

(H) Actual total fuel input at each replacement unit as determined in accordance with part 75 of this chapter;

(I) Calculations of allowance adjustments to be performed by the Administrator in accordance with paragraph (d)(2) of this section.

(2) Allowance adjustments by Administrator. (i) The Administrator will adjust the number of allowances in the compliance account for each source that includes the opt-in source or a replacement unit to reflect any changes between the estimated values submitted in the thermal energy plan pursuant to paragraph (a) of this section and the actual values submitted in the thermal energy compliance report pursuant to paragraph (d) of this section. The values to be considered for this adjustment include:

(A) The number of allowances transferable by the opt-in source to each replacement unit, calculated in paragraph (b) of this section using the actual, rather than estimated, thermal energy at the replacement unit replacing thermal energy at the opt-in source.

(B) The number of allowances deducted from the compliance account of the source that includes the opt-in source, calculated under §74.44(b)(2).

(ii) If the opt-in source includes in the opt-in utilization report under §74.44 estimates for reductions in heat input, then the Administrator will adjust the number of allowances in the compliance account for each source that includes the opt-in source or a replacement unit to reflect any differences between the estimated values submitted in the opt-in utilization report and the actual values submitted in the confirmation report pursuant to §74.44(c)(2).

(3) Liability. The owners and operators of an opt-in source or a replacement unit governed by an approved thermal energy plan shall be liable for any violation of the plan or this section at that opt-in source or replacement unit that is governed by the thermal energy plan, including liability for fulfilling the obligations specified in part 77 of this chapter and section 411 of the Act.

[60 FR 17115, Apr. 4, 1995, as amended at 63 FR 18841, 18842, Apr. 16, 1998; 70 FR 25337, May 12, 2005]

§74.48 Transfer of allowances from the replacement of thermal energy - process sources. [Reserved]

§74.49 Calculation for deducting allowances.

(a) Allowance deduction formula. The following formula shall be used to determine the total number of allowances to be deducted for the calendar year from the allowances held in the compliance account of a source that includes an opt-in source as of the allowance transfer deadline applicable to that year:

Total allowances deducted = Tons emitted Allowances deducted for reduced utilization where:

(1)(i) Except as provided in paragraph (a)(1)(ii) of this section, “Tons emitted” shall be the total tons of sulfur dioxide emitted by the opt-in source during the calendar year, as reported in accordance with subpart F of this part for combustion sources or subpart G of this part for process sources.

(ii) If the effective date of the opt-in source's permit took effect on a date other than January 1, “Tons emitted” for the first calendar year shall be the total tons of sulfur dioxide emitted by the opt-in source during the calendar quarters for which the opt-in source's opt-in permit is effective, as reported in accordance with subpart F of this part for combustion sources or subpart G of this part for process sources.

(2) “Allowances deducted for reduced utilization” shall be the total number of allowances deducted for reduced utilization as calculated in accordance with §74.44 for combustion sources or §74.45 for process sources.

(b) [Reserved]

[60 FR 17115, Apr. 4, 1995, as amended at 70 FR 25337, May 12, 2005]

§74.50 Deducting opt-in source allowances from ATS accounts.

(a)(1) Deduction of allowances. The Administrator may deduct any allowances that were allocated to an opt-in source under §74.40 by removing, from any Allowance Tracking System accounts in which they are held, the allowances in an amount specified in paragraph (d) of this section, under the following circumstances:

(i) When the opt-in source has permanently shut down; or

(ii) When the opt-in source has been reconstructed; or

(iii) When the opt-in source becomes an affected unit under §72.6 of this chapter; or

(iv) When the opt-in source fails to renew its opt-in permit.

(2) An opt-in allowance may not be deducted under paragraph (a)(1) of this section from any Allowance Tracking System Account other than the account of the source that includes opt-in source allocated such allowance:

(i) After the Administrator has completed the process of recordation as set forth in §73.34(a) of this chapter following the deduction of allowances from the compliance account of the source that includes the opt-in source for the year for which such allowance may first be used; or

(ii) If the opt-in source includes in the annual compliance certification report estimates of any reduction in heat input resulting from improved efficiency under §74.44(a)(1)(i), after the Administrator has completed action on the confirmation report concerning such estimated reduction pursuant to §74.44(c)(2)(iii)(E)(3), (4), and (5) for the year for which such allowance may first be used.

(b) Method of deduction. The Administrator will deduct allowances beginning with those allowances with the latest recorded date of transfer out of the compliance account of the source that includes the opt-in source.

(c) Notification of deduction. When allowances are deducted, the Administrator will send a written notification to the authorized account representative of each Allowance Tracking System account from which allowances were deducted. The notification will state:

(1) The serial numbers of all allowances deducted from the account,

(2) The reason for deducting the allowances, and

(3) The date of deduction of the allowances.

(d) Amount of deduction. The Administrator may deduct allowances in accordance with paragraph (a) of this section in an amount required to offset any excess emissions in accordance with part 77 of this chapter and when the source that includes the opt-in source does not hold allowances equal in number to and with the same or earlier compliance use date for the calendar years specified under §74.46(b)(1)(i) through (iv) in an amount required to be deducted under §74.46(b)(1)(i) through (iv).

[60 FR 17115, Apr. 4, 1995, as amended at 63 FR 18842, Apr. 16, 1998; 70 FR 25337, May 12, 2005]

['Air Programs']

['Acid Rain', 'Air Quality']

UPGRADE TO CONTINUE READING

Load More

J. J. Keller is the trusted source for DOT / Transportation, OSHA / Workplace Safety, Human Resources, Construction Safety and Hazmat / Hazardous Materials regulation compliance products and services. J. J. Keller helps you increase safety awareness, reduce risk, follow best practices, improve safety training, and stay current with changing regulations.

Copyright 2026 J. J. Keller & Associate, Inc. For re-use options please contact copyright@jjkeller.com or call 800-558-5011.