['Air Programs']

['Air Emissions']

01/23/2023

...

Authority: 42 U.S.C. 7401-7671q.

§1027.101 To whom do these requirements apply?

(a) This part prescribes fees manufacturers must pay for activities related to EPA's motor vehicle and engine compliance program (MVECP). This includes activities related to approving certificates of conformity and performing tests and taking other steps to verify compliance with emission standards in this part. You must pay fees as described in this part if you are a manufacturer of any of the following products:

(1) Motor vehicles and motor vehicle engines we regulate under 40 CFR part 86. This includes light-duty vehicles, light-duty trucks, medium-duty passenger vehicles, highway motorcycles, and heavy-duty highway engines and vehicles.

(2) The following nonroad engines and equipment:

(i) Locomotives and locomotive engines we regulate under 40 CFR part 1033.

(ii) Nonroad compression-ignition engines we regulate under 40 CFR part 1039.

(iii) Marine compression-ignition engines we regulate under 40 CFR part 1042 or 1043.

(iv) Marine spark-ignition engines and vessels we regulate under 40 CFR part 1045 or 1060. We refer to these as Marine SI engines.

(v) Nonroad spark-ignition engines above 19 kW we regulate under 40 CFR part 1048. We refer to these as Large SI engines.

(vi) Recreational vehicles we regulate under 40 CFR part 1051.

(vii) Nonroad spark-ignition engines and equipment at or below 19 kW we regulate under 40 CFR part 1054 or 1060. We refer to these as Small SI engines.

(3) The following stationary internal combustion engines:

(i) Stationary compression-ignition engines we certify under 40 CFR part 60, subpart IIII.

(ii) Stationary spark-ignition engines we certify under 40 CFR part 60, subpart JJJJ.

(4) Portable fuel containers we regulate under 40 CFR part 59, subpart F.

(b) [Reserved]

(c) Nothing in this part limits our authority to conduct testing or to require you to conduct testing as provided in the Act, including our authority to require you to conduct in-use testing under section 208 of the Act (42 U.S.C. 7542).

(d) Paragraph (a) of this section identifies the parts of the CFR that define emission standards and other requirements for particular types of engines, vehicles, and fuel-system components. This part 1027 refers to each of these other parts generically as the “standard-setting part.” For example, 40 CFR part 1051 is always the standard-setting part for recreational vehicles. For some nonroad engines, we allow for certification related to evaporative emissions separate from exhaust emissions. In this case, 40 CFR part 1060 is the standard-setting part for the equipment or fuel system components you produce.

[73 FR 59184, Oct. 8, 2008, as amended at 75 FR 22981, Apr. 30, 2010; 86 FR 34373, Jun. 29, 2021]

§1027.105 How much are the fees?

(a) Fees are determined based on the date we receive a complete application for certification. Each reference to a year in this subpart refers to the calendar year, unless otherwise specified. Paragraph (b) of this section specifies baseline fees that apply for certificates received in 2020. See paragraph (c) of this section for provisions describing how we calculate fees for 2021 and later years.

(b) The following baseline fees apply for each application for certification:

(1) Except as specified in paragraph (b)(2) of this section for Independent Commercial Importers, the following fees apply in 2020 for motor vehicles and motor vehicle engines:

| Category? | Certificate type | Fee |

|---|---|---|

| 1?The specified categories include engines and vehicles that use all applicable fuels. | ||

| (i) Light-duty vehicles, light-duty trucks, medium-duty passenger vehicle, and complete heavy-duty highway vehicles | Federal | $27,347 |

| (ii) Light-duty vehicles, light-duty trucks, medium-duty passenger vehicle, and complete heavy-duty highway vehicles | California-only | 14,700 |

| (iii) Heavy-duty highway engine | Federal | 56,299 |

| (iv) Heavy-duty highway engine | California-only | 563 |

| (v) Heavy-duty vehicle | Evap | 563 |

| (vi) Highway motorcycle, including Independent Commercial Importers | All | 1,852 |

(2) A fee of $87,860 applies in 2020 for Independent Commercial Importers with respect to the following motor vehicles:

(i) Light-duty vehicles and light-duty trucks.

(ii) Medium-duty passenger vehicles.

(iii) Complete heavy-duty highway vehicles.

(3) The following fees apply in 2020 for nonroad and stationary engines, vehicles, equipment, and components:

| Category? | Certificate type | Fee |

|---|---|---|

| (i) Locomotives and locomotive engines | All | $563 |

| (ii) Marine compression-ignition engines and stationary compression-ignition engines with per-cylinder displacement at or above 10 liters | All, including EIAPP | 563 |

| (iii) Other nonroad compression-ignition engines and stationary compression-ignition engines with per-cylinder displacement below 10 liters | All | 2,940 |

| (iv) Large SI engines and stationary spark-ignition engines above 19 kW | All | 563 |

| (v) Marine SI engines. Small SI engines, and stationary spark-ignition engines at or below 19 kW | Exhaust only | 563 |

| (vi) Recreational vehicles | Exhaust (or combined exhaust and evap) | 563 |

| (vii) Equipment and fuel-system components associated with nonroad and stationary spark-ignition engines, including portable fuel containers. | Evap (where separate certification is required) | 397 |

(c) We will calculate adjusted fees for 2021 and later years based on changes in the Consumer Price Index and the number of certificates. We will announce adjusted fees for a given year by March 31 of the preceding year.

(1) We will adjust the values specified in paragraph (b) of this section for years after 2020 as follows:

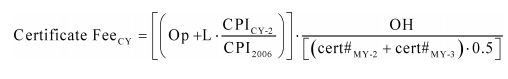

(i) Use the following equation for certification related to evaporative emissions from nonroad and stationary engines when a separate fee applies for certification to evaporative emission standards:

Where:

Certificate FeeCY = Fee per certificate for a given year.

Op = operating costs are all of EPA's nonlabor costs for each category's compliance program, including any fixed costs associated with EPA's testing laboratory, as described in paragraph (d)(1) of this section.

L = the labor costs, to be adjusted by the Consumer Price Index, as described in paragraph (d)(1) of this section.

CPICY-2 = the Consumer Price Index for the month of November two years before the applicable calendar year, as described in paragraph (d)(2) of this section.

CPI2006 = 201.8. This is based on the October 2006 value of the Consumer Price Index. as described in paragraph (d)(2) of this section

OH = 1.169. This is based on EPA overhead, which is applied to all costs.

cert#MY-2 = the total number of certificates issued for a fee category in the model year two years before the calendar year for the applicable fees as described in paragraph (d)(3) of this section.

cert#MY-3 = the total number of certificates issued for a fee category in the model year three years before the calendar year for the applicable fees as described in paragraph (d)(3) of this section.

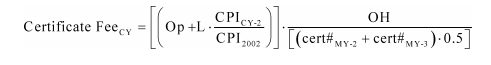

(ii) Use the following equation for all other certificates:

Where:

CPI2002 = 180.9. This is based on the December 2002 value of the Consumer Price Index as described in paragraph (d)(2) of this section.

(2) The fee for any year will remain at the previous year's amount until the value calculated in paragraph (c)(1) of this section differs by at least $50 from the amount specified for the previous year.

(d) Except as specified in §1027.110(a) for motor vehicles and motor vehicle engines, we will use the following values to determine adjusted fees using the equation in paragraph (c) of this section:

(1) The following values apply for operating costs and labor costs:

| Engine or vehicle category | Op | L |

|---|---|---|

| (i) Light-duty, medium-duty passenger, and complete heavy-duty highway vehicle certification | $3,322,039 | $2,548,110 |

| (ii) Light-duty, medium-duty passenger, and complete heavy-duty highway vehicle in-use testing | 2,858,223 | 2,184,331 |

| (iii) Independent Commercial Importers identified in paragraph (b)(2) of this section | 344,824 | 264,980 |

| (iv) Highway motorcycles | 225,726 | 172,829 |

| (v) Heavy-duty highway engines | 1,106,224 | 1,625,680 |

| (vi) Nonroad compression-ignition engines that are not locomotive or marine engines, and stationary compression-ignition engines with per-cylinder displacement below 10 liters | 486,401 | 545,160 |

| (vii) Evaporative certificates related to nonroad and stationary engines | 5,039 | 236,670 |

| (viii) All other | 177,425 | 548,081 |

(2) The applicable Consumer Price Index is based on the values published by the Bureau of Labor Statistics for All Urban Consumers at https://www.usinflationcalculator.com/under “Inflation and Prices” and “Consumer Price Index Data from 1913 to. . . .”. For example, we calculated the 2006 fees using the Consumer Price Index for November 2004, which is 191.0.

(3) Fee categories for counting the number of certificates issued are based on the grouping shown in paragraph (d)(1) of this section.

[73 FR 59184, Oct. 8, 2008, as amended at 74 FR 8423, Feb. 24, 2009; 75 FR 22981, Apr. 30, 2010; 86 FR 34373, Jun. 29, 2021]

§1027.110 What special provisions apply for certification related to motor vehicles?

(a) We will adjust fees for light-duty, medium-duty passenger, and complete heavy-duty highway vehicles as follows:

(1) California-only certificates. Calculate adjusted fees for California-only certificates by applying the light-duty, medium-duty passenger, and complete heavy-duty highway vehicle certification Op and L values to the equation in §1027.105(c). The total number of certificates issued will be the total number of California-only and federal light-duty, medium-duty passenger, and complete heavy-duty highway vehicle certificates issued during the appropriate model years.

(2) Federal certificates. Calculate adjusted fees for federal certificates with the following three steps:

(i) Apply the light-duty, medium-duty passenger, and complete heavy-duty highway vehicle certification Op and L values to the equation in §1027.105(c) to determine the certification portion of the light-duty fee. The total number of certificates issued will be the total number of California-only and federal light-duty, medium-duty passenger and complete heavy-duty highway vehicle certificates issued during the appropriate model years.

(ii) Apply the light-duty, medium-duty passenger, and complete heavy-duty highway vehicle in-use testing Op and L values to the equation in §1027.105(c) to determine the in-use testing portion of the fee. The total number of certificates issued will be the total number of federal light-duty, medium-duty passenger, and complete heavy-duty highway vehicle certificates issued during the appropriate model years.

(iii) Add the certification and in-use testing portions determined in paragraphs (a)(2)(i) and (ii) of this section to determine the total light-duty, medium-duty passenger, and complete heavy-duty highway vehicle fee for each federal certificate.

(b) For light-duty vehicles, light-duty trucks, medium-duty passenger vehicles, highway motorcycles, and complete heavy-duty highway vehicles subject to exhaust emission standards, the number of certificates issued as specified in §1027.105(d)(3) is based only on engine families with respect to exhaust emissions. A separate fee applies for each evaporative family for heavy-duty engines.

(c) If you manufacture a heavy-duty vehicle that another company has certified as an incomplete vehicle such that you exceed the maximum fuel tank size specified by the original manufacturer in the applicable certificate of conformity, you must submit a new application for certification and certification fee for the vehicle.

[86 FR 34375, Jun. 29, 2021]

§1027.115 What special provisions apply for certification related to nonroad and stationary engines?

(a) For spark-ignition engines above 19 kW that we regulate under 40 CFR part 1048 and for all compression-ignition engines, the applicable fee is based only on engine families with respect to exhaust emissions.

(b) For manufacturers certifying recreational vehicles with respect to both exhaust and evaporative emission standards, fees are determined using one of the following approaches:

(1) If your engine family includes demonstration of compliance with both exhaust and evaporative emission standards, the applicable fee is based on certification related to the combined family. No separate fee applies for certification with respect to evaporative emission standards. These are all considered engine families complying with exhaust emissions for determining the number of certificates for calculating fees for later years.

(2) If you have separate families for demonstrating compliance with exhaust and evaporative emission standards, a separate fee from the appropriate fee category applies for each unique family. Also, the number of certificates issued as specified in §1027.105(d)(3) is based on a separate count of emission families for exhaust and evaporative emissions for each respective fee category.

(c) For manufacturers certifying other spark-ignition engines or equipment with respect to exhaust and evaporative emission standards, a separate fee from the appropriate fee category applies for each unique family. A single engine or piece of equipment may involve separate emission families and certification fees for exhaust and evaporative emissions. Also, the number of certificates issued as specified in §1027.105(d)(3) is based on a separate count of emission families for exhaust and evaporative emissions for each respective fee category.

(d) For any certification related to evaporative emissions from engines, equipment, or components not covered by paragraph (a) through (c) of this section, the fee applies for each certified product independent of certification for exhaust emissions, as illustrated in the following examples:

(1) A fuel tank certified to meet permeation and diurnal emission standards would count as a single family for assessing the certification fee and for calculating fee amounts for future years.

(2) If an equipment manufacturer applies for certification to generate or use emission credits for fuel tanks and fuel lines, each affected fuel-tank and fuel-line family would count as a single family for assessing the certification fee and for calculating fee amounts for future years. This fee applies whether or not the equipment manufacturer is applying for certification to demonstrate compliance with another emission standard, such as running losses.

(e) If you certify fuel system components under 40 CFR part 1060, a single fee applies for each emission family even if those components are used with different types of nonroad or stationary engines.

(f) If your application for certification relates to emission standards that apply only in California, you must pay the same fee identified for meeting EPA standards.

(g) For marine compression-ignition engines, if you apply for a Federal certificate and an EIAPP certificate for the same engine family, a single fee applies for the engine family (see 40 CFR parts 94, 1042, and 1043).

(h) If you produce engines for multiple categories in a single engine family, a single fee applies for the engine family. For example, 40 CFR 60.4210 allows you to produce stationary and nonroad compression-ignition engines in a single engine family. If the certification fee for the different types of engines is different, the fee that applies for these engines is based on the emission standards to which you certify the engine family. For example, if you certify marine diesel engines to the standards that apply to land-based nonroad diesel engines under 40 CFR 94.912, the certification fee is based on the rate that applies for land-based nonroad diesel engines.

[73 FR 59184, Oct. 8, 2008, as amended at 75 FR 22982, Apr. 30, 2010]

§1027.120 Can I qualify for reduced fees?

(a) Eligibility requirements. Both of the following conditions must be met before you are eligible for a reduced fee:

(1) The certificate is to be used for sale of vehicles or engines within the United States.

(2) The full fee for an application for certification for a model year exceeds 1.0% of the aggregate projected retail sales price of all vehicles or engines covered by the certificate.

(b) Initial reduced fee calculation. (1) If the conditions of paragraph (a) of this section are met, the initial fee paid must be $750 or 1.0% of the aggregate projected retail sales price of all the vehicles or engines to be covered by the certificate, whichever is greater.

(2) For vehicles or engines that are converted to operate on an alternative fuel using as the basis for the conversion a vehicle or engine that is covered by an existing certificate of conformity, the cost basis used in this section must be the aggregate projected retail value-added to the vehicle or engine by the conversion rather than the full cost of the vehicle or engine. For this provision to apply, the existing certificate must cover the same sales area and model year as the requested certificate for the converted vehicle or engine.

(3) For remanufacturing systems, the cost basis used in this section must be the aggregate projected retail cost of a complete remanufacture, including the cost of the replacement components, software, and assembly.

(4) For ICI certification applications, the cost basis of this section must be the aggregate projected retail cost of the entire vehicle(s) or engine(s), not just the value added by the conversion. If the vehicles/engines covered by an ICI certificate are not being offered for sale, the manufacturer shall use the fair retail market value of the vehicles/engines as the retail sale price required in this section. For an ICI application for certification, the retail sales price (or fair retail market value) must be based on the applicable National Automobile Dealer's Association (NADA) appraisal guide and/or other evidence of the actual market value.

(5) The aggregate cost used in this section must be based on the total projected sales of all vehicles and engines under a certificate, including vehicles and engines modified under the modification and test option in 40 CFR 85.1509 and 89.609. The projection of the number of vehicles or engines to be covered by the certificate and their projected retail selling price must be based on the latest information available at the time of the fee payment.

(6) You may submit a reduced fee as described in this section if it is accompanied by a calculation of the fee based on the number of vehicles covered and the projected aggregate retail sales price as specified on the fee filing form. Your reduced fee calculation shall be deemed approved unless we determine that the criteria of this section have not been met. We may make such a determination either before or after issuing a certificate of conformity. If we determine that the requirements of this section have not been met, we may deny future reduced fee applications and require submission of the full fee payment until you demonstrate to our satisfaction that your reduced fee submissions are based on accurate data and that final fee payments are made within 45 days of the end of the model year.

(7) If we deny your request for a reduced fee, you must send us the appropriate fee within 30 days after we notify you.

(c) Revision of the number of vehicles or engines covered by the certificate. (1) You must take both of the following steps if the number of vehicles or engines to be produced or imported under the certificate exceeds the number indicated on the certificate (including a certificate under which modification and test vehicles are imported under 40 CFR 85.1509 and 89.609):

(i) Request that we revise the certificate with a number that indicates the new projection of the vehicles or engines to be covered by the certificate. We must issue the revised certificate before the additional number of vehicles or engines may be sold or finally imported into the United States.

(ii) Submit payment of 1.0% of the aggregate projected retail sales price of all the additional vehicles or engines.

(2) You must receive a revised certificate before the sale or final importation of any vehicles or engines, including modification and test vehicles, that are not originally included in the certificate issued under paragraph (b) of this section, or as indicated in a revised certificate issued under paragraph (c)(1) of this section. Such vehicles that are sold or imported before we issue a revised certificate are deemed to be not covered by a certificate of conformity.

(d) Final reduced fee calculation and adjustment. (1) If the initial fee payment is less than the final reduced fee, you must pay the difference between the initial reduced fee and the final reduced fee using the provisions of §1027.130. Calculate the final reduced fee using the procedures of paragraph (c) of this section but using actual production figures rather than projections and actual retail sales value rather than projected retail sales value.

(2) You must pay the difference between the initial reduced fee and the final reduced fee within 45 days of the end of the model year. The total fees paid for a certificate may not exceed the applicable full fee specified in §1027.105. We may void the applicable certificate if you fail to make a complete payment within the specified period. We may also refuse to grant reduced fee requests submitted under paragraph (b)(5) of this section.

(3) If the initial fee payment exceeds the final reduced fee, you may request a refund using the procedures of §1027.125.

(e) Records retention. You are subject to the applicable requirements to maintain records under this chapter. If you fail to maintain required records or provide them to us, we may void the certificate associated with such records. You must also record the basis you used to calculate the projected sales and fair retail market value and the actual sales and retail price for the vehicles and engines covered by each certificate issued under this section. You must keep this information for at least three years after we issue the certificate and provide it to us within 30 days of our request.

§1027.125 Can I get a refund?

(a) We will refund the total fee imposed under this part if you ask for a refund after failing to get a certificate for any reason.

(b) If your actual sales or the actual retail prices in a given year are less than you projected for calculating a reduced fee under §1027.120, we will refund the appropriate portion of the fee. We will also refund a portion of the initial payment if it exceeds the final fee for the engines, vehicles, or equipment covered by the certificate application.

(1) You are eligible for a partial refund related only to a certificate used for the sale of engines, vehicles, or equipment under that certificate in the United States.

(2) Include all the following in your request for a partial refund of reduced fee payments:

(i) State that you sold engines, vehicles, or equipment under the applicable certificate in the United States.

(ii) Identify the number of engines, vehicles, or equipment you produced or imported under the certificate, and whether the engines, vehicles, or equipment have been sold.

(iii) Identify the reduced fee that you paid under the applicable certificate.

(iv) Identify the actual retail sales price for the engines, vehicles, or equipment produced or imported under the certificate.

(v) Calculate the final value of the reduced fee using actual production figures and retail prices.

(vi) Calculate the refund amount.

(c) We will approve your request to correct errors in the amount of the fee.

(d) All refunds must be applied for within six months after the end of the model year.

(e) Send refund and correction requests online at www.Pay.gov, or as specified in our guidance.

(f) You may request to have refund amounts applied to the amount due on another application for certification.

[86 FR 34375, Jun. 29, 2021]

§1027.130 How do I make a fee payment?

(a) Pay fees to the order of the Environmental Protection Agency in U.S. dollars using electronic funds transfer or any method available for payment online at www.Pay.gov, or as specified in EPA guidance.

(b) Submit a completed fee filing form at www.Pay.gov.

(c) You must pay the fee amount due before we will start to process an application for certification.

(d) If we deny a reduced fee, you must pay the proper fee within 30 days after we notify you of our decision.

[86 FR 34375, Jun. 29, 2021]

§1027.135 What provisions apply to a deficient filing?

(a) Any filing under this part is deficient if it is not accompanied by a completed fee filing form and full payment of the appropriate fee.

(b) We will hold a deficient filing along with any payment until we receive a completed form and full payment. If the filing remains deficient at the end of the model year, we will continue to hold any funds associated with the filing so you can make a timely request for a refund. We will not process an application for certification if the associated filing is deficient.

[86 FR 34375, Jun. 29, 2021]

§1027.140 What reporting and recordkeeping requirements apply under this part?

Under the Paperwork Reduction Act (44 U.S.C. 3501 et seq.), the Office of Management and Budget approves the reporting and recordkeeping specified in the applicable regulations. The following items illustrate the kind of reporting and recordkeeping we require for engines, vehicles, and equipment regulated under this part:

(a) Filling out fee filing forms under §1027.130.

(b) Retaining fee records, including reduced fee documentation, under §1027.120.

(c) Requesting refunds under §1027.125.

§1027.150 What definitions apply to this part?

The definitions in this section apply to this part. As used in this part, all undefined terms have the meaning the Act or the standard-setting part gives to them. The definitions follow:

Application for Certification means a manufacturer's submission of an application for certification.

California-only certificate is a certificate of conformity issued by EPA showing compliance with emission standards established by California.

Federal certificate is a certificate of conformity issued by EPA showing compliance with EPA emission standards specified in one of the standard-setting parts specified in §1027.101(a).

Light-duty means relating to light-duty vehicles and light-duty trucks.

Manufacturer has the meaning given in section 216(1) of the Act. In general, this term includes any person who manufactures an engine, vehicle, vessel, or piece of equipment for sale in the United States or otherwise introduces a new engine, vehicle, vessel, or piece of equipment into commerce in the United States. This includes importers who import such products for resale, but not dealers.

Total number of certificates issued means the number of certificates for which fees have been paid. This term is not intended to represent multiple certificates that are issued within a single family or test group.

Void has the meaning given in 40 CFR 1068.30.

We (us, our) means the Administrator of the Environmental Protection Agency and any authorized representatives.

[73 FR 59184, Oct. 8, 2008, as amended at 75 FR 22982, Apr. 30, 2010]

§1027.155 What abbreviations apply to this subpart?

The following symbols, acronyms, and abbreviations apply to this part:

| ? | ? |

|---|---|

| CFR | Code of Federal Regulations. |

| CPI | Consumer Price Index. |

| EPA | U.S. Environmental Protection Agency. |

| Evap | Evaporative emissions. |

| EIAPP | Engine International Air Pollution Prevention (from MARPOL Annex VI). |

| ICI | Independent Commercial Importer. |

| MVECP | Motor vehicle and engine compliance program. |

| MY | Model year. |

| U.S | United States. |

[86 FR 34375, Jun. 29, 2021]

['Air Programs']

['Air Emissions']

UPGRADE TO CONTINUE READING

Load More

J. J. Keller is the trusted source for DOT / Transportation, OSHA / Workplace Safety, Human Resources, Construction Safety and Hazmat / Hazardous Materials regulation compliance products and services. J. J. Keller helps you increase safety awareness, reduce risk, follow best practices, improve safety training, and stay current with changing regulations.

Copyright 2026 J. J. Keller & Associate, Inc. For re-use options please contact copyright@jjkeller.com or call 800-558-5011.